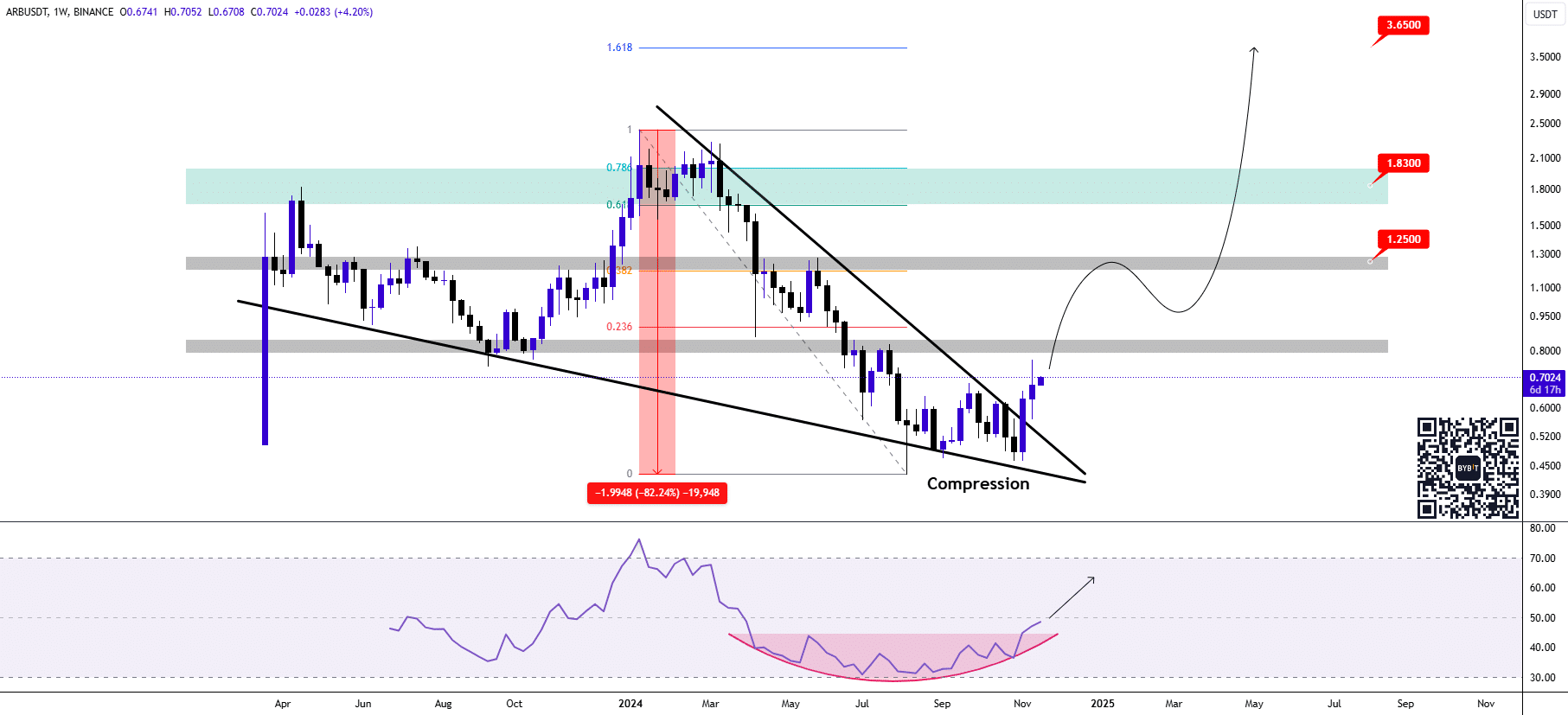

- According to analysts’ charts, ARB is now trading within a falling wedge pattern, signaling the potential for a rally to the upside.

- Other metrics, however, give mixed signals about what to expect from ARB in the coming days.

As a seasoned crypto investor who has weathered countless market cycles and witnessed the rise and fall of numerous digital assets, I find myself cautiously optimistic about Arbitrum (ARB). The formation of a falling wedge pattern is indeed intriguing, hinting at potential gains in the near future. Historically, these patterns have been successful, as suggested by analyst Alex Clay’s analysis.

Over the past month, Arbitrum [ARB] has made a strong recovery of approximately 23.13%, aiming to restore its equilibrium following a significant decrease. However, in the last 24 hours, it has faced challenges maintaining this momentum, only managing a slight rise of 1.37%.

Market sentiment seems somewhat hopeful, given the emergence of an encouraging trend. However, will ARB follow a bullish course? AMBCrypto delves deeper into this topic.

Falling wedge positions ARB for a rally

Financial expert Alex Clay has spotted a ‘falling wedge’ trend in the price movements of ARB – a well-known bullish indicator that suggests a temporary downturn followed by an eventual increase. Previous instances of this pattern have led to potential gains as high as 82.24%.

$1.250, $1.830, and $3.650.

In line with this perspective, the Relative Strength Index (RSI) appears to be shaping a curving upward pattern as it moves towards positive regions. This trend indicates that ARB might be approaching a beneficial zone for further growth.

Clay expressed optimism about ARB’s prospects, stating,

“As $ETH recovers, I am looking for its leading Layer 2 projects [like ARB] to rise as well.”

