- Cardano bulls remained resilient despite HODLer pressure, aiming for $1.

- If successful, FOMO is likely to sustain the rally, supported by several other factors.

As an analyst who has been closely observing the crypto market, I must admit that the current bullish trend for Cardano [ADA] is nothing short of remarkable. The coin’s impressive 140% surge over the past month, placing it among the top 10 gainers in the last 30 days, has left me quite impressed.

As an analyst, I’ve observed a striking rise in Cardano [ADA] during this bull run, soaring by an impressive 140% over the past month to reach $0.862. This remarkable price jump has propelled it into the ranks of top 10 performers within the last 30 days, outperforming many of its competitors in the crypto market.

Currently, the market trend is leaning more towards altcoins, and Bitcoin seems to be approaching a risky price zone. Some people might see Cardano’s recent daily increase by almost 10% as a possible indication of it being overvalued, so it’s crucial for short-term investors to exercise caution.

According to AMBCrypto’s analysis, it’s crucial that ADA aims for the $1 mark to prevent a possible correction. Hitting this significant psychological barrier may discourage hesitant sellers, and at the same time, stimulate fresh excitement amongst new investors who fear missing out (FOMO).

If the bulls succeed, ADA could soon set its sights on achieving a new all-time high.

Cardano is mirroring the 2021 cycle

It’s worth noting that since the elections, Cardano has shown significant progress, with a notable three-digit increase in value over the past month.

As a researcher, I find it significant that ADA has breached the $0.70 resistance level, a threshold untouched for almost eight months, highlighting its robust market performance.

It’s not surprising that Cardano has gained attention due to Bitcoin’s swift surge towards $100K. Investors have found it appealing as a suitable substitute, making it a notable beneficiary of the rally.

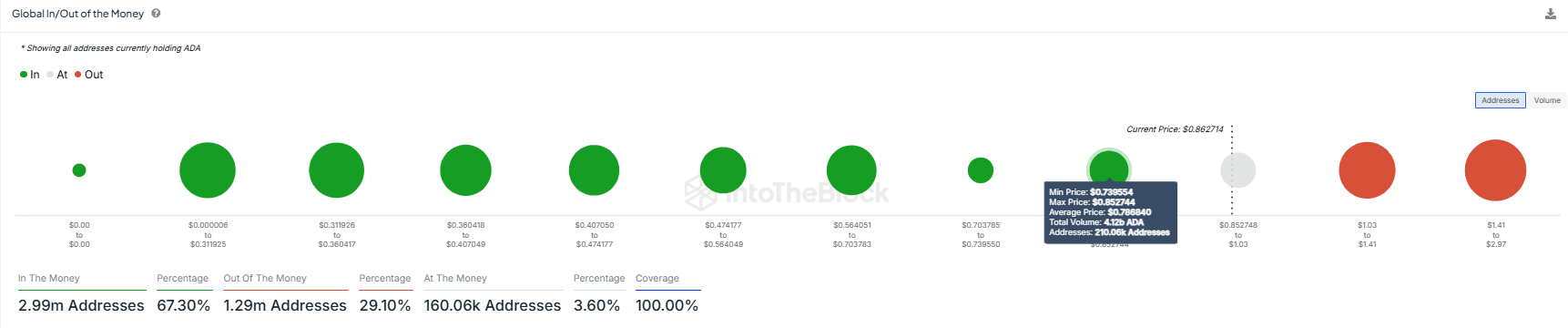

Consequently, roughly 210,000 ADA buyers who invested at a price of about $0.70 now collectively possess over 4.12 billion coins and are enjoying a net profit. This implies that the initial cost they paid for these coins is significantly lower than the current market value of ADA.

Source : IntoTheBlock

To clarify, the present cost represents an uptick of approximately 22%, compared to the point at which these wallets acquired their assets.

Yet, psychologically speaking, it appears unlikely that stakeholders will sell to make a profit, much like what happened during the time when Cardano attained its record high price of more than $3 three years ago.

