- PEPE coin’s pullback hit over 20% amid capital rotations.

- Supply pressure on centralized exchanges was below March highs.

As an experienced analyst with years of market observation under my belt, I see the current PEPE situation as a potential opportunity rather than a cause for alarm. The 20% pullback following capital rotations is not uncommon in this highly volatile memecoin segment.

In simpler terms, just like other meme-based cryptocurrencies, PEPE experienced a significant drop in value when big investors (referred to as “whales”) shifted their investments to different markets or sectors.

In simpler terms, it’s been disclosed in the recent Spot On Chain update that a significant investor, often referred to as a “whale,” has offloaded around 130 billion (approximately $3 million) of his PEPE tokens over the last three days, with the intention of investing in other digital currencies.

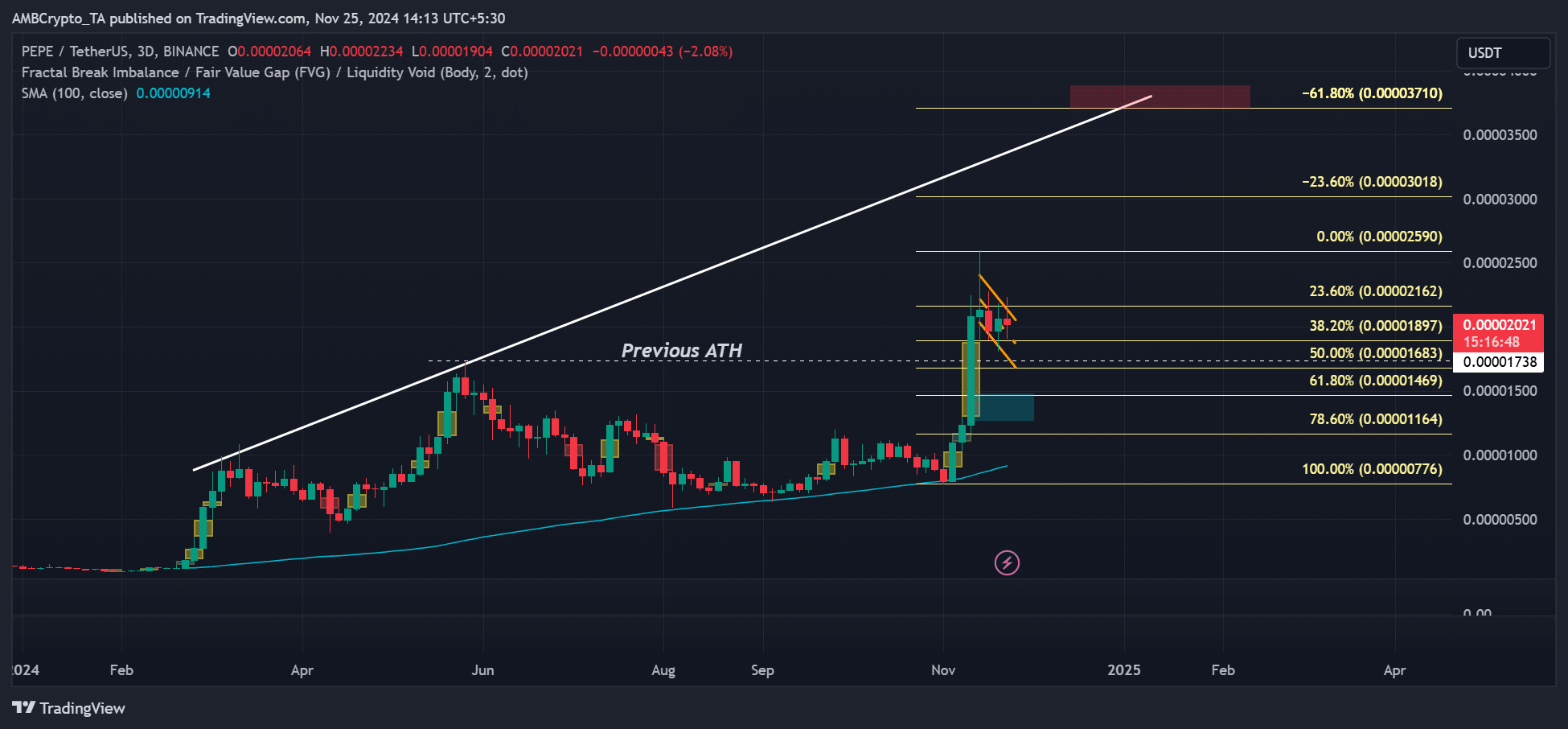

The drop in PEPE’s value, which currently stands at more than 20% from its all-time peak of $0.00002957, has been significant. However, one may wonder how much lower it could fall before we witness a robust rebound.

