- Ethereum whales are accumulating while reduced selling pressure hints at a potential supply squeeze.

- Growing daily transactions and short-term holder interest suggest ETH’s next bullish phase is near.

As a seasoned analyst with over two decades of experience in the financial markets, I’ve seen my fair share of market cycles and trends. The current state of Ethereum [ETH] presents a compelling case for potential growth, especially considering the key metrics that are aligning favorably.

Based on analysis by blockchain intelligence platform IntoTheBlock, it’s anticipated that Ethereum (ETH) could be the upcoming cryptocurrency to draw significant investment funds.

As a researcher, I’ve observed an astounding milestone in the cryptocurrency market: Bitcoin [BTC] has soared to an unprecedented all-time high of $99,261.30. Meanwhile, Ethereum is holding steady at $3,365.66, with a staggering 24-hour trading volume exceeding $55 billion.

Although Ethereum has not matched the recent growth of Bitcoin, it could be on the verge of a strong upward trend, as crucial indicators provide clues about its future direction.

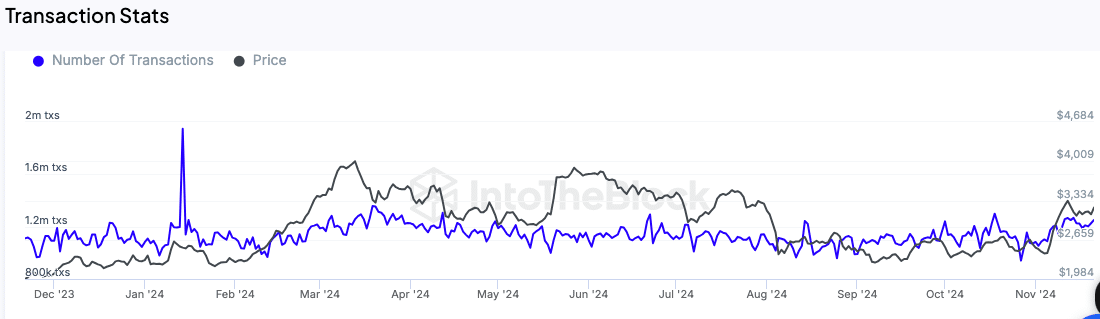

Daily transactions showing steady growth

There’s been a significant surge in the number of daily transactions on the Ethereum network over the past few months. According to data from IntoTheBlock, this increase has taken transactions from approximately 1.1 million to 1.22 million in the last quarter.

As I analyze the data, it’s clear that the consistent upward trend suggests more frequent use of the Ethereum network. This could potentially foreshadow heightened price dynamics in the future.

An increase in the number of daily transactions might be a preliminary indication of growing curiosity among users and investors, potentially leading to more movement in Ethereum’s price.

Large holders display confidence

The behavior of whales (significant investors) in Ethereum is another vital aspect being closely watched. As reported by IntoTheBlock, these large-scale holders, who possess at least 0.1% of Ethereum’s total circulating supply, are exhibiting a favorable net flow, which implies their faith in the asset’s potential.

This trend points towards increased buying from major investors, a historical indicator often associated with price increases.

Lessening the rate at which large investors are offloading their holdings suggests they might be expecting more growth. This kind of action generally reflects a sense of optimism among institutional and affluent investors, whose collective actions can significantly shape market movements.

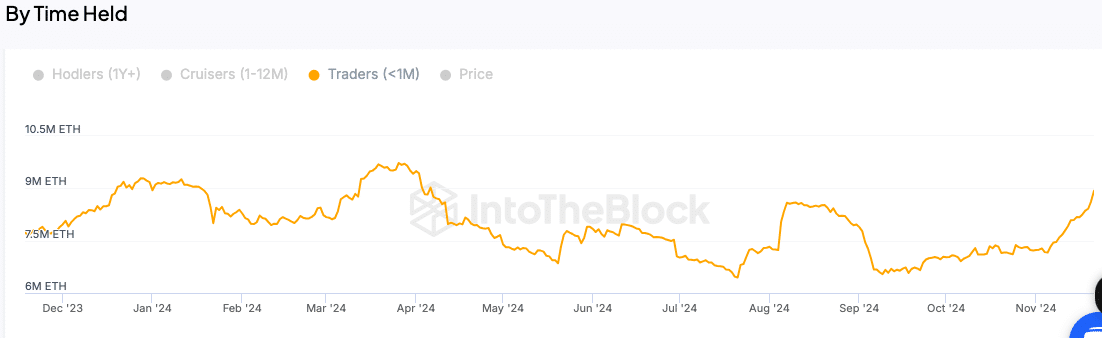

Increasing interest among short-term holders

Keeping an eye on short-term Ethereum holders, or those who’ve owned it for fewer than 30 days, is another focus. A rise in their numbers indicates that retail investors might be showing renewed enthusiasm towards the asset.

