- BTC faced a strong resistance at $98.9K.

- Selling pressure on BTC could rise soon, putting an end to its bull run.

As a seasoned researcher with years of experience in the crypto market, I have witnessed many ups and downs, bull runs, and bear markets. The current trajectory of BTC towards $100K is indeed fascinating but raises some concerns that need to be addressed.

Is it possible that Bitcoin [BTC] could be approaching the $100K level due to favorable market trends? But the question remains: Will this upward trend continue, or might Bitcoin experience a downward adjustment (price correction) shortly?

Bitcoin approaches $100K

After a week of massive price rises, BTC’s value started to come closer to the $100K mark. At the time of writing, the king coin was trading at $98.2K with a market capitalization of $1.94 trillion.

Currently, renowned cryptocurrency expert, Ali Martinez, has suggested on Twitter that investors consider selling a quarter of their Bitcoin (BTC) when its value reaches approximately between $173,000 and $200,000.

Moving on, he additionally highlighted a plan to sell 30% of his assets when the value of King Coin falls within the $200K – $300K price range.

Given the high targets set, AMBCrypto decided to conduct a more thorough investigation to determine if Bitcoin’s path forward is unobstructed.

Decoding BTC’s future

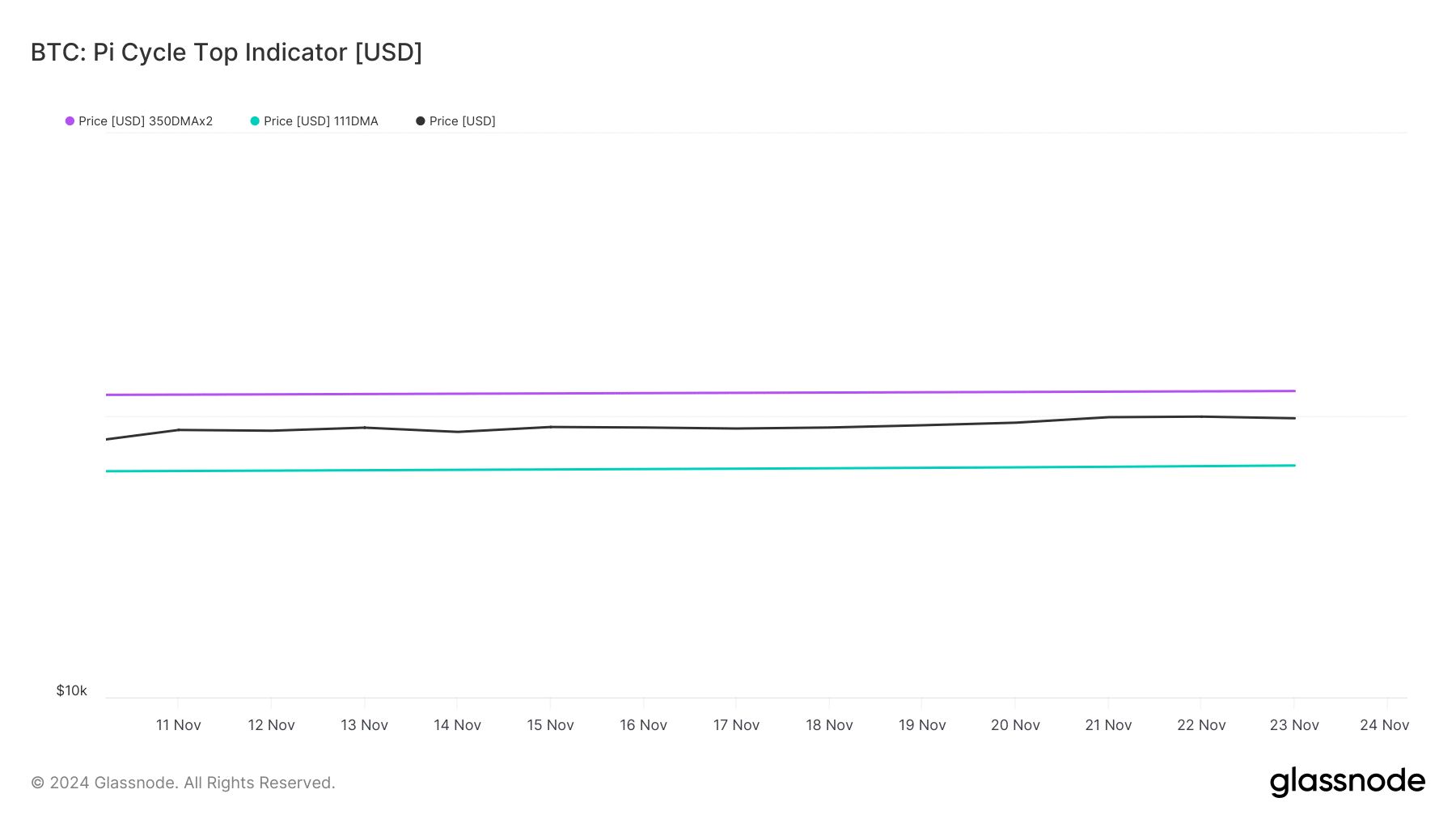

According to our examination of Glassnode’s data, Bitcoin was being traded within a specific price range. More specifically, the Pi Cycle Top indicator suggested that a potential Bitcoin market peak may have occurred around $121,000, while a possible bottom could be found at approximately $66,000.

