- Analysts believe that BTC might be on the verge of a major rally, citing historic on-chain indicators.

- However, profit-taking continues to apply downward pressure, limiting immediate gains.

As a seasoned crypto investor with a decade of experience navigating market cycles, I find myself intrigued by the current state of Bitcoin (BTC). The historic on-chain indicators suggesting a major rally are indeed compelling, but profit-taking activity continues to apply downward pressure.

In simple terms, Bitcoin (BTC) has shown remarkable growth, recording a 46.59% increase in value over the past month. This surge has significantly increased its total market value, now standing at approximately $1.94 trillion.

Regardless, the pace seems to have decelerated, and we’re yet to discern a definitive trend in the market. In the last day, Bitcoin’s price has slightly risen by 0.80%, maintaining its current holding pattern.

According to AMBCrypto’s evaluation, Bitcoin currently seems to be confined within a specific price range. However, past trends indicate that as market optimism increases, the price of Bitcoin may eventually break through this range and rise further.

BTC still has room to rally

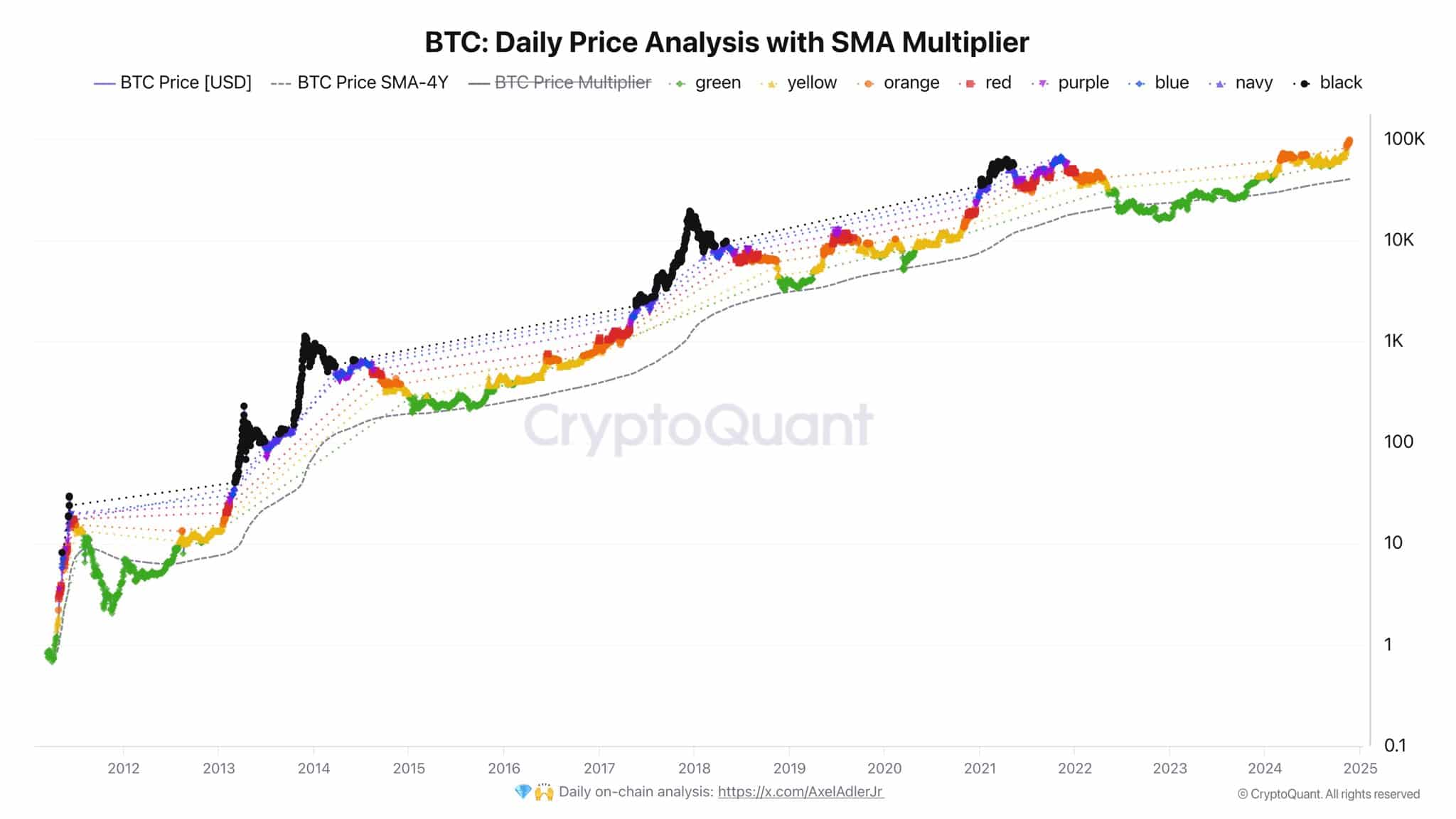

According to a chart shared by Alex Adler Jr., Bitcoin has yet to reach its cyclical peak.

The chart examines BTC’s performance using the Simple Moving Average (SMA) Multiplier, a tool designed to track price trends across market cycles.

The analysis uses color-coded zones—ranging from green (beginning of cycle) to black (top of cycle)—to represent Bitcoin’s market sentiment during different phases, from accumulation to peak speculation.

In his post, Adler stated:

“The orange dot has arrived. Red, purple, blue, navy, and black—are coming.”

In simpler terms, this suggests that Bitcoin’s cycle isn’t nearing its highest point yet, as there are still five more stages to go. Precedent indicates that these stages unfold in a consistent manner, with the last “black” stage signaling the beginning of a downtrend.

If this trend continues, Bitcoin might exceed the widely-discussed $100,000 threshold that’s been generating buzz in the market.

AMBCrypto delved deeper into understanding why, even with these encouraging statistics, Bitcoin’s full-blown rally hasn’t taken off as expected.

