- The cryptocurrency market saw more than $489 million in total liquidations after Bitcoin and most altcoins plunged lower.

- Forced selling from long liquidations and profit-taking fuelled the downtrend.

As a seasoned researcher with years of experience in tracking market trends and analyzing data, I find it fascinating to observe the ebb and flow of the cryptocurrency market. The recent volatility we’ve seen is not uncommon, but the sheer scale of liquidations and profit-taking activities caught my attention.

Over the weekend, the volatile nature of the cryptocurrency market increased significantly as all the leading cryptocurrencies by market value saw a drop in their trading prices.

Currently, the market is exhibiting indications of a revival; however, the overall market capitalization has decreased by 0.47% over the past 24 hours, amounting to approximately $3.35 trillion.

In the past day, Bitcoin’s [BTC] price has experienced significant fluctuations as it moved between approximately $95,700 and $98,600. Concurrently, Ethereum [ETH], the largest alternative coin, was decreasing by 1.39%, trading at around $3,383 at the time of reporting.

Apart from increased volatility that typically occurs over weekends as a result of reduced trading activity, there were additional elements contributing to the drop in prices as well.

$360M in long liquidations fueled the downtrend

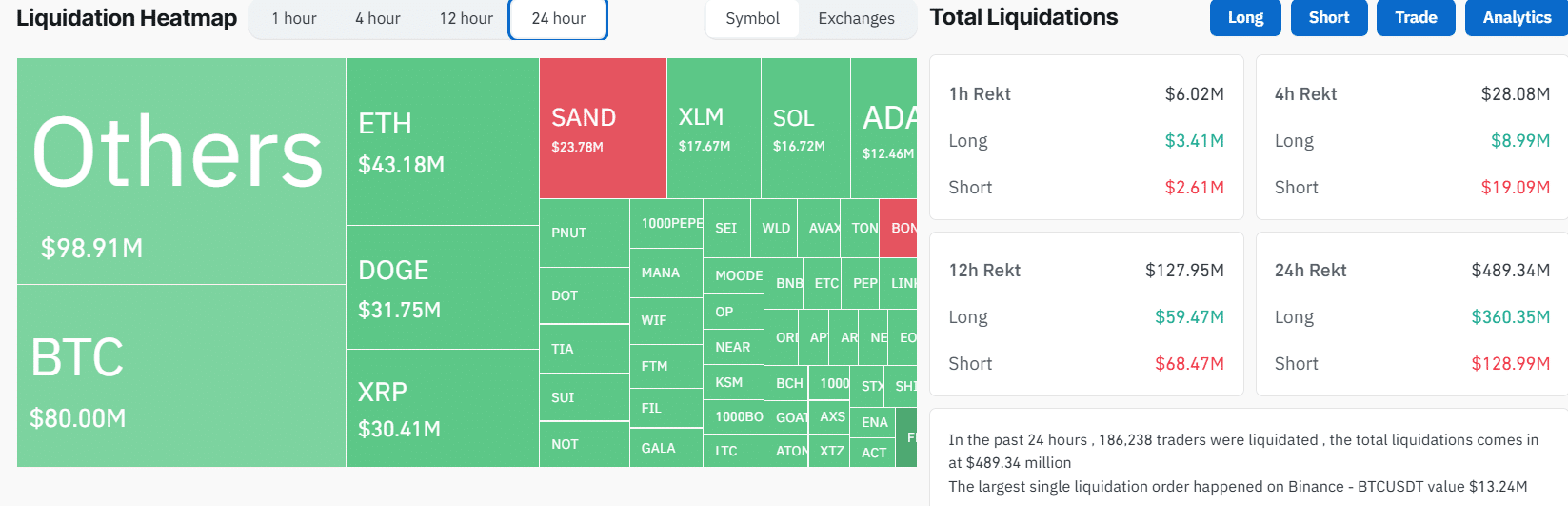

According to Coinglass data, over a span of 24 hours, the cumulative liquidations in the cryptocurrency market amounted to an impressive $489 million, impacting approximately 186,000 traders.

On this particular day, traders holding leveraged long positions experienced significant losses totaling approximately $360 million. Additionally, Bitcoin saw around $56 million in liquidations, which represents the highest daily long liquidations for Bitcoin in over a week.

Concurrently, Ethereum (ETH) and Dogecoin (DOGE) experienced the most significant liquidations among all cryptocurrencies, with losses amounting to approximately $32 million for ETH and around $21 million for DOGE.

When long traders are forced out due to liquidation, they must sell off their holdings. Consequently, this event contributed significantly to the recent market decline.

Profit-taking activity

Previously mentioned, weekends typically see reduced trading activity. Consequently, even a minor increase in buying or selling can produce a substantial effect on prices.

