- Bitcoin’s dominance slipped, sparking debate over altcoins’ growing market influence.

- Capital shifted to altcoins as Bitcoin faced mounting competition in crypto markets.

As a seasoned researcher who has witnessed the rise and fall of various cryptocurrencies, I must admit that Bitcoin’s recent decline in dominance has piqued my interest. While it is tempting to jump to conclusions, I find myself hesitant to call this an “altcoin season” just yet.

In simpler terms, the influence of Bitcoin (BTC) appears to be decreasing as of late, as its market share has dipped beneath significant levels.

Consequently, more and more money is being invested in alternative cryptocurrencies, leading to heated discussions among investors and financial experts.

Could it be that Bitcoin’s control over the market is slipping, or is this just a short-term fluctuation within a larger, ongoing upward trajectory?

The fall of Bitcoin’s dominance

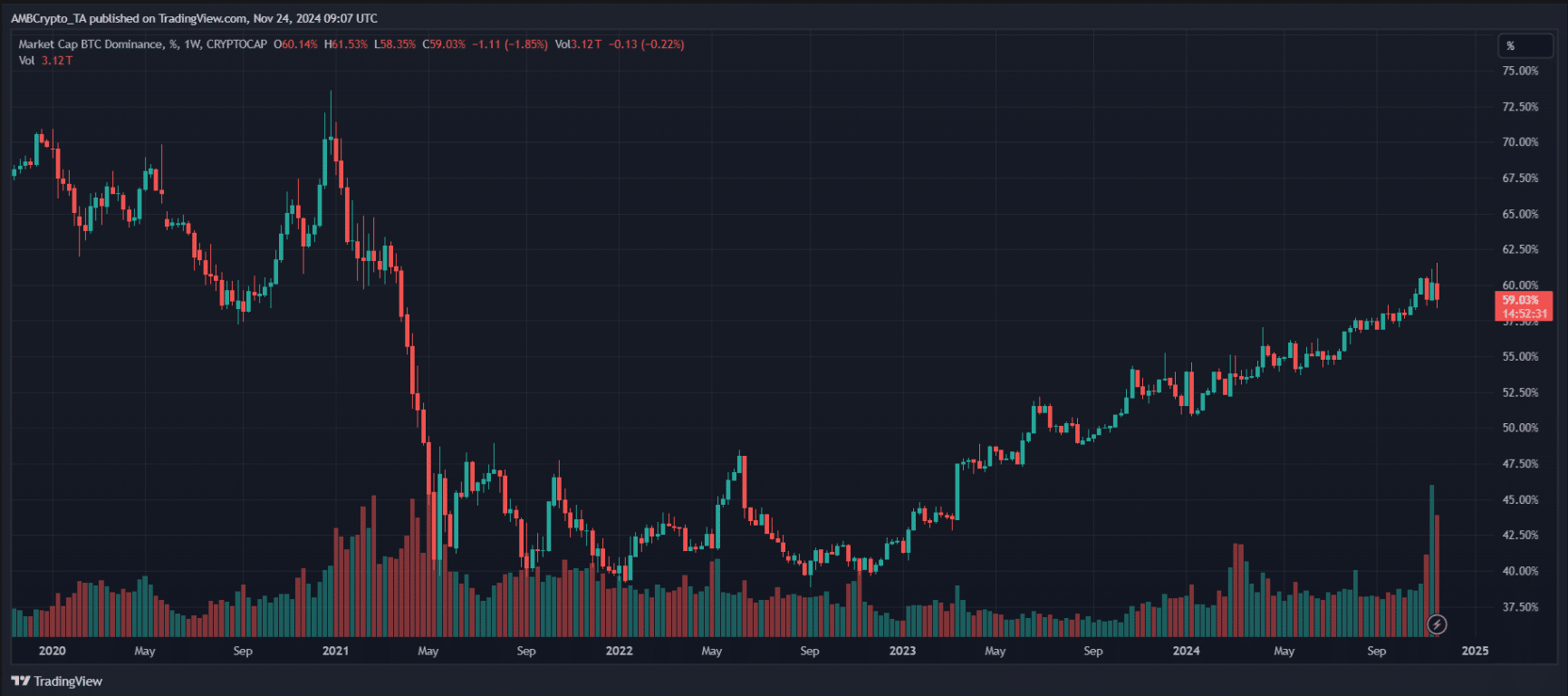

According to the graph provided, Bitcoin’s influence over the cryptocurrency market has fallen under the notable level of 50%, suggesting a broader perspective that indicates a potential decrease in Bitcoin’s control over the market.

