- Ethereum whales transferred 120,000 tokens worth $217.4 million.

- ETH surged by 2.67% over this period.

As a seasoned analyst with over a decade of experience in the crypto market, I’ve seen my fair share of whale activity. The recent transfer of 120,000 Ethereum tokens worth $217.4 million by these whales is indeed an interesting development.

For the past fortnight, the price of Ethereum [ETH] has remained within a narrow trading band, fluctuating between approximately $3100 and $3300.

Despite reaching a peak of $3446 recently, the altcoin hasn’t been able to consistently match its previous performance, causing uncertainty and a clear absence of guidance for large-scale investors or “whales.

As such, whales have made conflicting moves, with some selling while others are accumulating.

Ethereum whales transfer 120,000 tokens

Over the last day, I’ve noticed substantial intervention by significant investors (whales) in the Ethereum market. These whales have collectively moved approximately $217.4 million worth of Ethereum during this timeframe.

As reported by Whale Alert, a large investor (referred to as a “whale”) moved 29,999 ETH tokens valued at approximately $98.5 million to Binance. This action suggests that the whale may be planning to sell these tokens. If the market is unable to absorb such a massive sale, it could potentially have a negative impact on prices.

As an analyst, I’ve observed a significant movement of assets: a whale has transferred approximately 30,000 ETH tokens, equivalent to around $98.7 million, from Arbitrum to an anonymous wallet. This action implies that the large investor might be accumulating these tokens in a private wallet, possibly signaling a bullish sentiment or a strategic move.

In third place, it was noted that a whale moved 6,099 ETH tokens, equivalent to approximately $20 million, from OKEx to Cumberland. Transfers to Cumberland are typically not related to selling, but rather for providing liquidity.

This shows that 36,099 tokens were accumulated, while 29,999 tokens were moved for selling.

What does the ETH chart say?

