- IBIT’s options debut hit $4.28 billion, driving Bitcoin to a new all-time high.

- Grayscale’s upcoming launch of spot Bitcoin ETF options signals increasing competition in the crypto investment landscape.

As a seasoned crypto investor with over a decade of experience navigating the ever-changing digital asset landscape, I can confidently say that the recent debut of options trading for Bitcoin ETFs has been nothing short of breathtaking. The sheer volume of trading activity and the rapid ascent of Bitcoin to new all-time highs are unprecedented, even by crypto standards.

19th November marked the initial offering of options trading for the first Bitcoin [BTC] ETF, igniting a surge that propelled Bitcoin to another record-breaking high.

Just as anticipated, it was the BlackRock’s iShares Bitcoin Trust (IBIT) – the first Bitcoin ETF to offer options trading – that led the way in reaching this significant milestone.

Seyffart on Bitcoin ETF options

As a crypto investor, I was thrilled to witness the buzzing market activity that followed the launch, with a staggering notional exposure of approximately $1.9 billion being traded. This vibrant trading volume was underscored by James Seyffart, an analyst from Bloomberg Intelligence ETF, who emphasized this figure in his observations.

Remarking on the same, Seyffart noted,

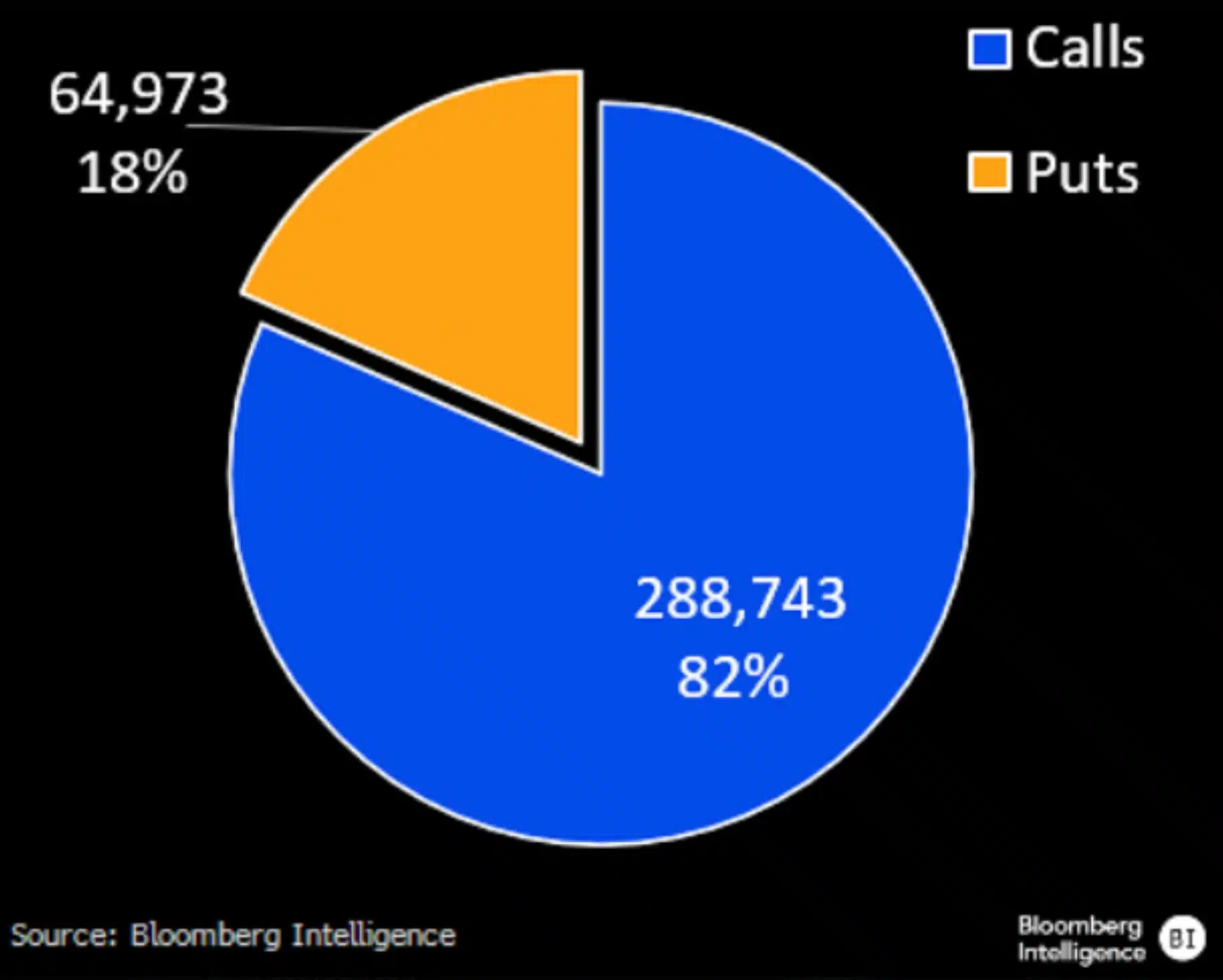

On its first day, the total value of options traded for IBIT amounted to approximately $1.9 billion in theoretical value, with 354,000 contracts being exchanged. Out of these, 289,000 were call options and 65,000 were put options.

He added,

The comparison here is 4.4 parts to 1, strongly suggesting that these choices likely contributed to Bitcoin reaching its latest record highs today.

How will the options trading help Bitcoin ETF?

If you’re new to the world of trading, let me clarify what a call option is. Essentially, it gives the holder the privilege, not the requirement, to acquire a certain asset at a fixed cost during a specified period.

If exercised, the seller of the call is required to sell the asset at the agreed price.

Instead, a put option gives the owner the opportunity to sell an asset at a set price by the option’s expiration date. This tool can be used tactically for risk management (hedging) or capitalizing on price fluctuations in the market.

As a researcher, I’ve been comparing the dynamics of the ProShares Bitcoin Strategy ETF (BITO) – America’s pioneering ETF for Bitcoin exposure – with the current trends in Bitcoin options trading. The latter has caught my attention due to its remarkable and distinct increase in activity.

To give an example, BITO made a highly-awaited debut, generating a trading volume of $363 million on its first day.

Balchunas echoes a similar sentiment

Eric Balchunas, a senior ETF analyst at Bloomberg, emphasized this analogy to illustrate the significant surge in the new options market. This momentum is indicative of increasing investor enthusiasm towards Bitcoin-linked financial instruments, according to him.

“$1.9 billion is unheard of for day one.”

Balchunas underscored the impressive expansion of a freshly introduced Bitcoin ETF, managing to amass an astounding $1.9 billion in trading volume, even with a cap on contracts at 25,000 positions.

This performance far surpasses the $363 million milestone achieved by $BITO over four years.

Compared to established ETFs such as GLD, which managed to amass an impressive $5 billion in just one day, there’s still plenty of potential for the growth of this newer ETF.

These graphs show its significant ability to draw even more investor attention, growing further in market traction.

What’s next?

On November 19th alone, IBIT’s remarkable debut in options trading resulted in a staggering $4.28 billion worth of transactions – a figure typically linked to the collective performance of several top-tier funds, not just one entity.

This achievement underscores the growing appetite for Bitcoin-related financial instruments.

On November 20th, Grayscale plans to ramp up rivalry by introducing option offerings for its physically-backed Bitcoin ETFs.

Indeed, it’s intriguing to consider the impact such a move could have on the dynamic growth of advanced cryptocurrency investment opportunities within the U.S. financial sector.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-11-21 08:40