- Bitcoin’s buying pressure on Binance increased sharply.

- However, BTC might face headwinds ahead as a few indicators turned bearish.

As a seasoned researcher with years of experience in the cryptocurrency market, I have seen my fair share of price fluctuations and trends. The recent increase in buying pressure on Binance for Bitcoin is certainly intriguing, and it seems that investors are eagerly stockpiling the king of cryptos. However, while the short-term outlook appears promising with a 14% price growth over the last week, I can’t help but notice a few bearish indicators that might pose challenges ahead.

After a short pullback, Bitcoin [BTC] has once again started to inch towards its all-time high.

In the not too distant past when Bitcoin’s price dropped, investors saw this as a chance to purchase at a lower cost. This action might have contributed to Bitcoin regaining its upward trajectory.

Will this increase in buying pressure propel BTC to a new ATH soon?

Investors are stockpiling Bitcoin

Recently, well-known crypto expert Ali shared a tweet highlighting a substantial increase in Bitcoin purchase demand on the Binance platform.

This clearly signaled growing bullish sentiment, suggesting upward price movement could be ahead.

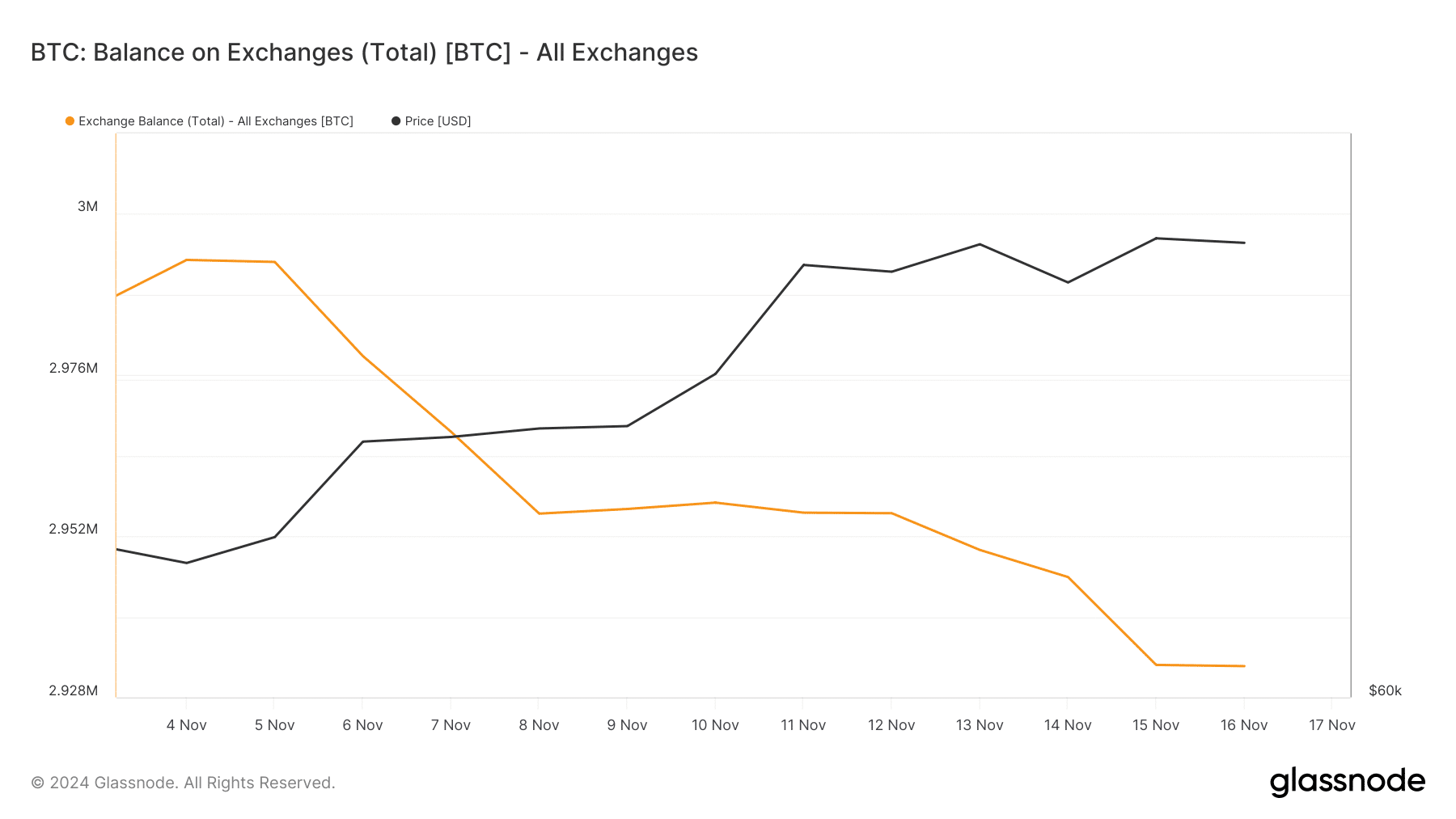

It was also demonstrated that there was strong demand in the market as a whole, since Bitcoin’s exchange balance indicated significant buying activity.

