- Bitcoin held steady above $90,000 despite increased miner selling and profit-taking activity.

- On-chain data highlighted a potential consolidation phase before the next potential breakout.

As a seasoned crypto investor with a decade of market experience under my belt, I have seen my fair share of miner profit-taking and subsequent price corrections. The recent surge in miner selling of over 3,000 BTC, as highlighted by analyst Ali Martinez, is not an unfamiliar sight to me.

Bitcoin (BTC) is continuing its robust uptrend, consistently holding values over $90,000 and approaching fresh record highs.

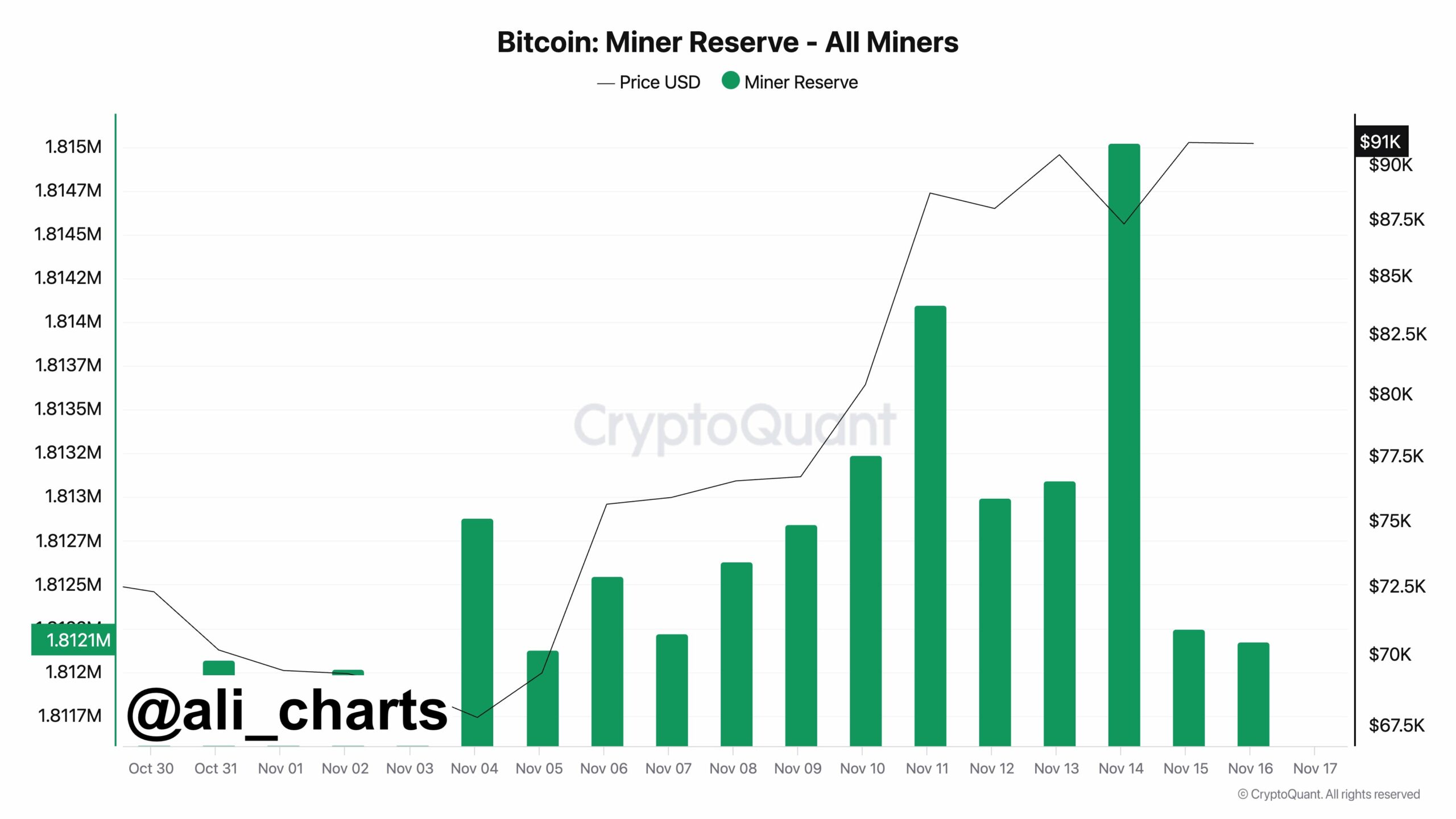

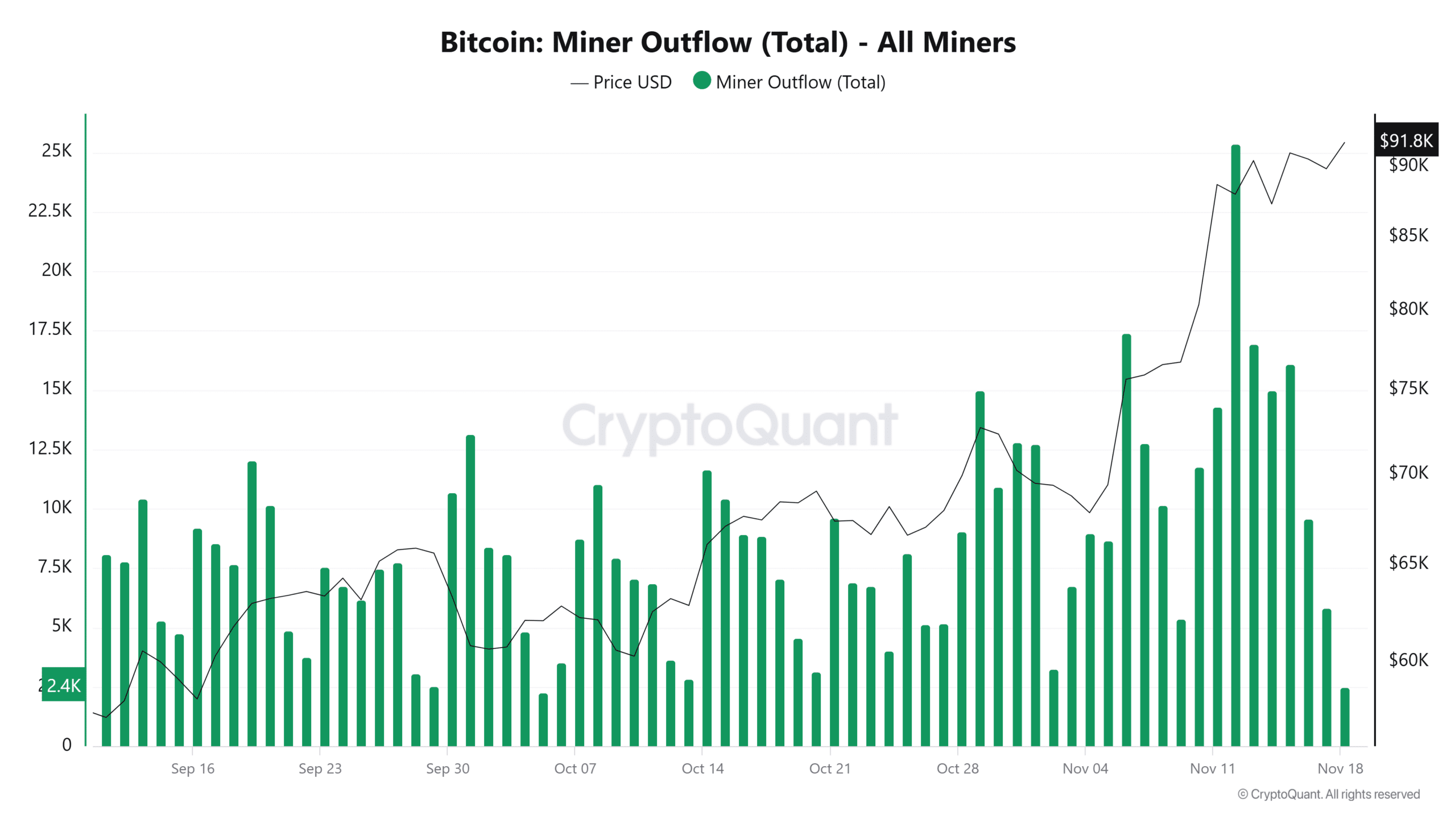

In the last 48 hours, Bitcoin miners have offloaded more than 3,000 Bitcoins, which could be an indication of a temporary decrease in value.

Miners cashing out their profits might boost supply, but Bitcoin’s continued holding above $90,000 indicates robust market faith. This also signals the start of a period where prices may stabilize and gather strength.

Bitcoin miners take profits

In the past two days, crypto expert Ali Martinez noted a significant selling spree by Bitcoin miners, offloading more than 3,000 Bitcoins valued at approximately $273 million.

When there’s an increase in the selling of minerals, it usually indicates a time of relaxation or slowdown, as miners, who are often regarded as long-term investors, decide to cash out during phases of fast price escalation.

In robust bull markets, it’s typical to see this kind of behavior. This could indicate that the market might soon experience a temporary halt or a potential decrease in prices over the short period ahead.

The graph depicting miner activity indicated a substantial increase in Bitcoins moving from miners’ wallets, which aligns with the recent rise in Bitcoin’s market value.

Historically, these sell-offs suggest that miners are securing their earnings, which could be a hint of a temporary slowdown or pause.

