- Bullish momentum seemed to be on PEPE’s as December’s 10x rally loomed

- PEPE’s rising hashrate pointed to bullish momentum too

As a seasoned analyst with over two decades of trading experience under my belt, I find myself intrigued by the latest developments surrounding PEPE Coin. The bullish momentum seems undeniable, with the 10x rally in December looming on the horizon and the rising hashrate pointing to a robust network.

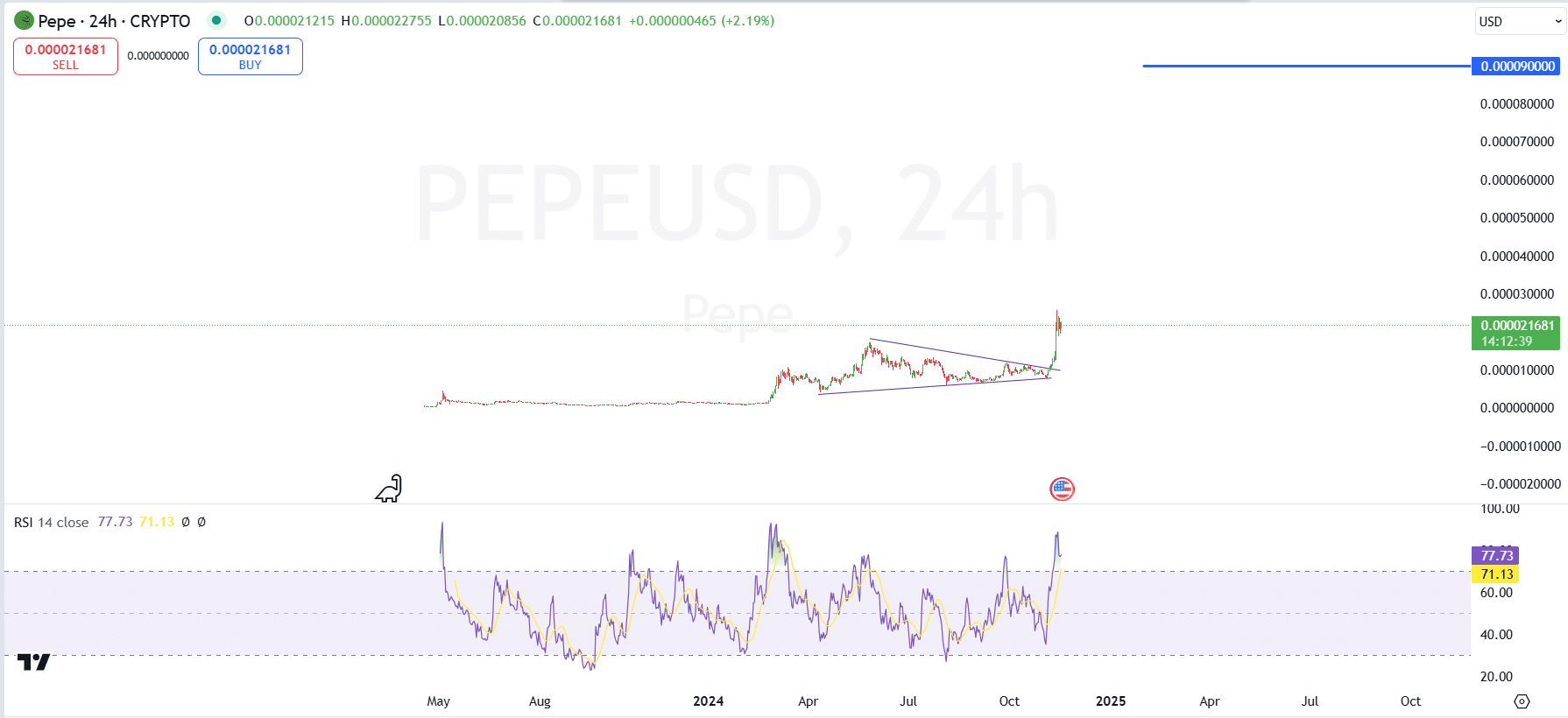

Currently, PEPE Coin is being traded at around $0.00002101, having a trading volume of about $4.85 billion over the past 24 hours. This follows a small upward trend on its charts, which has boosted its market capitalization to roughly $8.86 billion.

The recent movements of PEPE’s price suggest a period of consolidation, with the formation of triangle patterns that often indicate a major breakout might occur on the graphs. This technical setup has sparked interest among traders, particularly since it appears to resemble PEPE’s February rally where the token experienced an incredible 10x increase in just 40 days.

Given the growing excitement and significant market attention, it’s plausible that the token could reach $0.0009 by December 16 – Signaling yet another achievement for the digital asset.