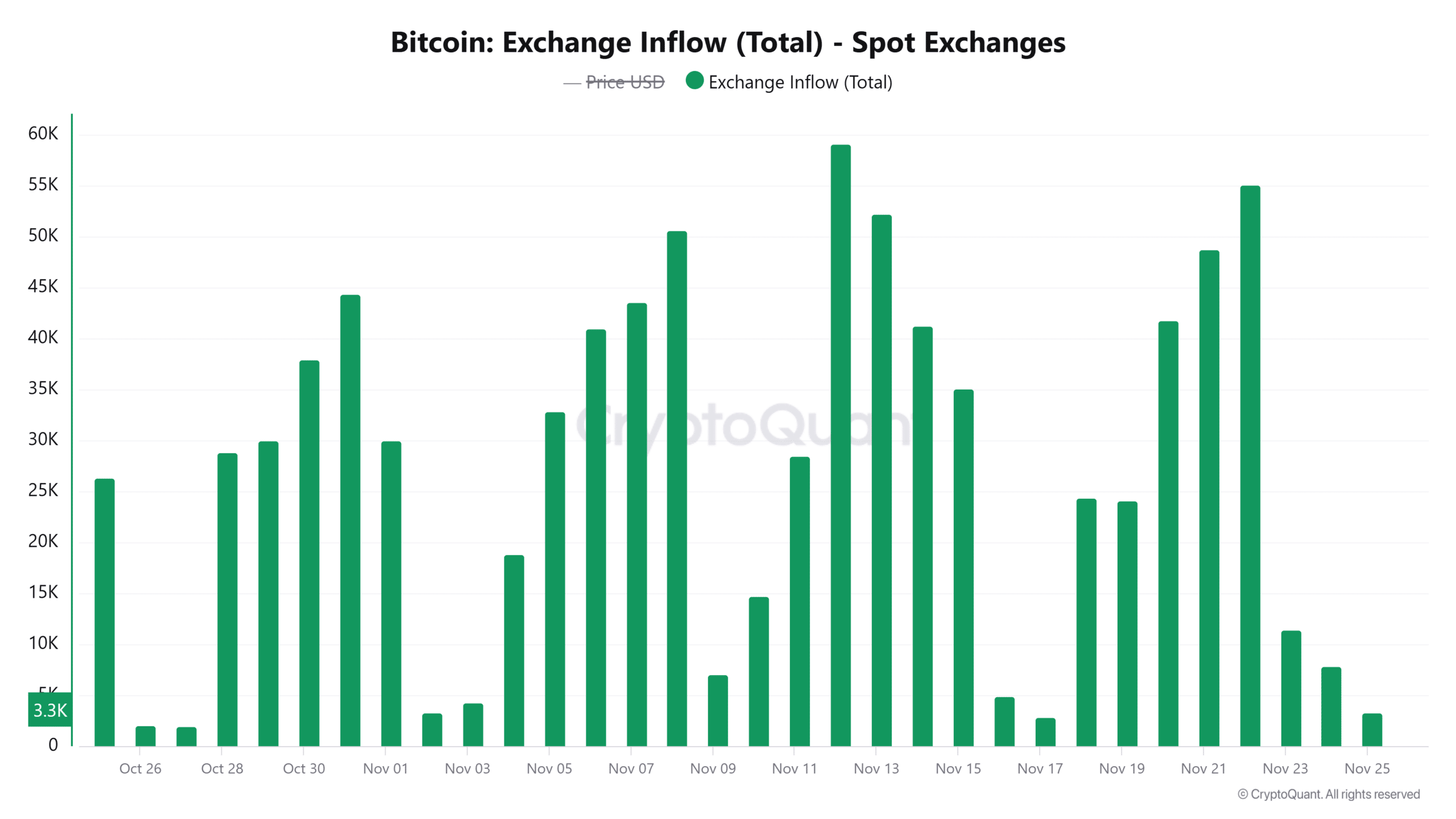

According to data from CryptoQuant, over 74,000 Bitcoins have recently flowed into popular trading platforms in the past three days. This surge could indicate that certain investors are cashing out following recent price increases.

Additionally, approximately 19,238 Bitcoins were transferred to exchanges during the weekend, which could potentially trigger selling actions. This increased selling pressure may have caused a decrease in Bitcoin’s price, leading to a subsequent drop in altcoin values as well.

Market sentiment still shows greed

As a researcher, I’ve observed that although there has been a recent market correction, the overall sentiment continues to lean towards optimism. This is evident in the Fear and Greed Index reading of 82, which signifies “extreme greed.

While this metric shows that traders are highly optimistic and confident, it can also hint at an upcoming correction or trend reversal. Therefore, traders should watch out for signs of intense profit-taking, as that could fuel further dips.

Read More

- OM PREDICTION. OM cryptocurrency

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Oblivion Remastered – Ring of Namira Quest Guide

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Poppy Playtime Chapter 4: Release date, launch time and what to expect

- Ian McDiarmid Reveals How He Almost Went Too Far in Palpatine’s Iconic ‘Unlimited Power’ Moment

- Quick Guide: Finding Garlic in Oblivion Remastered

- Sophia Grace’s Baby Name Reveal: Meet Her Adorable Daughter Athena Rose!

- Ryan Reynolds Calls Justin Baldoni a ‘Predator’ in Explosive Legal Feud!

- Lisa Rinna’s Jaw-Dropping Blonde Bombshell Takeover at Paris Fashion Week!

2024-11-26 00:07