- WLD has come into focus as it nears the crucial $3 resistance, with the potential to pivot towards $4 next.

- However, given its historical price action, the odds remain uncertain.

As a seasoned researcher with over two decades of market analysis under my belt, I find myself intrigued by Worldcoin [WLD]. The coin’s recent price action and trading volume surge have piqued my interest, hinting at a potential breakout. However, I remain cautiously optimistic, given WLD’s historical volatility and the elusive nature of predicting cryptocurrency markets.

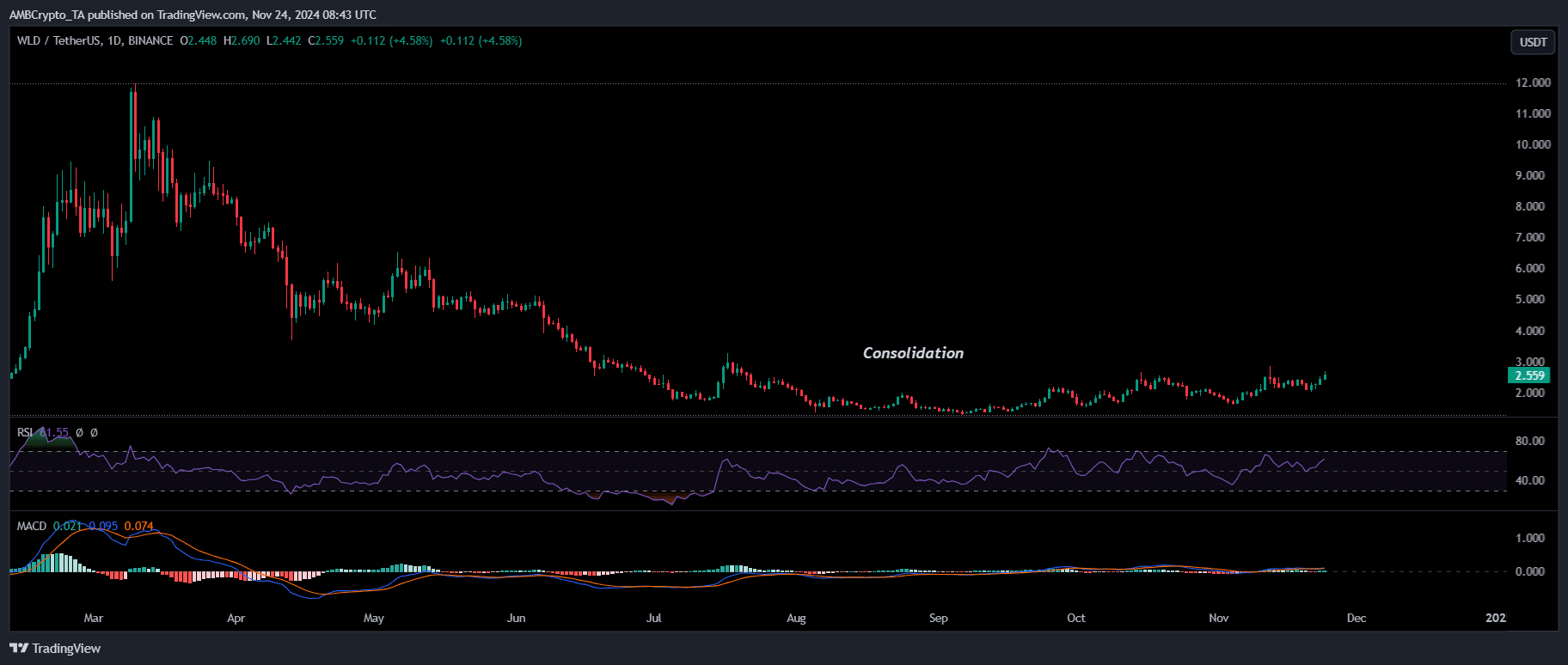

For approximately eight months now, Worldcoin (WLD) has been experiencing an extended period of stability, with the past four months showing a more pronounced level of standstill.

Currently trading at $2.63, Worldcoin (WLD) is still a significant distance away from its peak price of $11, which it achieved during the Bitcoin surge in March.