This decrease implies a rising curiosity among investors towards altcoins, as funds are being directed towards Ethereum [ETH], Solana [SOL], and lesser-known tokens. These could potentially contest Bitcoin’s dominant position in the market.

Historically, Bitcoin’s dominance has oscillated with market cycles.

In the initial period of cryptocurrencies, it held more than 90% of the market share. However, the bullish market trend of 2017 saw an increase in other digital currencies, or altcoins, which caused its control over the market to decrease significantly, dropping below 40%.

Over the following phases, Bitcoin managed to rebound somewhat, reaching approximately 70% in the year 2021. However, since then, its dominance in the market has been gradually decreasing.

The continuous rhythm of changes demonstrates how stories that keep evolving, groundbreaking technology developments, and shifting investor tastes impact the market, causing Bitcoin to vie against a more varied landscape of digital currencies as time goes by.

Altcoin season: Coins leading the charge

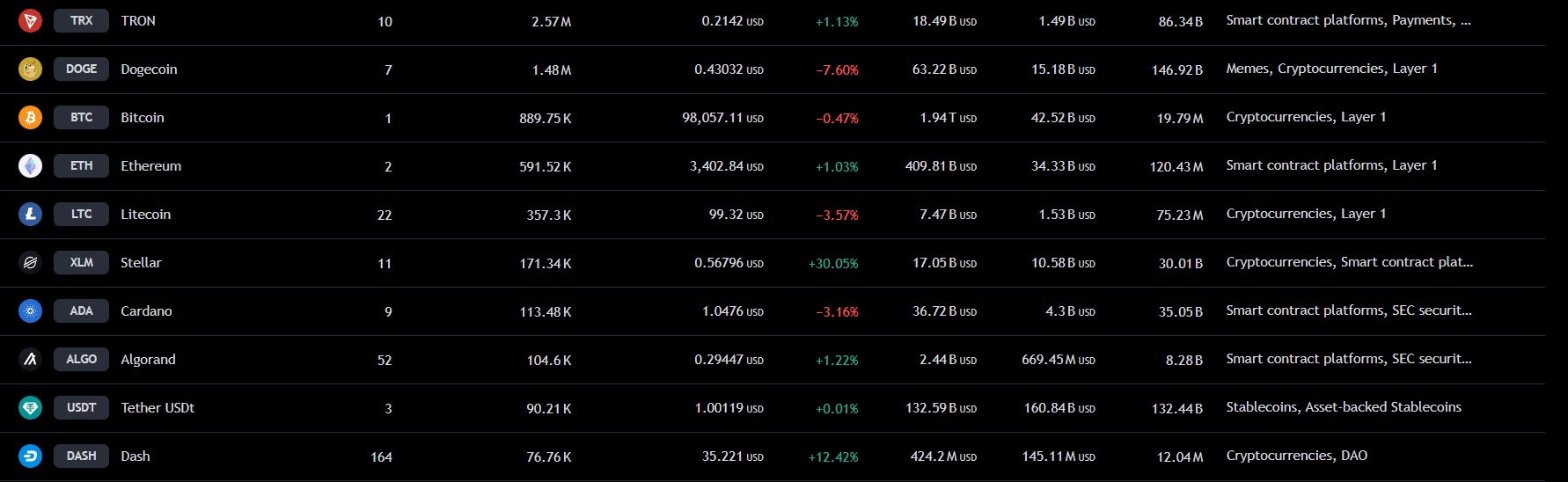

The transition of capital into altcoins indicates a potential altcoin season, as shown by the ranking of coins based on active addresses.

These digital coins such as Ethereum, Stellar (XLM), and TRON (TRX) are seeing significant popularity, largely due to a surge in on-chain transactions.

