- Bitcoin was gaining attention with bullish momentum, as analysts predicted a potential surge to $135,000

- Key metrics point to strong fundamentals, though risks remain.

As a seasoned researcher who has witnessed the crypto landscape unfold since its infancy, I must admit that Bitcoin’s current trajectory is reminiscent of the exhilarating ride we experienced back in late 2020. The parallels between then and now are striking, and the potential for another multi-leg rally is tantalizingly close.

Once more, Bitcoin (BTC) is grabbing attention as it surges forward due to a resurgence of optimistic market sentiment, causing both traders and analysts to set high-reaching price predictions.

As the crypto market recovers, people are making connections between Bitcoin’s current trend and its extraordinary surge towards the end of 2020, leading some to predict that another cycle like that might happen again.

Analyst maps Bitcoin’s path to $135,000

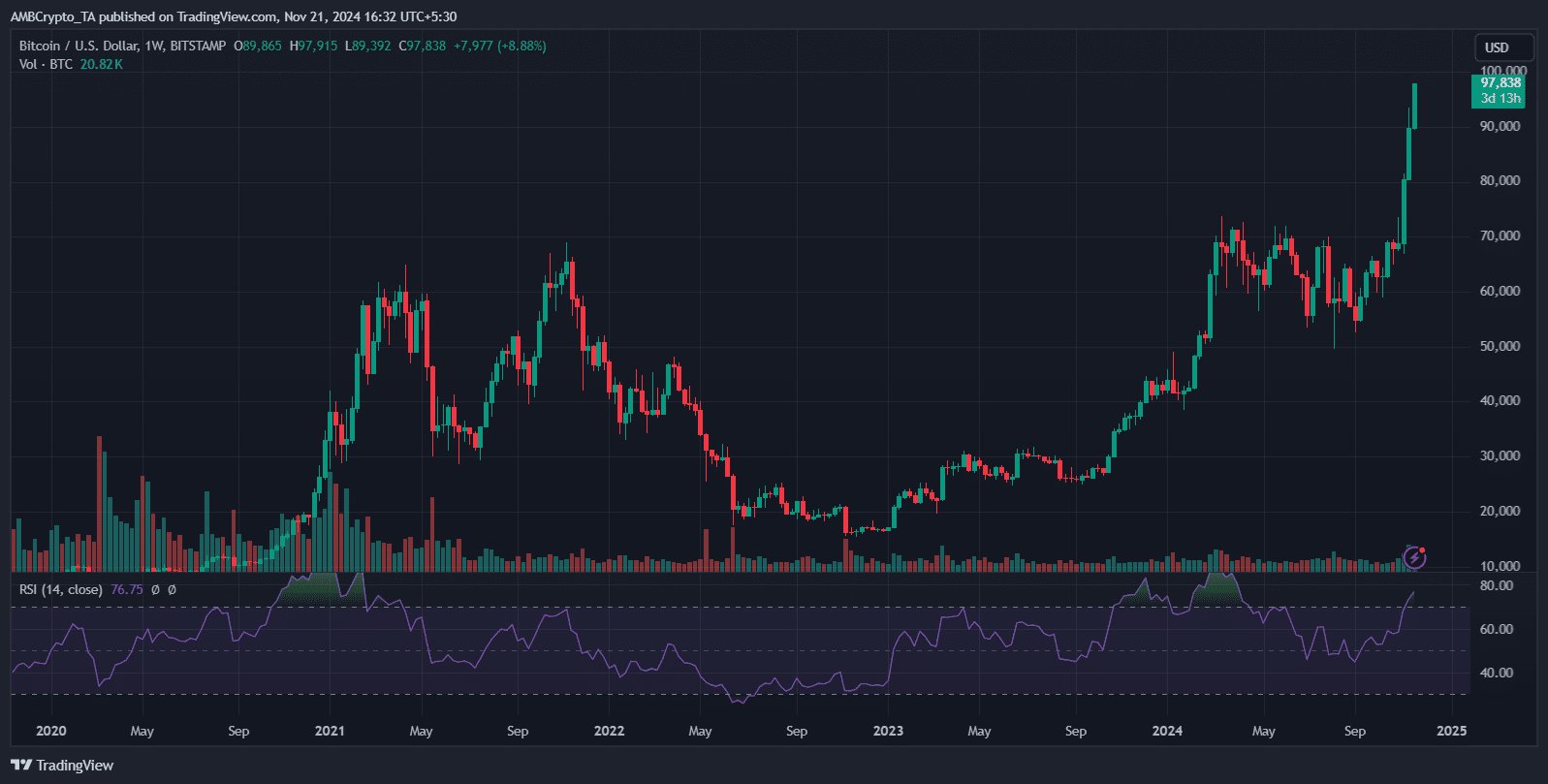

Recently, well-known cryptocurrency analyst Ali Martinez has noted similarities between the present price movement of Bitcoin and its surge in December 2020.

