- Despite ranking as one of the top IBC blockchains in terms of active users, it has failed to offset bearish sentiment.

- Traders remain largely pessimistic, with the majority taking short positions on the asset.

As a seasoned crypto investor with a few battle scars and war stories under my belt, I must admit that the current state of Celestia [TIA] leaves me feeling a bit like a lone sailor navigating treacherous waters. Despite its impressive user base, TIA’s price performance has been anything but smooth sailing lately.

Over the last four weeks, Celestia [TIA] has experienced a significant drop, losing more than 12% of its worth. A prolonged selling trend is evident in the daily chart, accompanied by another 6.60% decrease as negative sentiment escalates.

According to AMBCrypto’s analysis, it seems we might not have reached the lowest point yet for TIA’s market value. They caution that there could be more drops coming in the short term.

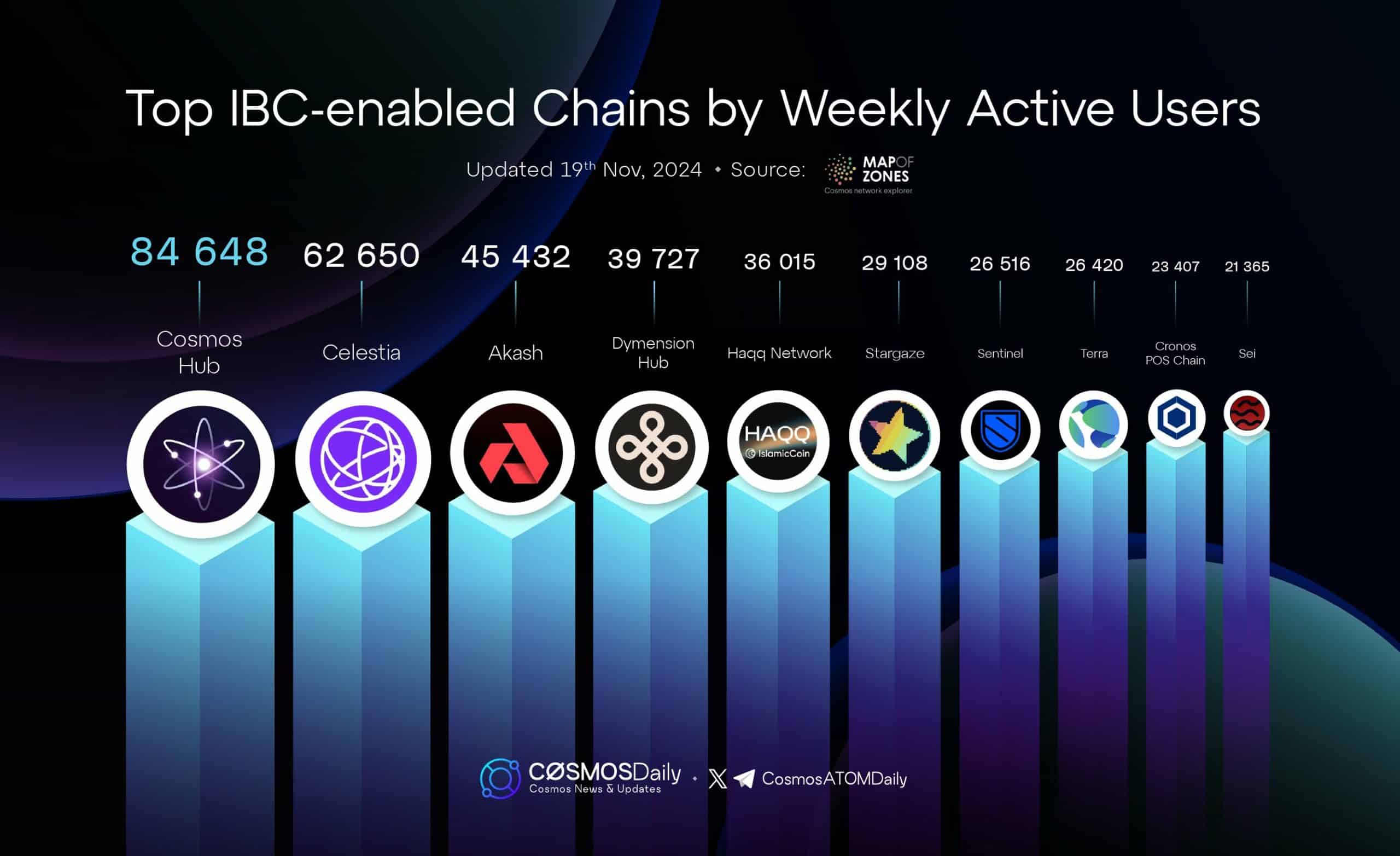

TIA’s active users surge, but market sentiment remains bearish

Over the last seven days, there’s been a substantial surge in the number of active users on the Celestial blockchain, which serves as the native network for TIA, notably boosting its user base.

