- Bitcoin dominance has dropped, causing altcoins to evolve into ‘safe havens’ during high-risk periods.

- However, full independence is still a long way off, as altcoins remain vulnerable to Bitcoin’s swings.

As a seasoned researcher with over a decade of experience in the crypto sphere, I have seen the market go through its fair share of rollercoaster rides. The recent surge and subsequent dip in Bitcoin dominance has been no exception. While it’s exciting to see altcoins gaining traction as ‘safe havens’ during high-risk periods, I can’t help but feel a sense of deja vu. History seems to be repeating itself, with altcoins still vulnerable to Bitcoin’s swings.

Over the last twenty days, the cryptocurrency market has been an emotional roller coaster, featuring dramatic ups and downs.

The whole thing started when Bitcoin reached a brand-new record peak of $99,317, boosting its control over the market to an impressive 61%.

However, as swiftly as enthusiasm grew, the market started to lose steam, causing everyone to ponder about the future: what lies ahead?

Achieving $100K won’t be a leisurely stroll through the woods; it will require great perseverance and resilience.

Consequently, another day went by without achieving the goal, as Bitcoin currently trades at around $98,300, and its influence has dipped slightly below 59%.

Despite the ongoing uncertainties, it’s the alternative cryptocurrencies, or altcoins, that are shining brightest lately, as some have surged over 100% in just a matter of days.

The high stakes tied to Bitcoin seem to have shifted investor focus toward more affordable assets.

Regardless, the destiny of alternative cryptocurrencies (altcoins) is closely tied to the performance of Bitcoin. Although consolidation has enabled several altcoins to break past significant mental obstacle barriers, a potential drop in Bitcoin’s value might quickly undo these advances.

Altcoins must focus on ‘unique’ strengths

There’s growing evidence that a significant change is picking up speed within the market. In the past, altcoins generally mirrored Bitcoin’s price fluctuations.

In more recent market phases, altcoins have been branching off and developing their own unique investment category.

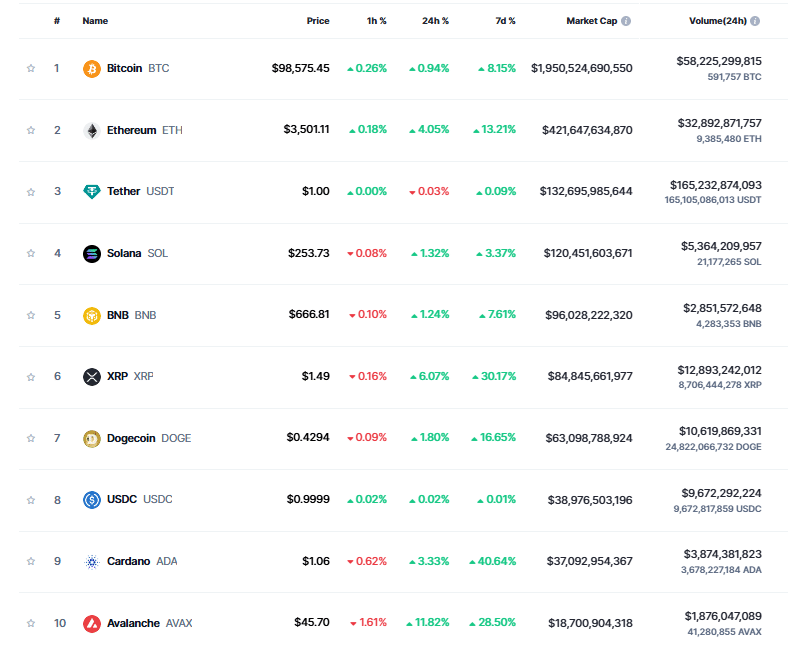

On a daily basis, Ethereum has managed to surpass the $3,500 resistance point, a level not seen as a target since July.

In fact, ETH is just one among many altcoins achieving key price milestones in this cycle, including breaking the elusive $1 mark.

Source : CoinMarketCap

Over the last four days, there’s been a gradual adjustment that reflects a decreasing influence of Bitcoin. However, it’s important to note that this decrease in Bitcoin’s dominance does not necessarily signal a bearish market trend.

Instead, it reflects the growing traction of altcoins as they capture a larger share of the market.

It’s been mentioned that this phenomenon frequently occurs when investors shift their Bitcoin earnings towards other cryptocurrencies (altcoins) in an attempt to spread their investments and potentially gain even greater yields.

To truly break free from the ups and downs of the Bitcoin market, it’s essential to emphasize the distinctive advantages of various altcoins, helping them stand out from overall market fluctuations.

As a researcher, I’ve come to appreciate Solana [SOL] for its exceptional performance. It stands out with its impressive throughput and remarkably swift transaction speeds, making it an intriguing prospect in the competitive landscape of blockchain technology.

It’s worth noting that a complete separation of altcoins from Bitcoin is still in its early stages. At the moment, only a few altcoins demonstrate noticeable autonomy.

As a crypto investor, I’ve observed that most altcoins haven’t shown the same robustness as Bitcoin yet. Consequently, their performance still appears to be strongly linked to Bitcoin’s, with minimal signs of deviation from this correlation so far.

If Bitcoin dominance falters, it could drag the market down

After 20 days of Bitcoin’s market fervor, analysts are hinting that a necessary pullback might occur, given the increasing indications of it becoming too heated.

According to AMBCrypto, it’s likely that a dip to around $96,000 to $98,000 will help sustain market confidence, as Bitcoin has been fluctuating in this price range for the past week.

However, a dip below this range could spell trouble, particularly for altcoins.

Back in March, when Bitcoin touched its all-time high of $73,000, a minor 5% dip over the subsequent two days instilled fear, leading me, as a crypto investor, to see Bitcoin plummet down to approximately $69,000. This decline also brought about a decrease in its dominance, which hovered around the 50% mark.

As a result, there was a widespread collapse in the market, affecting altcoins particularly harshly. Yet, the situation has significantly evolved over time, and certain altcoins have been identified as ‘safe spots’ during times of increased risk.

Even though the intensity of the response might not be exactly the same, it’s clear that a rectification is still necessary, given that the behavior of altcoins is heavily linked to Bitcoin’s performance.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Consequently, should Bitcoin’s influence weaken and its price falls below $95K, it’s highly probable that other cryptocurrencies will experience a similar downturn as well.

Although some altcoins may be gaining trust among investors, their role as reliable contenders doesn’t guarantee they will avoid losses. In fact, when investors retreat due to concerns about a potential market downturn, these altcoins could still experience declines.

Read More

- OM PREDICTION. OM cryptocurrency

- Solo Leveling Season 3: What You NEED to Know!

- Oblivion Remastered – Ring of Namira Quest Guide

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Oshi no Ko Season 3: Release Date, Cast, and What to Expect!

- Lisa Rinna’s Jaw-Dropping Blonde Bombshell Takeover at Paris Fashion Week!

- Poppy Playtime Chapter 4: Release date, launch time and what to expect

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Fantastic Four: First Steps Cast’s Surprising Best Roles and Streaming Guides!

2024-11-26 00:40