- Dogecoin’s 140% rally in November reignited discussions on reaching the $1 mark.

- Analysts debated the path to $1 for DOGE and the potential for a $100B market cap.

As a researcher with over a decade of experience in the cryptocurrency market, I have witnessed the rollercoaster ride that is Dogecoin [DOGE]. The recent 140% rally has undeniably reignited discussions about reaching the $1 mark, and while it’s tempting to jump on the bandwagon, my analytical instincts are screaming for caution.

Discussions are buzzing around Dogecoin’s [DOGE] recent surge, as people speculate whether it could reach its 2021 high of $0.74 and potentially even surpass the challenging $1 milestone.

As an analyst, I’m carefully evaluating the potential for a prolonged market burst associated with Dogecoin, considering various factors that might contribute to its stability. However, it’s essential to acknowledge the uncertainty surrounding this surge, as some traders are questioning whether it represents genuine momentum or merely a temporary spike driven by Dogecoin’s well-known volatility.

Dogecoin’s $1 target

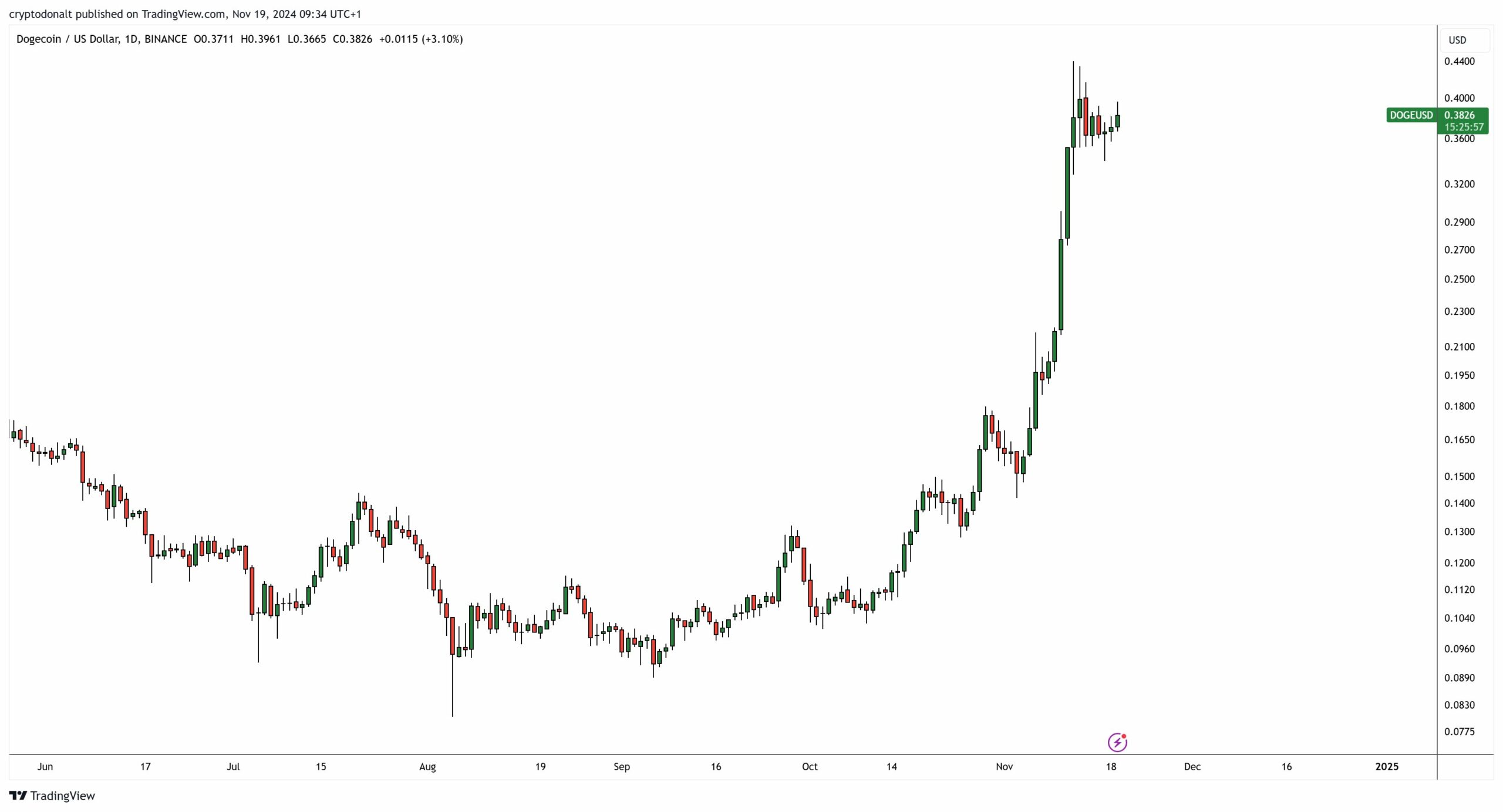

Discussions about Dogecoin have been on the rise within the cryptocurrency community as the coin has experienced a surge. As per DonAlt’s analysis, Dogecoin has jumped by approximately 140% since November, reaching a value of $0.40—a level not seen since late in 2021.

According to DonAlt, “the dog” might be due for a new phase of upward expansion, potentially reaching or even surpassing its previous peak of $0.74.

