- POL has formed a classic inverse head-and-shoulders pattern.

- This bullish outlook is supported by multiple on-chain metrics and technical indicators.

As an analyst with over a decade of experience in the crypto markets, I have seen my fair share of patterns and trends. The current setup for Polygon [POL] is particularly intriguing, given the classic inverse head-and-shoulders pattern that has formed.

Over the past month, Polygon‘s [POL] has shown remarkable progress, rising by approximately 13.93%. On a day-to-day basis, its performance has been even more impressive, with daily increases of around 5.41%.

As an analyst, if the anticipated bullish setup unfolds as planned, I foresee substantial growth that might propel POL towards the projected $5.6 mark.

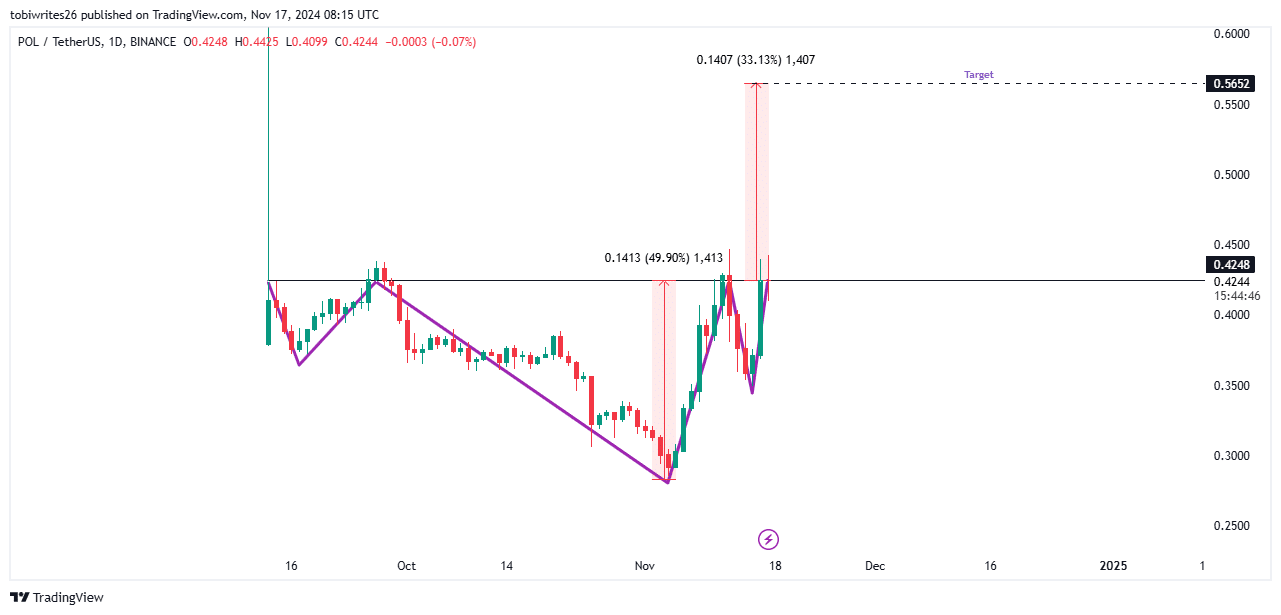

33% gain with head and shoulders pattern

The Position (POL) looks promising for a possible 33% increase, given that it has formed a head-and-shoulders pattern. Traditionally, such a pattern indicates an approaching price surge, often serving as a strong driver for upward trends in the market.

In a favorable situation, the price of POL needs to break through the resistance level (neckline) initially at 0.4282, after which it should maintain trading above that point. When this crucial barrier is successfully crossed, the asset is expected to carry on rising further.

If POL manages a successful breakout, it might aim for around $0.5652, which would signify a possible 33.13% increase. Reaching this point could trigger a price reevaluation, potentially driving further growth or causing a possible correction.

Bullish sentiment for POL

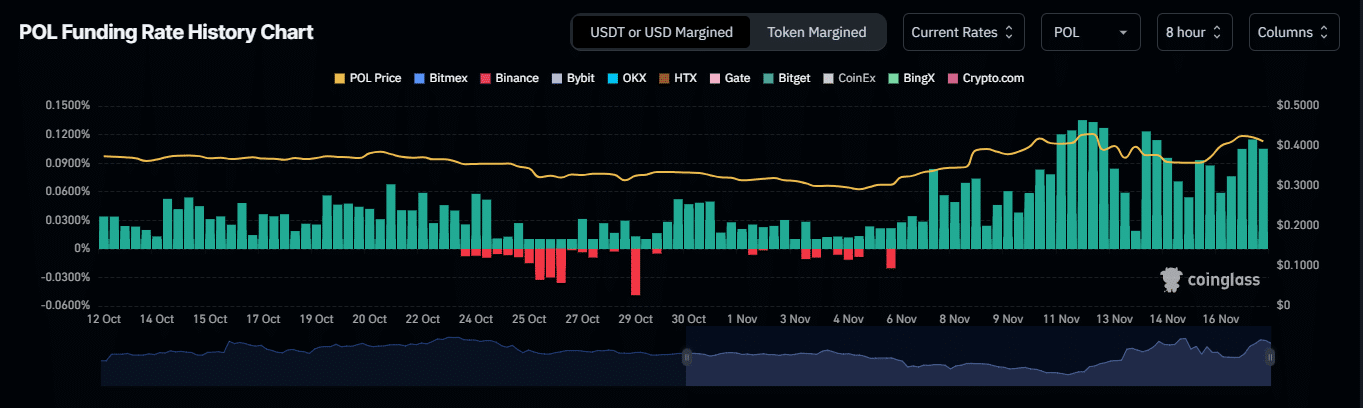

Currently, the Funding Rate for POL is at 0.0205%, suggesting robust buying interest and indicating a potential upcoming price surge, as reported by Coinglass.

