- The crypto fear and greed index hit ‘extreme greed’ as bullish bets on +$100K intensified.

- The retail market was back and could compound a price pullback scenario for BTC.

As a seasoned researcher with years of experience in the cryptocurrency market, I can tell you that these trends are both intriguing and somewhat predictable. The ‘extreme greed’ status on the Crypto Fear and Greed Index is a red flag that has often preceded local or cycle tops in Bitcoin’s price history. However, it’s also important to note that market sentiment can be misleading at times.

For some time now, the value of Bitcoin (BTC) has hovered near the $90,000 mark, yet the market’s enthusiasm has stayed high. In fact, as indicated by the Crypto Fear and Greed Index (FGI), this market sentiment has reached an “extreme greed” level.

As a crypto investor, I’ve noticed that based on Soso Value data, we’ve seen the fifth instance of an ‘extreme greed’ signal (scoring above 80) on the Fear & Greed Index since 2021. This suggests that there might be a high level of optimism in the market right now, which could potentially lead to increased volatility or a correction.

Historically, when the Fear & Greed Index (FGI) exceeded 80, it has often corresponded with Bitcoin’s local and long-term price peaks. In early 2024, Bitcoin reached a local top of over $73K when ‘extreme greed’ was reported among investors.

2021 saw a comparable signal peaking around February, which was followed by another peak in August, signifying the end of a cycle.

As a researcher examining the Bitcoin market trends, I am pondering whether the current trajectory will lead to a reversal and cause a price decline. However, the high levels of optimism in the options market seem to contradict this notion, at least until we surpass the $100K mark.

BTC options traders eye $95K — $110K targets

Based on the most recent information from Deribit, it appears that larger traders have maintained their optimistic stance. They’ve sold off bearish bets worth $75,000 and $85,000 while simultaneously increasing bullish bets valued between $95,000 and $110,000.

Part of the Deribit update read,

Combining November’s 84,000 calls with December’s 90,000 calls. Early purchase of additional November 90,000, December 90,000, and further December +95,000 calls. This strategy involves actions in both November and December for a total of 100,000 calls. Later, selling off December 75,000 to 80,000 puts and 90,000 calls, along with straddles. Buying call spreads across December and March for 110,000+ calls. The overall strategy maintains a bullish outlook.

In simpler terms, it seems that the majority of hedge funds were not anticipating Bitcoin’s price to fall below $80,000 or even $75,000, as indicated by their purchase of options to sell (puts) at those prices on December 7th.

Instead, their sights are set on a continued climb, aiming for prices ranging from $95,000 to $110,000 by the end of 2024 or early 2025.

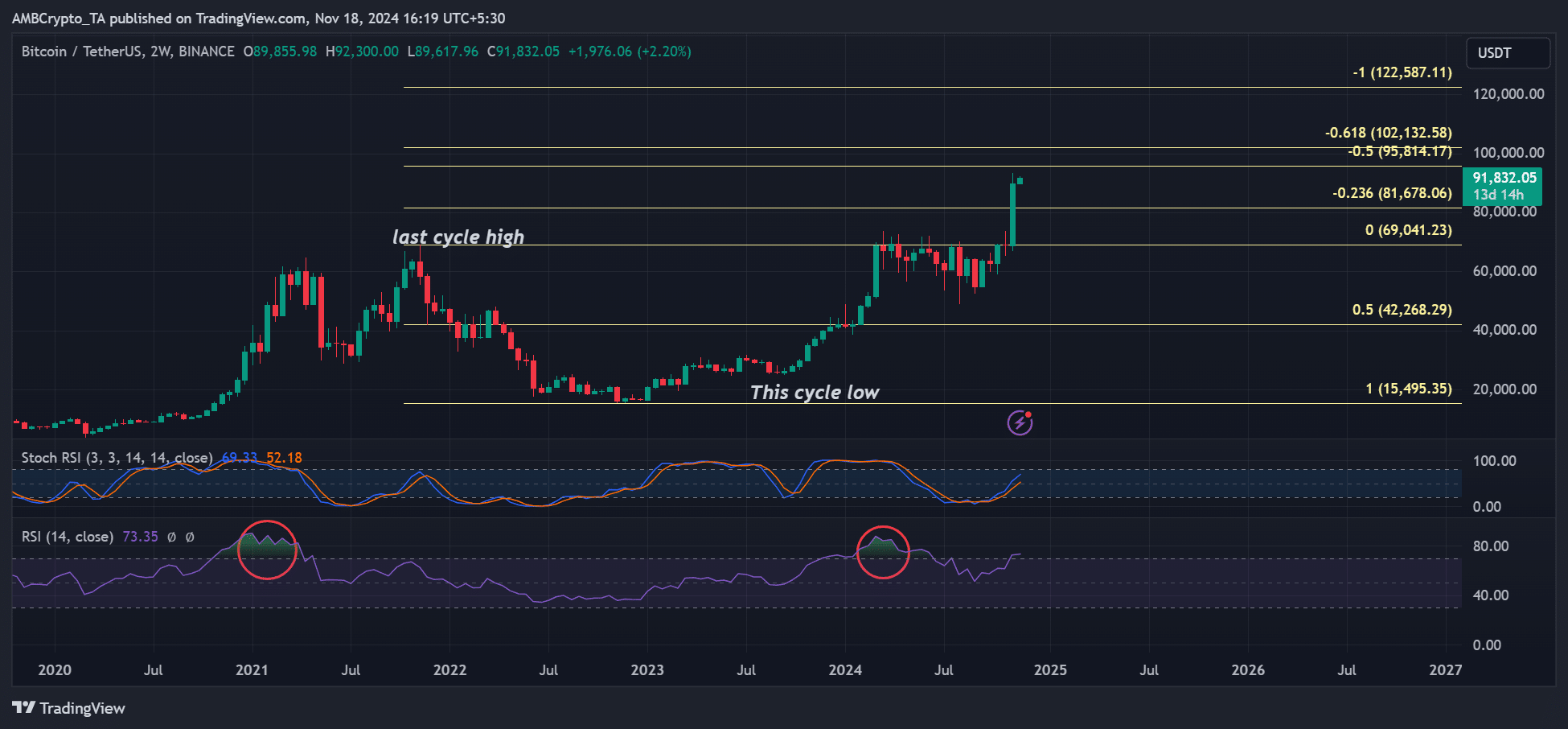

Similar price targets were painted on the BTC’s 2-week chart. The next key upside targets were at $95.8K and $102K.

As an analyst, observing the current price dynamics, I find myself on the verge of a potential overbought condition for BTC, as indicated by the Stochastic Relative Strength Index (RSI). This could signal that Bitcoin may aim for certain targets ahead.

In other words, when retail investors returned to the market, it often served as a strong indicator suggesting either a local peak or the end of a broader market cycle. Whales usually take advantage of such moments for exiting their positions by providing liquidity.

Read Bitcoin [BTC] Price Prediction 2024-2025

Nevertheless, the founder of CryptoQuant, Ki Young Ju, issued a word of caution about the possibility of a price adjustment, yet he suggested it might not herald the onset of a bear market. In other words, while a price drop could occur, it may not signal the start of a prolonged downtrend in prices.

If I were a gigantic whale, I’d hold on and wait for more sellers to exit the market. The trend is just getting started, and if retail investors join in at $100K, we might see some temporary drops, but they wouldn’t signal the beginning of a prolonged bear market, in my opinion.

Read More

2024-11-19 08:08