Nevertheless, optimism is growing, as one influential expert foresees a possible surge to $4. Boosted by a 50% increase in trading activity over the last 24 hours, WLD is approaching its prior $3 barrier of resistance.

A significant increase in both volume and market activity might indicate that World’s Land (WLD) is about to break out of its extended downtrend, possibly heralding the beginning of its rebound phase.

Could this be the turning point investors have been waiting for?

Bullish indicators signal untapped potential

As a crypto investor, I often find that a consolidation phase means there’s less money flowing in, with both buying and selling activities leveling off. To push past this stage and spark a breakout, it’s essential to increase my buying pressure significantly.

Examining its day-to-day price fluctuations, it’s evident that WLD is experiencing an obvious imbalance. This imbalance is characterized by persistent stronger selling actions compared to buying actions, which has kept the coin trapped within the limits of approximately $1 and $2.

Source : TradingView

As an analyst, I observe that the Relative Strength Index (RSI) continues to reside within the undervalued range, indicating a promising opportunity for further upward momentum.

In simple terms, it seems that bulls are taking advantage of this situation, which is clear from an increase in trading activity leading to nearly a 6% rise in prices over the past day.

Although such positive signs might drive WLD up toward the $4 mark with heightened market fluctuations, it’s doubtful that these alone would be strong enough to push it back to its previous record high.

Reaching this milestone would necessitate active involvement from major stakeholders, helping maintain the current pace.

Whales must step in to balance WLD’s momentum

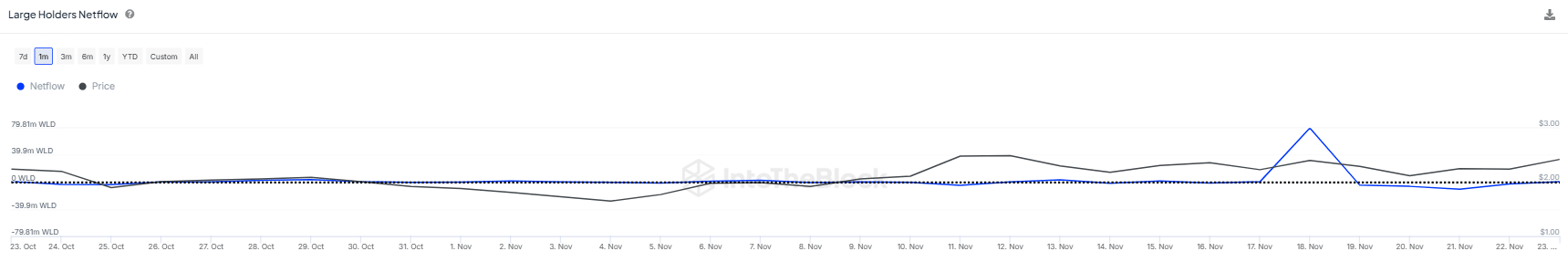

For the last month, major token holders have predominantly been transferring tokens out rather than adding more, with just one notable exception where over 80 million tokens were withdrawn from exchanges.

Source : IntoTheBlock

Despite the attempt, the activity didn’t significantly influence its price trend, implying that excessive volatility might be hindering WLD from experiencing a breakout.

To overcome the current strong selling pressure, a persistent and regular build-up of resources might be necessary instead.

In the ongoing market scenario, I find myself leaning towards short positions on WLD due to its present positioning. This strategy seems rational, considering WLD’s current market status.

However, there is still a silver lining: increased trading volume and speculative interest could set the stage for a potential reversal if bulls regain control.

As a crypto investor, I’ve been observing the market closely and here’s my take: If we see a minor increase in whales buying into the market, it might throw off the short-sellers who have built up their positions over the past few months. This could potentially hinder the price from escalating further.

Should the purchasing activity become more intense, it may trigger a ‘short-covering rally’. During such an event, those who have shorted the market would be compelled to buy back their holdings to prevent further losses. This rapid buying can lead to a brief yet substantial increase in price.

Realistic or not, here’s WLD market cap in BTC’s terms

Given the present discrepancy between demand for purchasing and supplying, it seems that a short squeeze might serve as the primary trigger to help WLD break free from its downturn, possibly even reaching a new record peak.

But this depends on trading volume staying elevated and whales actively participating.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-11-25 00:08