The Funding Rate measures the cost of maintaining a balance between an asset’s spot and Futures prices. In this case, the fact that longs are paying shorts indicates that the market sentiment is bullish.

Furthermore, Open Interest increased by 7.30% to reach approximately $96.62 million, suggesting a bullish trend in the market since the majority of unresolved contracts are held by the bulls.

The market’s growth spiked by an impressive 98.12%, hitting a significant total of $606.64 million, which underscores a continued bullish momentum. As the value of POL increases, these on-chain indicators point towards a promising future for this asset.

Strong bullish sentiment

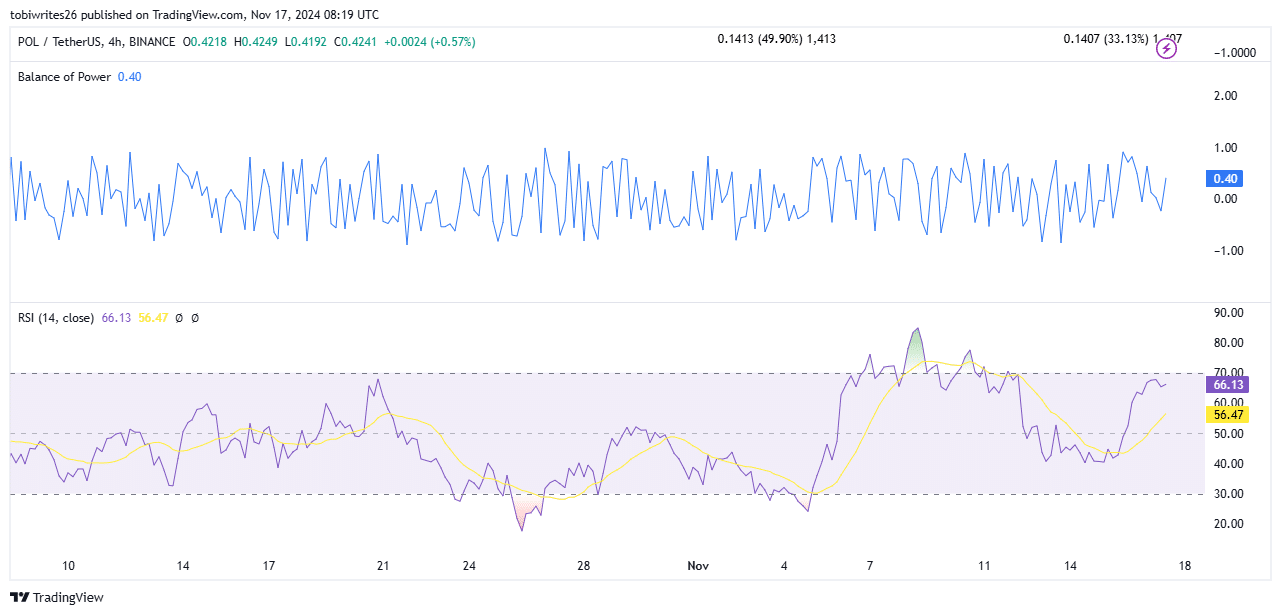

The technical analysis is bolstering the argument for a bullish trend in POL, as the Balance of Power (BoP) and Relative Strength Index (RSI) both suggest a strong uptrend, indicating positive momentum moving forward.

In simpler terms, the Balance of Power (BoP) reflects who holds more power between buyers and sellers. Currently, at the latest update, the BoP stands at 0.41, suggesting that buyers have the upper hand. This could mean a situation favorable for price increases.

Read Polygon’s [POL] Price Prediction 2024–2025

In simpler terms, the Relative Strength Index (RSI) indicated that we were in a bullish zone, showing a value of 66.13. This means there’s potential for more growth ahead because the asset hasn’t yet reached an overbought state and might continue its upward trajectory.

Should these technical signals and on-chain measurements persistently exhibit a strong upward trend, it’s reasonable to anticipate that the value of POL may continue climbing.

Read More

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- The Weeknd Shocks Fans with Unforgettable Grammy Stage Comeback!

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

- Taylor Swift Denies Involvement as Legal Battle Explodes Between Blake Lively and Justin Baldoni

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Solana – Long or short? Here’s the position SOL traders are taking

- Lilo & Stitch & Mission: Impossible 8 Set to Break Major Box Office Record

- Shundos in Pokemon Go Explained (And Why Players Want Them)

2024-11-17 21:11