- Weekly altcoin trading volume surged as Cardano saw a shift in dynamics.

- Most of active addresses holding ADA were “At the Money” despite the price surge.

As a seasoned researcher with years of experience navigating the volatile cryptocurrency markets, I’ve witnessed many trends come and go. Yet, the recent surge in altcoin trading volume, particularly Cardano (ADA), has been nothing short of extraordinary.

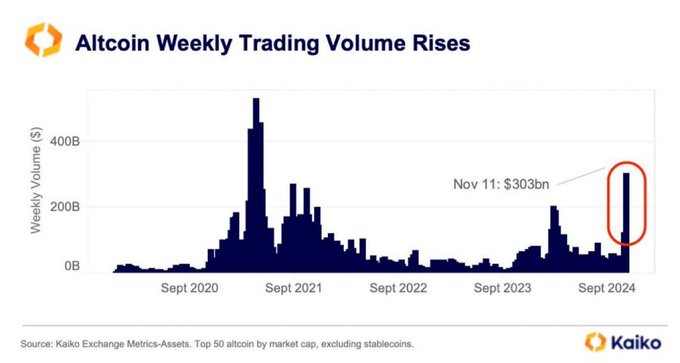

The weekly altcoin trading volume soared to its highest point since 2021, marking a significant milestone.

During the month of November, weekly trading volumes surpassed $303 billion, suggesting a renewed enthusiasm among investors for alternative cryptocurrencies.

This spike, in addition to indicating expanding liquidity, occurred concurrently with an observable upsurge in the value of alternative coins such as Ethereum (ETH), Cardano (ADA), and Ripple (XRP).

Investors are expanding their investment horizons, moving past just Bitcoin [BTC], enticed by cutting-edge technology developments and the possibility of substantial profits in leading alternative cryptocurrencies.

The increased action indicates that the altcoin market is experiencing significant growth, making it an energetic element within the wider cryptocurrency panorama.

ADA volume surge and price prediction

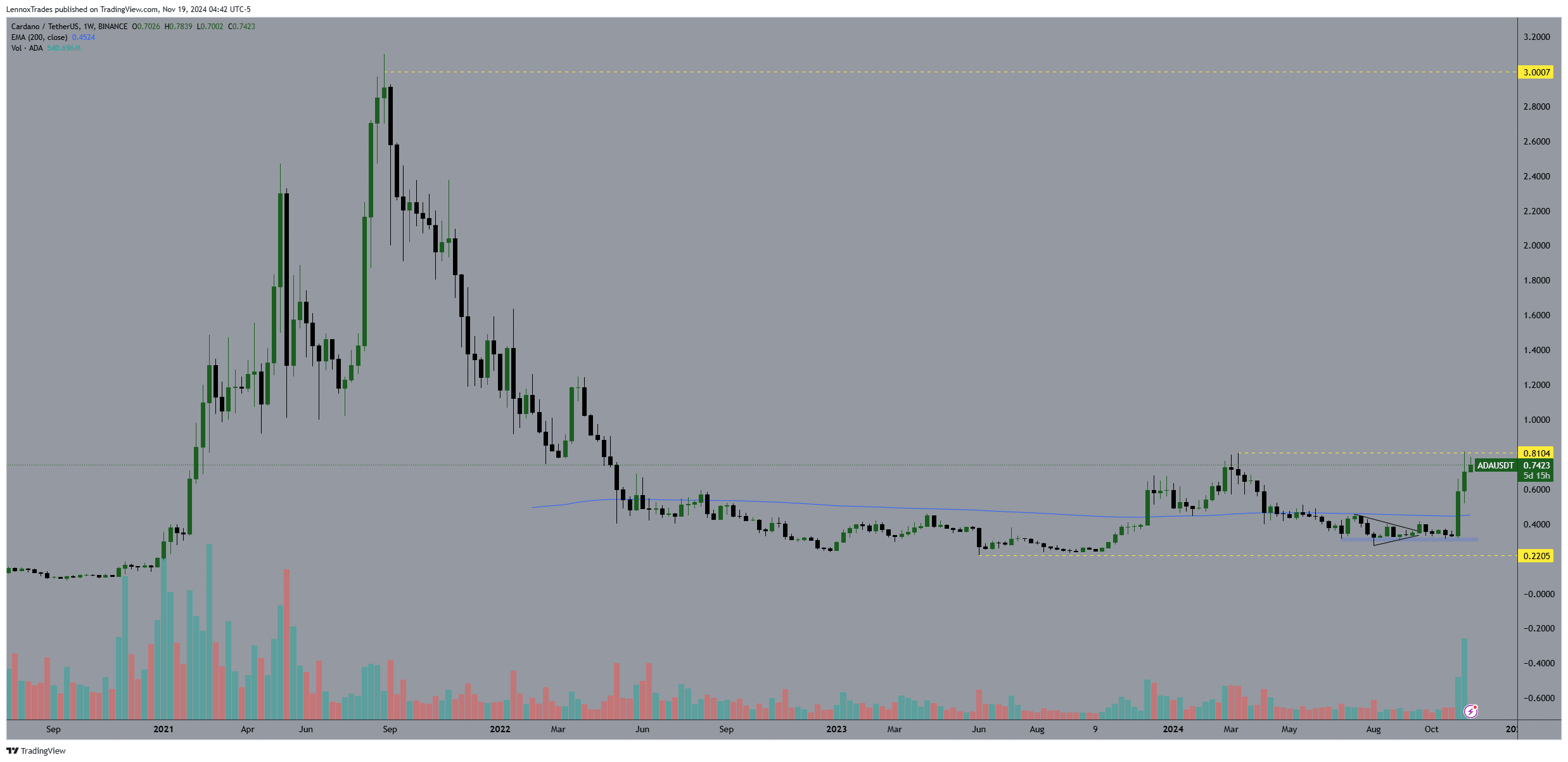

Over the past week, the trading volume for Cardano has significantly increased in tandem with the wider cryptocurrency market, mirroring a comparable surge during the 2021 bull market. This uptick in volume suggests heightened investor attention and trading activity.