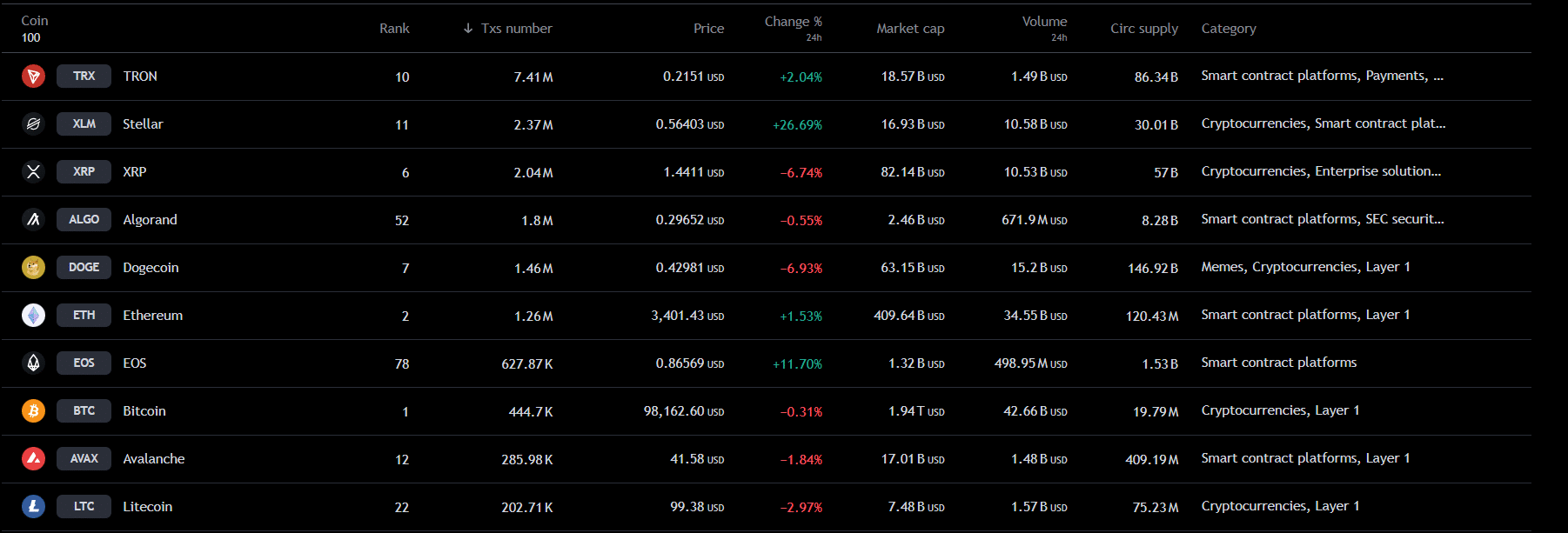

The transaction rankings underscore TRON’s authority even more, as it executed an impressive 7.41 million transactions, highlighting its expanding influence in payment systems and Decentralized Finance (DeFi).

In a close second place, Stellar showed impressive numbers with approximately 2.37 million, underscoring its dominance in cross-border remittances. Meanwhile, Ethereum remains significant, boasting around 1.26 million, largely due to its role in high-value activities such as Decentralized Finance (DeFi) and Non-Fungible Tokens (NFTs).

