- Solana has continued rising, creating new support levels.

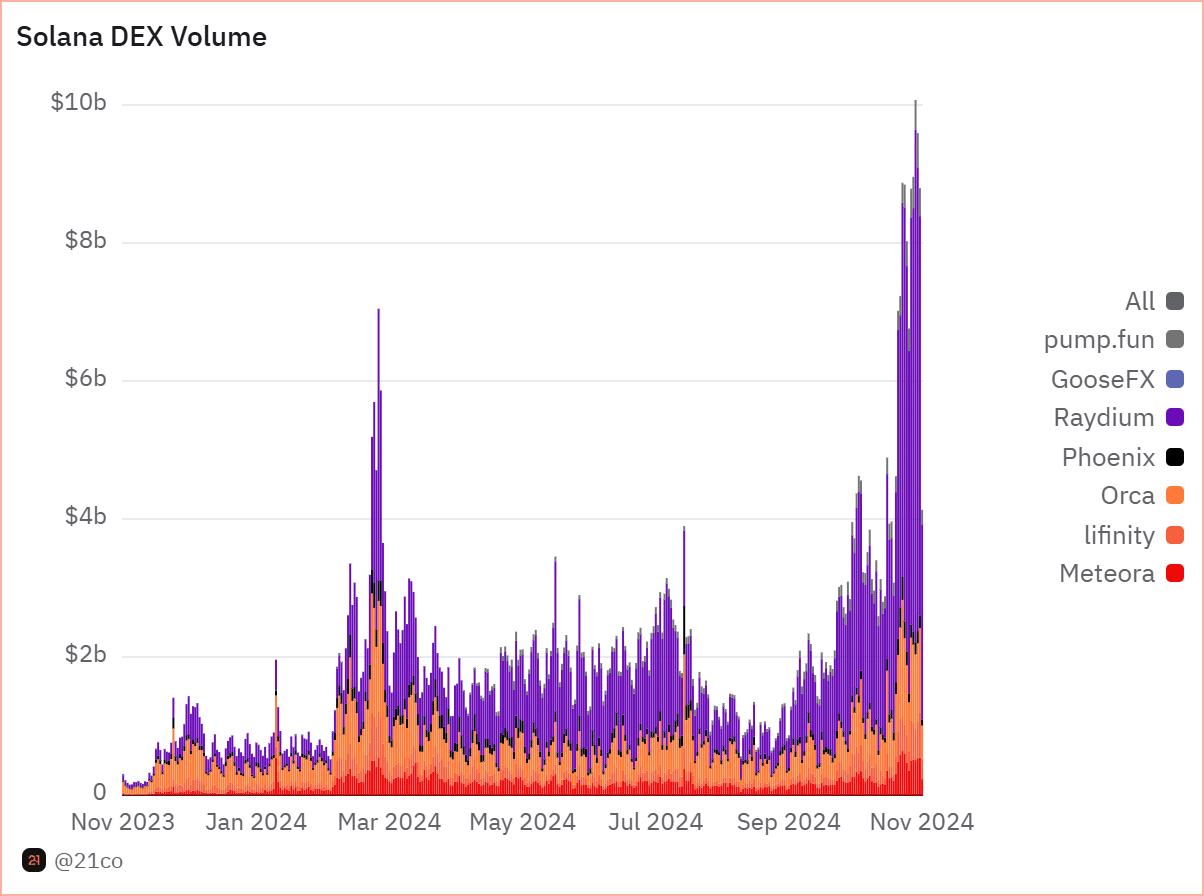

- The DEX volume continues to see record spikes.

As an experienced analyst with years of immersion in the ever-evolving world of cryptocurrencies, I have witnessed my fair share of bull runs and bear markets. The current surge in Solana (SOL) activity has undeniably caught my attention.

🔥 EUR/USD Rollercoaster Ahead After Trump Tariff Plans!

The euro faces intense pressure — shocking forecasts now revealed!

View Urgent ForecastActivity on the Solana [SOL] blockchain is surging, with a significant rise observed in trading volumes at decentralized exchanges and an uptick in token destruction events.

This triggered an intense increase in user interaction and network involvement, piquing the interest of the cryptocurrency community.

With Solana’s price steadily increasing, concerns emerge about whether this upward trend will persist or if a decline might occur in the near future.

Solana DEX volume surges

In the last several weeks, trading volumes on Solana’s decentralized exchanges (DEX) have significantly increased, with Raydium [RAY] and Phoenix taking the forefront in this surge.

According to Dune Analytics, the overall volume has just passed $10 billion, indicating that the network is currently experiencing one of its most active periods in recent times.

The increase in popularity demonstrated a definite surge in the desire for Solana-linked decentralized finance apps.

The increase in action highlighted the rising involvement and accessibility to funds within Solana’s network.