PEPE coin recovery chances

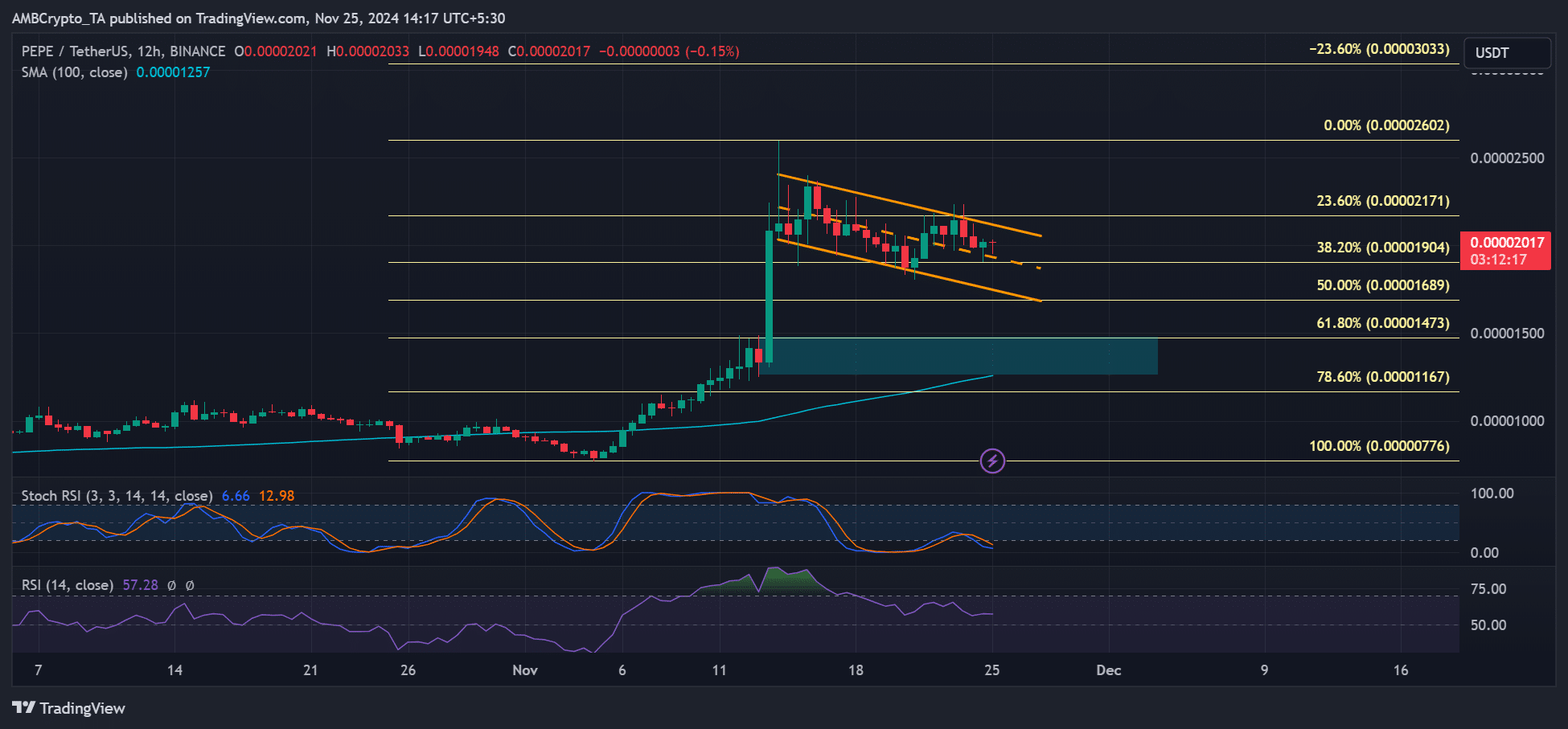

Currently, the 12-hour graph indicates a bearish trend for PEPE, with a downward sloping channel suggesting potential further decline. The price movement appears to be slowing, as indicated by the Stochastic RSI showing an oversold condition.

As an analyst, I find myself in a position where short-selling could potentially yield benefits if the price dips to the lower channel or reaches the 50% Fibonacci Retracement level. However, it’s important to note that the most extensive decline might not surpass the Golden Ratio at the 61.8% Fibonacci Retracement level ($0.000014).