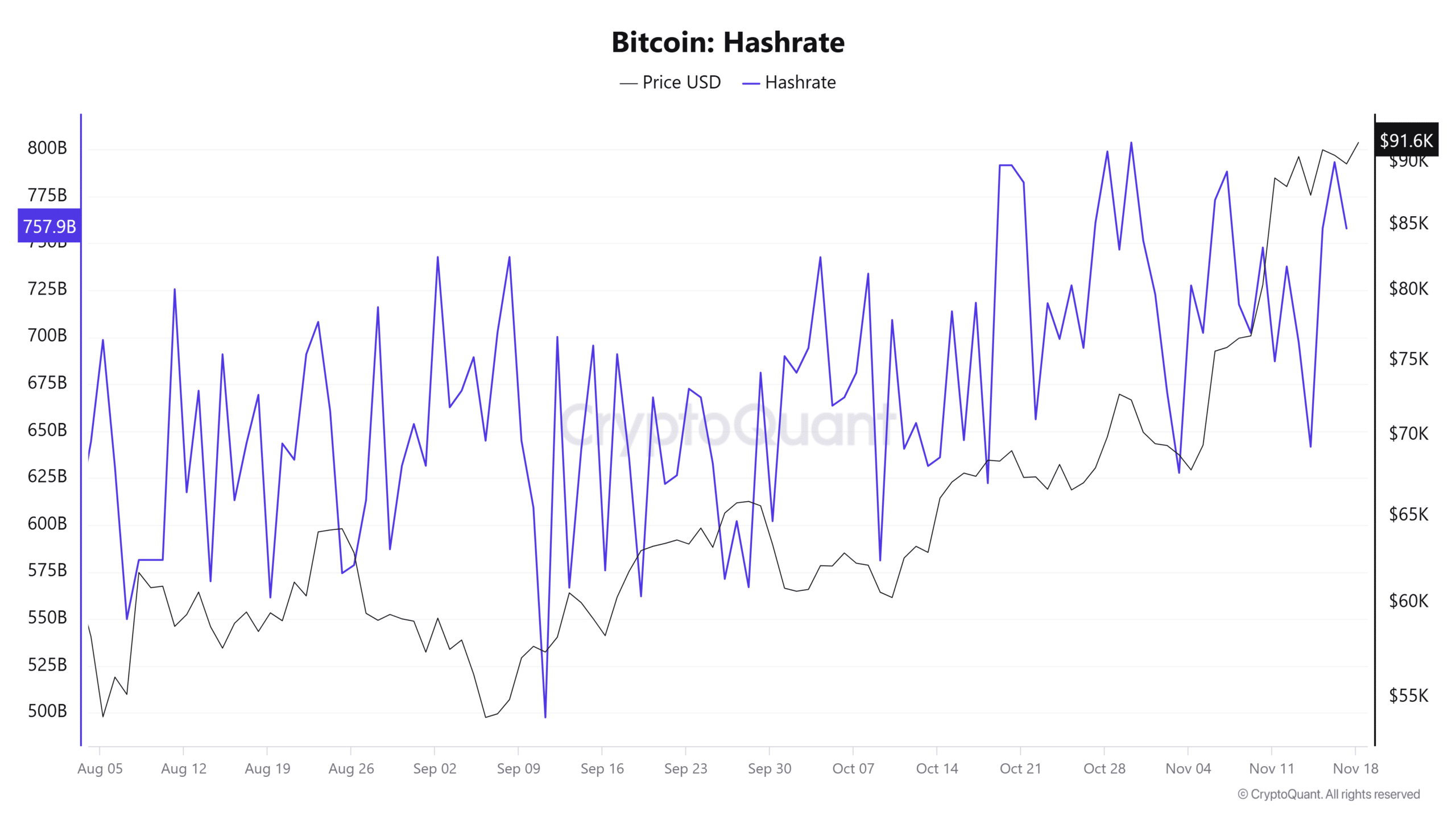

Bitcoin’s strong network health was also proven with hashrate levels reaching new highs.

As a researcher examining this data, I noticed an uptick that signified enhanced network security measures and increased competition among miners. Interestingly, this growth occurred despite some miners choosing to sell part of their holdings, which underscores their confidence in the system’s long-term potential.

An increase in hashrate highlights strong long-term foundations, even as there’s temporary market pressure for selling.