Therefore, the possibility of BTC going towards $100K wasn’t too ambitious.

It appears that investors are still weighing the possibility of purchasing Bitcoin. Earlier reports by AMBCrypto indicated a withdrawal of about 65,000 Bitcoins from exchanges in recent times.

The value of these coins exceeded six billion dollars, suggesting a strong increase in demand for Bitcoin purchases.

According to information from CryptoQuant, there was a significant demand for Bitcoin (BTC), as suggested by the decline in available Bitcoin on exchanges, indicating that people were more likely to buy rather than sell.

A decrease in purchasing activity often suggests that the likelihood of further price growth is increased, since investors have demonstrated trust in the leading cryptocurrency.

In addition, the premium for Bitcoin on Coinbase was a vibrant green, indicating strong buying interest from American investors. This bullish trend might have contributed to Bitcoin’s potential rise toward $100,000.

However, nothing can be said with utmost certainty.

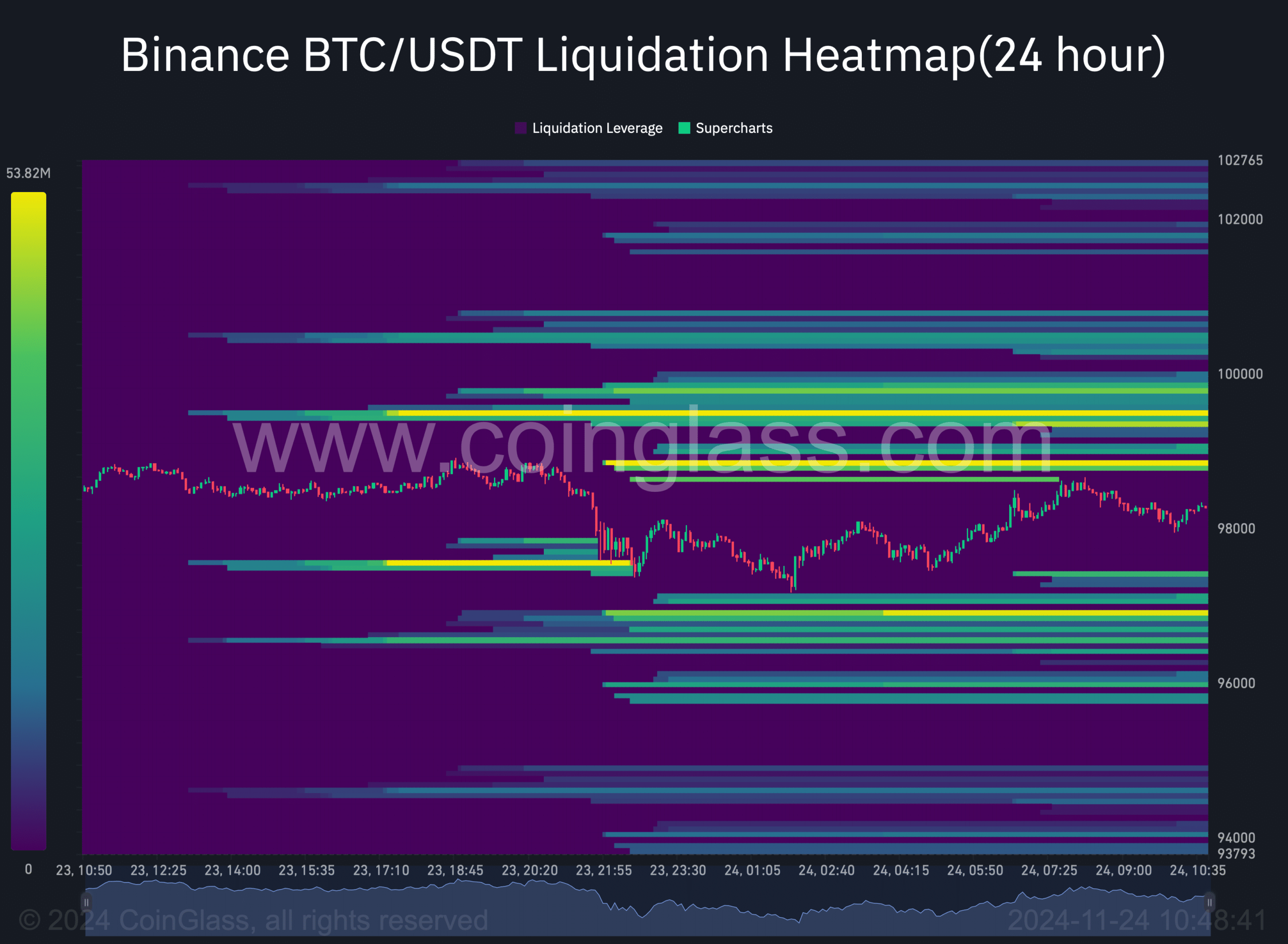

The chart showing the liquidation of the King Coin indicated that it encountered significant opposition around $98,900. Increased liquidation events tend to function as hurdles, potentially causing price reversals.

