- Whale accumulation was underway, positioning ADA for its next major price surge.

- In the derivatives market, traders were heavily betting on an upswing, with long positions dominating sentiment.

As a seasoned researcher with over two decades of experience navigating the tumultuous waters of the cryptocurrency market, I can confidently say that Cardano’s [ADA] performance is nothing short of remarkable. The recent surge, with ADA up by a staggering 216.78% in the past month and an additional 20.55% in the last 24 hours, leaves me positively giddy at the prospect of what’s to come.

In recent times, the performance of Cardano‘s cryptocurrency, ADA, has been exceptional, surging by an impressive 216.78% over the past month. Moreover, its latest 20.55% growth in the last day serves as a testament to the persistent bullish trend it is experiencing.

The main reason for this surge in the market seems to be large-scale purchases by ‘whales’ and heightened buying interest in derivative exchanges. According to AMBCrypto, there might be even greater gains to come.

Whale accumulation behind ADA’s rally?

Analyst Ali Observed on Platform X (previously known as Twitter) that the recent surge in Cardano’s ADA price may be largely attributed to increased whale activity. This refers to major investors buying large quantities of the digital currency.

The analyst believes that the current surge we’re seeing is merely a prelude to what’s expected in the future, based on several positive trends and signals.

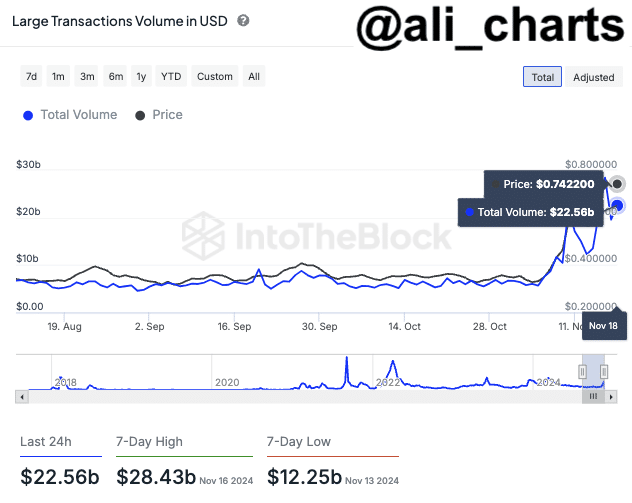

Over the past week, Ali Charts showed that Cardano’s (ADA) daily transaction volume significantly increased and remained stable around $22 billion each day. This peak reached an impressive high of $28.43 billion over the course of the last seven days, marking its highest point in this timeframe.

The rise in activity can be attributed to larger investments by both whales (large-scale traders) and institutions, as they have been expanding their holdings.

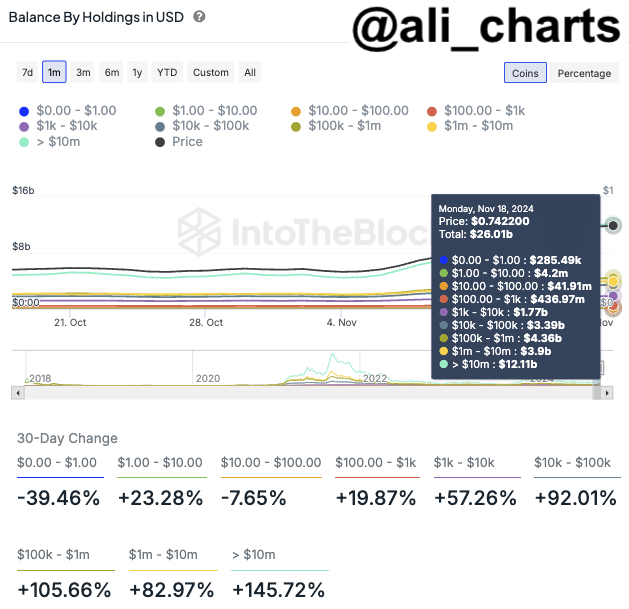

The analyst pointed to a notable rise in the “Balance By Holding in USD,” which tracks ADA holdings across wallet balances. This increase reflected a major accumulation by large holders.