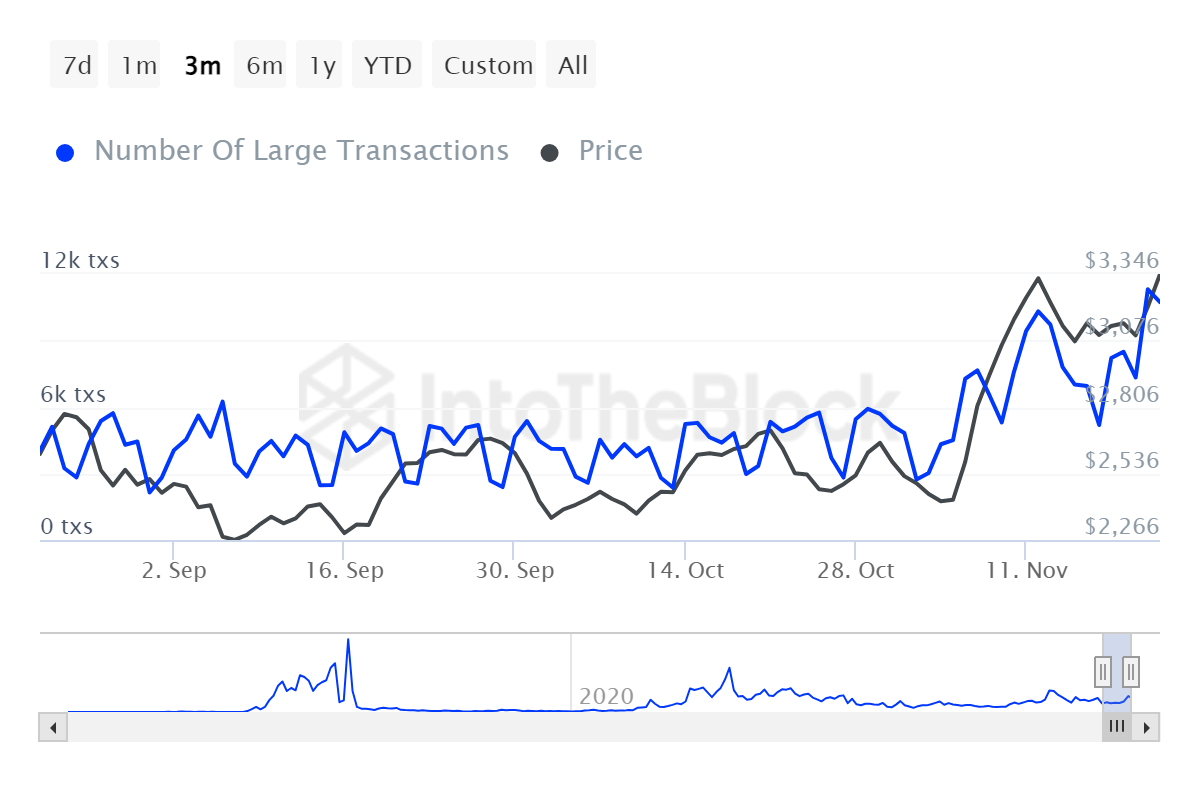

Over the last day, it appears that whale activity with Ethereum (ETH) has significantly increased, reaching a five-month peak of approximately 10,730 large transactions.

This shows that whales are actively participating, thus strengthening the network’s fundamentals.

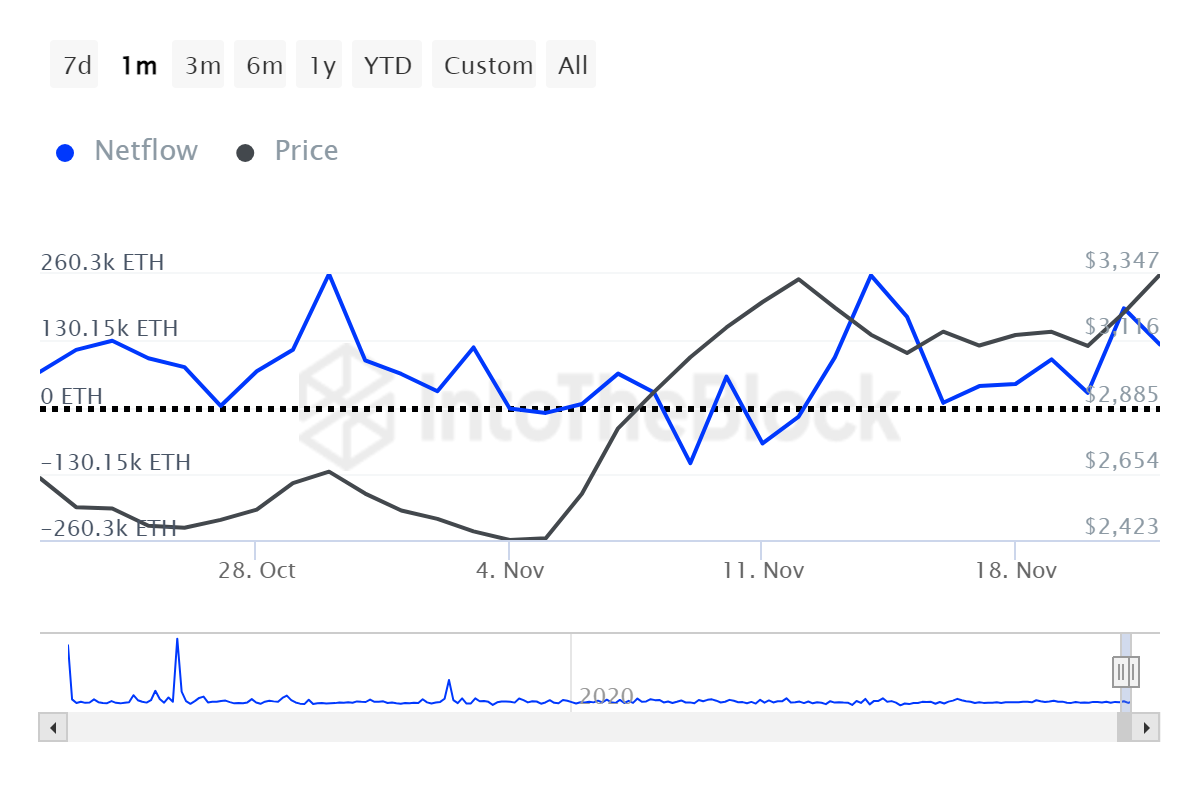

It’s clear that a significant number of large investors are showing optimism, given the greater volume of funds flowing in compared to those flowing out. This trend is supported by the positive net flow of 122.4k among large holders, implying that more whales are purchasing rather than selling.

