- Ethereum reserves on derivative exchanges have surged to the highest level in more than a year as speculative activity rises.

- Rising open interest also suggests traders are increasingly betting on Ethereum’s future price moves.

As a seasoned crypto investor with a knack for reading market trends, I find myself intrigued by the latest developments surrounding Ethereum [ETH]. While the short-term performance of ETH has been lackluster, the derivative market tells a different story. The surge in ETH reserves on derivative exchanges to multi-month highs and the rising open interest suggest that speculative traders are positioning themselves for future price movements.

In recent times, Ethereum (ETH) hasn’t been able to match the success of Bitcoin (BTC) and leading alternative coins, as its value decreased by approximately 6% over the past week, placing it at $3,123 at the current moment.

The persisting downtrend in Ethereum seems to be due to insufficient buying interest to offset the prevailing selling pressure, as per AMBCrypto’s report. At present, sellers hold more influence, obstructing any significant price increase beyond the resistance level.

On the other hand, examining the futures market reveals a discrepancy. The speculative behavior concerning Ethereum is currently at its peak in months, suggesting that derivative investors are preparing for potential future price fluctuations.

ETH reserves on derivative exchanges hit multi-month highs

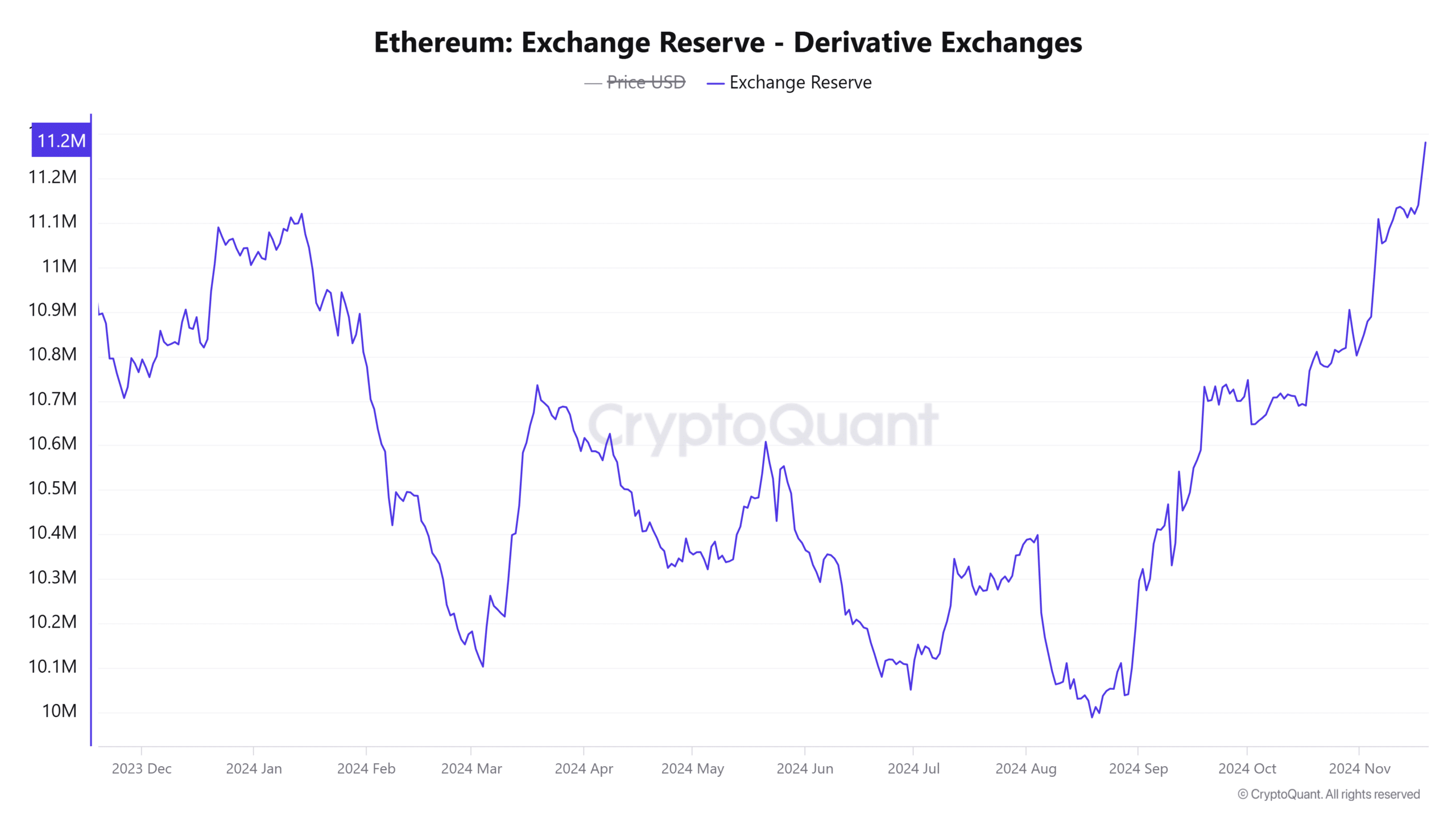

The data provided by CryptoQuant indicates a growing enthusiasm towards Ethereum, as the amount of Ethereum held on derivative trading platforms currently stands at approximately 11.28 million, which is its highest point in more than a year.