Over the past fortnight, there’s been a significant decline in the value of our measure, which suggests that investors have been accumulating large amounts of the leading crypto asset, often referred to as the ‘king of cryptos’.

According to CryptoQuant’s findings, the Bitcoin Coinbase premium showed a positive color (green), indicating that American investors were displaying a robust appetite for purchasing Bitcoins.

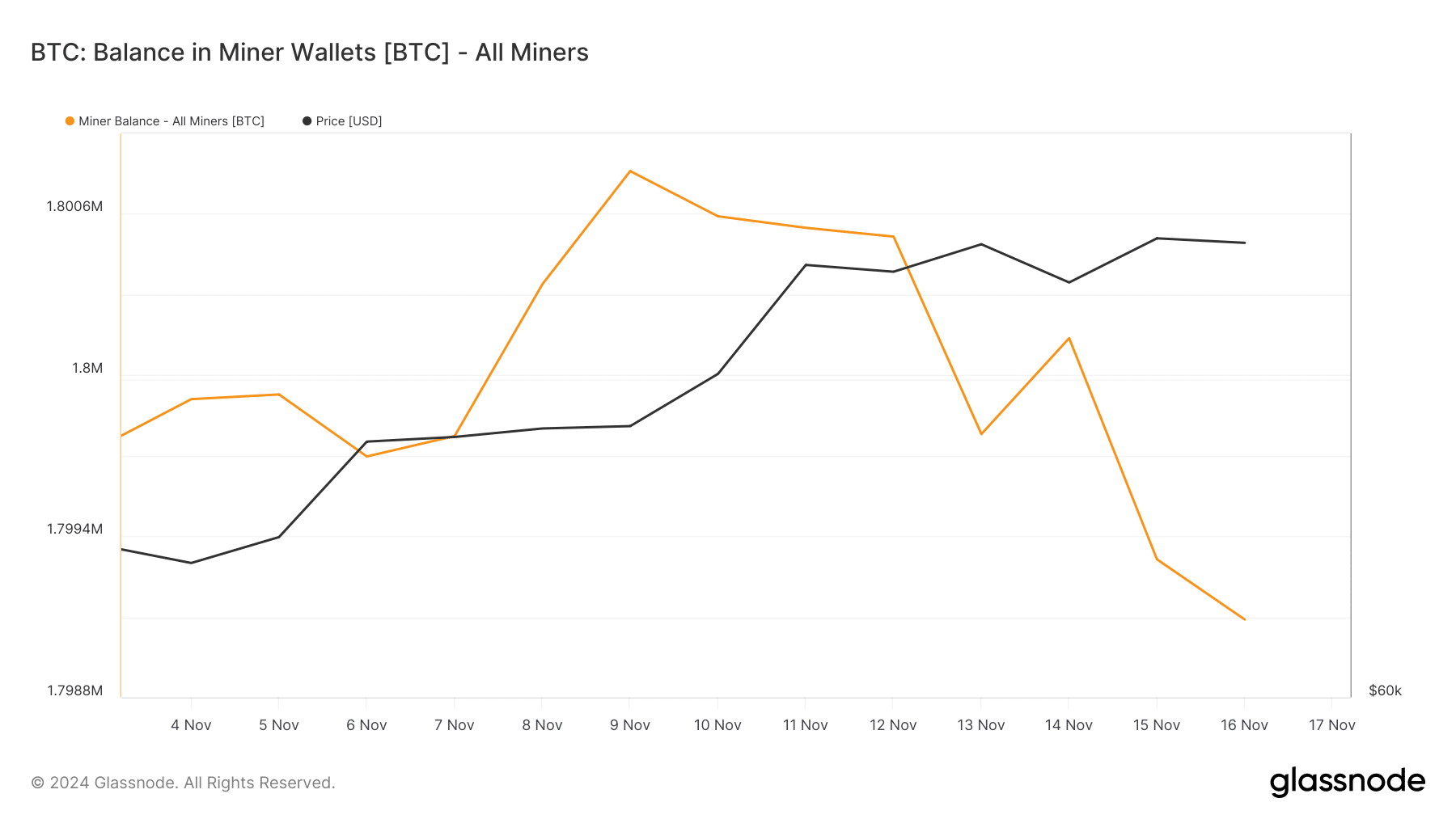

Nonetheless, Bitcoin miners didn’t show confidence in the king coin. This was evident from the considerable drop in BTC’s miners balance—a sign of miners’ sell-off.

