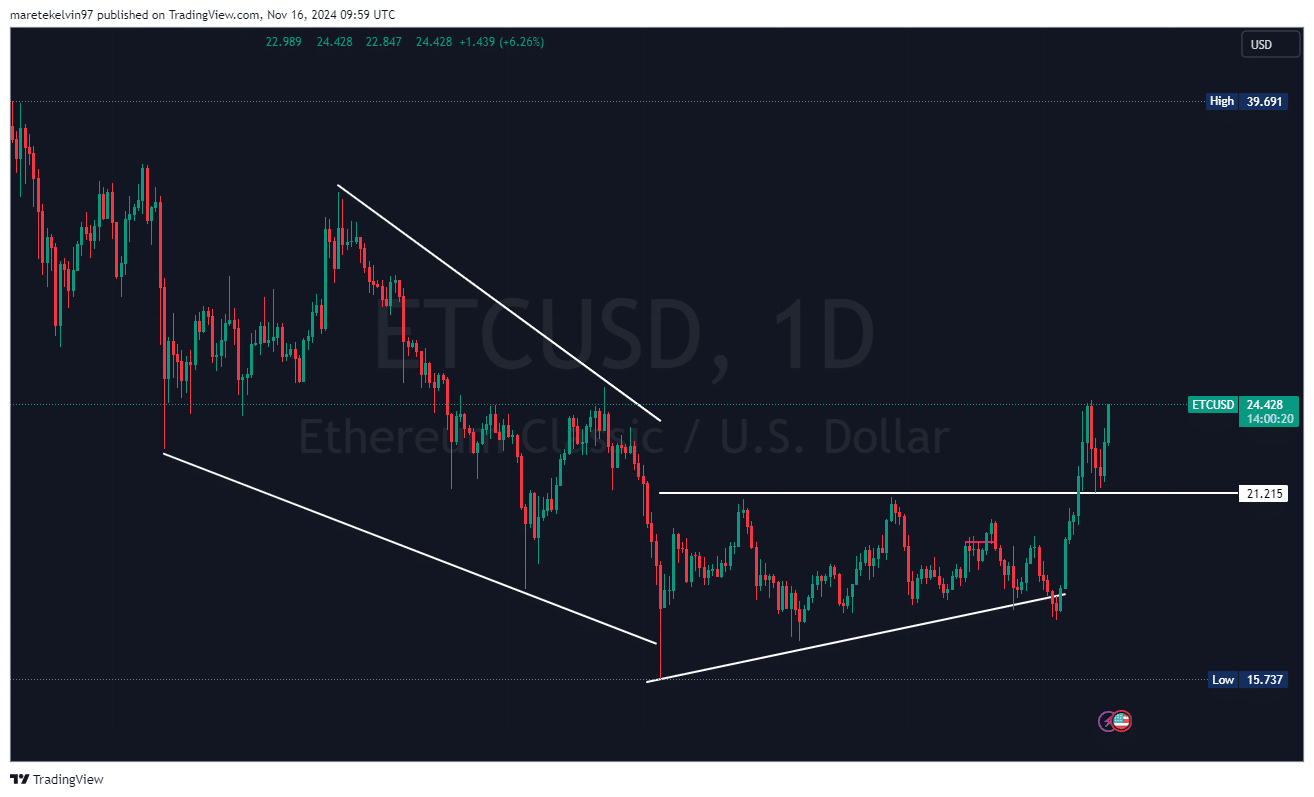

- ETC’s bounce from the $21.215 support level showed strong buying pressure at lower levels