Yet, even though the Relative Strength Index (RSI) remained over 50, signifying continued demand strength, it was holding steady at the moment. If additional investors joined the ‘buy the dip’ trend, it might spark a probable price rebound.

If fear of missing out (FOMO) sparks a resurgence in the upward trend, there’s a possibility that the resistance target (white) might be achieved. This could happen more effectively if Bitcoin surpasses the $100,000 mark.

Low sell pressure on CEXes

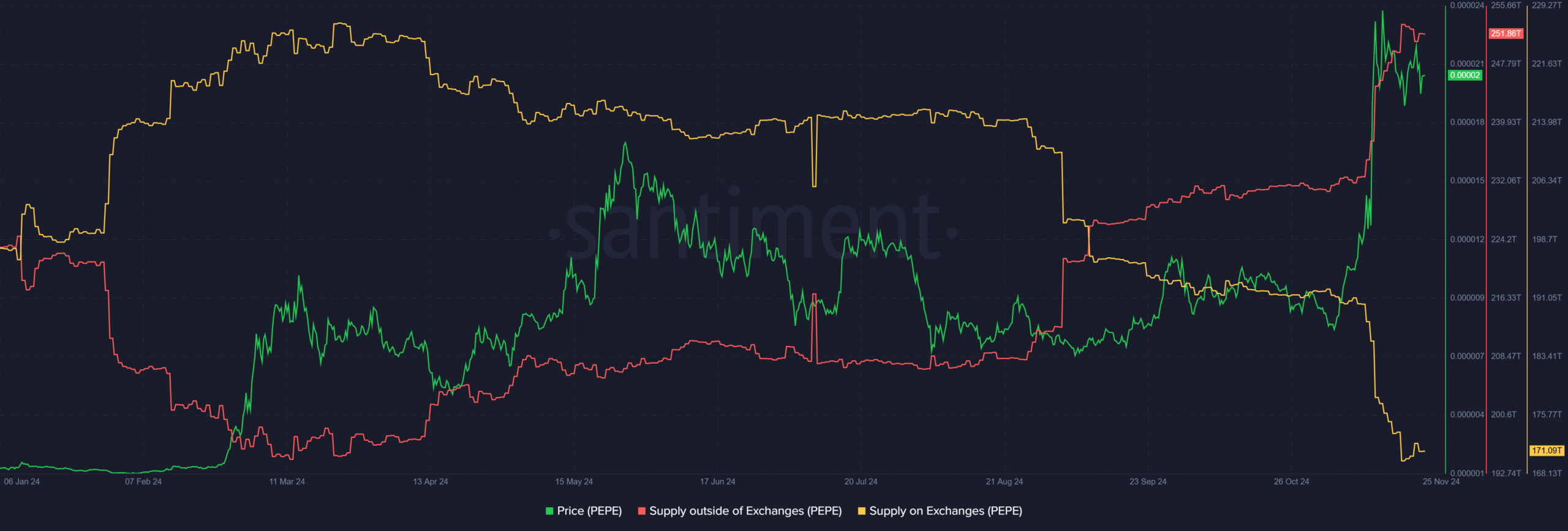

It seems PEPE might get another chance at a comeback, as the sell-off on centralized exchanges wasn’t as strong as it was during the peak in March based on Santiment data.

By mid-March, the circulating PEPE on exchanges (represented by the yellow line) peaked at around 230 trillion units. Currently, the excess supply stands at approximately 171 trillion units. This reduction might provide PEPE with enough leeway to bounce back.

Read Pepe [PEPE] Price Prediction 2024-2025

Indeed, a significant surge occurred in buying at dips, which was evident through the rise in off-exchange supply (represented in red on the chart), as the prices started to fall.

From my perspective as an analyst, historically, these specific signals have been considered positive signs that often precede a potential price turnaround for the amphibian-themed meme token.

Read More

- OM/USD

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- ETH/USD

- Solo Leveling Season 3: What You NEED to Know!

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Lisa Rinna’s RHOBH Return: What She Really Said About Coming Back

- Inside the Turmoil: Miley Cyrus and Family’s Heartfelt Plea to Billy Ray Cyrus

- Aimee Lou Wood: Embracing Her Unique Teeth & Self-Confidence

- Leslie Bibb Reveals Shocking Truth About Sam Rockwell’s White Lotus Role!

- Solo Leveling Season 3: What Fans Are Really Speculating!

2024-11-25 22:15