- Bitcoin has dragged itself back to the $98,000 price range.

- Its Funding Rate has remained positive for weeks.

As a seasoned researcher with years of experience navigating the volatile world of cryptocurrencies, I must admit that Bitcoin’s current rally has me a bit on edge. While it’s always thrilling to witness such historic price surges, my analytical side can’t help but notice the warning signs flashing like neon lights in Vegas.

With Bitcoin [BTC] nearing the $100,000 milestone, concerns are raised regarding the longevity of its ongoing surge.

As an analyst, I’m finding myself amidst a buzzing investor community brimming with excitement. However, upon closer examination of various market indicators, it seems prudent to exercise caution.

Essentially, AMBCrypto has examined three key aspects to determine if Bitcoin’s current state might be indicative of an overly heated market condition.

Bitcoin’s price momentum and overbought conditions

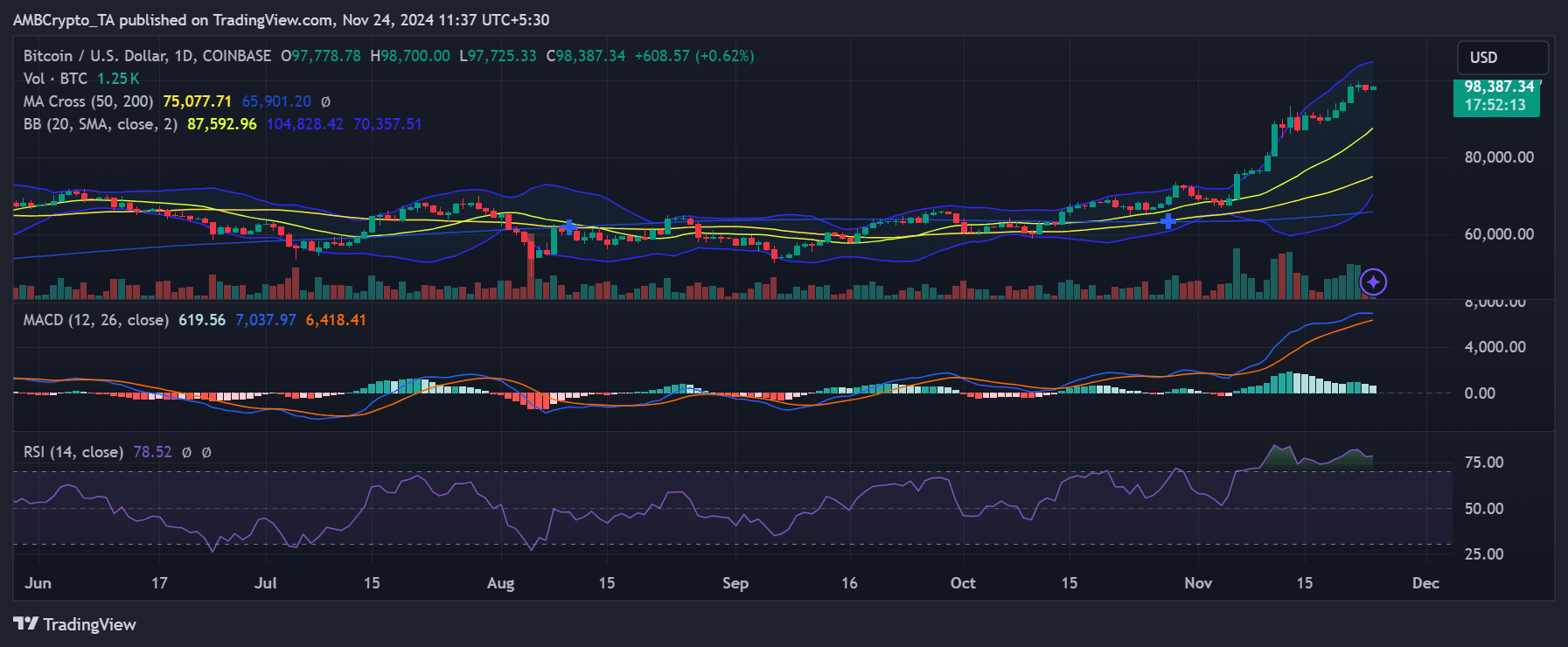

Looking at the day-to-day BTC/USD graph, we can see that Bitcoin has been on a steep incline recently. This digital currency, often referred to as the ‘king coin’, surged past consolidation levels around $65,000 only a few weeks back.

In simpler terms, the Relative Strength Index (RSI) currently reads 78.6, suggesting that Bitcoin may be experiencing an overbought state. Previous data shows that when the RSI exceeds 70, it often signals a short-term correction as traders tend to cash out their gains.

Furthermore, it was indicated by Bollinger Bands that the price was close to the upper boundary, suggesting heightened market volatility.

If the current market price is consistently higher than its average over the past 20 days, it might indicate an upcoming reversal to the mean (mean reversion). This possibility becomes stronger when selling due to profit-taking intensifies.

