- SOL Global Investments plans to raise $2.5M to buy more Solana tokens.

- The fund’s share surged over 850% as SOL rallied from $138 to $248.

As a seasoned researcher with a knack for spotting trends and patterns in the cryptocurrency market, I find myself intrigued by SOL Global Investments’ strategy. Having witnessed the meteoric rise of Bitcoin through MicroStrategy’s strategic investments, it’s fascinating to see a similar approach being applied to Solana.

A Canadian investment fund specializing in Solana [SOL] and its technology environment, SOL Global Investments, intends to collect approximately C$3.6 million (equivalent to about $2.5M USD), with the aim of purchasing additional SOL tokens.

This fund intends to accumulate funds by offering common stocks, much like MicroStrategy does, using both debt and equity to purchase Bitcoin (BTC) for the purpose of increasing the value of its own stocks (MSTR).

Instead of MicroStrategy, this fund produces income for its investors by staking Solana (SOL) and appreciating in value.

Has the fund’s share price (SOL) seen growth similar to MicroStrategy’s (MSTR) following Bitcoin’s recent record highs, thanks to Solana’s surge?

SOL Global Investments share

The newly announced strategy was put forth only two days following its acquisition of approximately 8,123 SOL tokens worth $2 million on November 18th.

Remarkably, it seems the investment’s strategy is proving successful, given the fund’s stock price rise. Specifically, the value of its Solana stock (SOL) has soared to record highs, with Solana showing consistent growth since October.

This year up until now, its stock has experienced a remarkable increase of 73%. In contrast, Solana’s growth has been even more impressive, rising by almost 300%. The correlation between this stock and the price of Solana has strengthened significantly since October. However, earlier in Q4 2024, they had been somewhat independent before this connection was reestablished.

Over the past few weeks, the share price of our fund has soared dramatically, rising from just $0.02 at its October lows to almost $0.2. This represents an impressive increase of more than 850%.

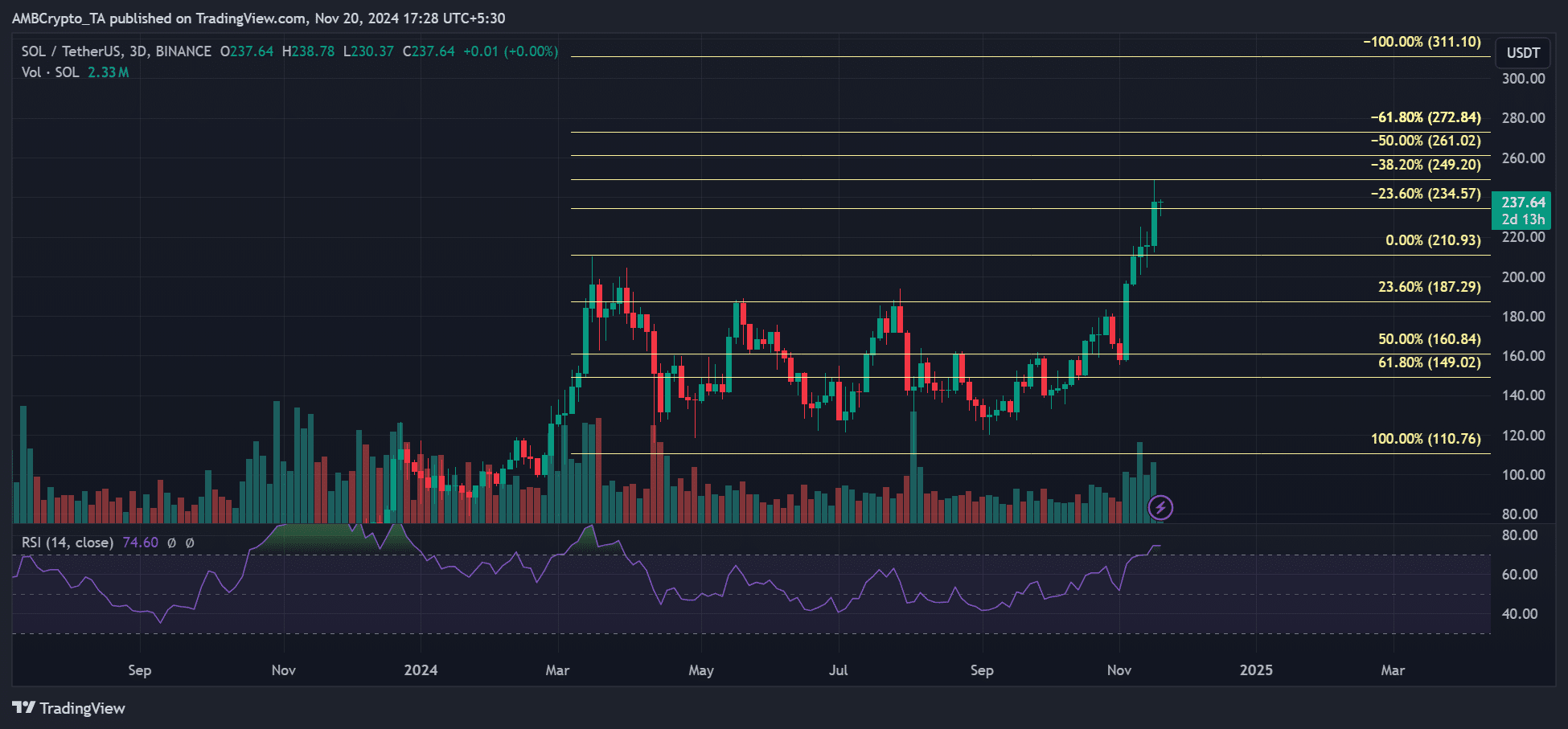

During that timeframe, Solana (SOL) increased significantly, moving up from 82% and approximately $138 to over $248. Since the fund is sensitive to changes in Solana’s price, it may experience greater gains if Solana continues to rise on its charts.

At press time, SOL was valued at $237 and could eye $250 and $260 levels.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-11-21 03:03