Bitcoin stands strong

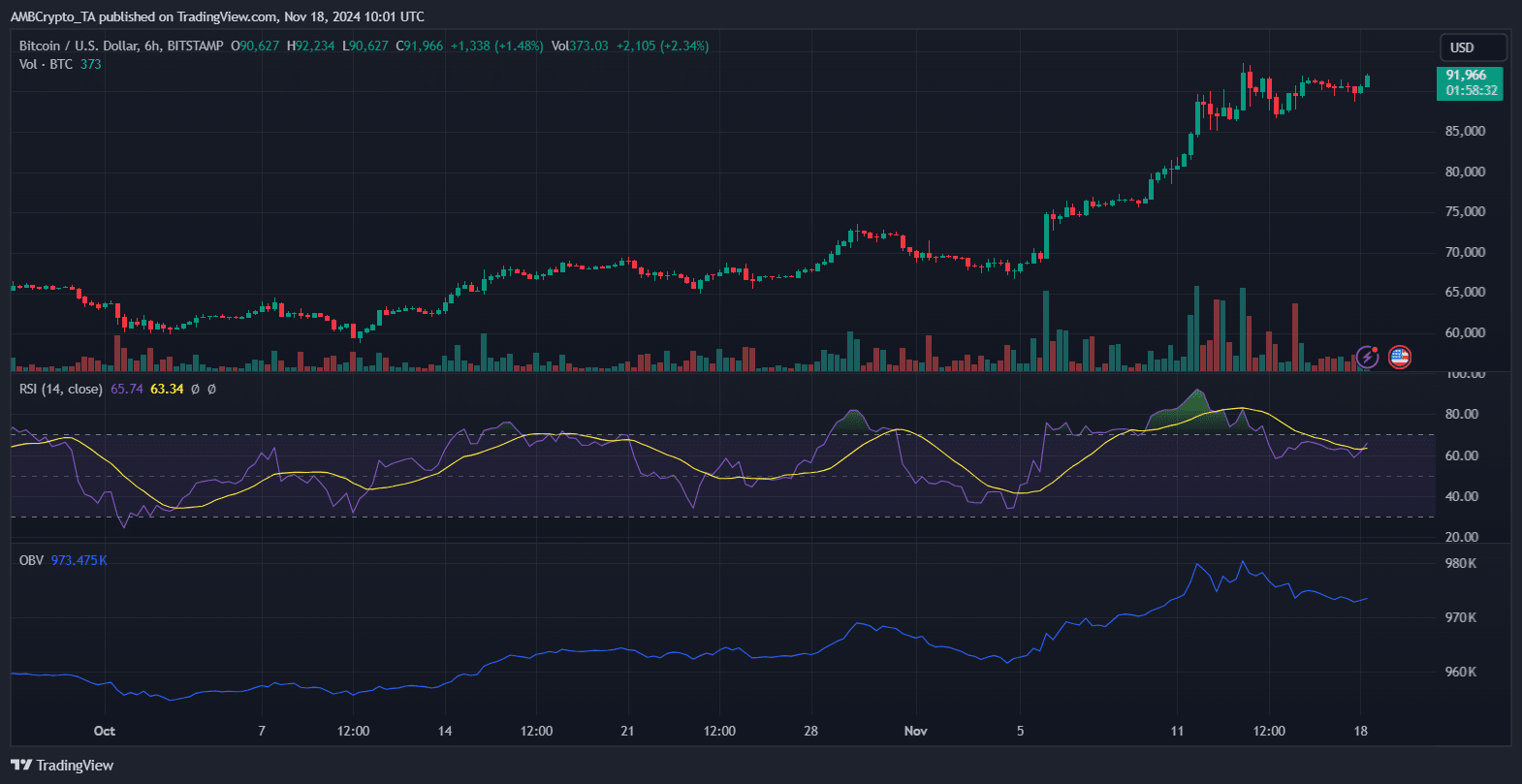

In simpler terms, over the last 11 days, Bitcoin’s price has been consistently increasing and breaking new records, reaching heights never seen before. This persistent growth demonstrates a robust upward trend for Bitcoin, which currently maintains its position above $90,000.

As a researcher observing the market’s dynamics, it appears that we’re transitioning into a consolidation period following a robust rally. The escalating actions of both investors and miners, cashing out their profits, are a clear indication of this shift.

Consolidation phase ahead?

The fact that Bitcoin is currently holding steady above $90,000 is a normal and advantageous progression after its dramatic surge in value.

Combining resources or forces can help the market stabilize after significant growth, eliminate less resilient participants, and create a more robust base from which further progress can be made.

Important resistance points, notably around $88,000 to $90,000, are crucial for preserving the overall upward trend.

If the price falls slightly below this point, it might indicate an increase in sellers, which could lead to a more significant decline – a deeper correction. Conversely, if buyers manage to hold the price within this range, it could boost investor confidence, paving the way for additional growth.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Regardless of temporary selling by miners and investor withdrawals, the underlying strength of Bitcoin continues to be solid.

If Bitcoin maintains its current level, it could potentially lead to a surge toward $100,000, making the ongoing period of stability a crucial phase in the pathway for future price growth.

Read More

- OM/USD

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- Solo Leveling Season 3: What You NEED to Know!

- Disney’s ‘Snow White’ Bombs at Box Office, Worse Than Expected

- Solo Leveling Season 3: What Fans Are Really Speculating!

- Despite Strong Criticism, Days Gone PS5 Is Climbing Up the PS Store Pre-Order Charts

- Jelly Roll’s 120-Lb. Weight Loss Leads to Unexpected Body Changes

- The Perfect Couple season 2 is in the works at Netflix – but the cast will be different

- Netflix’s Dungeons & Dragons Series: A Journey into the Forgotten Realms!

2024-11-19 05:12