As a researcher examining the data, I’ve noticed an increase in higher reserve balances on derivative exchanges related to Ethereum (ETH). This suggests that speculative traders are actively engaging in leveraged trading surrounding ETH. In other words, these traders are essentially wagering on the potential future price swings of Ethereum.

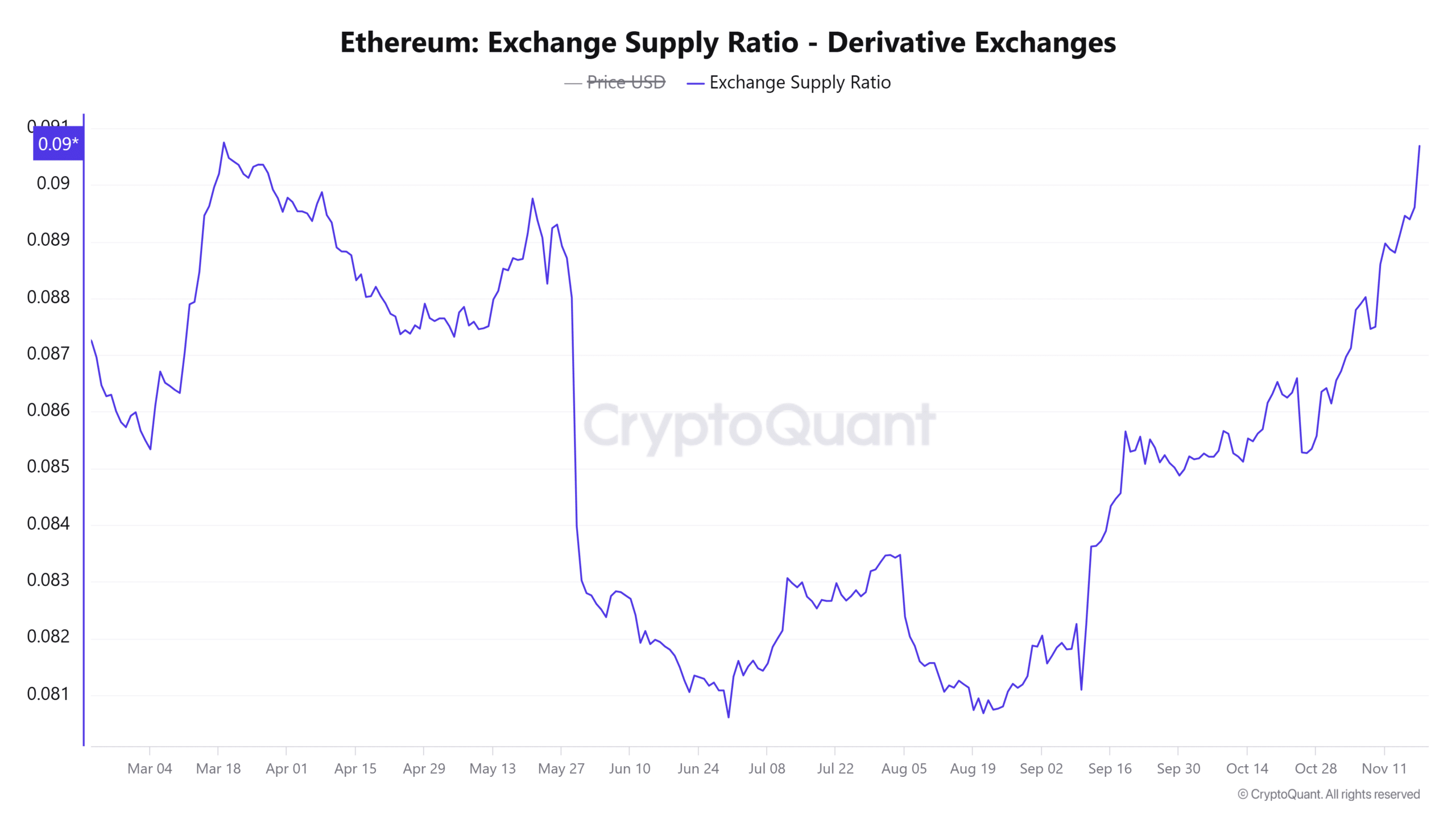

Currently, it’s apparent that there’s a growing trend in speculation, and this can be observed even in the derivative exchange ratio. At the moment, this ratio is 0.09, meaning that approximately 9% of Ethereum’s total circulating supply is being held on derivative exchanges.

The value of this indicator has reached its peak level since April, indicating a significant change in the market’s dynamics, with derivative trading activities appearing to be a crucial factor shaping Ethereum’s temporary price movements.

