- Litecoin has surged over the past month leaving 65% of holders in profit.

- LTC has surged by 20.42% on monthly charts.

As a seasoned researcher with years of experience observing the crypto market, I must say that the recent surge of Litecoin (LTC) has caught my attention. Having closely followed its journey since 2013, I can attest to the fact that this altcoin has shown remarkable resilience and potential over the years.

Over the past month, Litecoin (LTC) has been climbing steadily after hitting a low of $64, peaking at $98. Currently, it’s trading around $89 – a 20.42% increase from its previous position.

The profits from this have put numerous investors in a positive position, with analysts speculating about the future price fluctuations of the altcoin.

Over 60% of LTC holders currently in profit

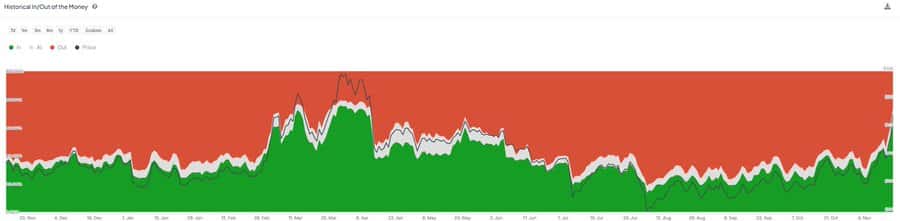

Approximately two-thirds (65.39%) of Litecoin (LTC) owners are presently experiencing a profit, marking the largest number of profitable holders since April.

Meanwhile, 26.72% or 2.14 million addresses are out of the money, while 7.89% are at the money.

If a large percentage of investors are making a profit, there’s a risk of selling behavior that could potentially lower prices. This trend, where people might choose to sell when they recover their initial investment, has been noticed by IntoTheBlock’s analysis. They suggest that many traders who were “out of the money” in 2021 may decide to sell once they reach their break-even point.

For context, during the 2021 bull cycles, LTC surged to $413 in May and $302 in November.

Despite a recent increase in Litecoin’s value, it is still about 78% lower than its 2021 peak. This means that those who currently hold it would need to see a significant rise for the altcoin to return to its 2021 levels, which seems unlikely at this time.

Impact on LTC price charts

It’s wise to also verify other market signals besides the positive outlook given by IntoTheBlock for Litecoin.

Initially, it’s worth noting that the trend for LTC at the moment appears robust, potentially pushing the cryptocurrency towards its previous peak levels.

The current market trend appears to be driven by buyers, as they hold the reins. Examining Litecoin’s Moving Average Convergence Divergence (MACD), we notice that the MACD line has been above its signal line since a bullish crossover occurred about two weeks back.

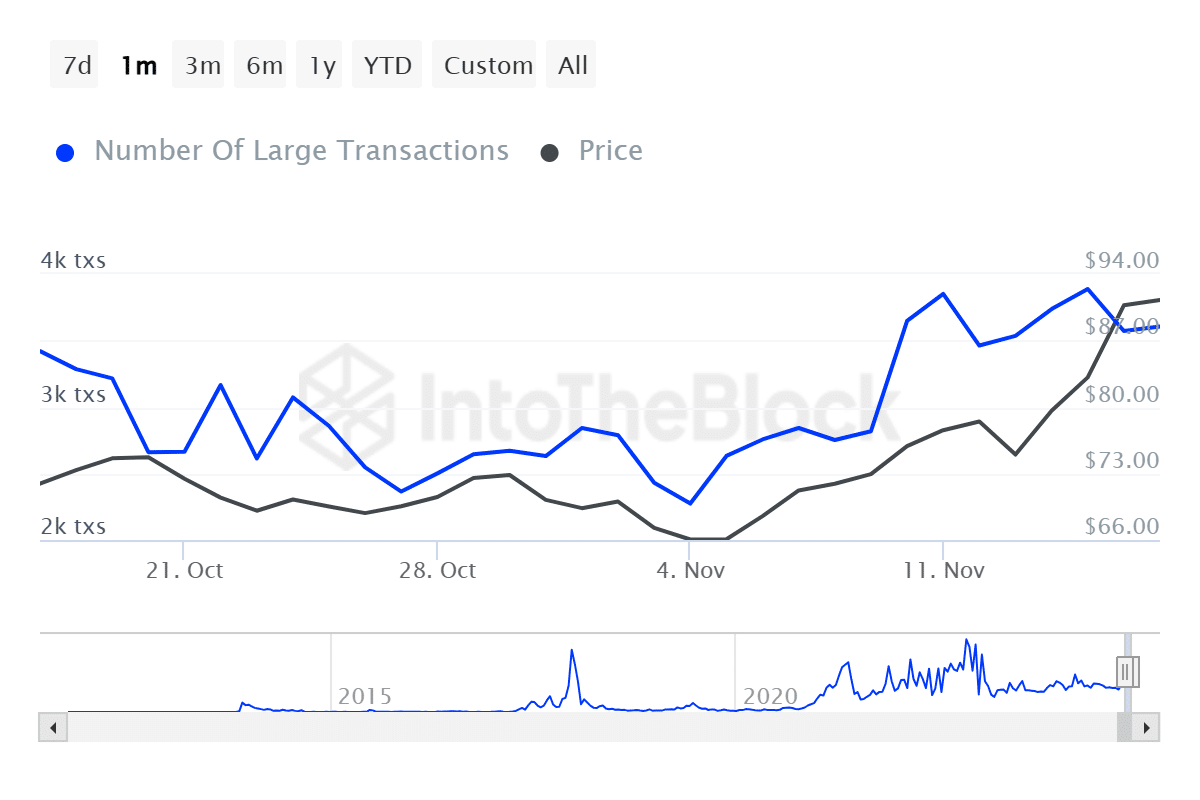

Additionally, it seems that large investors or “whales” are dominating the market as buyers have taken charge. Over the last seven days, the percentage of Litecoin held by significant investors (netflow ratio) has dropped from 5.8% to 1.01%.

A decrease in the number of transfers from major holders to exchanges might indicate strong faith in the upward trend, thereby intensifying the bullish energy.

This surge in big trades suggests that these large transactions might be ‘whales’ buying up LTC.

What next?

To summarize, despite Long Term Capital (LTC) experiencing a robust surge now, it’s unlikely that its 2021 holders will generate resistance, particularly over the short term.

Read Litecoin’s [LTC] Price Prediction 2024–2025

Nevertheless, at present, the altcoin is experiencing an upward trend, as buyers are dominating the market. This situation might lead to additional price increases as depicted on the charts.

If these favorable circumstances persist, it’s likely that LTC will regain the $98 mark. Should it manage to burst through this point, we can expect LTC to reach approximately $105.

Read More

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

- Taylor Swift Denies Involvement as Legal Battle Explodes Between Blake Lively and Justin Baldoni

- The Weeknd Shocks Fans with Unforgettable Grammy Stage Comeback!

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Disney Cuts Rachel Zegler’s Screentime Amid Snow White Backlash: What’s Going On?

- Disney’s Animal Kingdom Says Goodbye to ‘It’s Tough to Be a Bug’ for Zootopia Show

- Shundos in Pokemon Go Explained (And Why Players Want Them)

2024-11-19 17:44