The strength indicator of the memecoin indicates a positive trend, implying increasing bullish energy. Yet, the future action hinges on significant confirmation of a breakout beyond the boundaries of the symmetrical triangle pattern it’s trapped in.

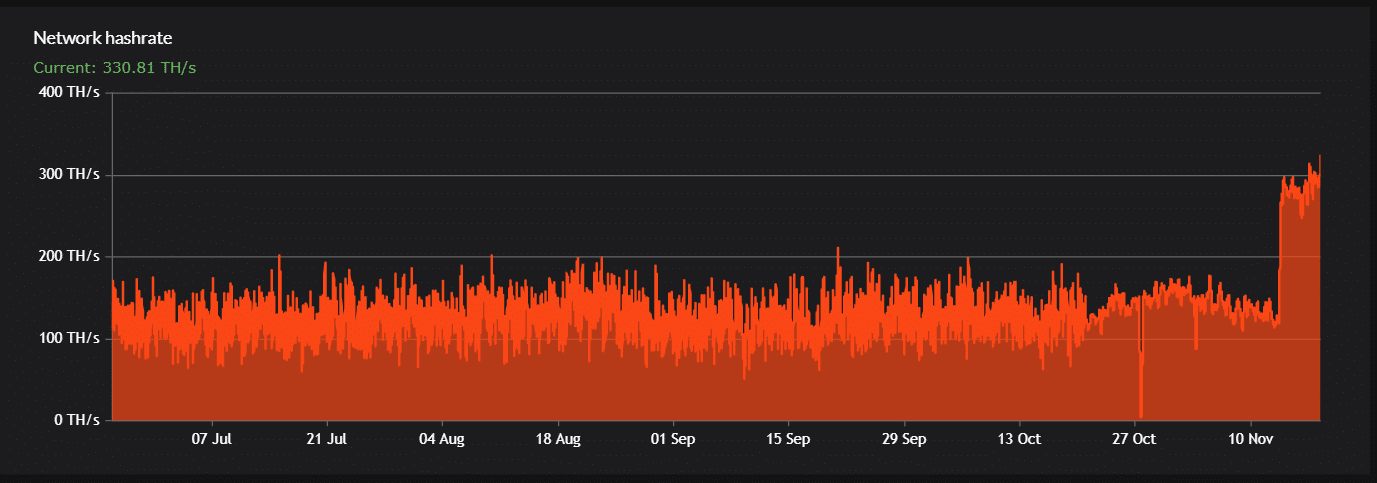

PEPE hashrate surges to 330 TH/s, boosting network security

The graph showed a significant increase in PEPE’s network hashrate, reaching an impressive 330.81 terahashes per second (TH/s). In simpler terms, this hashrate indicates the high level of computational power utilized by miners to verify transactions and maintain the security of the blockchain.

A larger hashrate indicates increased mining effort, stronger network protection, and improved decentralization – Each element contributing to a greater sense of trust in the blockchain’s dependability.

This significant increase indicates a heightened level of miner interest, possibly because of enhanced profitability or predictions of future price increases. For PEPE, an uptick in hashrate might boost its price, as it suggests a robust and more stable network.

As a researcher, I’ve noticed that an increase in mining participation tends to coincide with optimistic market sentiments, drawing in both traders and investors. Yet, this surge also amplifies the mining competition, potentially impacting profit margins.

