- XLM’s incredible rally indicated intense buying pressure despite the altcoin season not fully kicking in.

- A short-term pullback from the overbought levels cannot be ruled out, given the overbought levels.

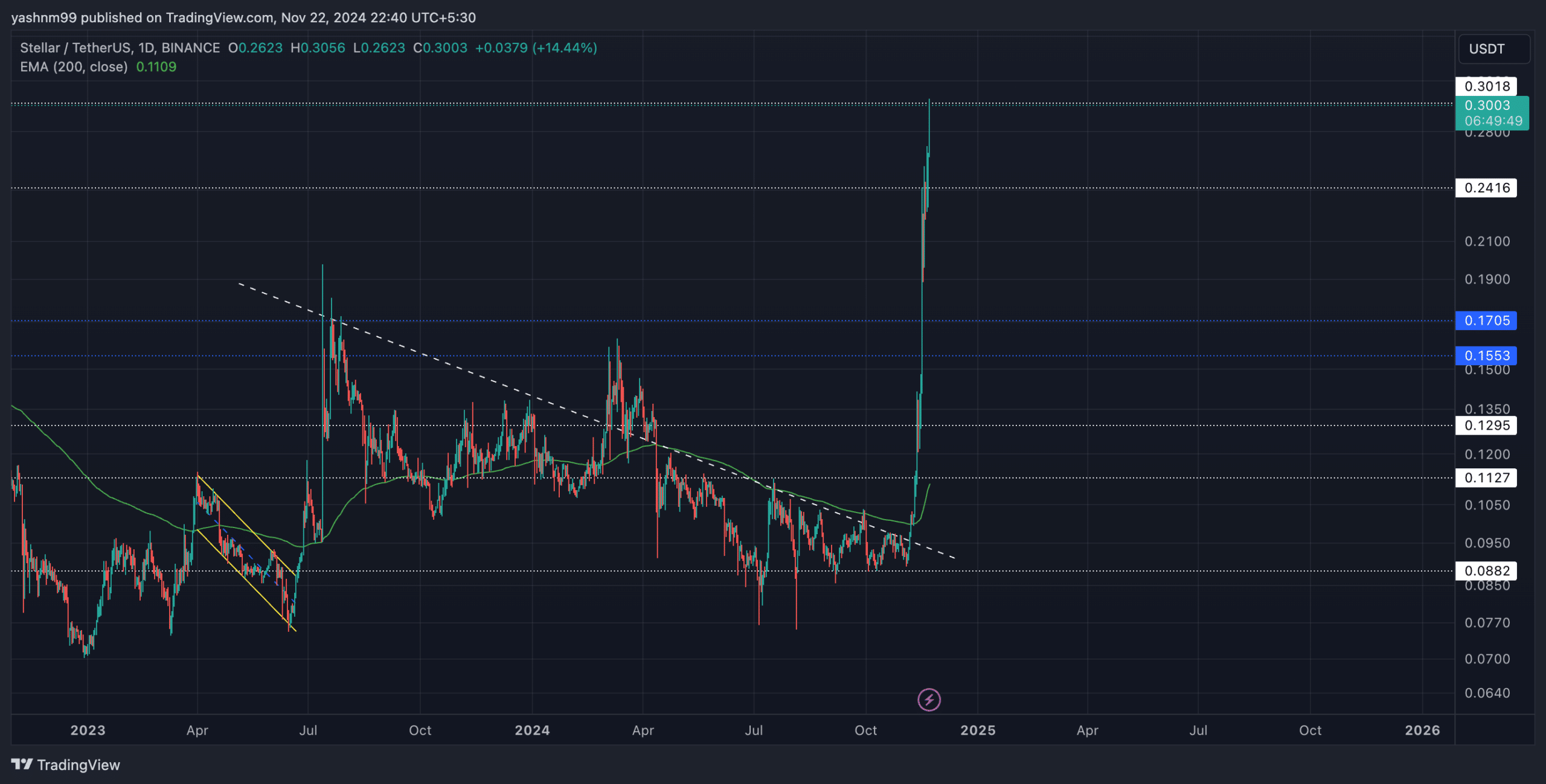

As a seasoned analyst with years of experience in navigating the ever-changing crypto landscape, I can confidently say that Stellar’s [XLM] current rally is nothing short of impressive. Despite the altcoin season not fully kicking off yet, XLM has managed to defy expectations and surge an astounding 220% in just 17 days.

Over the past period, Stellar’s value (XLM) has experienced an impressive surge, with optimistic views about Bitcoin (BTC) driving momentum and propelling Stellar towards record highs that it hasn’t seen in years.

Currently, one XLM coin is being sold for $0.3027 following a significant surge of 26% over the past day. Since the Relative Strength Index (RSI) is now above 86, indicating an oversold market, there might be a possible correction or pullback coming up.

Yet, since the market is currently in an uptrend, any shift in overall market opinion might have a substantial influence on XLM’s trajectory.

Can XLM bulls hold on after 220% surge?

Despite Ethereum‘s [ETH] relatively poor performance, suggesting that the altcoin season was not yet here, Stellar Lumens (XLM) shone brightly among other altcoins, experiencing a notable surge of over 220% in just the past 17 days.

After receiving backing at the $0.08 mark, this boost occurred, prompting buyers to drive prices beyond the crucial 200-day moving average ($0.1109 as of now).

On November 22nd, XLM reached its peak in over 35 months, reaching approximately $0.3. At present, XLM’s movements have positioned it close to this resistance level.

Approaching levels near the current position may pave the way for bulls to advance towards the $0.4 resistance within the upcoming weeks.

Failing to surpass this level in the short term could result in a fall back towards the $0.24 support, a point that matches up with the former trendline resistance.

The continuous surge in Bitcoin’s price, reaching unprecedented peaks, fuels optimism about further growth. Yet, the Relative Strength Index (RSI) showing signs of being overbought suggests that a potential pause or pullback might occur shortly.

Key levels to watch

For the bulls (investors expecting prices to rise), the $0.3 mark serves as a significant barrier or obstacle. Overcoming this hurdle could potentially propel XLM towards its next potential resistance point, which is at $0.4.

Prediction: If things don’t go as expected, there’s a potential support level at approximately $0.24. Dropping below this point might cause XLM to return to the $0.17 range.

XLM derivatives data analysis

The trading volume has significantly increased by around 92.97%, hitting a total of approximately $2.32 billion, suggesting a high level of investor engagement during the current market surge.

The Open Interest climbed up by a substantial 56.83%, reaching $174.74 million. This rise indicates that traders are increasingly taking on new positions, potentially signaling they anticipate significant market shifts.

The 24-hour long/short ratio for XLM stood at 0.9743, indicating a reasonably balanced sentiment.

Read Stellar’s [XLM] Price Prediction 2024–2025

As a researcher analyzing trading activity on Binance, I found that the Long/Short Ratios for individual accounts and top traders were slightly in favor of bullish positions, with values at 1.0186 and 1.0346 respectively, suggesting a slight advantage for long positions over short ones.

Keep an eye on Bitcoin’s price fluctuations and gauge the general market mood, as this information is crucial when deciding whether to go long or short on it.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-11-23 12:07