During that period, even with occasional bearish corrections and unpredictable day-to-day price fluctuations, I found myself persistently optimistic – the bulls were relentless in pushing Cardano (ADA) beyond the $1 barrier. This significant leap seemed to trigger a parabolic rise, hinting at potential trajectory towards $2. Given this pattern, it’s intriguing to consider if a similar trend might emerge in our current market scenario.

So, is $1 on the horizon?

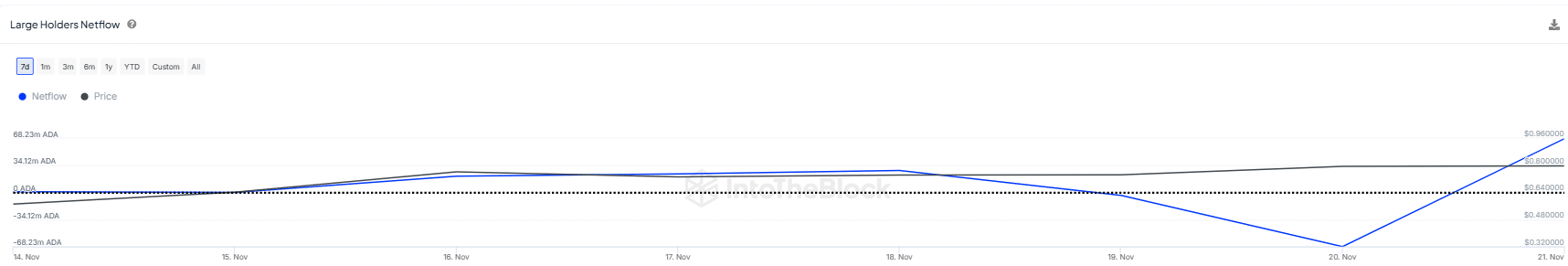

2 days back, around $68 million was withdrawn from substantial HODLer wallets and moved to exchanges. Yet, this action didn’t cause any significant price fluctuations. Interestingly, despite this, Cardano demonstrated strength and even saw a near 3% increase the next day.

Source : IntoTheBlock

Despite some of these outflows being compensated by equivalent withdrawals the following day, this incident underscored the increasing attractiveness of ADA to investors.

It appears as though an accumulation period might be starting, where investors are taking up the selling force, positioning Cardano (ADA) for a possible rise towards the $1 mark.

Psychologically, people who have earned a profit tend to want to keep their investments, hoping for even greater gains. This behavior supports the theory that AMBCrypto previously suggested.

External factors cannot be overlooked

Besides deterring hesitant investors from offloading, setting the price of Cardano at $1 might ignite fear of missing out (FOMO) in the market, especially since Bitcoin holders are likely to sell after realizing their profits. Although Bitcoin may experience a temporary drop, altcoins like Cardano seem prepared to benefit from this transition.

It makes sense that as Bitcoin approaches $100K but seems to be consolidating, investors might shift focus towards large-cap tokens. This could happen unless Bitcoin attracts fresh attention from potential buyers who view the current price level as a possible market bottom and consider it an opportunity for investment.

Read Cardano’s [ADA] Price Prediction 2024–2025

Furthermore, if past trends are any indication, when Bitcoin reaches approximately $100,000, it tends to cause a ripple effect across the entire cryptocurrency market. It’s expected that altcoins such as Cardano may encounter a similar shift in capital, though on a smaller scale, since Bitcoin is likely to garner most of the attention at that point.

Considering the present market trends, where investors are encouraged to hold and amass as Bitcoin stabilizes just below its predetermined goal, it appears that Cardano could reach $1 in the near future.

Read More

- OM/USD

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- Solo Leveling Season 3: What You NEED to Know!

- Disney’s ‘Snow White’ Bombs at Box Office, Worse Than Expected

- Solo Leveling Season 3: What Fans Are Really Speculating!

- Despite Strong Criticism, Days Gone PS5 Is Climbing Up the PS Store Pre-Order Charts

- Jelly Roll’s 120-Lb. Weight Loss Leads to Unexpected Body Changes

- The Perfect Couple season 2 is in the works at Netflix – but the cast will be different

- Netflix’s Dungeons & Dragons Series: A Journey into the Forgotten Realms!

2024-11-22 22:16