Through his observation of similar patterns in Bitcoin’s price trend and Relative Strength Index (RSI) values, Martinez proposed a possible guide or forecast for the future movement of Bitcoin.

Based on his prediction, Bitcoin might climb up to around $108,000, then dip down to approximately $99,000, and later soar to potentially reach $135,000. This forecast mirrors the patterns seen in Bitcoin’s market behavior in 2020, suggesting that past trends could repeat, hinting at a possible recurrence of events.

Parallels to 2020 and key metrics

In simpler terms, the recent trend of Bitcoin’s price is similar to its surge in December 2020. Both instances displayed a continuous rise in peak prices and stable Relative Strength Index (RSI) values, indicating a growing bullish energy.

Towards the end of 2020, the value of Bitcoin surged from approximately $20,000 to more than $40,000 within a short period, primarily due to increased institutional investment and escalated fear of missing out among retail investors.

In a similar vein, the current rise in Bitcoin, reaching over $97,000, demonstrates an increase in momentum due to increased investment from institutional players and economic uncertainties on a larger scale.

The similarity in the paths suggests a potential multi-step surge, possibly interspersed with periods of stabilization. Yet, it’s important to note that current market circumstances involve increased volatility and a broader range of cryptocurrencies, which might lead to different outcomes.

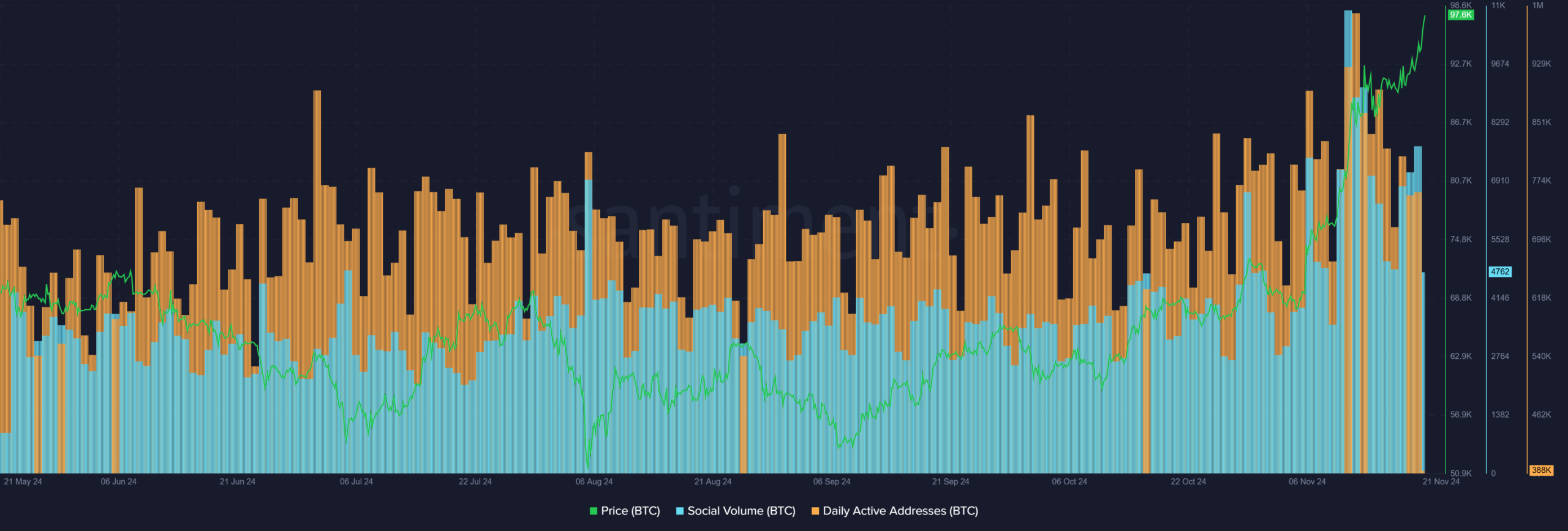

The number of daily active Bitcoin (BTC) addresses has exceeded 476,000, suggesting ongoing expansion in the network. At the same time, social media activity related to BTC stays high with 388,000 interactions, showing robust involvement within the market.

As an analyst, I can confidently affirm that the trends observed in these metrics are consistent with my earlier projections for Martinez. The increasing user adoption and vibrant community engagement mirror historical patterns that have typically been indicative of prolonged price growth.