Presently, Bitcoin is being traded approximately at $98,200, which represents a minor rise compared to its dip to the $97,000 range during the previous trading day.

Bitcoin SOPR shows profit-taking

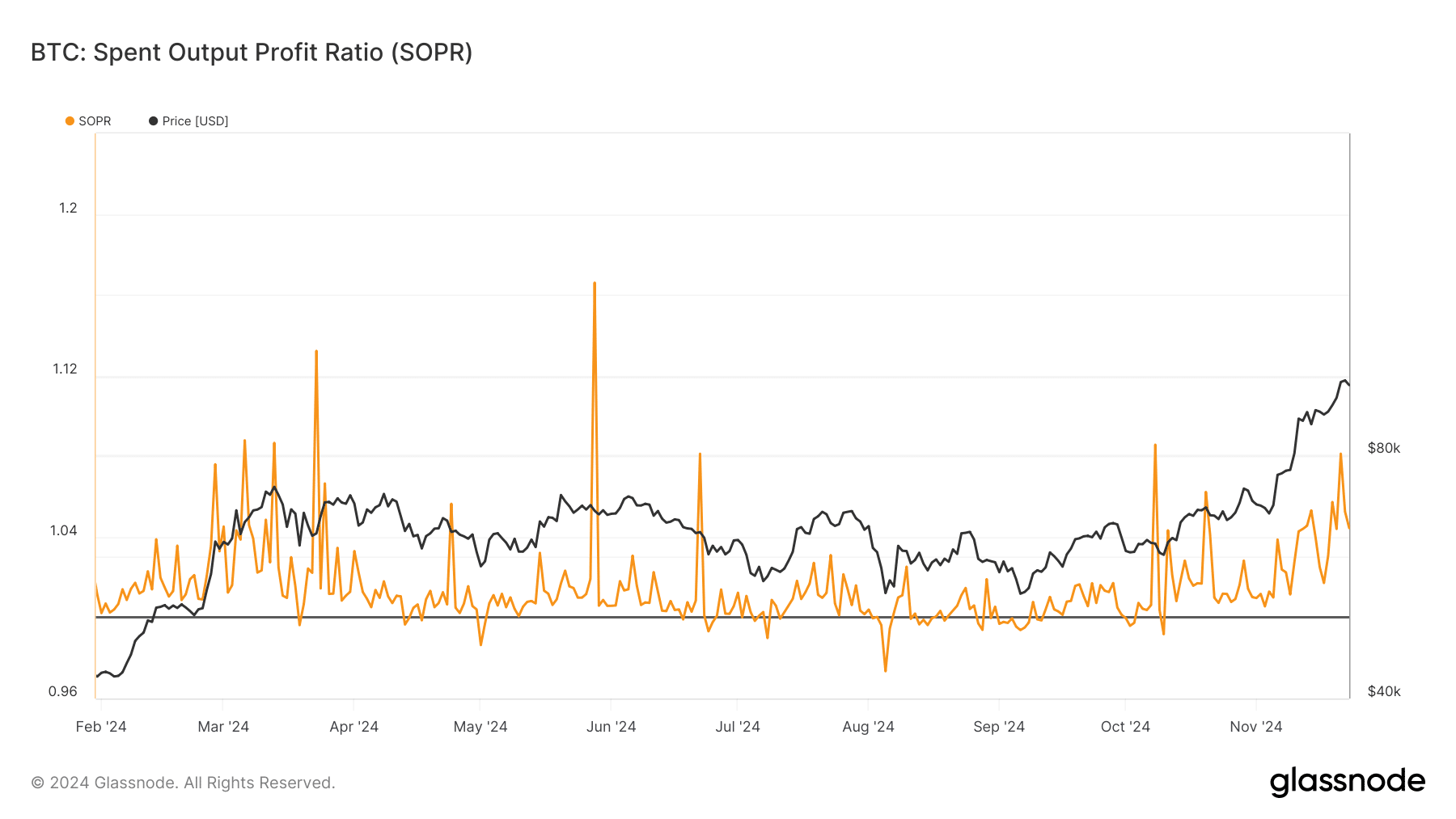

The SOPR graph provided a more distinct depiction of the market dynamics, as this ratio indicates whether the coins transferred on the blockchain are currently profitable. Notably, it has consistently increased in tandem with Bitcoin’s price.

According to AMBCrypto’s examination, the SOPR figures climbed approximately to 1.08 over the last week, suggesting a surge in realized profits.

Historically, high SOPR levels tend to occur around market peaks, since investors tend to sell their holdings more frequently during a bullish frenzy.

A sharp drop in the SOPR could indicate heightened selling activity, possibly leading to a wider market adjustment. At present, the SOPR spike has decreased somewhat, with a value of approximately 1.04.

