- Ethereum’s price surge and transaction velocity signal the start of an altcoin season, as per analysts.

- Chainlink shows strong growth with increasing active addresses and open interest, indicating bullish sentiment.

As a seasoned researcher with over a decade of experience in the ever-evolving world of cryptocurrencies, I find myself intrigued by the recent developments in the market. The surge in Ethereum’s price and transaction velocity, coupled with Chainlink’s impressive growth, certainly hints at the beginning of an altcoin season.

In simple terms, Ethereum (ETH), ranked as the second-largest digital currency in terms of market value, has shown its resilience lately with significant increases. Over the last day, ETH experienced a nearly 10% jump, reaching a trading price of $3,374 at the moment this text was penned.

Despite being about 30% lower than its peak of $4,878 reached in 2021, the current surge suggests a possible rise in positive momentum across the wider cryptocurrency market, particularly altcoins.

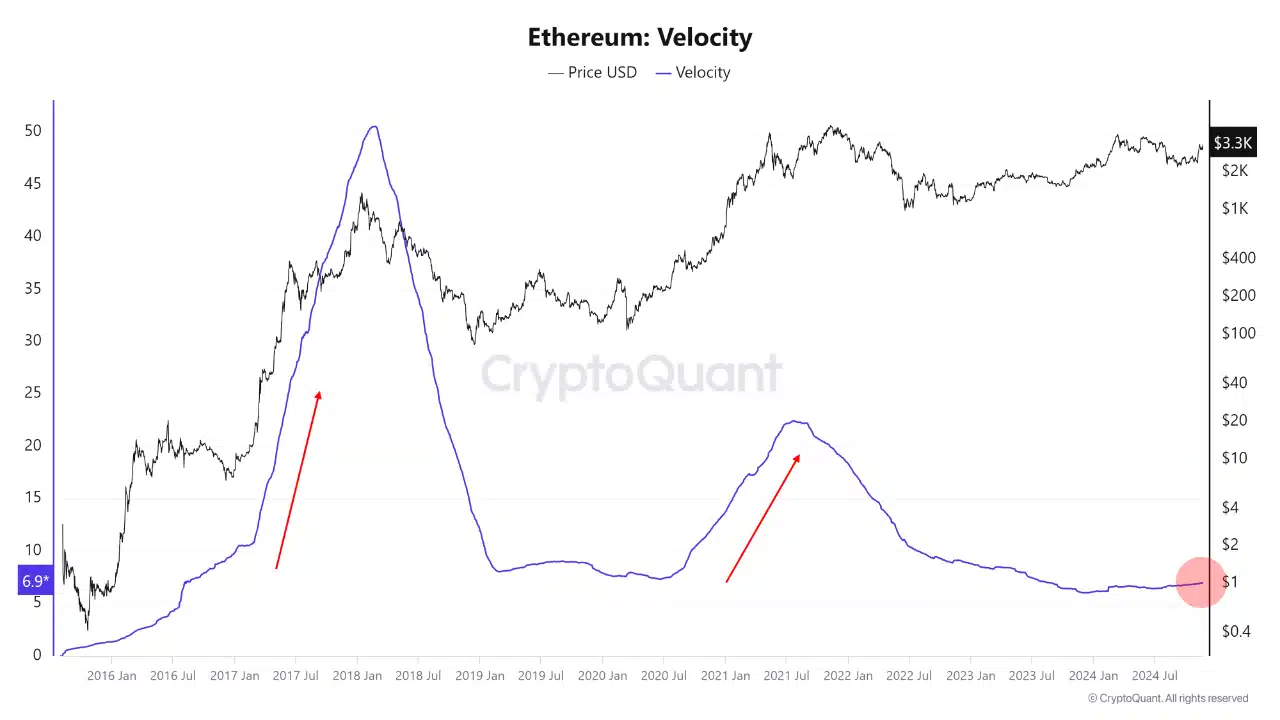

In the current scenario, CryptoQuant analyst Mac.D has suggested that we might be witnessing the start of an altcoin boom, based on his recent post on the QuickTake platform. He emphasized that Ethereum’s increasing circulation speed and growing number of transactions could be signs of this market surge.

