- Spot Bitcoin ETFs recorded a historic $3.13 billion weekly inflow, showcasing growing investor confidence.

- Altcoins like Solana, XRP, and Litecoin witnessed significant institutional inflows amid Bitcoin’s dominance.

As a researcher with over two decades of experience in financial markets, I find myself constantly amazed by the dynamic nature of the cryptocurrency sector. The recent surge in inflows into Bitcoin ETFs and altcoins is nothing short of remarkable, particularly given the historical context of Donald Trump’s presidential election victory that has continued to reverberate through these digital realms.

As an analyst, I’ve observed that the aftershocks of Donald Trump’s presidency have persistently stirred up a flourishing era in the crypto market, driving both expansion and heightened activity.

As an analyst, I observed a significant development last week when global investment products collectively attracted approximately $3.13 billion in net inflows, marking a crucial turning point.

This increase was mainly caused by increased curiosity about U.S. Bitcoin [BTC] exchange-traded funds (ETFs), highlighting how the market is continually changing its nature.

Crypto inflows break record

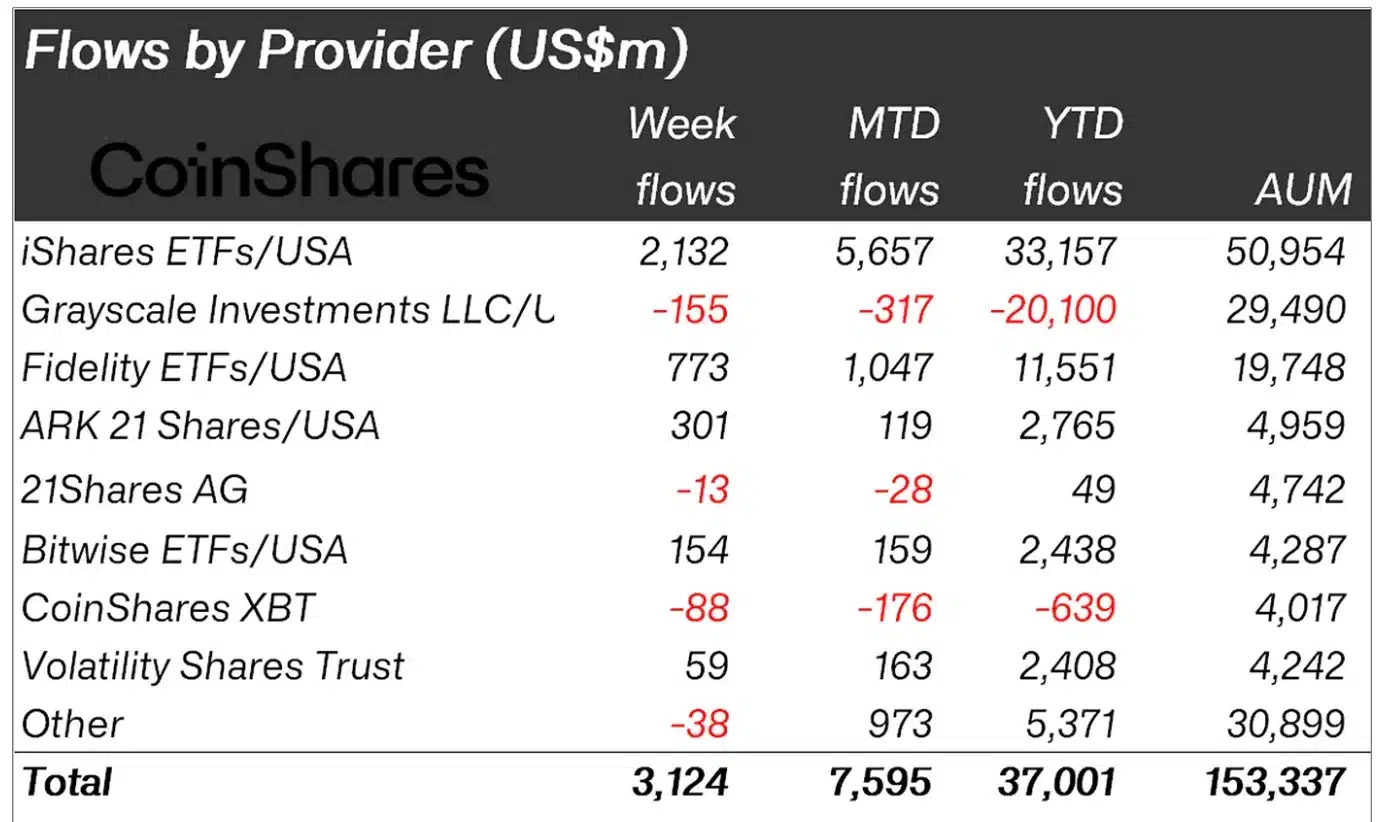

Based on information from CoinShares, this development underscores a rising level of trust among investors and demonstrates how political and economic changes can significantly reshape the cryptocurrency sector.

As per the report,

Last week, investments in digital asset products experienced their highest weekly influx ever, amounting to approximately $3.13 billion. This addition brings the total year-to-date inflows to an all-time high of $37 billion.

During the week of November 18th to 22nd, there was a significant surge in spot Bitcoin ETFs. According to SoSoValue’s report, this increase amounted to an impressive 102% from the previous week’s $1.67 billion.

In other words, these profits signify the seventh straight week where investments are flowing in, demonstrating continuous energy and increasing investor excitement. Furthermore, the total assets we’re managing reached a record peak of $153 billion.

Even as other players grew, BlackRock’s IBIT remained a leading force in the market, holding an impressive $48.95 billion in total assets on November 22nd. This figure represents a substantial increase of $31.33 billion in cumulative inflows.

On the other hand, Grayscale’s GBTC holdings amounted to approximately $21.61 billion in total assets, however, it has experienced withdrawals totaling over $20 billion since its launch.

Blackrock’s IBIT outshines

Indeed, upon closer examination, it was discovered that around $2.05 billion of the recent influxes occurred last week primarily originated from IBIT.