Communications between different blockchain networks, such as Celestial, facilitate seamless data exchange and compatibility. As per recent statistics, Celestial has garnered 62,650 active users, positioning it as the second most popular in terms of user engagement among Inter-Blockchain Communication (IBC) chains.

As a researcher examining the trends of TIA, I’ve noticed an uptick in active users, yet this growth hasn’t seemed to boost its market performance. Contrary to expectations, TIA’s value has persistently decreased. According to CoinMarketCap, its market capitalization has dipped by 6.29%, now standing at $2.14 billion, and the trading volume has dropped dramatically by 48.69%.

The data indicates a decrease in investor trust towards TIA, and deeper examination hints at potential prolonged downward trends (bearishness) in the future.

Bears tighten grip on the market

Currently, a pessimistic outlook is prevalent in the market, further strengthening the negative indicators already in place.

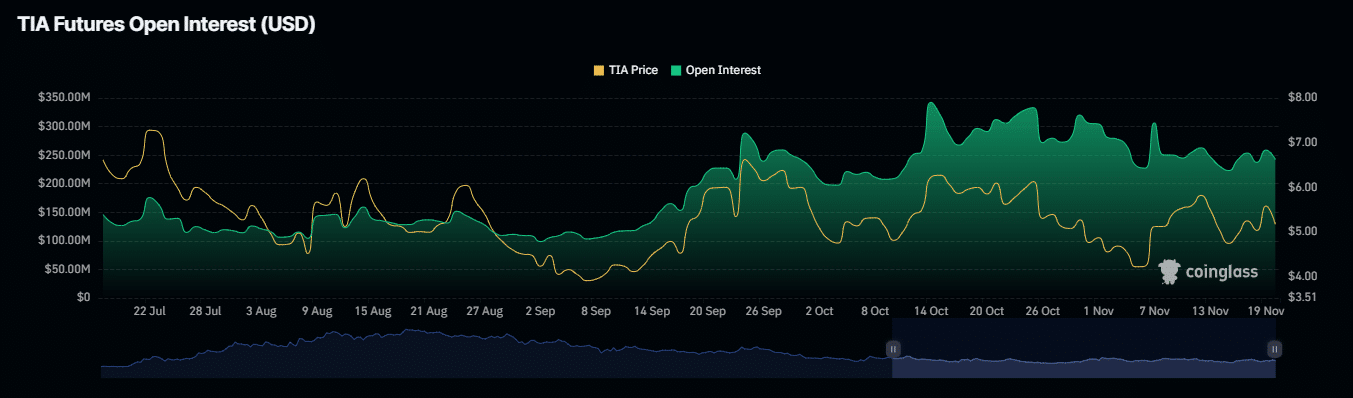

Over the last day, the amount of derivative contracts (futures specifically) with no settlement yet – known as Open Interest – has dropped by 7.33%. This decrease brings the total down to approximately $238.65 million.