Profit-taking activity slows BTC rally

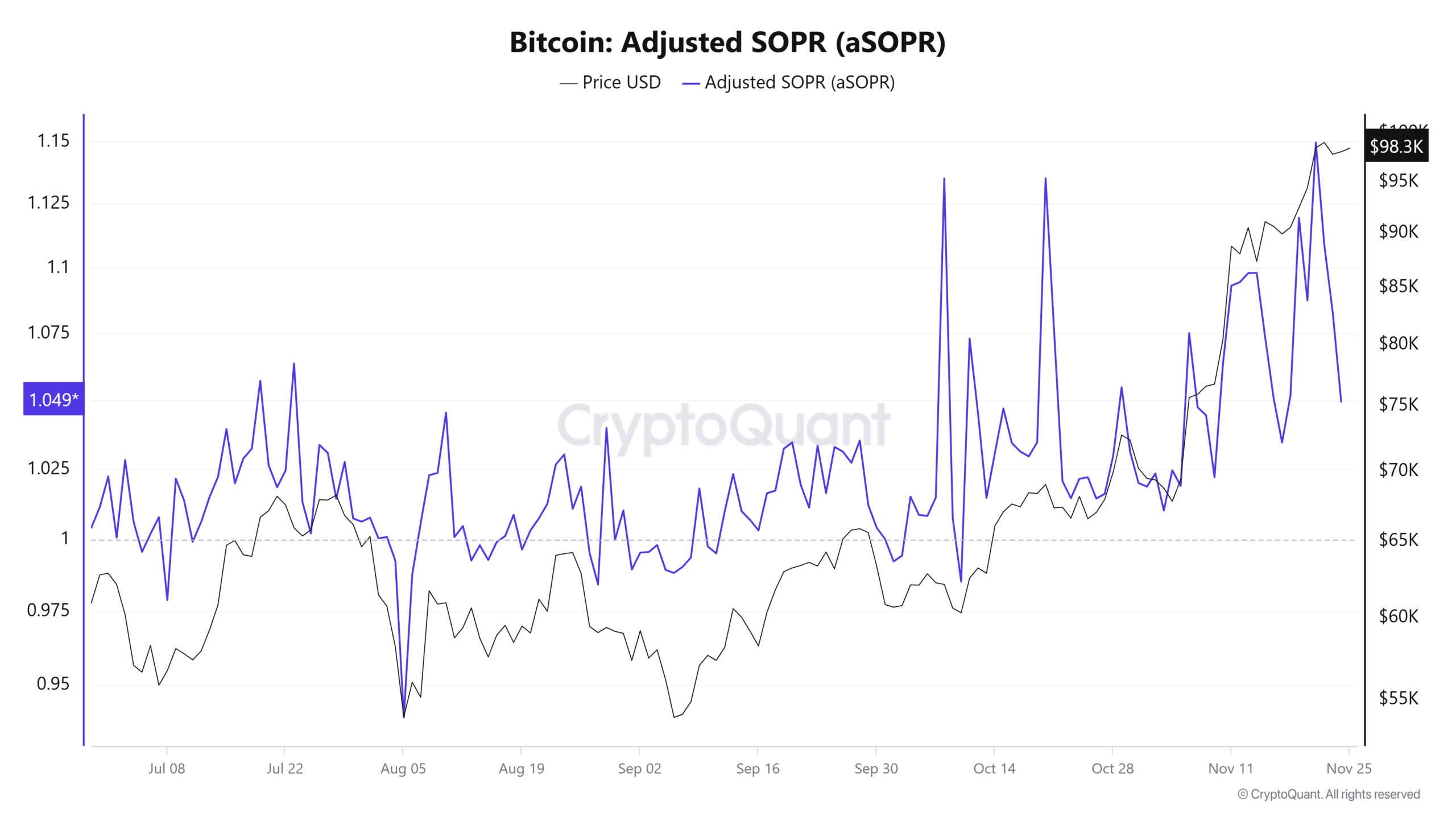

According to the newest findings from CryptoQuant, excessive selling due to profit-taking is hindering Bitcoin’s (BTC) price growth, stopping it from experiencing substantial increases.

At the current moment, the Adjusted Spent Output Profit Ratio (aSOPR) – a tool that indicates if Bitcoin investors are realizing gains or losses on their holdings – stands at approximately 1.049, suggesting that, on average, these investors might be selling Bitcoin for a slight profit.

Investments being sold for a profit, as suggested by readings greater than 1, exert additional downward pressure on Bitcoin’s price, thereby slowing its upward trend.

Furthermore, the Buy/Sell Ratio Indicator, which demonstrates whether buying or selling activity is more prevalent in the market, was recorded as 0.963 during the time of this report.

This implies that more units of Bitcoin are being sold than bought, which advantages the ‘bear’ investors over the ‘bull’ investors, potentially postponing Bitcoin’s price increase for a longer period.