PEPE’s bullish trend cools down

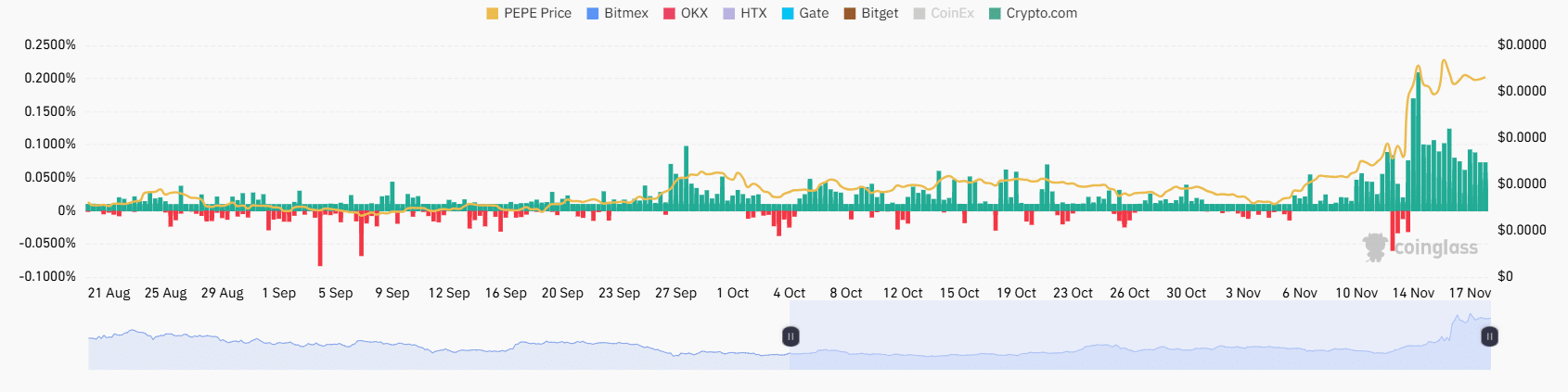

Starting on November 5th, PEPE started a continuous increase in value, accumulating bullish energy as funding rates on major platforms like Bitmex, OKX, and Gate progressively became positive. In fact, the upward trend reached its peak on November 4th – Indicating a substantial spike that was bolstered by increased trading activity and robust long positions.

Throughout this span, traders showed increasing optimism as favorable funding rates underscored their readiness to pay extra fees for maintaining bullish stances.

Following November 14th, the price of the memecoin started to gradually decrease, with its value being influenced by changing funding rates. Although funding occasionally stayed positive, suggesting lingering optimism among investors, periods of negative funding rates hinted at profit-taking and uncertainty within the market.

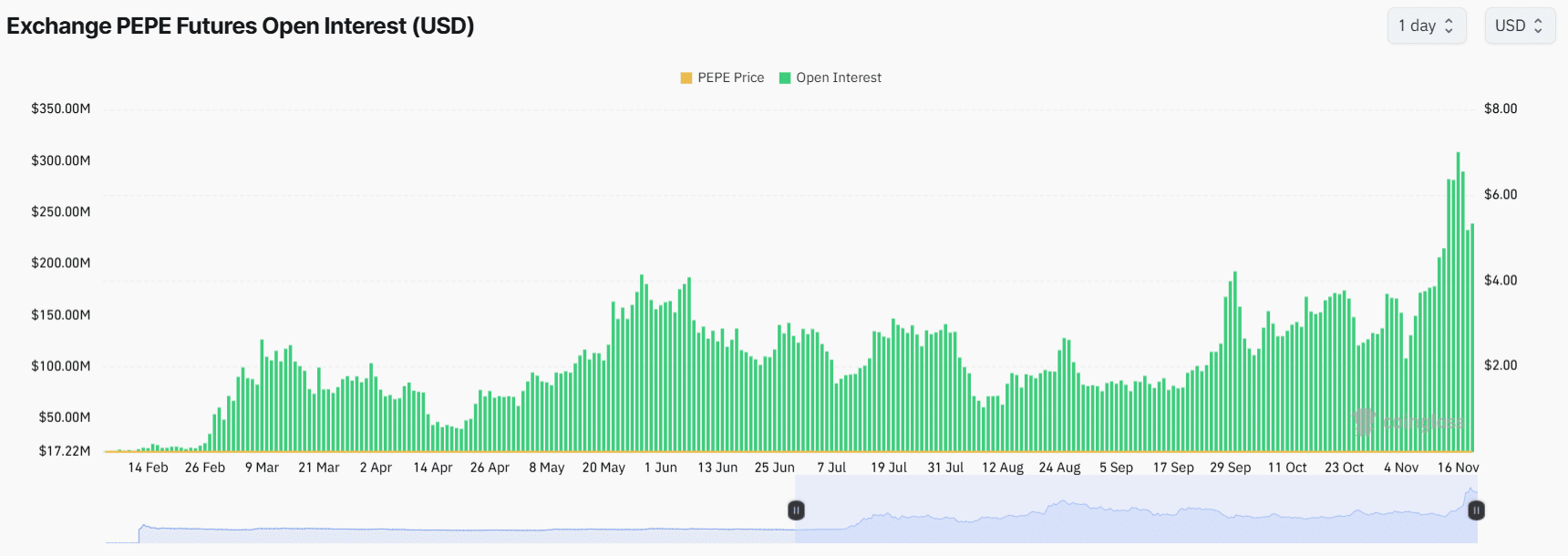

At the same time as this consolidation, the Open Interest for PEPE’s Futures reached an all-time high of $308 million on November 16th, suggesting a marked increase in market activity and trader involvement.

It appears that this peak aligns with PEPE’s current upward price trend, indicating increased optimism from traders and a spike in speculation.

In summary, Open Interest refers to the combined worth of all unfilled futures agreements, and its consistent increase before November 16th indicated a robust market momentum and high liquidity.

It’s important to mention that the Open Interest dropped down to approximately $239 million on November 18, suggesting a reduction in held positions.

This decrease might indicate investors are cashing out or changing their perspective after the high point. Although the drop mentioned earlier may signal wariness among traders, the Open Interest remains high, implying that there’s ongoing enthusiasm for PEPE.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-11-19 12:08