Furthermore, there are more traders holding short positions than long ones, which is evident in a Long-to-Short ratio of 0.8328. This suggests that the bearish sentiment seems to be strengthening among traders.

The small proportion of the liquidated long positions (valued at approximately $941,100) matches the recent sell-off, intensifying the fall in the asset’s value. Conversely, only around $71,340 worth of short positions were closed during the same timeframe, underlining the strong influence of bearish sentiment.

If this continuing trend heads downwards – a prediction that’s currently most likely according to TIA’s outlook – AMBCrypto’s analysis suggests possible lower levels where the asset might settle.

TIA risks falling to $3.6 as bearish pressure mounts

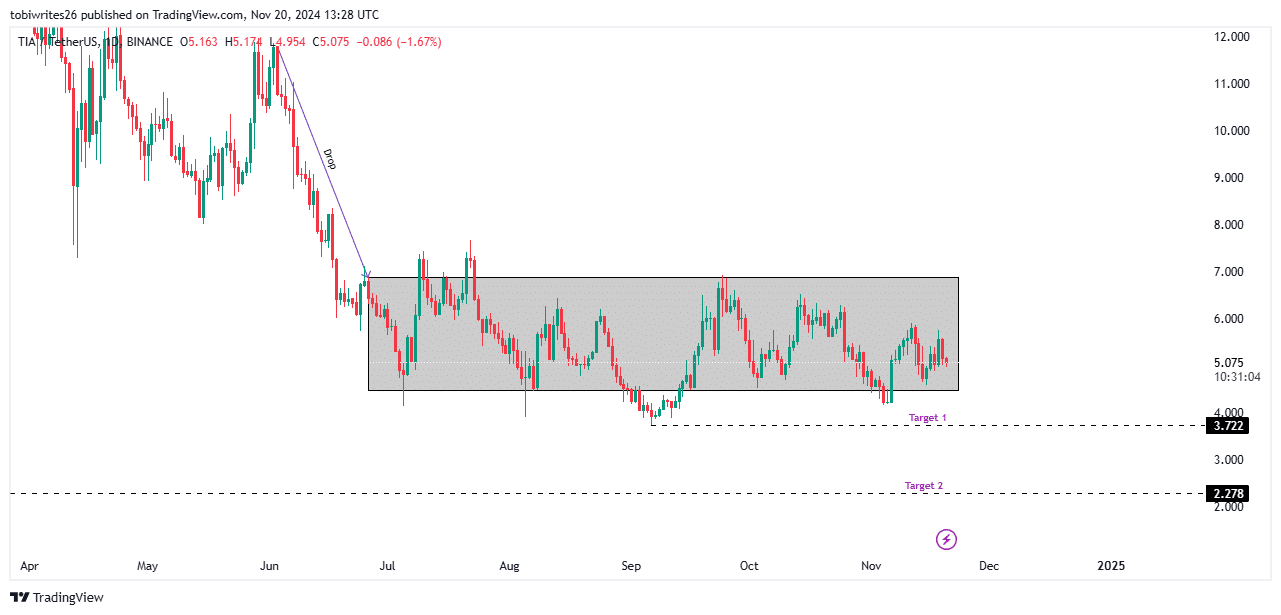

For about three months now, TIA’s trades have been confined to a range known as a consolidation channel. This range is defined by significant support and resistance levels. These types of patterns often signal an impending breakout, which could head in either an uptrend or a downtrend direction.

At this point of market downturn, TIA has two significant potential drop points to consider. The initial one lies at $3.7, a level that might be reached should the selling activity increase further.

If the downward trend continues, there’s a possibility that the value could drop more sharply, reaching approximately $2.2.

Read More

- PI PREDICTION. PI cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- WCT PREDICTION. WCT cryptocurrency

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- PS5 Finally Gets Cozy with Little Kitty, Big City – Meow-some Open World Adventure!

2024-11-21 12:07