These elements play a crucial role in the long-term expansion of this network and emphasize its position as a strong contender, challenging Ethereum [ETH] and other first-layer blockchains.

The influx of liquidity into Solana’s Decentralized Exchanges (DEXs) has substantial implications for the demand and, consequently, the price of SOL tokens.

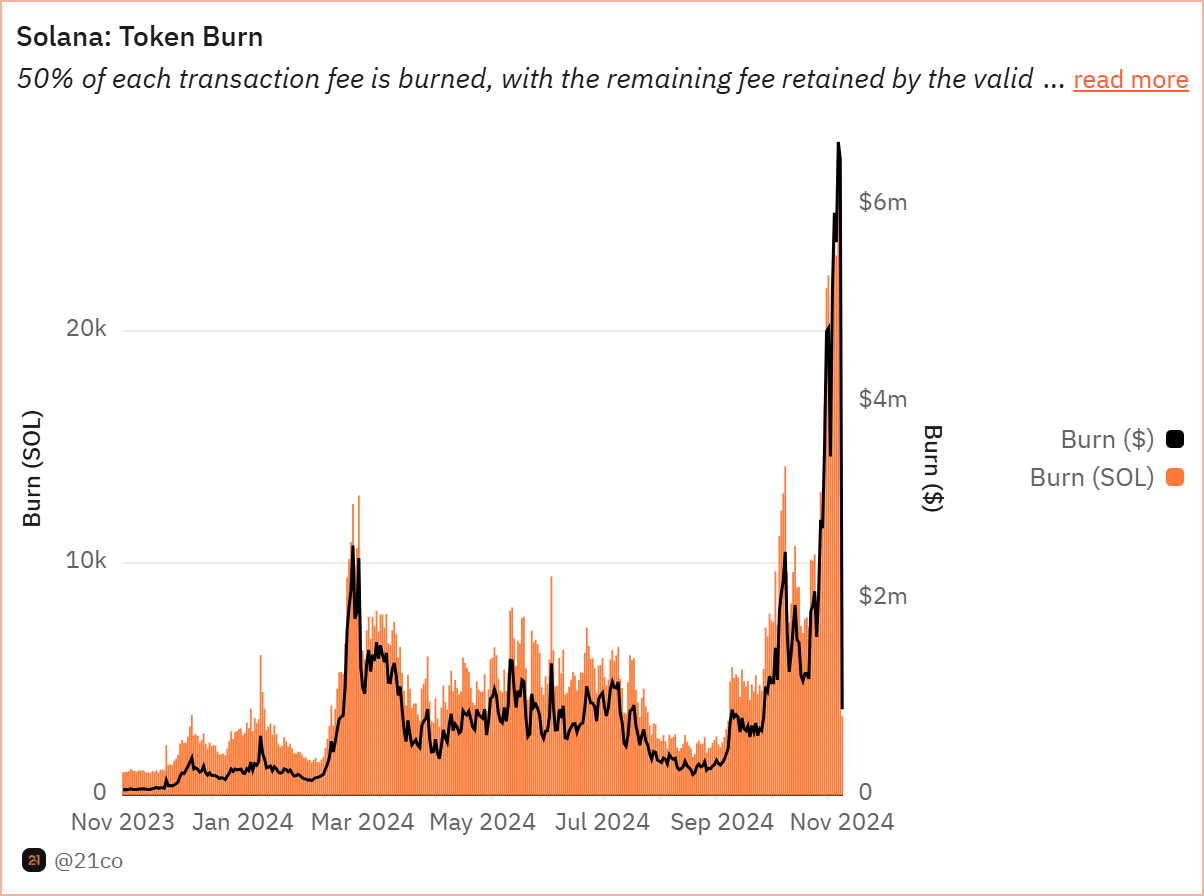

Token burns: Strengthening Solana

In addition to the high trading volumes on its decentralized exchanges, Solana’s token burn system is significantly influencing the structure of its economic framework.

As an analyst, I observe that approximately half of each Solana (SOL) transaction fee is being destroyed, leading to a gradual decrease in the circulating supply. This contraction, in turn, fosters a sense of scarcity within the market, as the demand for SOL remains relatively constant or even increases.

Recent data reveals that Solana has burned over $6 million of transaction fees, a record-breaking milestone showcasing the network’s bustling activity.

The burning mechanism in Solana (SOL) not only limits the amount available for circulation, but it also boosts the perceived worth of SOL. With increasing activity, the pace of these burns accelerates, creating a deflationary environment that is favorable to long-term investors.

This reduced supply dynamic provides a strong tailwind for a token already gaining momentum.