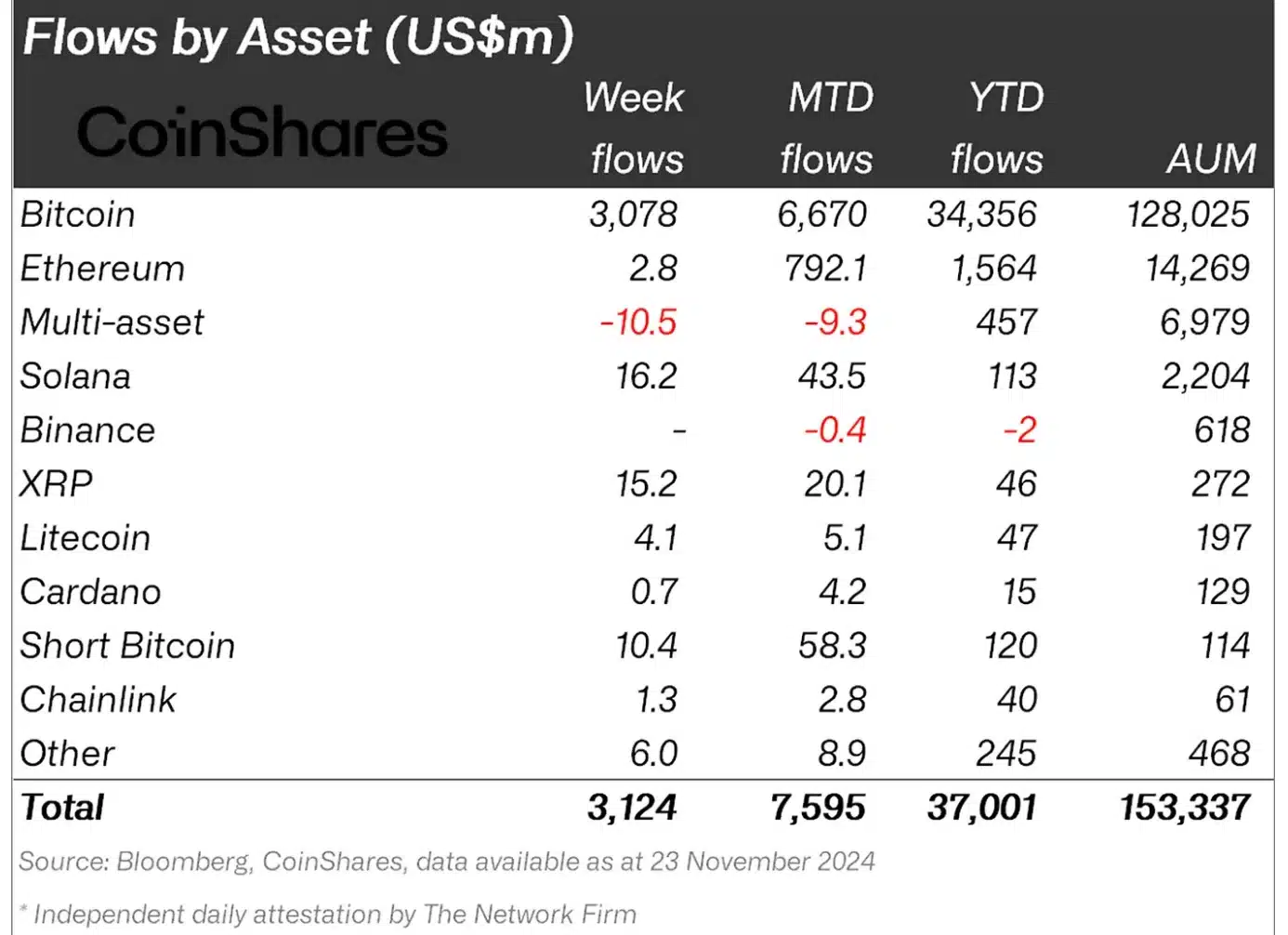

These Bitcoin funds led the charge, contributing $3 billion to the weekly total—a stark contrast to the modest $309 million first-year inflows for U.S. gold ETFs.

As a researcher, I’ve observed an intriguing trend unfolding: the persistent surge in Bitcoin’s price has sparked a significant influx of funds – totaling $10 million – into short-Bitcoin investment products. This indicates that even as institutional and individual investors are drawn to Bitcoin, there’s also a substantial contingent betting against its continued rise.

These products’ monthly sales reached an unprecedented peak of $58 million, a figure not seen since August 2022.

Bitcoin is not alone

As a researcher, I’ve observed an intriguing trend: Despite Bitcoin’s dominance in investment inflows, altcoins have been steadily gaining traction among institutional investors, showcasing their increasing allure.

As a researcher, I’ve noticed an interesting trend in the crypto market this week: Solana (SOL) has been leading the charge among altcoins with a notable $16 million in net weekly inflows. This surpasses Ethereum (ETH), which saw a significant but less impressive inflow of approximately $2.8 million.