Whales—wallets holding up to 1% of the asset’s total supply—have shown a massive growth.

In the past 30 days, wallets that contain between one million and ten million dollars of ADA have experienced an 82.97% increase in their holdings, while those with more than ten million dollars have seen a significant jump of 145.72%.

Price movement signals possible ADA rally

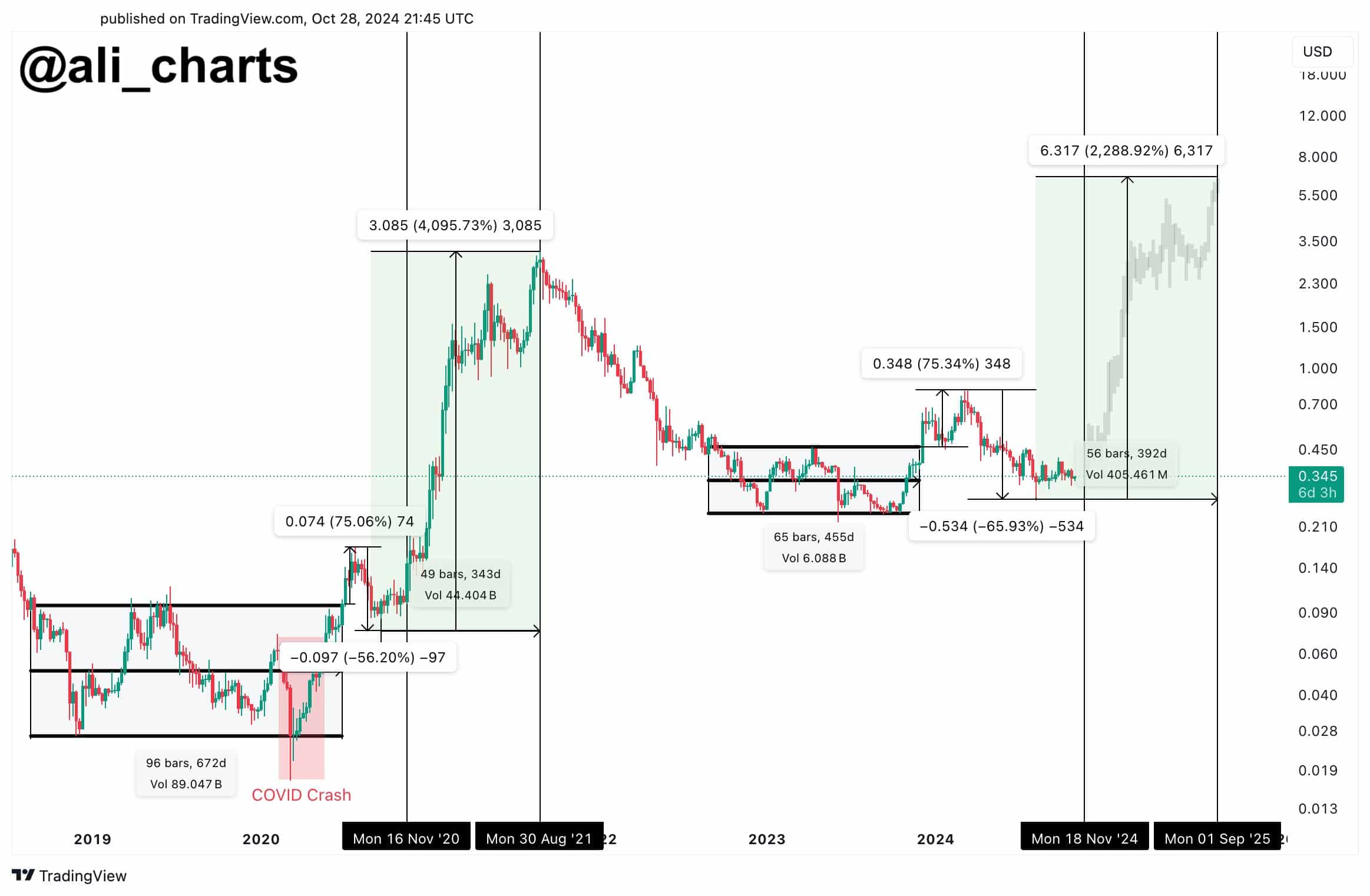

Ali Charts noted that the price fluctuations of ADA appeared similar to a self-repeating pattern, reflecting a likeness to its path taken in 2020.