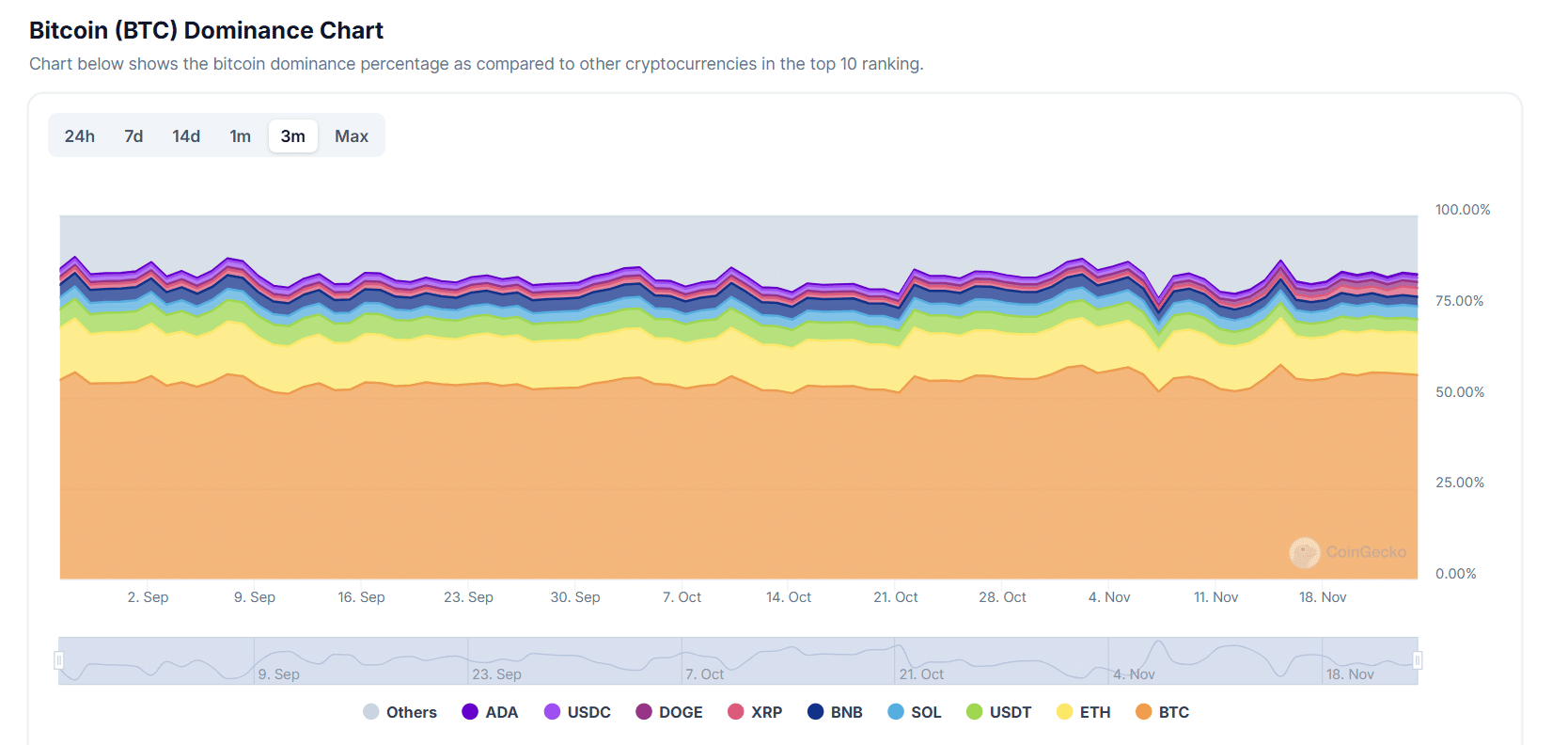

As a crypto investor, I’ve noticed that insights from the Bitcoin dominance chart have solidified a trend: The declining market share of Bitcoin has paved the way for altcoins such as Ethereum, Solana, and TRON to establish substantial ground in the market.

In certain areas of the market, Ethereum currently holds more than 20% of the share, whereas newcomers such as Avalanche [AVAX] are experiencing consistent growth in investments.

This dynamic signals a redistribution of capital as investors seek value beyond Bitcoin.

Is altcoin season finally upon us?

The shift from Bitcoin dominance to altcoins is driven by a mix of factors.

Investors are being influenced by regulatory demands to explore altcoins that operate within compliant structures, like Stellar. Meanwhile, economic instability prompts them to diversify their investments for safety.

Technological advancements, like Ethereum’s upgrades, further enhance altcoin competitiveness.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Despite its recurring pattern, the decrease in Bitcoin’s market share hints at a maturing digital currency ecosystem, as alternative coins (altcoins) are increasingly taking on significant structural roles. This trend suggests a possible long-term change rather than just a temporary “altcoin boom.

This diversification highlights evolving investor priorities in a rapidly changing market.

Read More

2024-11-25 08:08