- LimeWire’s recent rally showed strong buying interest as it broke above key resistance levels

- Buyers should watch for a potential bullish 20/50 day EMA crossover as it could signal the start of a more extended uptrend

As a seasoned researcher with years of experience analyzing cryptocurrency markets, I find LimeWire’s (LMWR) recent surge incredibly intriguing. The altcoin breaking key resistance levels and rallying over 200% is a clear sign of strong buying interest, which I’ve not seen since the days of Napster and Kazaa!

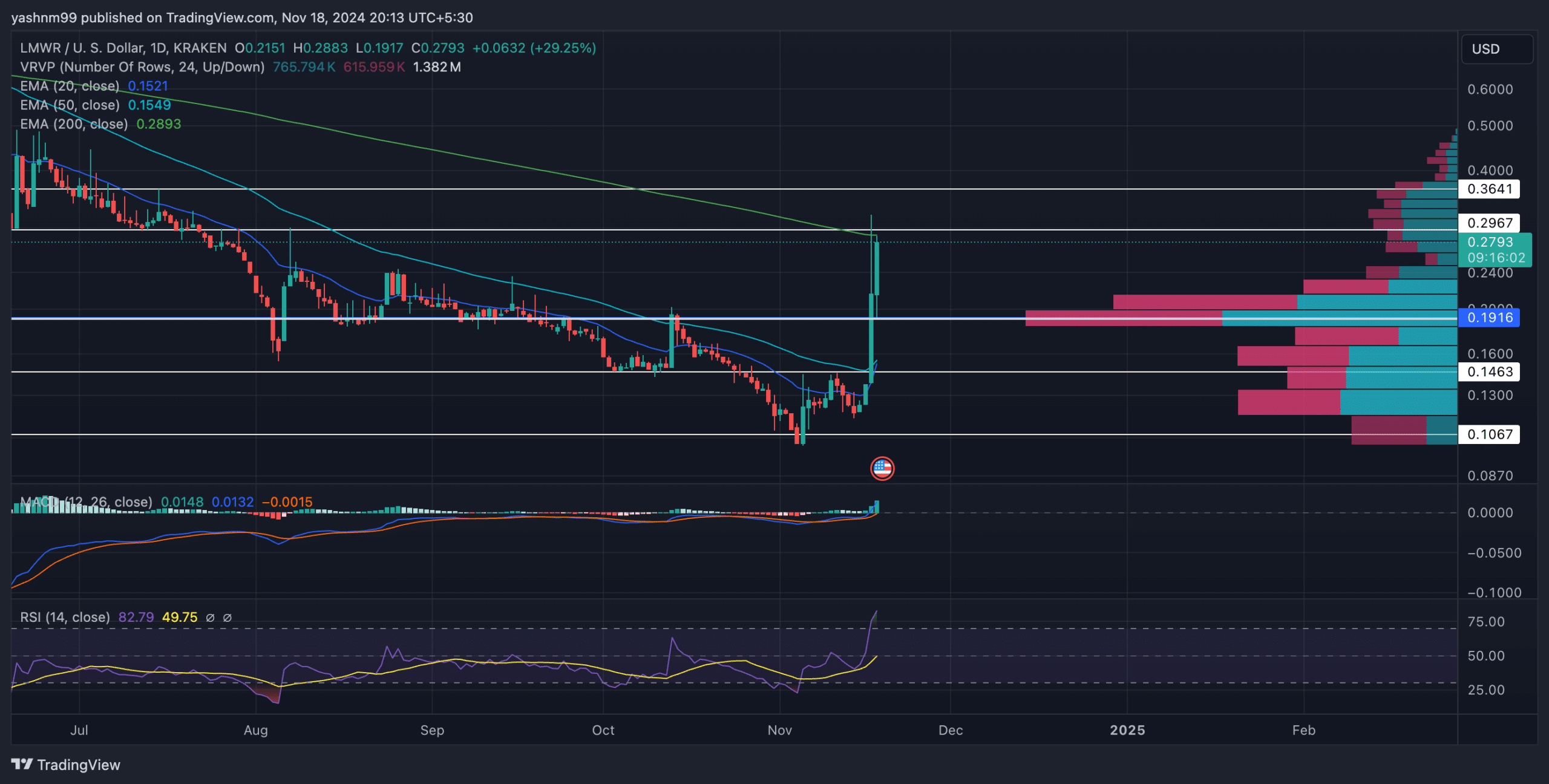

In recent times, LimeWire (LMWR) has been drawing attention due to an impressive surge in value over the last few days. The digital coin soared by more than 200% from its rally on November 5th, reaching approximately $0.32 on November 17th. This dramatic increase propelled LMWR into a period of price exploration as it successfully broke through its previous resistance level.

Currently, LMWR stocks are approximately $0.27 per share, marking an increase of around 65% over the past day. The stock’s movements have repeatedly challenged the resistance at roughly $0.3, but so far have failed to secure a conclusive close above this point. Notably, the $0.3 resistance level appears to coincide with the 200-day Exponential Moving Average (EMA), creating a crucial hurdle for buyers looking to break through.

Can LMWR buyers sustain the momentum or will sellers reclaim control?

Recently, LMWR managed to surpass its 20-day and 50-day moving averages (at $0.151 and $0.1545 respectively), and is currently trying to maintain its position above these temporary supports. If the 20-day moving average crosses over the 50-day moving average in a bullish manner, it may signal the start of a more robust recovery, potentially aiming for the resistance at $0.36.

If LMWR doesn’t manage to rise above the $0.3 mark, there could be a brief downturn, with potential support found at $0.2. Currently, the Relative Strength Index (RSI) is approximately 81, suggesting that LMWR is overbought.

As a crypto investor, I should exercise some caution since an RSI (Relative Strength Index) above 80 might signal a potential shift if there’s a significant increase in selling pressure, which could lead to a market reversal.

It’s important to point out that the value of this altcoin experienced an impressive surge of more than 260% in its daily trading volumes. This spike happened alongside a significant increase of over 65% in its daily price, indicating a strong upward trend. However, it is also crucial for traders to keep an eye on Bitcoin‘s price fluctuations. This is because the overall market mood could potentially impact LMWR’s future actions.

MACD and Volume Profile Analysis

Just now, the MACD indicator has turned positive, as the MACD line has crossed above the signal line. The MACD line has risen significantly above the zero-line, while the signal line is about to cross over the equilibrium. If these two lines continue to climb steadily, it would strengthen the short-term bullish trend suggested by LMWR charts.

Ultimately, the Visible Volume Profile Range (VPVR) showed a substantial region with increased buying interest spanning from $0.15 to $0.21. If there’s a market reversal or dip, this area might provide robust support.

Instead, it shows there’s not much resistance found above $0.32. This means if we see a strong push past this price point, it might lead to swift increases, potentially taking us up to $0.36 and even further.

Read More

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

2024-11-19 13:11