- Bitcoin recently reached a new all-time high of $93,477, but is now stabilizing above $90,000.

- Analysts evaluate metrics like MVRV and exchange outflows to gauge potential continuation or cooling of BTC’s rally.

As an experienced crypto investor with a penchant for analyzing market trends and metrics, I find myself intrigued by the current state of Bitcoin [BTC]. After witnessing its meteoric rise to a new all-time high of $93,477, it’s interesting to see BTC stabilizing above the $90,000 mark.

Following a week where it hit numerous record-breaking peaks, Bitcoin (BTC) seems to be taking a break, as its price growth indicators show a slowdown. On the 13th of November, Bitcoin reached an unprecedented high of $93,477.

After that point, it saw a modest dip of around 2.8% and has since held steady above the $90,000 threshold. Currently, Bitcoin is being traded at $90,959, representing a minor 0.6% rise in the last 24 hours.

Is there still room for upward momentum?

As Bitcoin’s price fluctuations continue, financial experts are carefully scrutinizing if any additional growth opportunities remain.

Yonsei Dent, an analyst at CryptoQuant, shared his views on the current status of Bitcoin, emphasizing the MVRV ratio – a crucial on-chain metric that measures the relationship between realized value and market value, offering an estimate of whether the market is overvalued or undervalued.

In previous market trends, Dent points out that the peak of the MVRV ratio frequently coincided with market highs. To illustrate this, he mentions three instances: in 2013, 2017, and 2020, the highest points in Bitcoin’s market cycles corresponded to a downward trend noted in the MVRV ratio.

Later on, Dent observed that although the MVRV ratio reached a peak of 2.78 in March 2024, slightly under its long-term trendline, it has since bounced back to 2.6 due to Bitcoin’s latest surge.

He noted that when a short-term, monthly moving average crosses above a long-term, yearly moving average, it could signal an upcoming positive trend.

Regardless of whether the MVRV will indeed hit 2.9-3.0 is not definitive, but this trend hints at a possibility of continued growth in Bitcoin’s price.

Key metrics indicating Bitcoin’s next moves

Beyond just analyzing the MVRV ratio, I always make sure to delve into other significant Bitcoin metrics as well, to get a comprehensive understanding of the asset’s future direction.

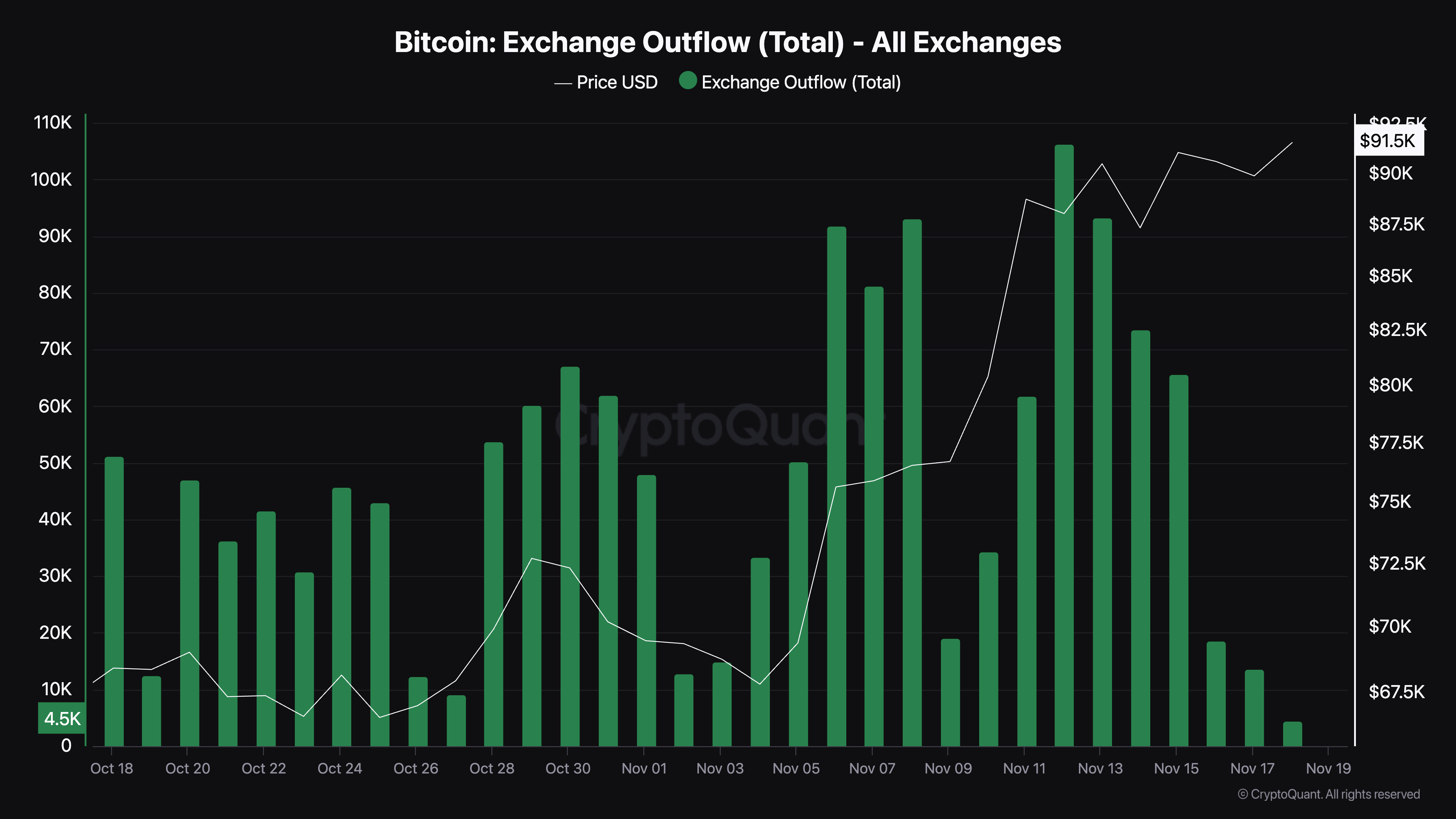

Over the past week, I’ve noticed that Bitcoin’s exchange outflows have been on an upward trajectory in line with its price increase. Interestingly, this trend seems to be decelerating at the start of the new week. The data I’m referring to comes from CryptoQuant.

On the 17th of November this past Sunday, Bitcoin’s total withdrawals from exchanges were roughly 13,617 BTC, which is significantly lower compared to the approximately 30,000 BTC withdrawn a week earlier.

As an analyst, I observe a decrease in asset outflows, which might signal a change in investor attitudes. It appears that market players could be momentarily halting their buying spree or delaying the withdrawal of their funds from exchanges.

This growth might indicate that investors are being cautious, suggesting a phase of consolidation or a decrease in demand intensity.

Another metric worth examining is Bitcoin’s open interest, as reported by Coinglass. Bitcoin’s open interest has increased by 2.76%, reaching a current valuation of $56.22 billion.

The upward trend correlates with a substantial growth (16.42%) in the value of Bitcoin’s open interest, now standing at approximately $61.83 billion. An escalation in open interest suggests an expanding involvement in the market, typically signifying increased trading action and heightened investor attention.

Read Bitcoin (BTC) Price Prediction 2024-25

On the other hand, a rise in open interest, notably within the futures market, may potentially lead to increased price fluctuations.

With an increasing number of traders adopting derivative trading, the market might react swiftly to major events or changes in public opinion, leading to sudden fluctuations in prices.

Read More

2024-11-19 00:08