Investors keep BTC from dropping

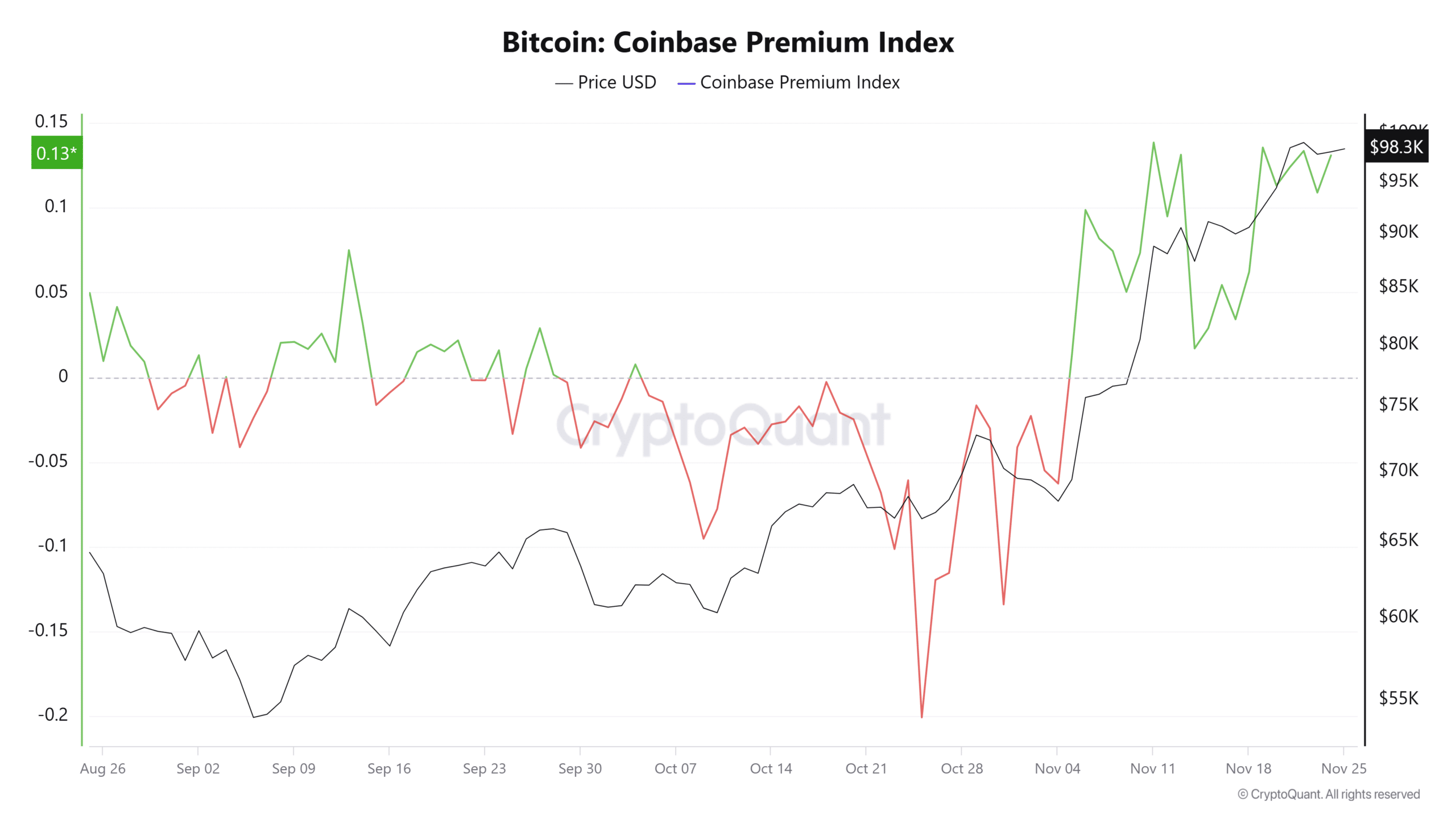

CryptoQuant reports that U.S. investors have been actively buying Bitcoin (BTC) in recent days.

The gap in Bitcoin prices between Coinbase and Binance, as indicated by the Coinbase Premium Index, has risen slightly to 0.1308. This figure is nearly at par with its peak in November, which stood at 0.1384.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Reading a positive value on this index means that U.S. investors are exhibiting more purchasing power than their counterparts in other markets, suggesting increased buying activity.

This increased demand has helped stabilize BTC’s price, preventing further declines.

Read More

- Gold Rate Forecast

- Discover Liam Neeson’s Top 3 Action Films That Will Blow Your Mind!

- OM PREDICTION. OM cryptocurrency

- Kanye West Praises Wife Bianca’s Daring Naked Dress Amid Grammys Backlash

- Nintendo Switch 2 Price & Release Date Leaked: Is $449 Too Steep?

- Netflix’s New Harlan Coben Series Features Star-Studded Cast You Won’t Believe!

- Meet the Stars of The Wheel of Time!

- Why Gabriel Macht Says Life Abroad Saved His Relationship With Family

- Where Teen Mom’s Catelynn Stands With Daughter’s Adoptive Parents Revealed

- EUR PKR PREDICTION

2024-11-26 10:16