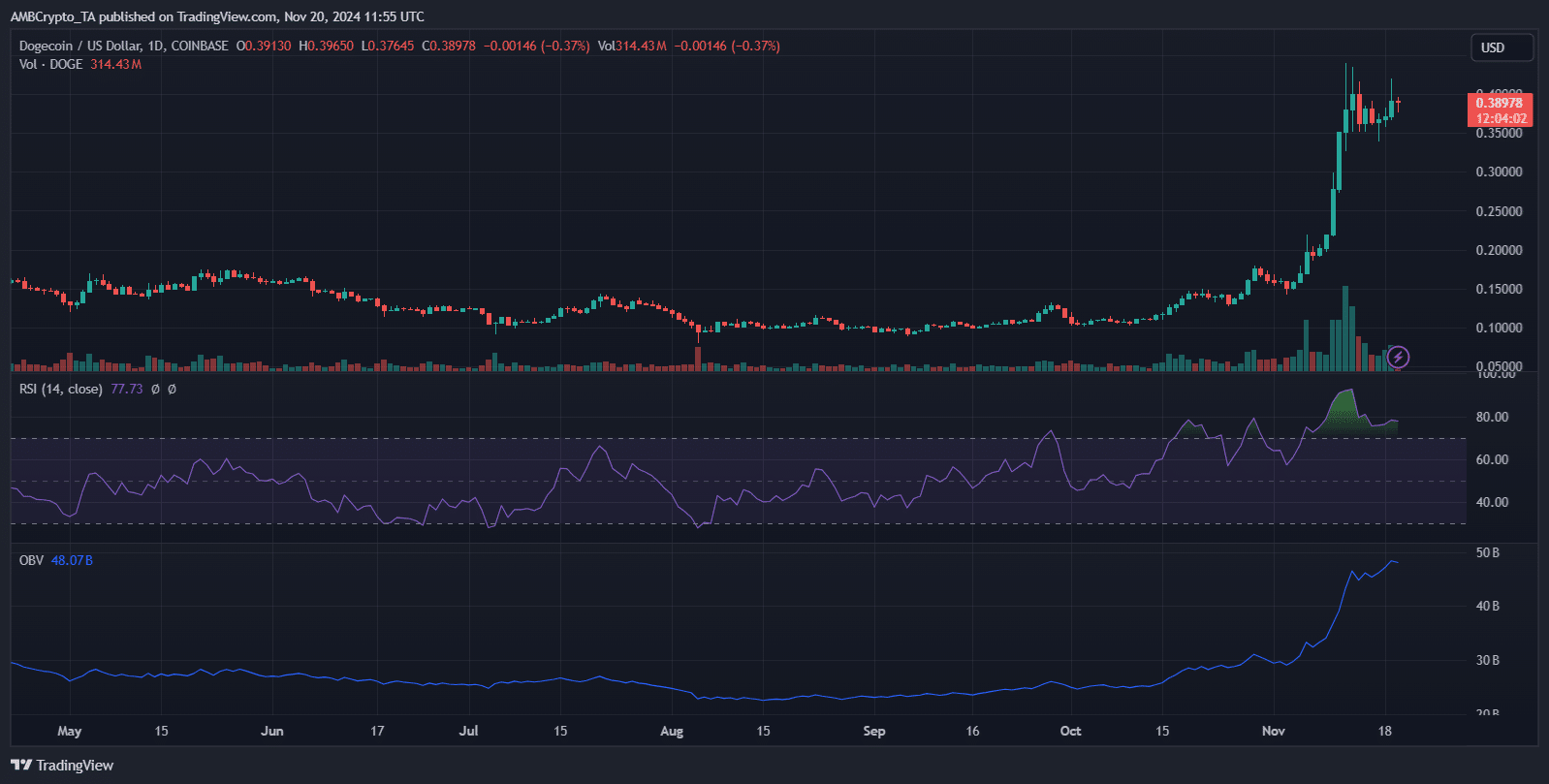

As a researcher, I’m observing a surge of optimism in the market, reflected in the ascending Fear and Greed Index, currently standing at 81%. Additionally, the On-Balance Volume (OBV) indicates a growing trader interest, suggesting a potentially positive trend ahead.

On the other hand, RSI values indicating oversold conditions and Dogecoin’s past price swings suggest a need for caution in enthusiasm, since comparable surges usually resulted in significant corrections.

The path to $1 for DOGE

The possibility of Dogecoin reaching $1 relies on two contrasting possibilities. One scenario is marked by a phase of consolidation, during which Dogecoin finds reliable support between approximately $0.40 and $0.50. This cautious strategy might appeal to conservative investors, fostering a strong base for a steady upward trend.

In the second, potentially more unstable situation, there’s a prediction that Dogecoin (DOGE) may experience a surge due to increased speculation and involvement from large investors (whales). Such activity might propel DOGE above its previous record high of $0.74.

Even though the general mood, as indicated by an 81% Fear and Greed Index, seems hopeful, Dogecoin’s history of price fluctuations serves as a reminder to keep expectations in check.

Reaching a $1 valuation implies that the market capitalization needs to surpass $140 billion, which is a significant hurdle given the present financial structure. However, the strong surge in November gives us reason to believe that this lofty goal, while difficult, might not be entirely out of reach.

Is the $100 billion market cap next?

Achieving a market capitalization of $100 billion from its current value of $57 billion means the price needs to almost double. Factors like large investors amassing more shares, increased publicity, and expanding usage in areas such as payments or gratuity might drive this increase.

According to well-known crypto analyst Master Kenobi, reaching this significant goal is not just about financial achievement; rather, it symbolizes a cultural and emotional triumph for the Dogecoin community. This victory could rekindle excitement among individual and institutional investors alike.

Achieving that valuation calls for more than just buzz from speculation. Instead, it necessitates substantial advancements in the ecosystem – such as forming strategic partnerships, implementing integrations, and boosting its overall utility.

Read Dogecoin [DOGE] Price Prediction 2024-2025

Despite the optimism, the risks remain. Dogecoin’s price history is marked by short-term surges followed by sharp corrections. Without fundamental growth, maintaining a $100 billion market cap could be fleeting.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- SOL PREDICTION. SOL cryptocurrency

2024-11-20 19:04