The significance of this measurement lies in the fact that traders who keep their investments for a shorter duration are quick to respond to market fluctuations, thus significantly influencing the overall trading activity.

An increase in their actions might lead to a period of optimism for Ethereum, particularly when combined with the continued faith displayed by major stakeholders.

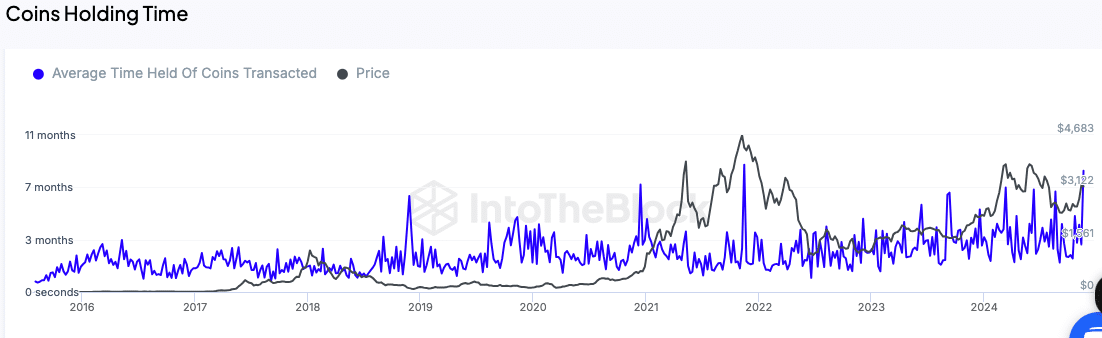

Longer holding times indicate reduced selling pressure

The typical duration that transacted Ether coins are held before being sold by their owners has significantly risen to approximately eleven months. This trend suggests a decrease in selling actions from Ethereum users.

This trend points to a supply squeeze, as fewer tokens are being circulated in the market.

A decreased eagerness to offer goods for sale usually contributes to price consistency and may pave the way for a rising trend in prices. This aspect, along with increasing activity within the network, is something investors are keeping a close eye on.

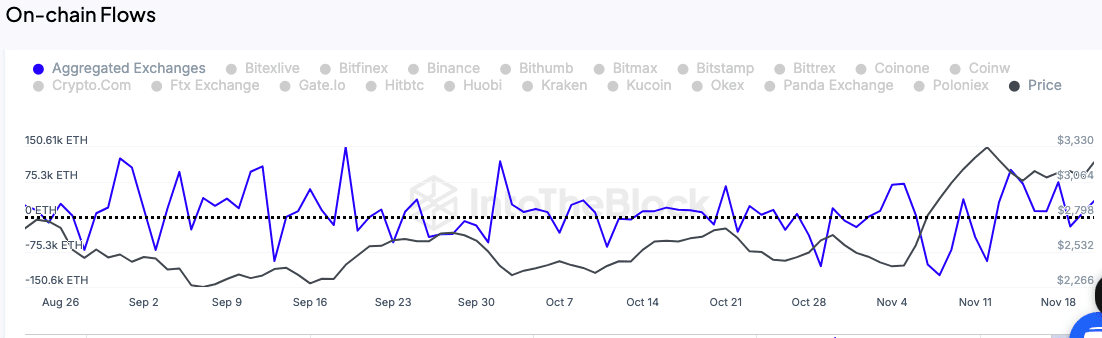

Exchange flows reflect accumulation trends

Monitoring the transfer of Ethereum tokens between exchanges could potentially indicate future changes in price.

A decline in incoming exchange transactions usually means that investors are accumulating assets by transferring them into personal wallets instead of leaving them on the exchanges, where they might be sold later.

Read Ethereum’s [ETH] Price Prediction 2024–2025

As a crypto investor, I’ve noticed that the inflow of Ethereum into exchanges remains relatively low. This trend suggests that Ether holders prefer to keep their coins rather than offload them, indicating a strong sense of confidence in its potential growth and long-term value.

In other words, this buildup is consistent with predictions that prices will rise soon, given the possibility that demand could exceed supply.

Read More

- OM/USD

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- Solo Leveling Season 3: What You NEED to Know!

- Solo Leveling Season 3: What Fans Are Really Speculating!

- Despite Strong Criticism, Days Gone PS5 Is Climbing Up the PS Store Pre-Order Charts

- Jelly Roll’s 120-Lb. Weight Loss Leads to Unexpected Body Changes

- The Perfect Couple season 2 is in the works at Netflix – but the cast will be different

- Joan Vassos Reveals Shocking Truth Behind Her NYC Apartment Hunt with Chock Chapple!

- Disney’s ‘Snow White’ Bombs at Box Office, Worse Than Expected

2024-11-22 21:12