This trend encompasses the buildup stage, the decline due to COVID-19, followed by a surge in November 2020 which catapulted ADA to its peak price of $3.085.

It seems that ADA followed a comparable pattern, moving out of an accumulation stage, undergoing a drop, and now exhibiting indications of an uptrend.

Should the pattern of this fractal unfold, it’s possible that Cardano (ADA) could experience a significant surge, amounting to approximately 2,288.92%. If this trend continues, Cardano’s price might climb up to $6.30—a rise that has already begun taking shape.

Even so, ADA might momentarily decelerate while it builds up more speed to reach greater heights.

As a crypto investor, I find myself contemplating that if the market takes a dip, this particular asset could potentially slide down to around $0.80. Yet, at such a price point, the strong buying interest might surge, rekindling the upward momentum and propelling the rally once more.

Currently, there’s a significant buying pattern for about 1.19 billion ADA, distributed across roughly 48,000 different accounts. This indicates robust investor enthusiasm and could be a sign of an upcoming trigger for another price spike.

Derivative traders fuel bullish pressure

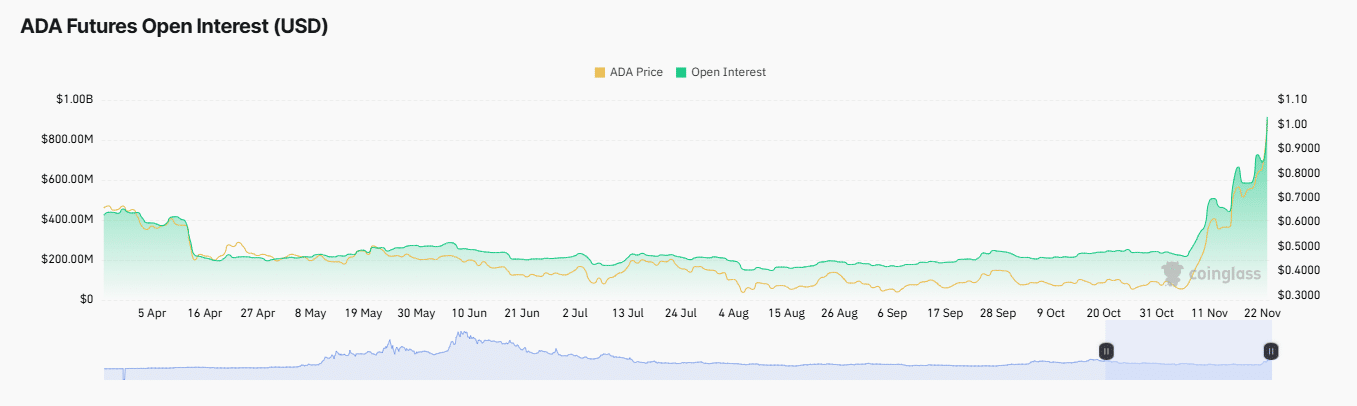

According to an analysis by AMBCrypto on Coinglass, there’s been a surge of interest among traders focusing on derivatives, particularly in the creation of long positions. It’s anticipated that this trend will continue as optimism among investors becomes more robust.

At the current moment, Open Interest – a tool for measuring market expectations by considering the aggregate worth of incomplete derivative agreements – has significantly leaned towards optimism. In fact, it experienced an increase of approximately 35.37%, amounting to a significant figure of $1.02 billion.

Read Cardano’s [ADA] Price Prediction 2024–2025

At the same time, several small sales adding up to approximately $11.12 million took place as traders who had wagered on a drop in price were compelled to wrap up their trades due to ADA’s price surge.

boosting optimism is the growing Funding Rate, currently at 0.0572%. An uptick in the Funding Rate, such as the one observed here, often reflects more long traders in control, thereby strengthening predictions of an upward trend.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Masters Toronto 2025: Everything You Need to Know

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-11-24 11:04