Will this be enough for a new ATH?

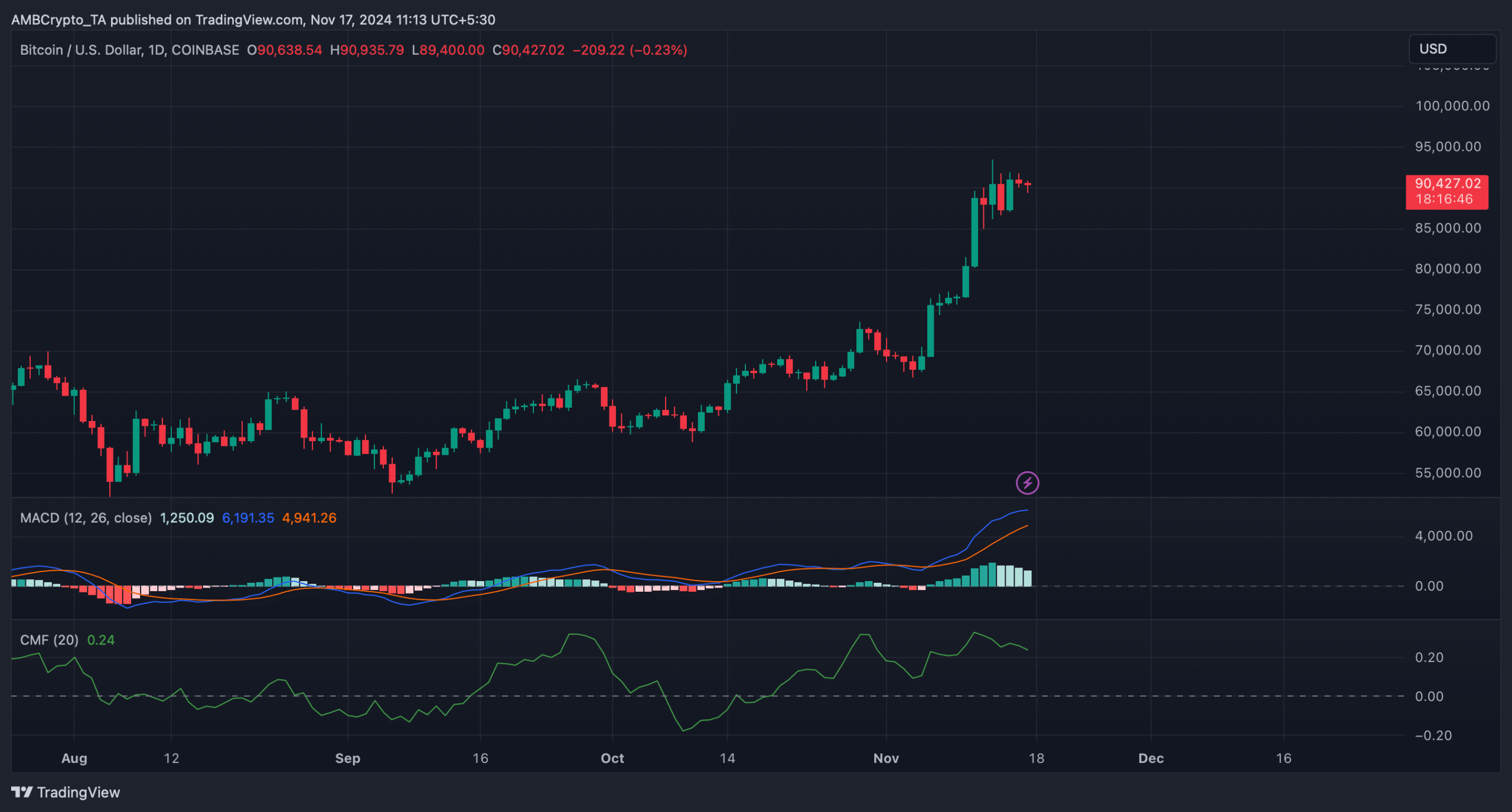

Over the past week, a surge in investor demand has boosted Bitcoin’s price by about 14%, bringing it nearer to the $91,000 mark once more.

Should the current increase in value persist, it’s likely that Bitcoin could hit a record-breaking peak in the near future.