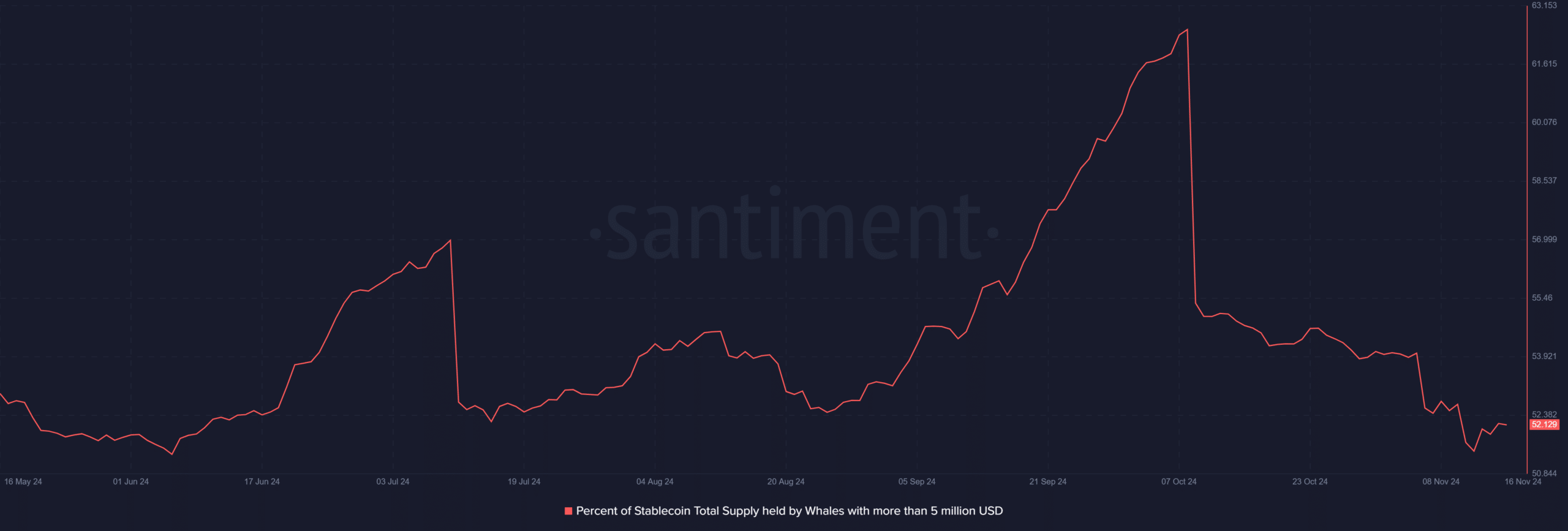

- Whale accumulation patterns pointed to a potential for sustained upward momentum

As a seasoned crypto investor with over a decade of experience navigating the volatile digital asset markets, I find myself increasingly intrigued by Ethereum Classic [ETC]. The recent bounce from the $21.215 support level has been nothing short of impressive, showcasing strong buying pressure at lower levels and hinting at whale accumulation patterns that point to a potential for sustained upward momentum.

Ethereum Classic (ETC) showed remarkable resilience, holding firm following a notable point of reinforcement at approximately $21.215 on the price graphs.

Currently, the value of that altcoin has increased by 11% over the past 24 hours, creating a strong impression of an upward trend in the daily chart. Intriguingly, this price fluctuation has sparked interest among both traders and investors.

ETC support level validation

The recent bounce from the descending triangle support at $21.215 was not just a typical rebound.

As a crypto investor, I’ve noticed some intriguing trends in the on-chain data. It appears that whales have been aggressively amassing their holdings at this level, and large holders continue to maintain substantial positions here, even amidst earlier market turbulence. This institutional confidence serves as a strong foundation for the technical setup, offering reassurance and potentially signaling a bullish outlook.

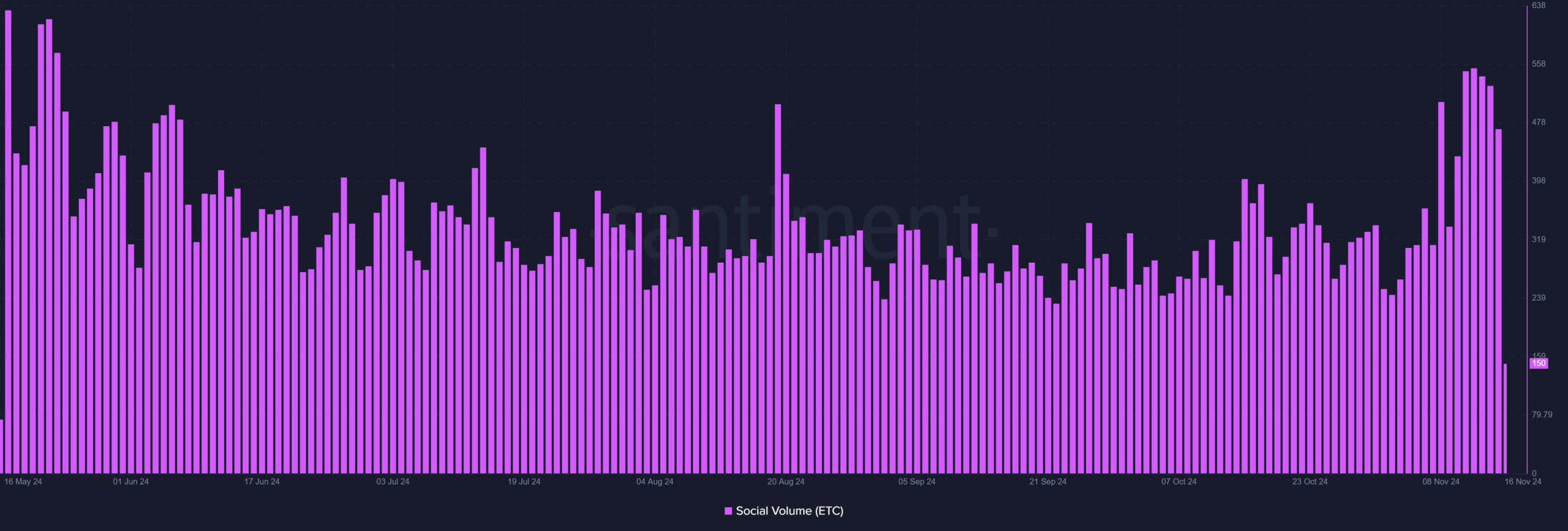

At the same time, AMBCrypto’s examination of social activity on Santiment suggested a significant increase in this surge. This increase added weight to the altcoin’s rise as depicted on the price charts.

Significantly, the Social Volume indicates increased market involvement, approaching participation rates last seen in early June. This significant increase in activity can typically signal upcoming price growth on the asset’s graph.