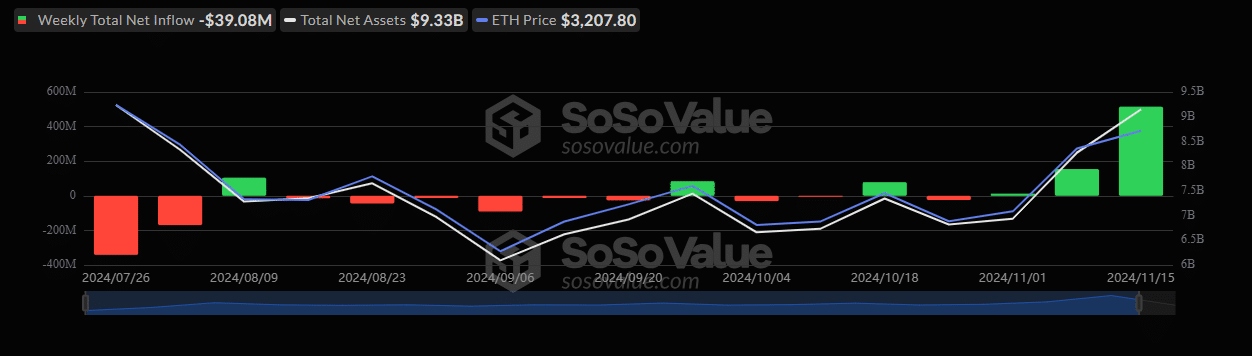

How ETH recovery could drive Arbitrum price rally

The rebound in Ethereum‘s value could have a substantial impact on tokens operating on Layer 2 networks, such as ARB, since their development and expansion largely rely on the success of Ethereum.

Over the last seven days, Ethereum (ETH) has started to bounce back, sparking renewed curiosity among traditional investors. According to Sosovalue’s data, an Ethereum spot ETF recorded its largest single-week influx, amounting to $515.17 million, suggesting that investors are actively buying the asset.

Should Ethereum (ETH) continue its upward trend, there’s a good chance that related assets such as Aave (ARB) will also benefit from this positive momentum. This could boost overall market optimism and significantly fuel a surge in the value of ARB.

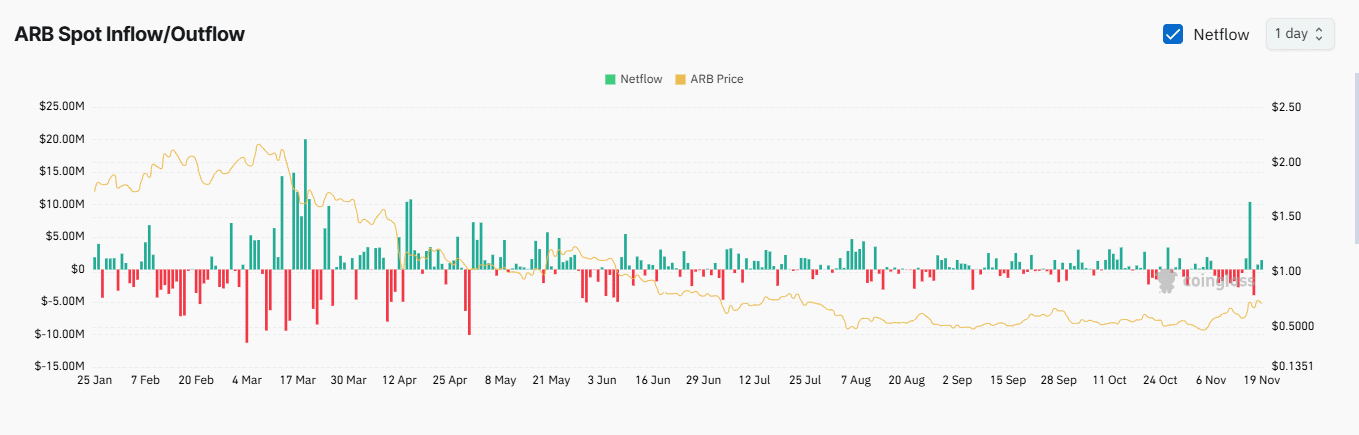

Conflicts among on-chain trading activities

As an analyst, I’ve noticed a significant development in the on-chain trading dynamics of ARB. While the Funding Rate, serving as a gauge for the group balancing the gap between current and future asset prices, suggests that there’s a strong presence of buyers or long positions, it’s crucial to delve deeper into these trends.

Currently, the Funding Rate is sitting at 0.0192%. This indicates a positive outlook on the market, as the high rate suggests strong optimism and expectation for continued growth in an upward direction.

Read Arbitrum’s [ARB] Price Prediction 2024–2025

On the contrary, there’s been a substantial increase in outgoing ARB Exchange Netflow over both daily and weekly periods, indicating that market participants might be moving their holdings to exchanges, which is often a signal of upcoming selling activity.

Over the last seven days, about $1.95 million of ARB has been sent to trading platforms, and a significant portion, approximately $1.44 million, was moved within the last day. If this pace persists, it might significantly impact the asset’s price, potentially contradicting the current optimistic predictions.

Read More

- Gold Rate Forecast

- Masters Toronto 2025: Everything You Need to Know

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

2024-11-19 22:32