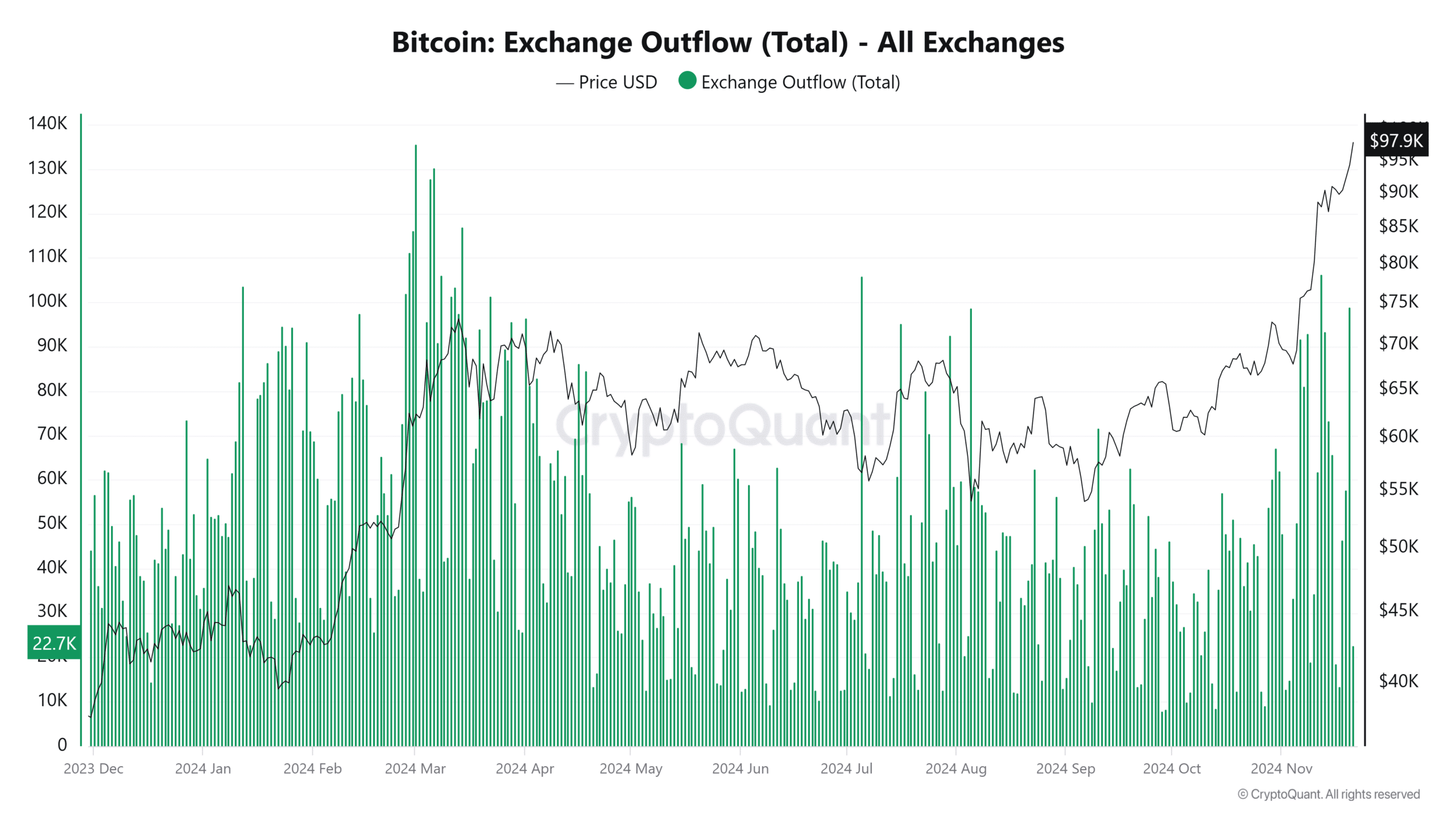

The rise in Bitcoin being transferred off exchanges, indicating a significant build-up by investors, suggests a tightening of the supply – a trend that historically is associated with a bullish market for Bitcoin.