Altcoin season begins

The speed at which coins change hands within a market, calculated by dividing the yearly coin transactions by the overall number of coins available, tends to increase during periods when altcoins experience growth.

Even though the current transaction speed on Ethereum is about seven times its total supply, its significance as a key collateral asset for institutional investors is set to be crucial.

The analyst highlighted that an increase in Ethereum’s value may encourage Decentralized Finance (DeFi) liquidity and signal the beginning of an altcoin market surge.

Ethereum’s recent surge can be understood within a broader perspective. Compared to its performance during recent market surges, Bitcoin has outperformed Ethereum. However, Ethereum’s significant role in supporting Decentralized Finance (DeFi) and its preference among institutions as collateral make it poised for considerable impact.

On one hand, issues like rivalry from quicker and less expensive blockchain platforms such as Solana, Tron, and Aptos underscore the obstacles Ethereum needs to surmount. But on the other, as Ethereum’s transaction activity increases and accelerates, it is anticipated that this will foster liquidity generation, which in turn will advantage the broader altcoin market.

LINK as a case study

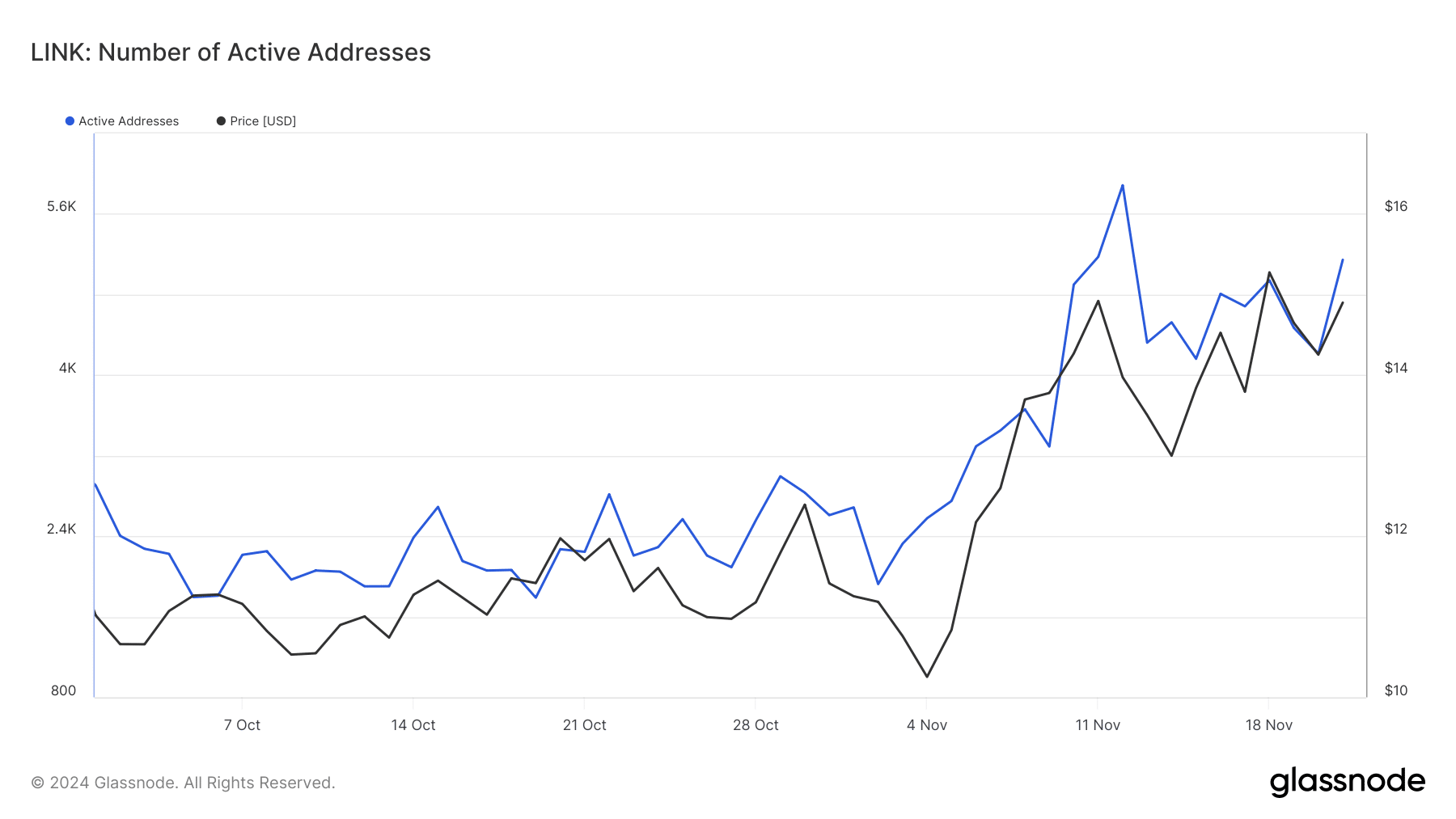

Examining Chainlink, a well-known alternative coin, lends credence to the idea of an ‘altcoin rally’. In just a week, LINK has climbed by 16.6%, reaching a trade value of $15.26.

The increase in growth observed here is consistent with the heightened activity on Ethereum and seems to indicate a wider movement in altcoins. Evidence for this can be found in key statistics that strengthen this argument: Chainlink’s active addresses – an indicator of retail involvement – have skyrocketed significantly, jumping from less than 2,000 in October to over 5,000 by November 21st, as reported by Glassnode.

Read Ethereum’s [ETH] Price Prediction 2024–2025

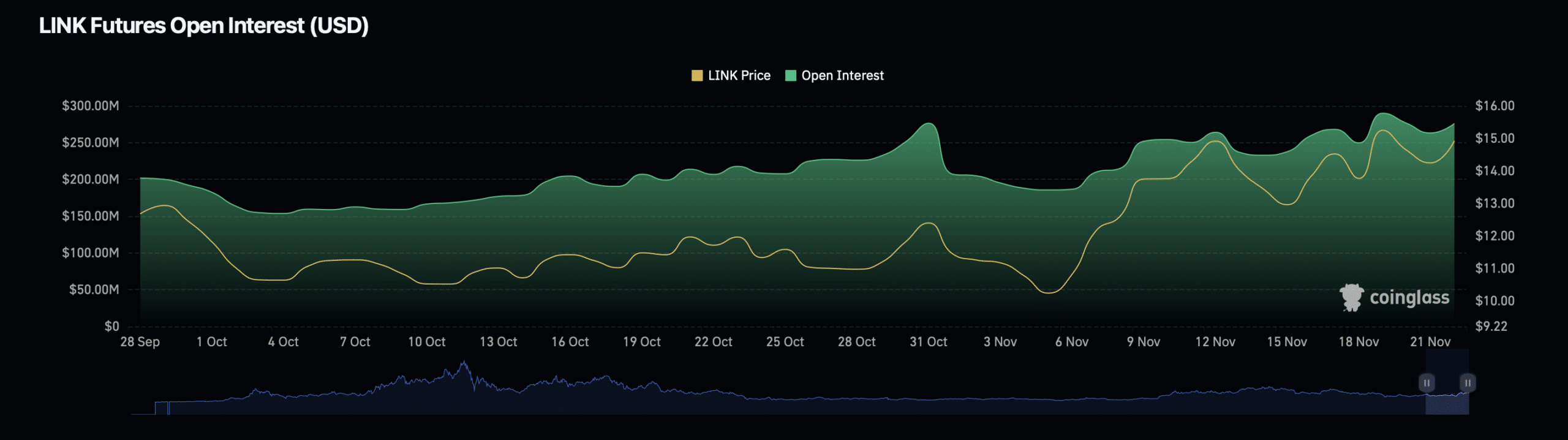

Evidence continues to mount that we’re heading into an altcoin boom period, as Chainlink’s derivatives data exhibits optimistic trends. As per Coinglass, the value of open interest for LINK has risen by 7.76%, currently standing at approximately $294.88 million.

Furthermore, the open interest volume of LINK has increased by 0.86%, amounting to approximately $726.97 million. This trend indicates a surge in investor engagement and faith in LINK’s short-term growth prospects.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-11-23 00:39