- Kaspa has seen an impressive rally, but now faces a significant resistance level that could cap its momentum.

- On-chain metrics offered mixed signals, leaving the market uncertain about KAS’s next move.

As a seasoned crypto investor with battle scars from countless market cycles, I can confidently say that Kaspa [KAS] has shown impressive resilience and potential. Its recent surge of 11.92% in 24 hours is nothing short of remarkable, especially considering the overall bearish sentiment lingering in the crypto space.

In the last 24 hours, the digital currency Kaspa (KAS) has climbed to be among the leading performers within the cryptocurrency market, experiencing a significant increase of 11.92%, due to an escalating level of investor enthusiasm.

The positive trend persists consistently throughout different periods. Over the last week, KAS has seen a growth of 6.43%, while during the last month, it has achieved a substantial increase of 27.15%.

Although there’s hope that KAS could hit a record high, the mixed opinions among investors are causing uncertainty about what might happen next, as it’s hard to predict KAS’s future moves.

KAS faces challenges on its path to recovery

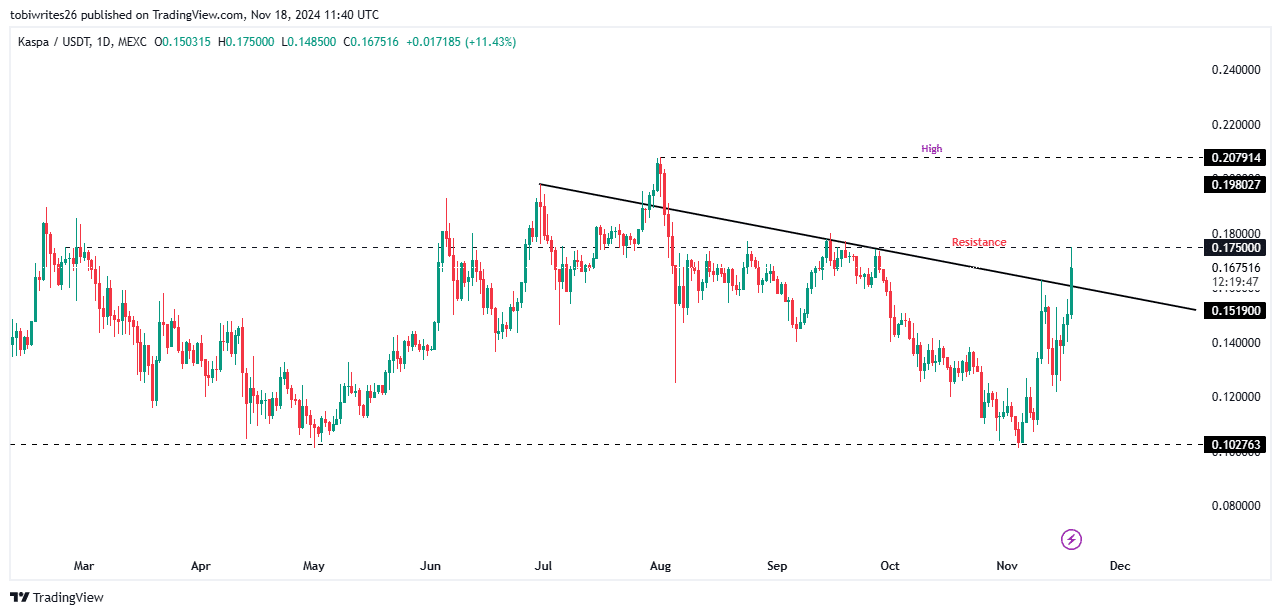

KAS has experienced a significant rise following its successful breakout from a long-term downward trendline that previously thwarted five successive price increases.

Although they’ve made a notable advancement, KAS is currently encountering substantial obstacles at the $0.1750 mark, a price where it has consistently halted any additional growth in the past.

Should KAS successfully trade beyond the current resistance point, it might be poised to hit a fresh record peak, exceeding $0.2079 compared to its current value.

If a pessimistic outlook dominates, the asset could revert to the downward sloping trendline, halting any potential advancement.

To predict KAS’s upcoming action, AMBCrypto delved deeper into other market indicators. Yet, the overall feeling amongst market players was divided.

Bulls, bears compete for control

At the moment, there seems to be a struggle going on between optimistic investors (bulls) and pessimistic ones (bears), each playing a significant role in shaping the ups and downs of market prices.