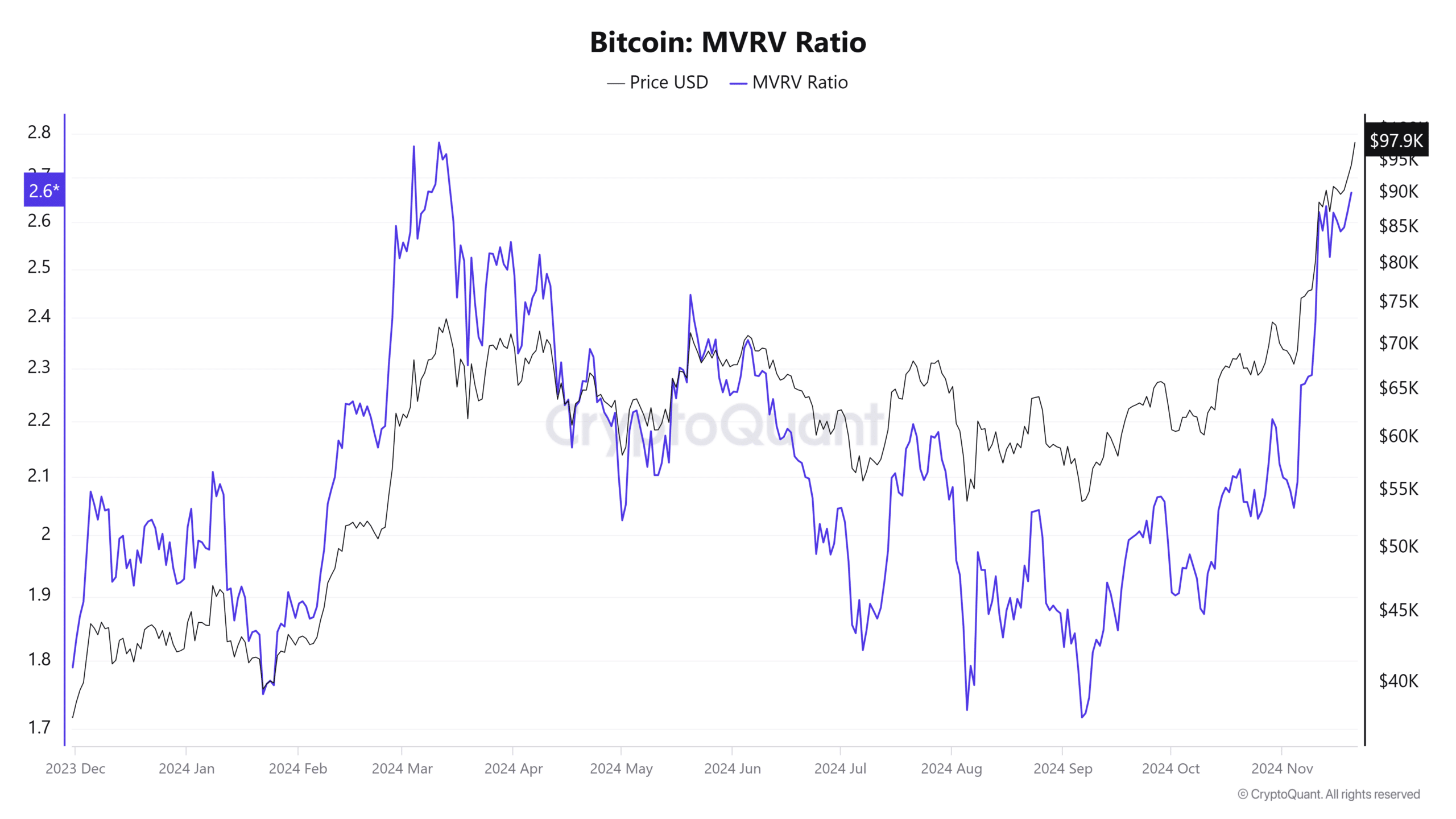

Concurrently, as the MVRM Ratio nears 2.6, it indicates an increase in unrealized gains; however, it’s still lower than the heightened enthusiasm observed in previous market cycles, hinting at potential for additional growth.

When there’s less items for sale but more people wanting to buy them, it can cause a sudden shortage or imbalance in supply and demand. This situation, which was seen at the end of 2020, led to quick price increases, supporting the validity of Martinez’s $135,000 target price.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Challenges and risks to Bitcoin’s $135k journey

Although Martinez’s prediction seems convincing, it’s crucial for investors to take into account several potential risks. The high volatility of Bitcoin and the uncertainties in global economic trends might cause disruptions that deviate from the projected path.

Furthermore, the wide range of cryptocurrencies available creates rival assets, which could weaken Bitcoin’s leading position.

Approaching MVRV Ratio levels suggesting potential overselling increases the likelihood of significant price drops. Sudden changes in market feelings might intensify negative pressures.

When dealing with Bitcoin’s unpredictable market, it’s crucial to approach it with a mix of hopeful but measured expectations, and careful financial management to mitigate potential risks.

Read More

2024-11-22 03:04