- Injective experienced a significant surge in Total Value Locked (TVL), reflecting growing confidence in its blockchain.

- However, this has been overshadowed by persistent retail sell-offs, which continue to exert downward pressure.

As a seasoned researcher with years of experience navigating the tumultuous waters of the crypto market, I find myself intrigued by the unique case of Injective [INJ]. While its Total Value Locked (TVL) has surged impressively, the price action tells a different story.

As an analyst, I’ve observed that Injective [INJ] has seen a significant increase of 9.33% over the past month. However, it seems to be experiencing a slowdown, with a 5.06% pullback in the recent weekly trading sessions. The daily losses have exacerbated this trend, as an additional 1.60% drop was seen due to shifting market sentiment pushing its value lower.

Can INJ’s TVL surge drive a price rebound?

Based on information from Chainbroker, Injective has seen a significant surge of 61.2% in Total Value Locked (TVL) within the last week, raising the figure to approximately $2.52 billion. This substantial growth suggests a strong increase in investor confidence towards its ecosystem.

TVL, which measures the total worth of assets locked, loaned, or supplied for liquidity within a DeFi protocol, serves as a crucial indicator of its performance. However, unlike many other instances where high TVL figures coincide with rising prices, INJ’s situation deviates from this pattern.

Although the total value locked (TVL) increased significantly, the price of INJ decreased by 5.06% over the same timeframe, implying a decline in market participants’ trust or optimism.

The continued drop in price is primarily due to intense selling by individual investors, outweighing the growing usefulness of the blockchain technology.

Retail traders turn bearish on INJ

According to IntoTheBlock’s data, there seems to be a rise in selling actions, and the pessimism among individual investors, or retail traders, is growing stronger.

Over the last seven days, the typical transaction amount, representing the average value of daily transactions, has decreased and currently stands at $6,419.46. This slow trend in movement is usually a reflection of less active retail traders, suggesting that the market may be approaching a cautious or bearish stance.

The reduction in activity is also supported by a decrease of 15.94% in Daily Active Addresses (DAA) during this timeframe. Usually, a drop in DAA indicates decreasing engagement and increased selling, factors that likely played a role in INJ’s recent price decline.

In my analysis, the overall negative market sentiment is evident with a total of $754,270 worth of long positions being liquidated. This indicates that traders are compelled to close their positions due to the persistent downward trend, highlighting their bearish outlook on the market.

It’s clear that the market is showing signs of falling, and retail forces are significantly contributing to INJ’s current difficulties.

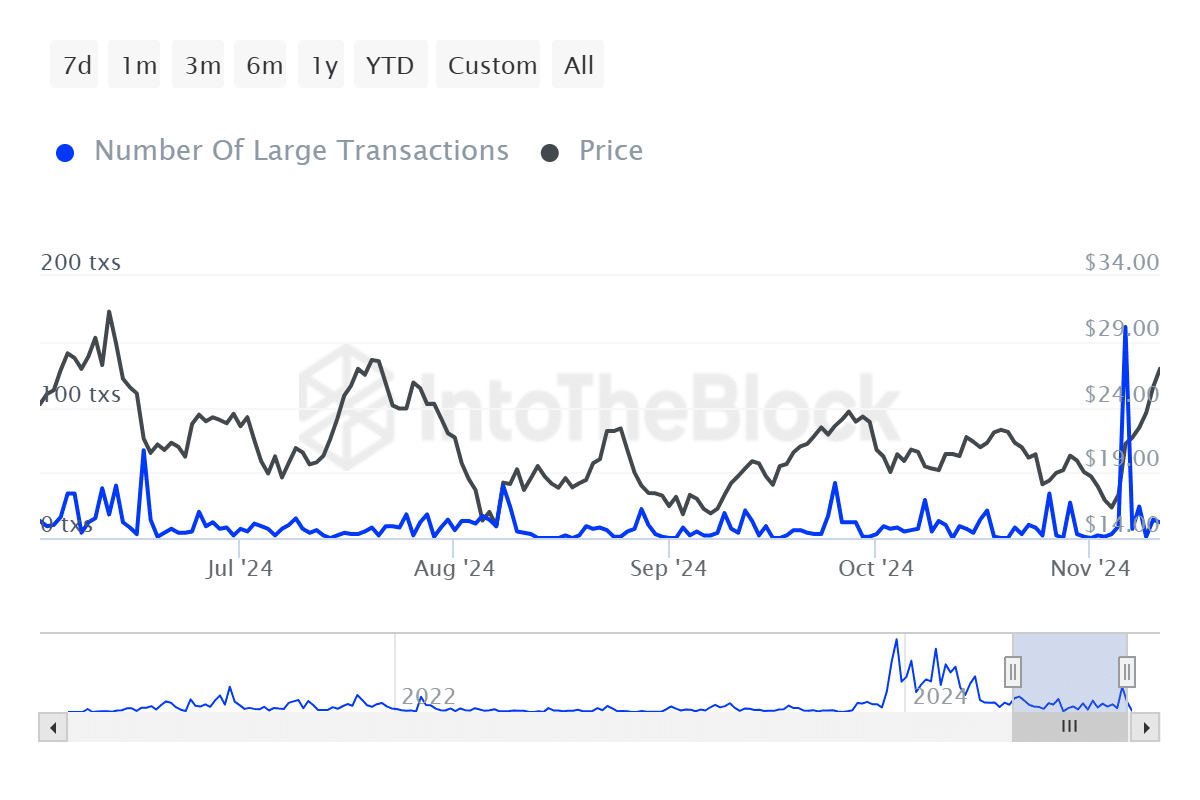

Whales hold back, leaving INJ’s market direction uncertain

In the recent period, significant investors, often referred to as “whales,” have been relatively quiet, conducting just one notable deal within the last 24 hours and a limited number of 22 sizeable transactions during the past week.

The minimal level of action indicates that whales, major players in the market, seem hesitant and are choosing not to make significant, market-altering decisions at this time.

Read Injective’s [INJ] Price Prediction 2024–2025

Generally, a spike in significant purchases often points towards a stronger pattern. When this occurs alongside a decrease in prices, it usually reflects pessimistic feelings (bearish sentiment), whereas if it happens together with a rise in prices, it signifies optimistic trends (bullish momentum).

In the coming days, it’s crucial to keep an eye on the behavior of large investors (whales) because their actions might significantly influence International Jewelry’s (INJ) future significant market maneuver. Both possible scenarios could have a decisive impact on the course INJ takes next.

Read More

2024-11-21 23:04