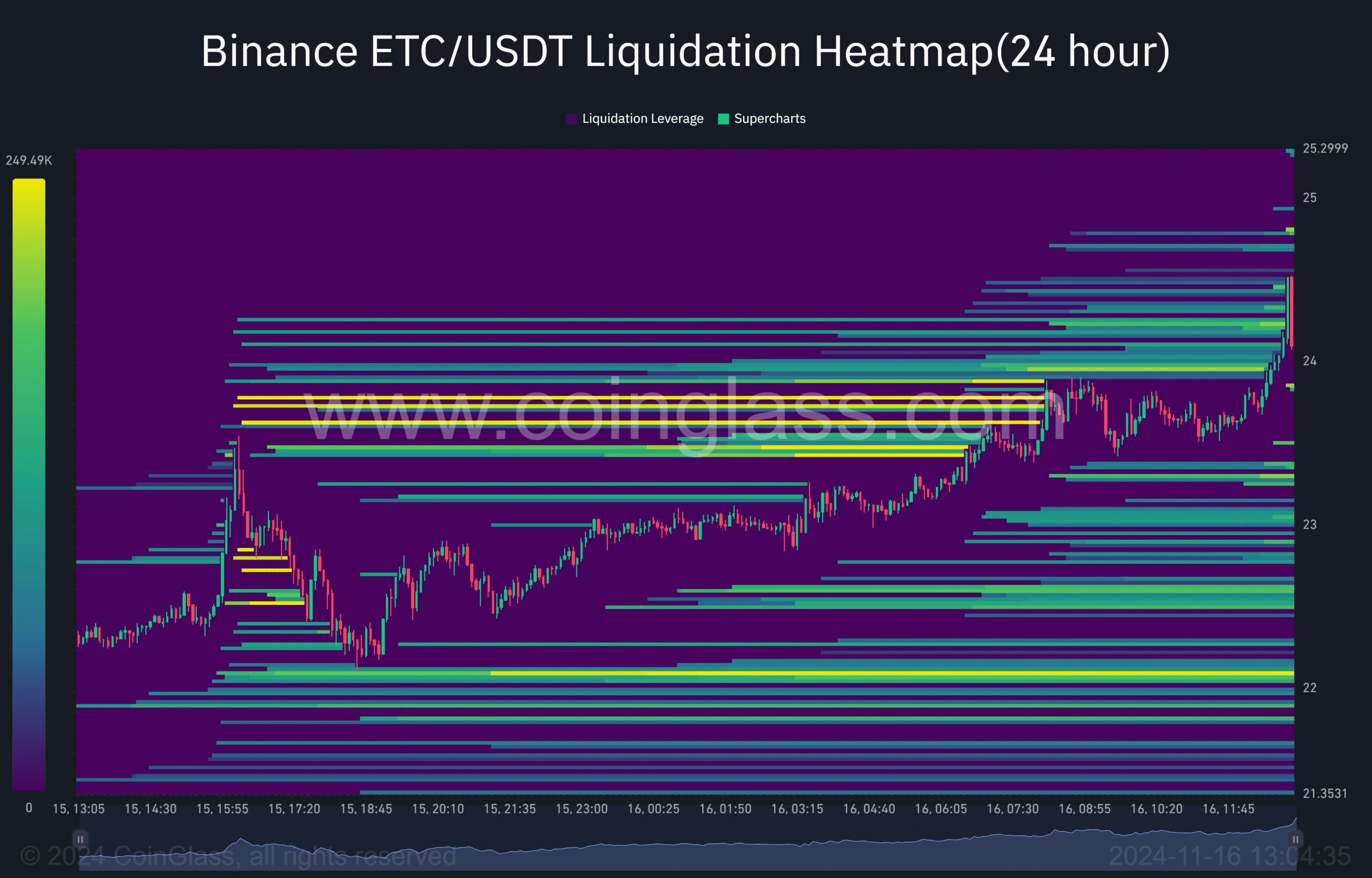

ETC liquidations point higher

ETC’s breakout from the descending triangle pattern highlighted a potential trend reversal.

Furthermore, it appeared that ETC’s price trend was marked by a series of rising bottoms. Meanwhile, the liquidation map highlighted a concentration of short positions near the $24 mark. If these short positions are activated, they may propel additional upward movement in the price.

Key resistance levels in focus

At a glance, you’ll find the potential resistance point conveniently close by when we reach $25. Historically, breaching this crucial resistance level hasn’t been fruitful, but this latest surge appears more robust, boasting greater social involvement and substantial backing from ‘whales’.

A possible breach might trigger a cascading effect of short squeezes.

Read Ethereum [ETC] Price Prediction 2023-24

The combination of multiple factors suggests a highly optimistic perspective for ETC in the immediate future, indicating potential price increases.

Based on a predicted price range of $26 to $27, bolstered by solid liquidation figures and growing buying interest, the altcoin appears primed for additional growth. However, the crucial fight is anticipated around $24.50-$25. This significant area could potentially trigger ETC’s rally once it is surpassed.

Read More

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2024-11-17 10:15