Additionally, Ripple (XRP), Litecoin (LTC), and Chainlink (LINK) were also notable contributors to the event, raising approximately $15 million, $4.1 million, and $1.3 million respectively.

The data indicates growing trust in the altcoin market, driven by robust price trends and the widespread utilization of these digital currencies in diverse applications.

It’s quite evident that the election had a significant influence on the cryptocurrency market, as these recent advancements highlight.

Nevertheless, it’s important to understand that there might be other influencing factors contributing to these patterns. As stated by James Butterfill, Head of Research at CoinShares.

The current increase in action seems fueled by a mix of easier money policies and the sweeping victory of the Republican party in the latest U.S. elections.

Read More

- Solo Leveling Season 3: What You NEED to Know!

- OM PREDICTION. OM cryptocurrency

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- How to Get to Frostcrag Spire in Oblivion Remastered

- Captain America: Brave New World’s Shocking Leader Design Change Explained!

- Oshi no Ko Season 3: Release Date, Cast, and What to Expect!

- Daredevil’s Wilson Bethel Wants to “Out-Crazy” Colin Farrell as Bullseye in Born Again

- tWitch’s Legacy Sparks Family Feud: Mom vs. Widow in Explosive Claims

- Moana 3: Release Date, Plot, and What to Expect

2024-11-26 14:32