As a crypto investor, I’ve noticed that there’s been more whale activity in accumulating cryptocurrencies rather than offloading them. This suggests a net inflow into the market, even though certain whales might be cashing out.

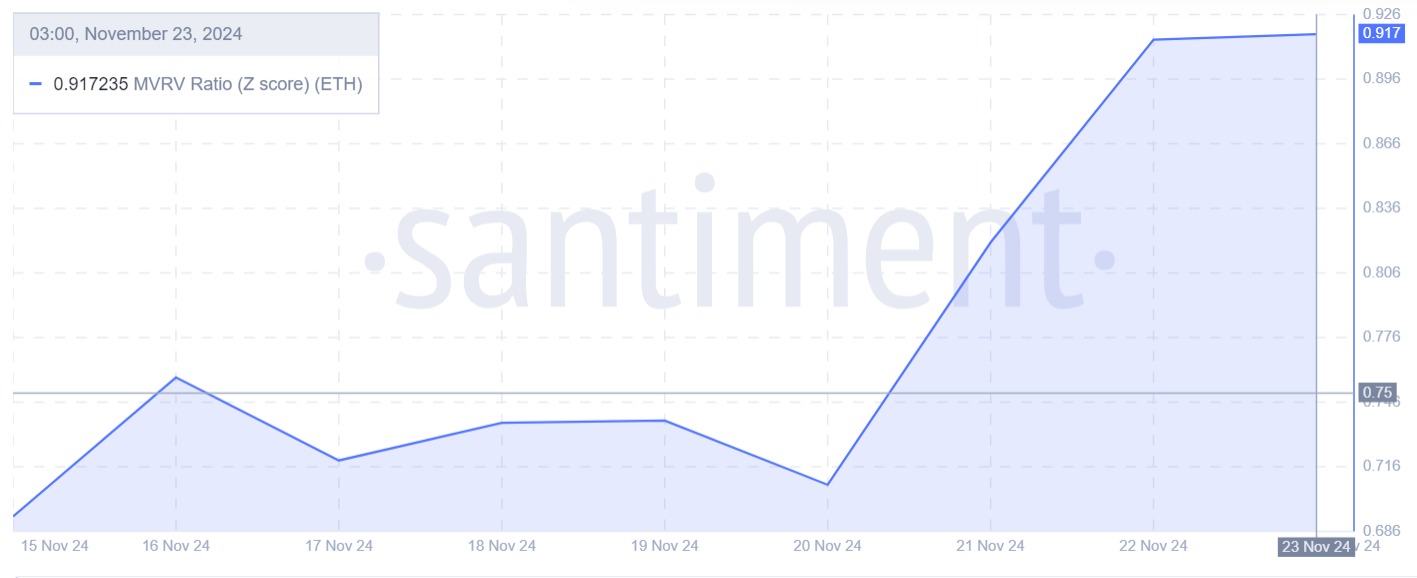

In simpler terms, when the MVRV (Z score) reaches approximately 0.9, it indicates that the altcoin’s price is lower than its fair value. This situation represents a potential low-risk investment opportunity for large investors, as they can purchase the altcoin at a discounted price and potentially profit from its market entry.

What next for the altcoin?

In most cases, whale transactions influence the direction of prices. Consequently, as we speak, Ethereum (ETH) has climbed from a bottom of $3260 to $3350.

As a researcher studying whale behavior, I’ve observed that their accumulations surpass their sell-offs. This suggests that the market has effectively accommodated any potential selling pressure, maintaining its equilibrium.

Read Ethereum’s [ETH] Price Prediction 2024–2025

Although ETH has struggled to maintain bullish momentum, large holders show signs of life.

If the favorable opinion persists, Ethereum (ETH) may encounter its next notable resistance level at approximately $3560. Should the bulls struggle to maintain their momentum, there’s a possibility of a reversal, causing Ethereum’s price to potentially drop down to around $3000.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- SOL PREDICTION. SOL cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- PGA Tour 2K25 – Everything You Need to Know

- MrBeast Slams Kotaku for Misquote, No Apology in Sight!

2024-11-23 16:08