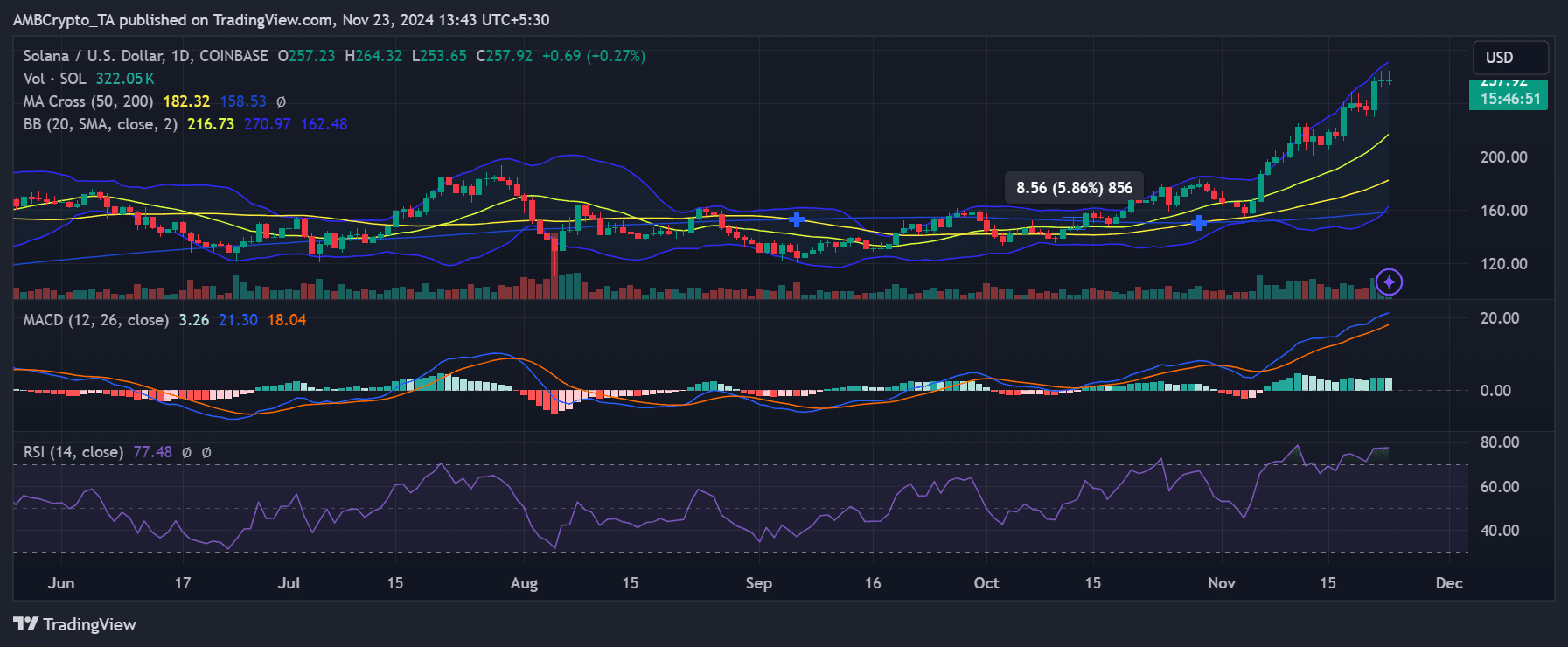

Can SOL break through resistance?

Recently, the value of SOL has been skyrocketing, reaching levels above $250 and nearly touching its highest mark for the year. However, AMBCrypto’s examination suggests a blend of indicators.

Significantly, the Relative Strength Index (RSI) showed signs of overbought territory, implying a potential pause or consolidation phase might be on the horizon. Meanwhile, the Moving Average Convergence Divergence (MACD) continued to exhibit a bullish trend, pointing towards additional growth opportunities.

The significant obstacle or limit for further price rise is located around $275. Reaching this level might cause a surge or it may serve as a hindrance instead.

As I observe the continuous increase in on-chain activities and maintain a watchful eye on decentralized exchange (DEX) volumes as well as token burns, it seems these elements could potentially generate the thrust required to surmount this current resistance level.

However, failure to clear this level might cause SOL to retrace to key support at nearly $230.

The surging DEX volumes and escalating token burns reflect strong adoption and activity.

The direction of Solana’s price is influenced by overall market opinions and crypto market dynamics, but its underlying strengths point towards a positive trend. However, whether it can maintain this growth is still uncertain.

Read More

- OM PREDICTION. OM cryptocurrency

- Solo Leveling Season 3: What You NEED to Know!

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- Oblivion Remastered – Ring of Namira Quest Guide

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Gumball’s Epic Return: Season 7 Closer Than Ever!

- Oshi no Ko Season 3: Release Date, Cast, and What to Expect!

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Lisa Rinna’s Jaw-Dropping Blonde Bombshell Takeover at Paris Fashion Week!

- Poppy Playtime Chapter 4: Release date, launch time and what to expect

2024-11-24 04:08