The increase suggests a broader change in market behaviors, hinting at a change in investment strategies within the altcoin market.

It seems investors are rebuilding their trust in cryptocurrencies such as ADA, potentially leading to more growth, given the trends observed in market movements.

Recently, the price of ADA experienced an uptick, successfully breaching a significant resistance point. The weekly price movement of ADA against Tether (ADA/USDT) displayed a breakout from its consolidation period, suggesting robust bullish tendencies.

If ADA’s current price nears its former resistance at $0.8, surpassing and sustaining this level might lead to Cardano aiming for a new high of approximately $3 – a price point that was previously reached during the 2021 peak.

The recent surge in ADA’s price indicates a possible continuation of growth if it continues on its current path, bolstered by enhancements within the Cardano network and rising user adoption.

As ADA nears the $1 milestone, attention turns to maintaining strong trading volume and market backing to drive its rise toward $3.

Profitability of active addresses

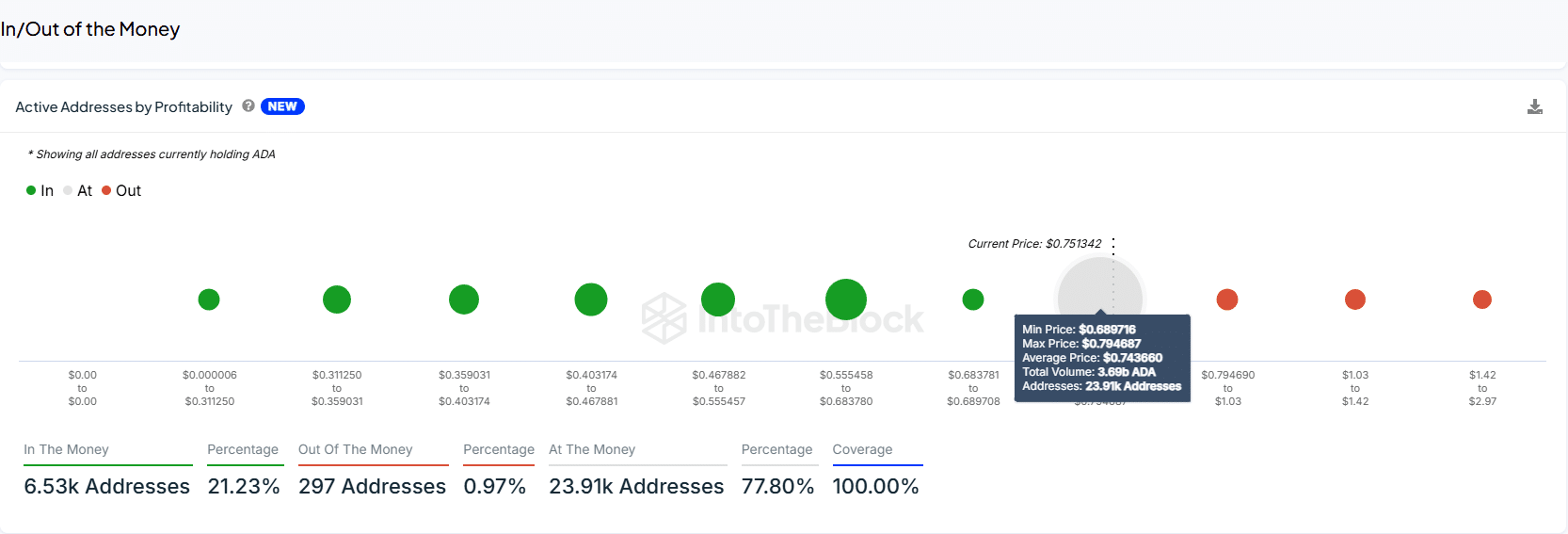

As a researcher examining the financial situation of ADA holders, I found that a substantial portion (approximately 77.80%) of them are currently teetering around the break-even point, with their respective wallet addresses numbering approximately 23,910.

Most of the addresses tended to concentrate near the price points between approximately $0.689 and $0.795, suggesting a significant area of accumulation. Notably, this cluster aligns closely with the current Cardano (ADA) price of $0.751342.

Approximately 0.99% (or just under 1%) of active Ada holders’ addresses, numbering at around 297, failed to earn a return on their investment.

Read Cardano’s [ADA] Price Prediction 2024–2025

Furthermore, approximately one out of five addresses held profitable balances, suggesting that only a modest percentage of actively used addresses had gained financial returns.

This distribution showed a predominant sentiment of profitability within the Cardano market.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-11-20 04:40