Therefore, it will be crucial for BTC to go above that level in order for it to target $100K.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

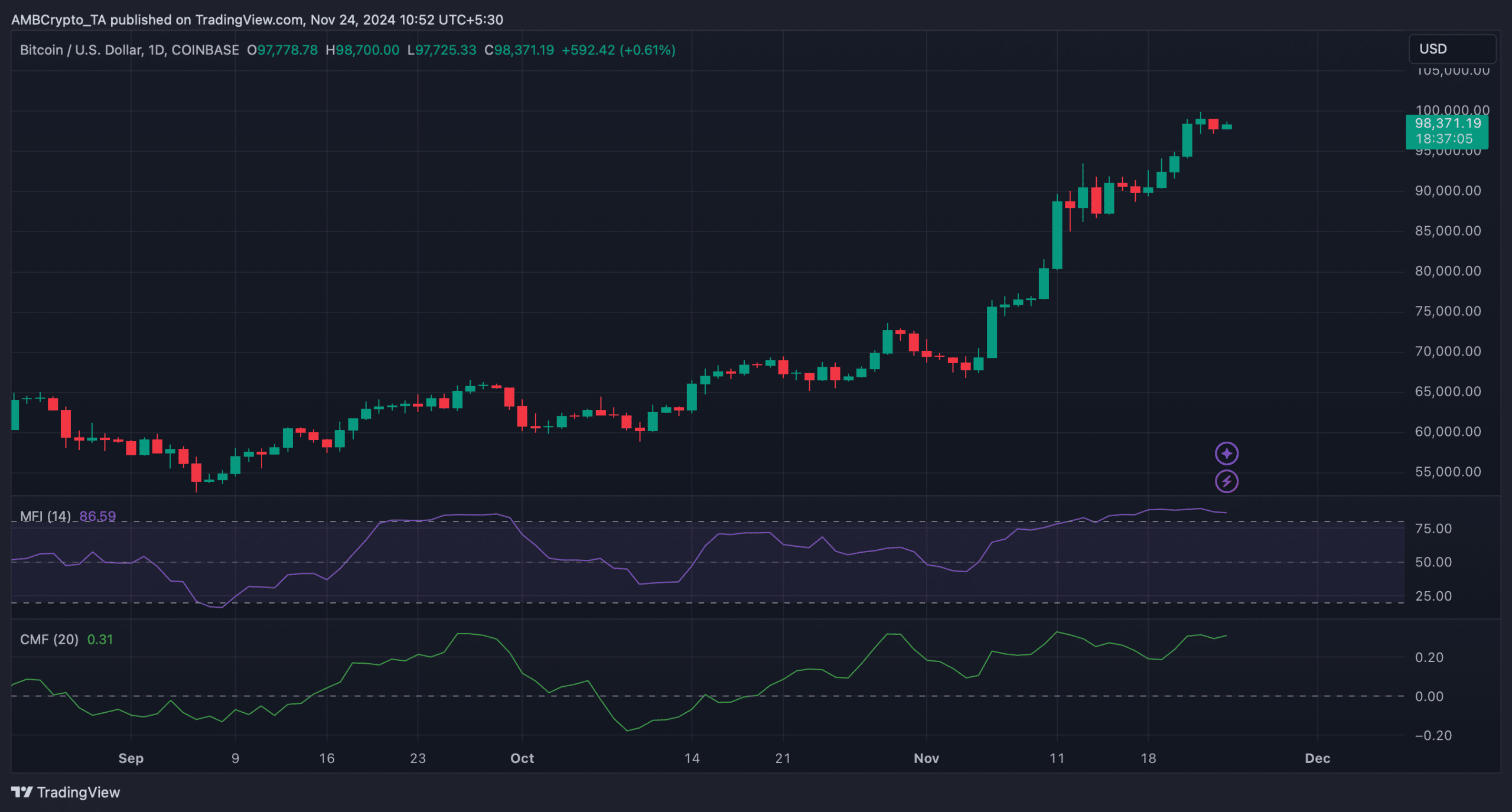

As a researcher, I noticed that the Chaikin Money Flow (CMF) for Bitcoin showed an increase, signifying a rise in buying pressure. This strengthened the case for a bullish trend.

On the other hand, since the Money Flow Index (MFI) was positioned within the overbought area, it might lead to a sell-off, potentially causing Bitcoin’s price to decrease.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Masters Toronto 2025: Everything You Need to Know

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-11-24 13:11