An increase in leveraged ETH trading might lead to price volatility because of compulsory sell-offs when ETH experiences sudden price changes. Furthermore, this trading style can strengthen existing bullish or bearish market sentiments based on the positions taken by traders.

Ethereum’s open interest makes another high

The total value of open contracts for Ethereum, as reported by Coinglass, has reached an all-time high of $18.31 billion, indicating a surge in new positions related to ETH. Since the beginning of this month, the open interest for ETH has grown significantly by over $4 billion.

Read Ethereum’s [ETH] Price Prediction 2024–2025

When the number of ongoing contracts increases and the fee for holding these contracts stays above zero, it suggests that there are more traders opting to take long positions rather than short ones. This often indicates a bullish sentiment towards potential price trends in the future.

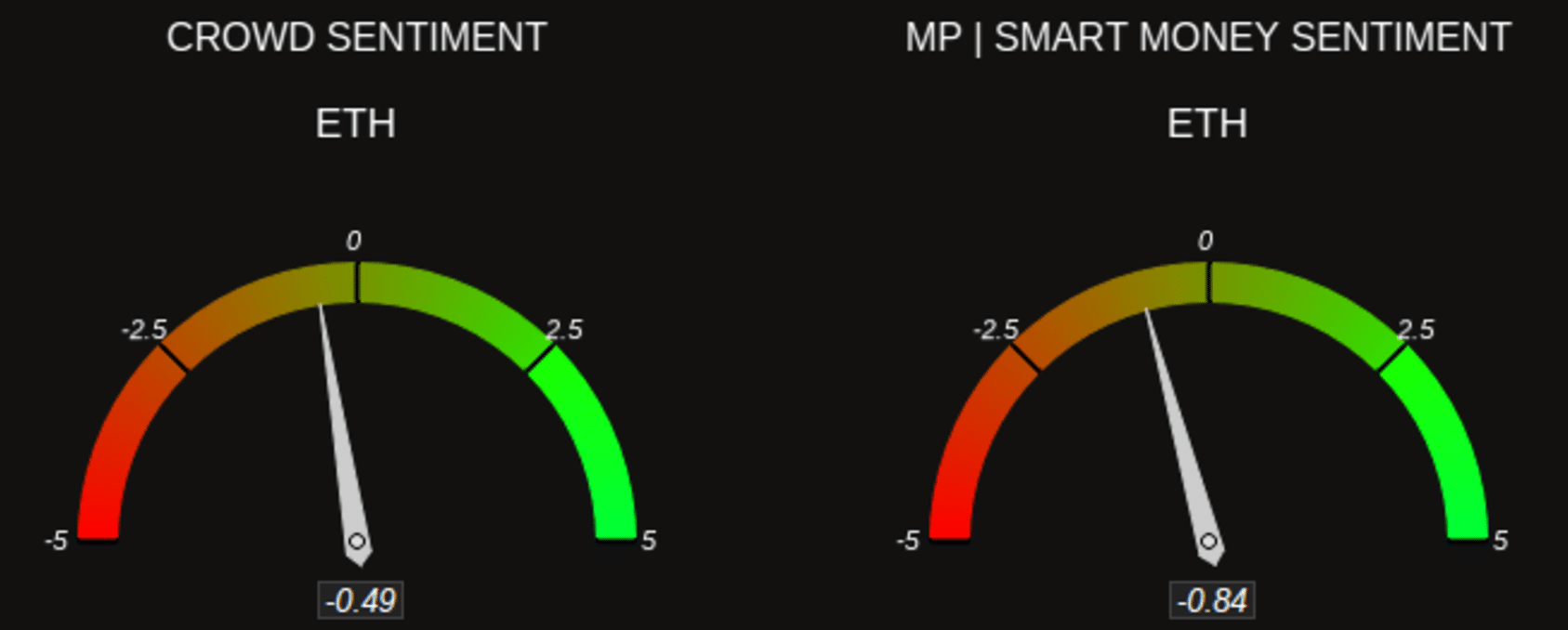

As a researcher, I’ve been analyzing data from Market Prophit, and it appears that the prevailing sentiment towards Ethereum in the market is generally bearish. This bearish attitude might lead to decreased demand, potentially hindering any significant bullish recovery.

Read More

- OM/USD

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- Solo Leveling Season 3: What You NEED to Know!

- Solo Leveling Season 3: What Fans Are Really Speculating!

- Despite Strong Criticism, Days Gone PS5 Is Climbing Up the PS Store Pre-Order Charts

- Jelly Roll’s 120-Lb. Weight Loss Leads to Unexpected Body Changes

- The Perfect Couple season 2 is in the works at Netflix – but the cast will be different

- Joan Vassos Reveals Shocking Truth Behind Her NYC Apartment Hunt with Chock Chapple!

- Disney’s ‘Snow White’ Bombs at Box Office, Worse Than Expected

2024-11-20 08:07