- After noting a triple-digit surge in just two days, Secret saw a slight downturn from the $0.42 resistance

- A golden cross on the daily chart could trigger a long-term bullish trend

As a seasoned crypto investor with a knack for spotting trends and analyzing charts, I’ve seen my fair share of market volatility. Secret (SCRT) has been quite the rollercoaster ride lately, surging over 200% in just two weeks, only to face a slight downturn at the $0.42 resistance. While the golden cross on the daily chart could potentially trigger a long-term bullish trend, it’s crucial to remember that the market never sleeps and neither do its surprises.

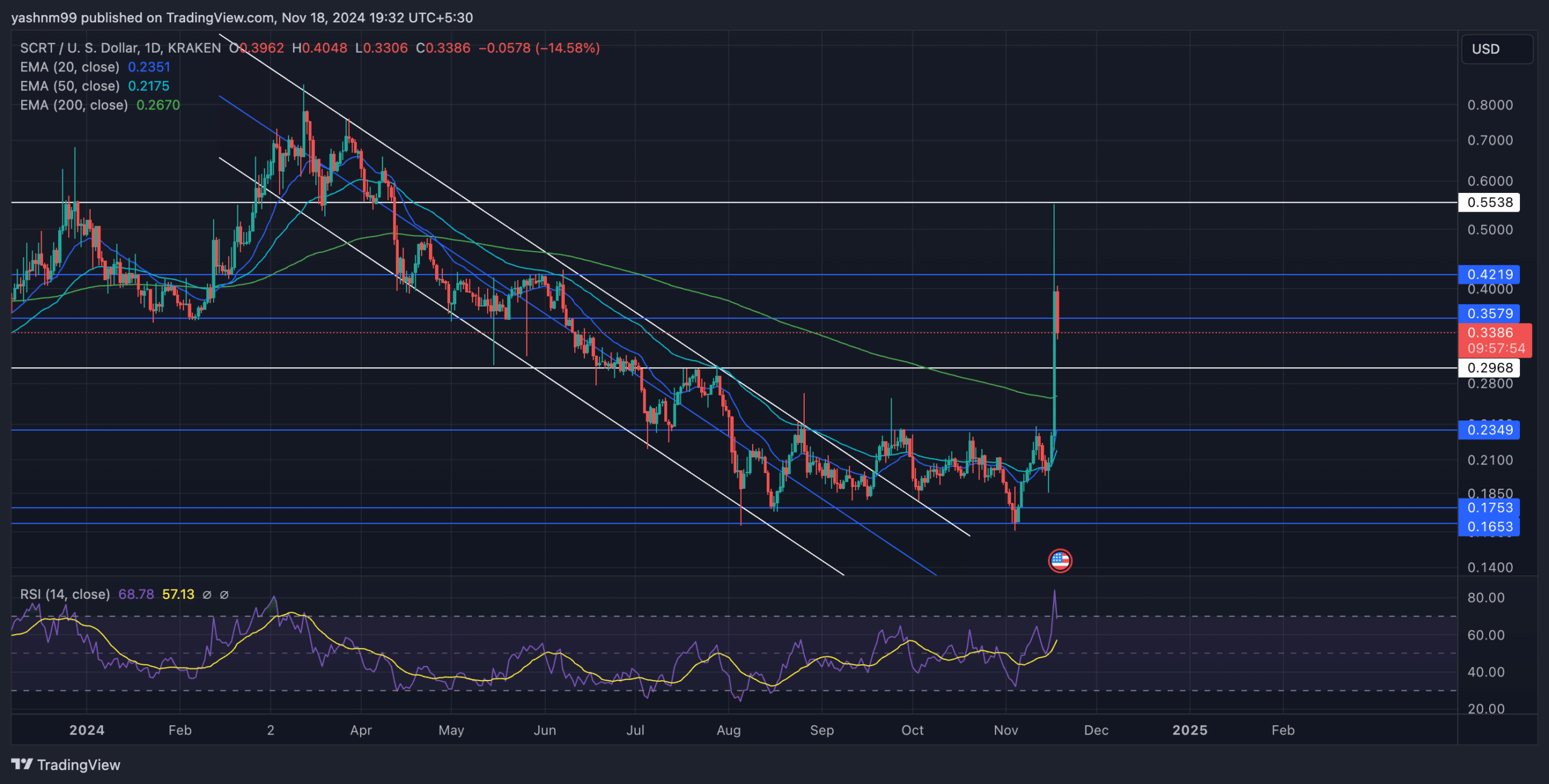

Over the course of two weeks, starting from November 5th through November 17th, SCRT experienced a significant surge exceeding 200%, which was driven by a succession of ‘green’ price increases (represented as green candles on a chart).

The digital currency equivalent to Bitcoin surpassed the significant barrier of $0.23, a level that had previously acted as a cap for nearly three months. Yet, the surge in demand encountered its first substantial challenge since the altcoin struggled to maintain levels above the $0.35 threshold after briefly touching a seven-month peak.

Currently, SCRT is being traded at approximately $0.34 per unit. Over the past 24 hours, its price has dropped more than 32%, indicating a weakening bullish trend.

Can SCRT buyers sustain the momentum?

The recent behavior of the altcoin emphasizes the role of Exponential Moving Average (EMA) levels in predicting Scrt’s short-term path. Right now, Scrt is sitting slightly above its 20-day, 50-day, and 200-day EMAs, suggesting a robust upward trend. Yet, the $0.42 barrier has triggered a temporary bearish movement on the graphs.

If SCRT manages to climb above its resistance at around $0.357 (which is close to its 200-day moving average), it might pave the way for potential exploration of the $0.42 to $0.55 price range. A ‘golden cross’ where the 20-day EMA surpasses the 200-day EMA could further boost a bullish recovery trend.

Instead, if the price falls below $0.29, it could indicate the end of the bullish trend and cause the price to move towards the $0.23 support level. This situation might result in long-term consolidation. The nearby Exponential Moving Average (EMA) levels are significant areas where buyers should hold their ground to prevent a more severe correction from occurring.

Lately, the Relative Strength Index (RSI) momentarily reached 83 but then dropped to 68, indicating that the strong bullish momentum might be starting to slow down following its overbought state. Even though the RSI’s moving average remains above 50, it suggests that buyers may still hold a slight advantage in the market for now.

SCRT Derivatives data analysis

Over the last 24 hours, there was a significant increase of more than 217.34% in the volume, which coincided with losses and suggests a powerful downward trend (bearish move). At the same time, the Open Interest saw a sharp decrease of 28.93%, possibly because numerous traders closed their positions due to the high market volatility.

In simpler terms, the balance between bulls (those who believe prices will rise) and bears (those who believe prices will fall) was approximately equal, as shown by a 0.9631 ratio over a 24-hour period. This suggests no clear advantage for either side. On the other hand, when looking at the ratio of SCRT/USDT on Binance, there appears to be a more optimistic outlook among top traders, with a value of 1.2, indicating that they are favoring the bulls over the bears.

As an analyst, I’d advise keeping a vigilant watch on the Relative Strength Index (RSI) and derivative data to catch early signs of the market’s next move. A potential rebound at $0.29 could pave the way for another surge towards $0.42. Conversely, if the price breaks down below $0.29, it might be wise to consider adopting more defensive trading strategies.

Read More

- PI PREDICTION. PI cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Quick Guide: Finding Garlic in Oblivion Remastered

- WCT PREDICTION. WCT cryptocurrency

2024-11-19 10:15