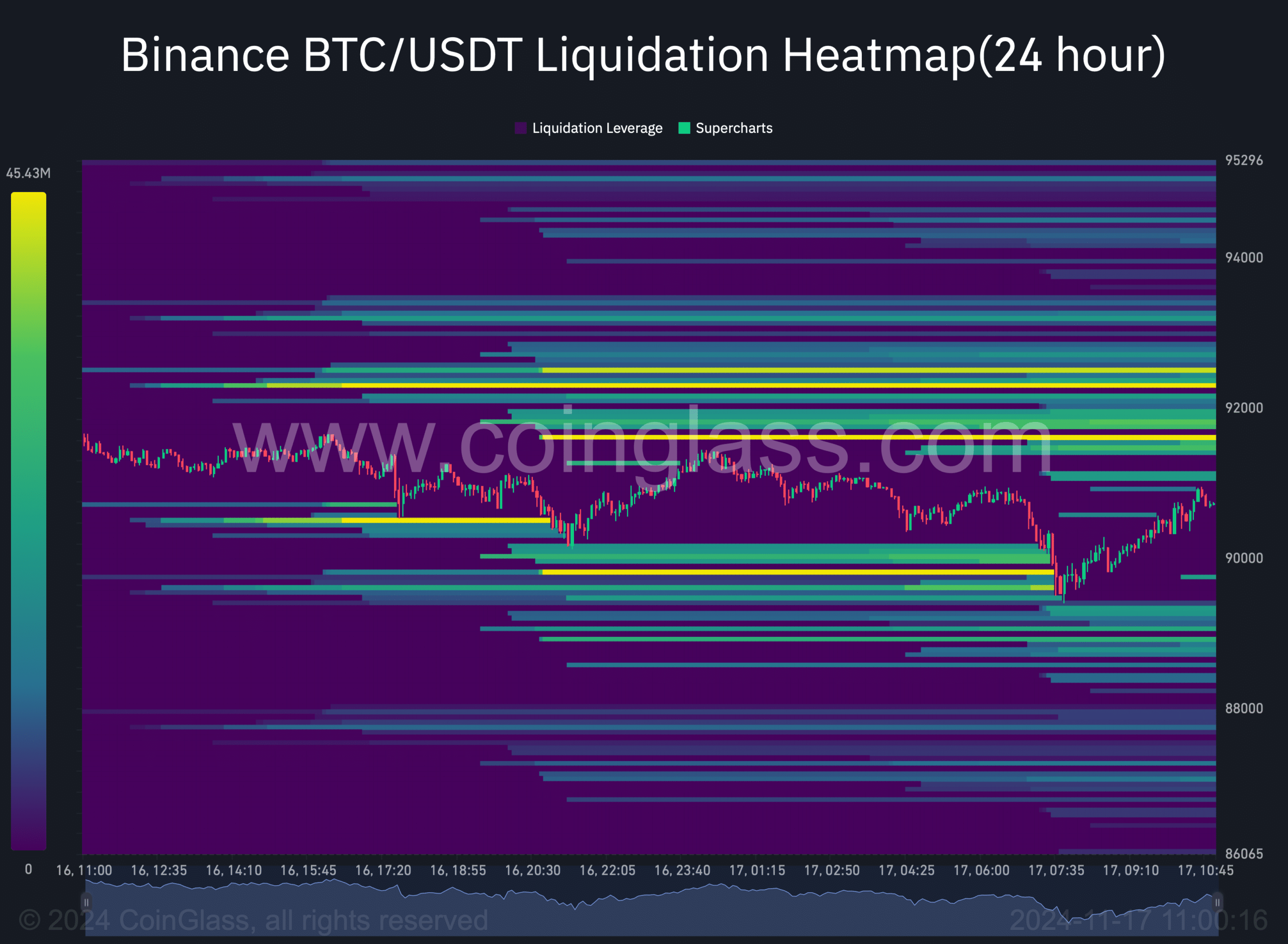

Initially, it appeared that Bitcoin wouldn’t encounter significant issues in reaching around $91,000 again. This was due to the fact that the price for liquidating Bitcoin would surpass $91,600.

Whenever liquidation rises, it indicates that the chances of a price correction are high.

Contrarily, not all factors contributed to an increase in price. For example, Bitcoin’s average supply-weighted cost of production (aSORP) shifted to red, suggesting that more investors were offloading their holdings at a profit. In the midst of a bullish trend, this could potentially signal a market peak.

According to the analysis by the King Coin’s Binary Capital Duration Demand, there has been a greater-than-usual shift in long-term holders over the last week. If this movement was due to selling, it could potentially lead to unfavorable consequences.

In simpler terms, the Chaikin Money Flow (CMF), which is used alongside the Accumulation/Distribution model for Bitcoin (aSORP), showed a decrease, indicating a shift in the balance towards more selling pressure rather than buying pressure.

Read Bitcoin (BTC) Price Prediction 2023-24

A falling CMF confirms a downtrend, which, on this occasion, could create problems on BTC’s roads to $91k.

Nonetheless, the MACD continued to show a bullish advantage in the market, suggesting that the possibility of BTC retesting its ATH can’t be ruled out yet.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Gold Rate Forecast

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-11-17 14:15