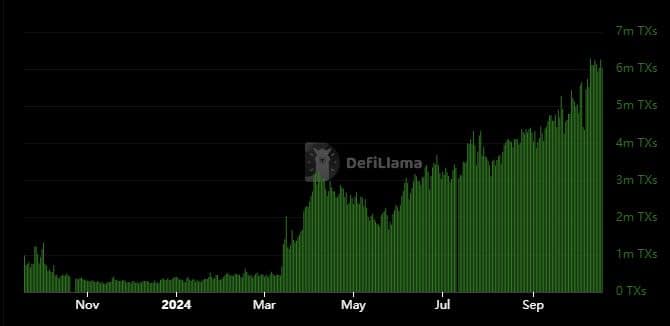

- Base transactions soared to a new ATH on the back of strong network activity

- Base continues to maintain its top dog position in the Ethereum layer 2 landscape

As a seasoned crypto investor with a knack for spotting promising projects, I must say that Base has been a standout performer in recent times. With its robust network activity and impressive transaction volumes, it’s clear that the project is gaining traction and building real-world utility.

As a researcher, I’ve noticed an uptick in the activity within the Base network over the past few days, particularly since last week. Remarkably, the cryptocurrency market has witnessed one of its busiest weeks to date, marked by significant achievements.

Moving ahead to this past week, it seems that Base is showing no signs of slowing down. In fact, the number of daily transactions on the network reached an astounding 7.63 million on November 18th, marking a new record for the highest single-day transaction count in the network’s history.

Previously mentioned achievement in the transaction process highlighted the extent of usefulness within Base. Even though there was an increase in transactions, the amount of activity recorded on the blockchain significantly decreased compared to its previous peak from last week.

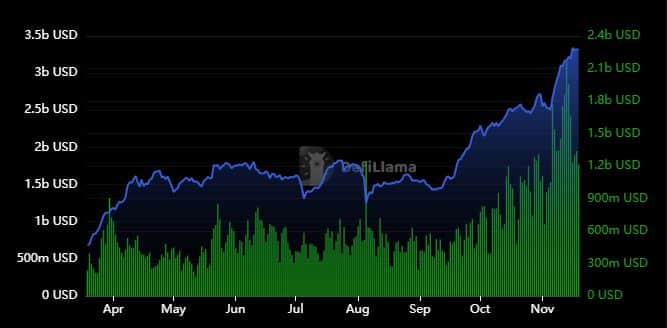

On Monday, daily trading volume amounted to approximately $1.33 billion, while the volume over the past 24 hours was around $1.21 billion. To put it into perspective, last week’s highest volume was recorded at a staggering $2.1 billion.

Conversely, the amount of value secured within the Base network reached an all-time high over the weekend. It surged to a peak of $3.33 billion on Saturday, and since then, it’s been fluctuating close to that level.

To put it simply, I’ve noticed a remarkable increase in our network’s Total Value Locked (TVL). In just this year alone, we’ve nearly tripled its value from the all-time low seen in August, speaking volumes about the growing trust and engagement within our community.

Base stablecoin marketcap drops despite growing activity

On most blockchain networks, an increase in the market capitalization of stablecoins tends to coincide with a rise in network activity. Contrastingly, Base has observed a distinct pattern lately: instead of growing, the number of stablecoins is decreasing within its ecosystem.

On October 31st, the total value of Base’s stablecoin market cap reached an all-time high of $3.81 billion. However, as of now, that amount has decreased to $3.59 billion.

As a crypto investor, I’ve noticed that one possible factor behind the recent dip might be intensifying competition in yield farming, which seems to have reduced incentives. However, it’s encouraging to see that network fees continue to grow positively.

Fees jumped to $423,000 in the last 24 hours. For context, the fees peaked at $496,300 in mid-November, but were less than $50,000 at their lowest point in the last 3 months. This was a reflection of the budding activity within the network.

The remarkable scale of Base’s performance has solidified its status as the foremost Ethereum layer 2 network. This was evident not only in the high volume it handled but also in the significant amount of Total Value Locked (TVL) it held. It held a commanding lead of approximately 30.08% within the Ethereum ecosystem, with Arbitrum trailing behind at 26.79%.

Previously, our platform surpassed Layer 2 solutions during the last market surge. Given this performance, and should we maintain our current pace, our network could potentially stay ahead in the upcoming months.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Upper Deck’s First DC Annual Trading Cards Are Finally Here

- Michael Saylor’s Bitcoin Wisdom: A Tale of Uncertainty and Potential 🤷♂️📉🚀

- Has Unforgotten Season 6 Lost Sight of What Fans Loved Most?

- The Battle Royale That Started It All Has Never Been More Profitable

- SUI’s price hits new ATH to flip LINK, TON, XLM, and SHIB – What next?

- EastEnders’ Balvinder Sopal hopes for Suki and Ash reconciliation: ‘Needs to happen’

- McDonald’s Japan Confirms Hatsune Miku Collab for “Miku Day”

2024-11-20 11:03