- SOL jumped to a new all-time high as the bullish sentiment extended its stay.

- Solana registered a new all-time high in TVL and Open Interest.

As a seasoned researcher with years of experience in the crypto market under my belt, I must admit that watching Solana (SOL) soar to new heights has been quite an exhilarating ride this month. The network’s recent achievements are nothing short of impressive, with SOL reaching its highest price point ever and setting records for TVL and Open Interest.

It looks like Solana (SOL) is heading towards its most successful month of 2021, with this week being especially noteworthy due to significant advancements across various aspects of the network.

The Solana community is currently rejoicing over a fresh record high for their native digital currency. Over the past 12 hours, the price of SOL has continued its upward trend, peaking at $264.39, setting a new record high for the cryptocurrency.

At the moment, shares of SOL were traded at $259.35, and they’ve moved into an overbought region. The highest point it reached was a 69% increase from the lowest price it had this month.

In simpler terms, the value of this cryptocurrency showed a downward trend compared to its strength indicator (RSI), suggesting potential increased selling might occur. Yet, there seems to be no significant rise in intense selling, as the market is generally optimistic and most investors prefer not to go against the positive sentiment.

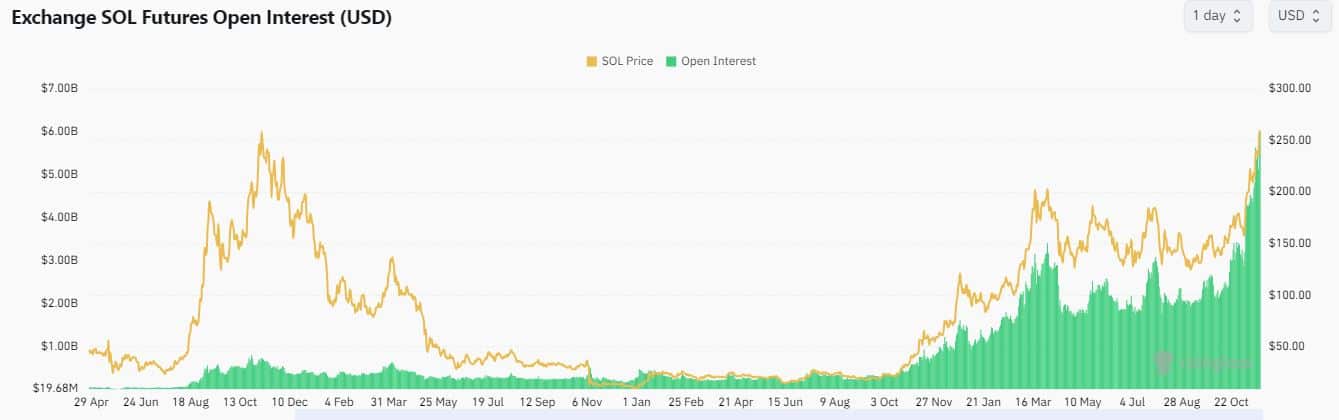

The interest and need for SOL reached unprecedented levels, with its Open Interest (OI) hitting an all-time high of $6.03 within the past 24 hours. This record-breaking level in OI suggests a significant contribution from derivative demand to SOL’s remarkable price movement, alongside strong interest from the spot market.

The Organization for Investment (OI) proposes that Shorter Operated Ledger (SOL) might react to short selling, particularly when prices are high. In the past 24 hours, there were more short positions in SOL (50.63%) than long positions (49.37%). This could potentially indicate a change in sentiment and an upcoming increase in selling pressure.

Solana network activity recap

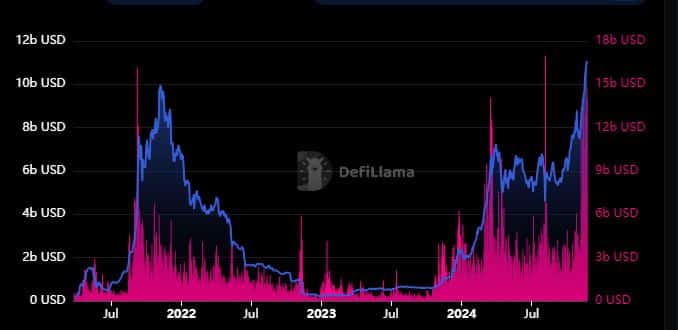

Additionally, Solana observed remarkable spikes in certain crucial performance benchmarks. To illustrate, its Total Value Locked (TVL) skyrocketed to an astounding $11.08 billion within a 24-hour period, setting a new record for the highest TVL value yet.

In the past day, Solana’s on-chain activity reached an impressive peak of $14.81 billion, marking the busiest period for the network in the previous ten weeks.

The most significant trading volume on Solana’s blockchain was recorded on August 5th, a day marked by a market crash as a result of the unraveling of the Japanese carry trade.

Realistic or not, here’s SOL market cap in BTC’s terms

Can SOL maintain its bullish momentum?

This month’s optimistic market outlook has propelled prices to unprecedented levels, yet at the point of composition, Solana (SOL) was excessively overvalued. If the market continues its current trajectory, SOL could potentially reach $300 – a significant milestone that might be achieved in the near future.

However, pullbacks are expected down the road, which could result in significant profit-taking.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-11-23 08:08