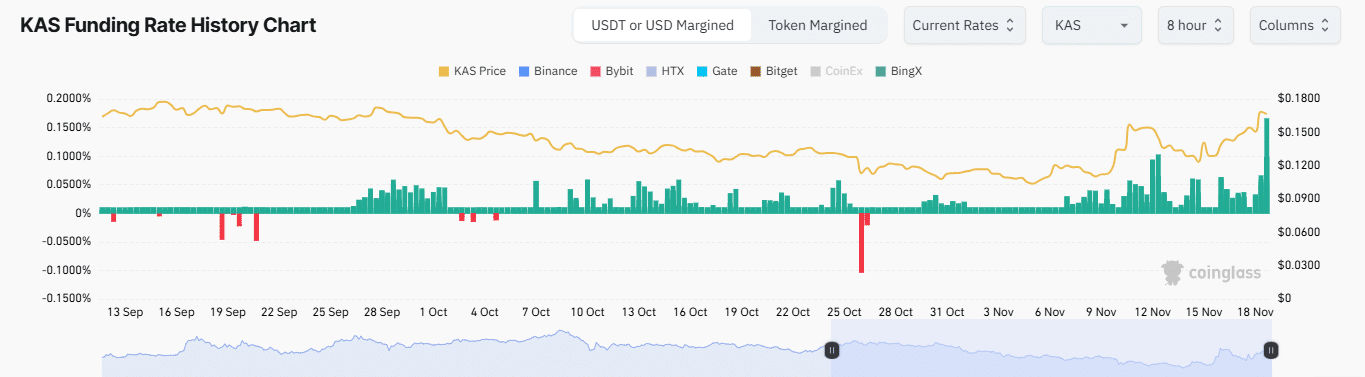

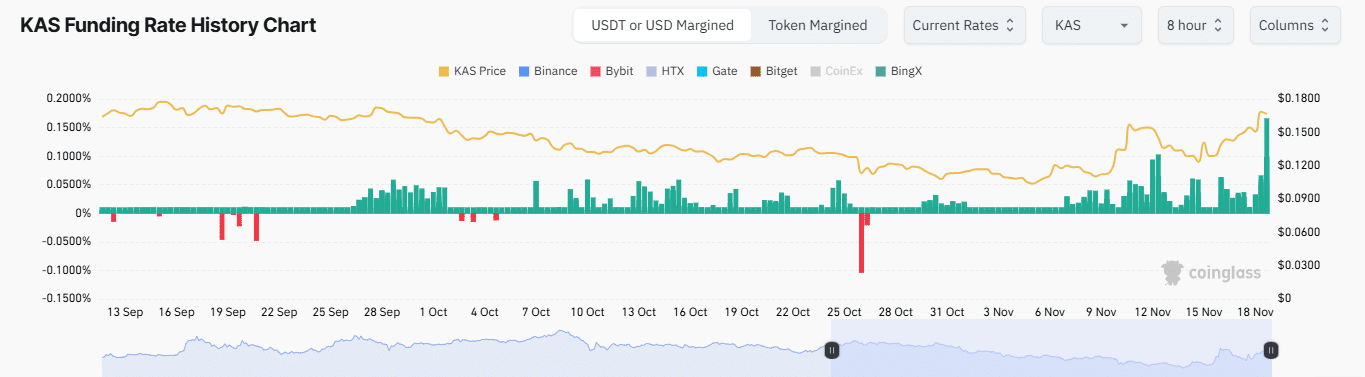

Currently, the Funding Rate and Open Interest on Coinglass indicate a context that seems to support further bullish trends, but there may also be hints of a possible downturn.

The current Funding Rate, which estimates the fee charged for keeping a balance even in both the immediate (spot) and future markets, is set at 0.0200%.

As a crypto investor, when I see Positive Funding Rates, it means that those who have taken long positions (buying) are actually paying off those with short positions (selling). This usually suggests a bullish market sentiment, implying that prices might surge even higher.

Meanwhile, Open Interest has surged by 22.12%, reflecting an increase in active contracts.

At the current moment, this situation suggests increased market engagement, as bulls control a substantial chunk of these contracts, collectively worth approximately $124.95 million.

Although there are positive signs suggesting a bullish market, it’s noticeable that bearish actions have been observed in recent sell-offs of long positions, predominantly on shorter trading periods.

Prolonged sell-offs happen when the price decreases, causing the activation of sellers’ stop-loss orders, which intensifies the overall negative trend.

On the one-hour timeframe, a significantly larger amount of long positions, valued at approximately $90,780, were terminated, as opposed to only around $6,970 worth of short positions. This imbalance boosts the downward trending pressure.

During a full day’s period, long positions were liquidated for approximately $261,610, indicating continued bearish sentiment.

In simpler terms, for every 100 contracts in the market, slightly over 90 are short positions, while only about 10 are long positions.

Read Kaspa’s [KAS] Price Prediction 2024–2025

Imbalances in the market can make it susceptible to adjustments or corrections, as too many investors end up with excessive exposure on a single side of the trade.

As bulls strive to reclaim dominance and push prices higher, the growing impact of bearish actions hints at an impending change or increased market turbulence in the short run.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- Quick Guide: Finding Garlic in Oblivion Remastered

- Katy Perry Shares NSFW Confession on Orlando Bloom’s “Magic Stick”

- Disney Quietly Removes Major DEI Initiatives from SEC Filing

- How to Get to Frostcrag Spire in Oblivion Remastered

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- Elon Musk’s Wild Blockchain Adventure: Is He the Next Digital Wizard?

- Unforgettable Deaths in Middle-earth: Lord of the Rings’ Most Memorable Kills Ranked

2024-11-19 11:04