An overleveraged market

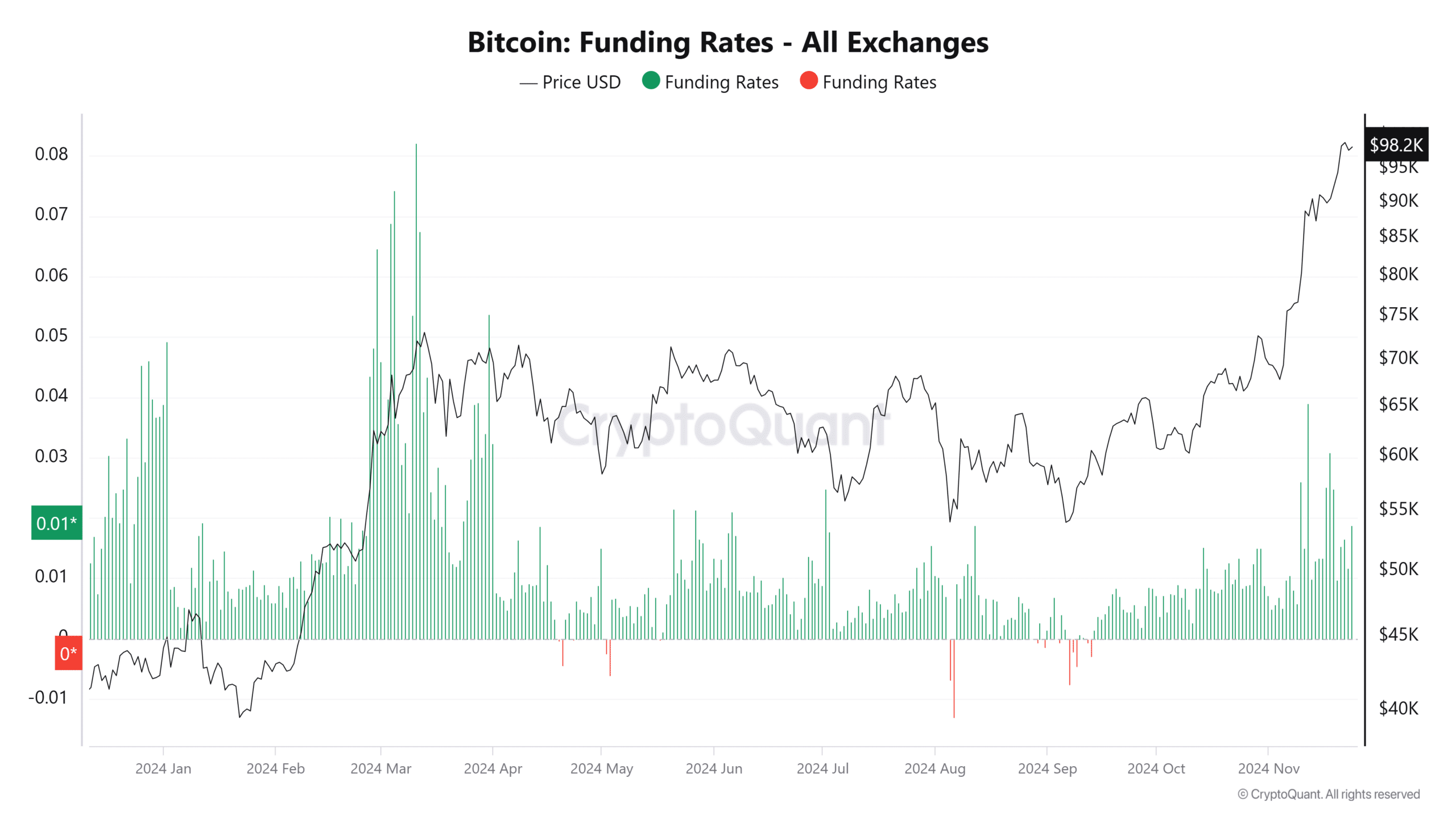

A significant increase was observed in the Bitcoin Funding Rates chart on prominent trading platforms.

As a researcher studying market trends, I’ve observed that funding rates turn out to be favorable when more trades are made with long positions, indicating a balanced or bullish market. However, exceptionally high funding rates could signal excessive leveraging, potentially hinting at an over-optimistic or over-leveraged market scenario.

Currently, Funding Rates are nearing values reminiscent of the 2021 bull market crest, suggesting that there might be too much speculative excitement in the air.

As a crypto investor, I’m aware that if a market correction happens, heavily leveraged positions could intensify the sell-off by triggering liquidations. This increased selling could put additional pressure on prices to fall further.

Market reset before stable trends?

It’s clear that Bitcoin’s recent surge has been remarkable, but when you consider the alignment of overextended Relative Strength Index (RSI) levels, elevated Spent Output Profit Ratio (SOPR), and escalating Funding Rates, it suggests a possibility of the market heating up.

Read Bitcoin’s [BTC] Price Prediction 2024-25

As a researcher, I posit that a corrective measure could rejuvenate the market, establishing a foundation for steady, sustainable expansion instead of being driven by frenzied speculation.

As a crypto investor, I can’t help but feel excited about Bitcoin’s potential for further growth. However, I also acknowledge that the swift climb it has experienced carries certain risks that need careful consideration.

Read More

2024-11-24 16:08