- Bitcoin’s volatility intensifies as liquidations trigger sharp price swings, with $337 million wiped out.

- Liquidations amplify Bitcoin’s volatility, creating opportunities and risks as the price tests key levels.

As a seasoned researcher who has weathered countless market storms, I find myself both exhilarated and cautious as I observe Bitcoin’s current price movements. The $100,000 milestone is a beacon for many crypto enthusiasts, but the road to this landmark has been paved with volatility.

The significant spike in Bitcoin’s [BTC] value approaching $100,000 has ignited substantial market fluctuations, resulting in approximately $337 million worth of long positions being closed within a day.

When the cost drops below $93,000, there’s a significant risk of more sell-offs happening. This is particularly true given that there are approximately $772 million worth of short positions that could be affected. If the market bounces back to around $98,000, traders need to stay vigilant because a rapid rise in prices might trigger a chain reaction of liquidations, potentially pushing prices even higher.

Here’s a look at the factors behind Bitcoin’s wild price swings.

Testing the $100,000 Threshold

Discussions about Bitcoin’s progression towards the $100,000 mark have been center stage in financial talks, as its recent movements show both optimism and growing caution. For a moment, Bitcoin reached $94,999, but then dipped slightly to $94,577.

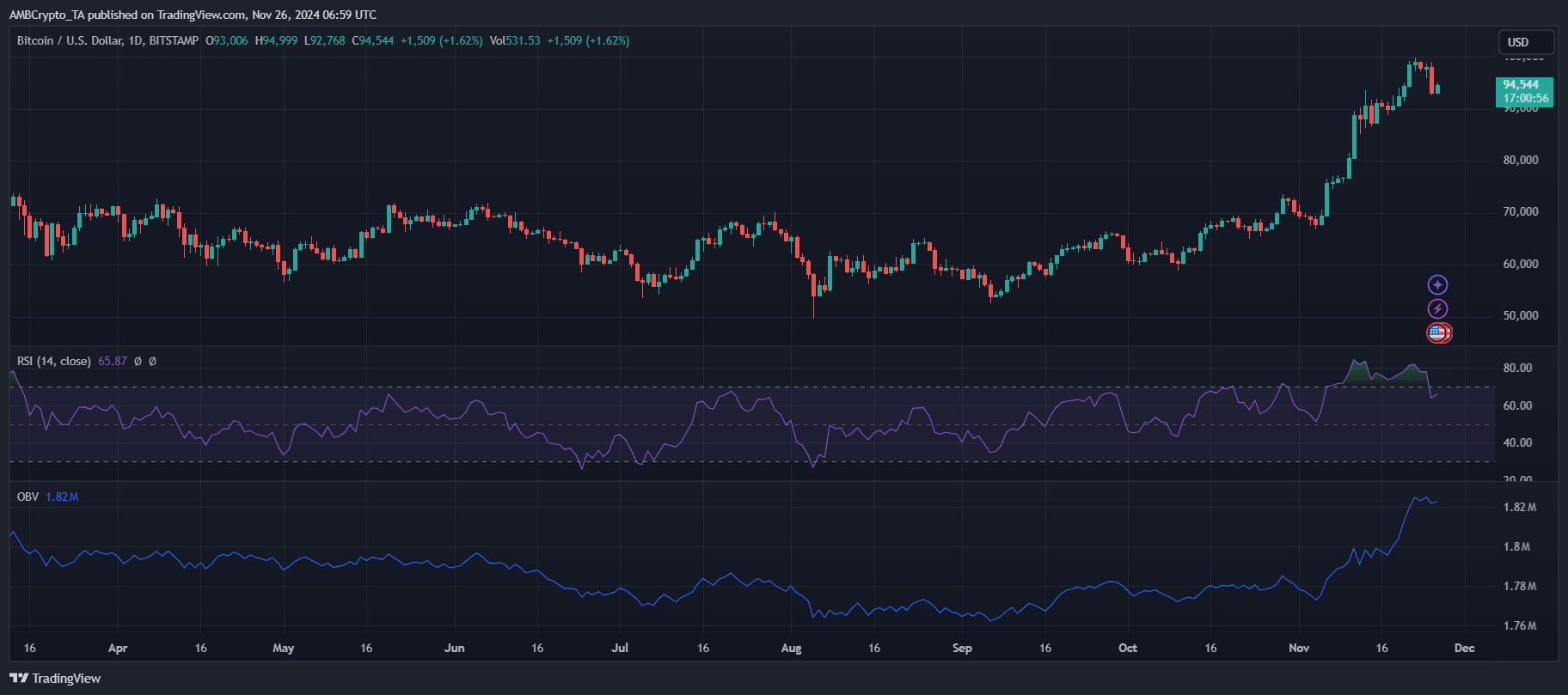

65.91 on the Relative Strength Index suggests that Bitcoin is still in a bullish phase, yet it’s close to entering overbought territory. The On-Balance Volume stands at 1.82 million, indicating robust buying activity, but this level of interest seems to be slowing down compared to previous surges.

As the trading band for Bitcoin shrinks, it hints at a possible period of consolidation, where the price may stabilize, prior to another attempt at breaking out and resuming its upward or downward movement.

As long as the upward momentum continues, if the price drops below $93,000, it might initiate a downward trend, particularly given the heightened potential for sudden price changes due to forced selling or liquidations.

Instead, continuous buying interest could potentially propel Bitcoin upwards to $98,000 or even beyond, leaving traders in a state of anticipation during this crucial period.

The role of liquidation in market volatility

Bitcoin’s current market turbulence is significantly influenced by the process of liquidation, which intensifies price fluctuations as forced position closures occur. Over the last day alone, approximately $337 million worth of long positions have been liquidated, resulting in steep declines in value.

Delving into the current state of the Bitcoin market, I find myself observing a decline in its value, dropping beneath the $93,000 mark. This trend raises my concern about potential escalations, as there is currently $772 million worth of short positions at play.

If Bitcoin surges back towards $98,000, such a move might trigger a wave of margin calls or stop-loss orders, potentially causing more sell-offs and boosting the price even higher.

Monitoring significant price points closely becomes essential during this cycle of liquidation, as the increased volatility can lead to unexpected market fluctuations. Traders must stay alert to prevent being swept up by sudden shifts in the market.

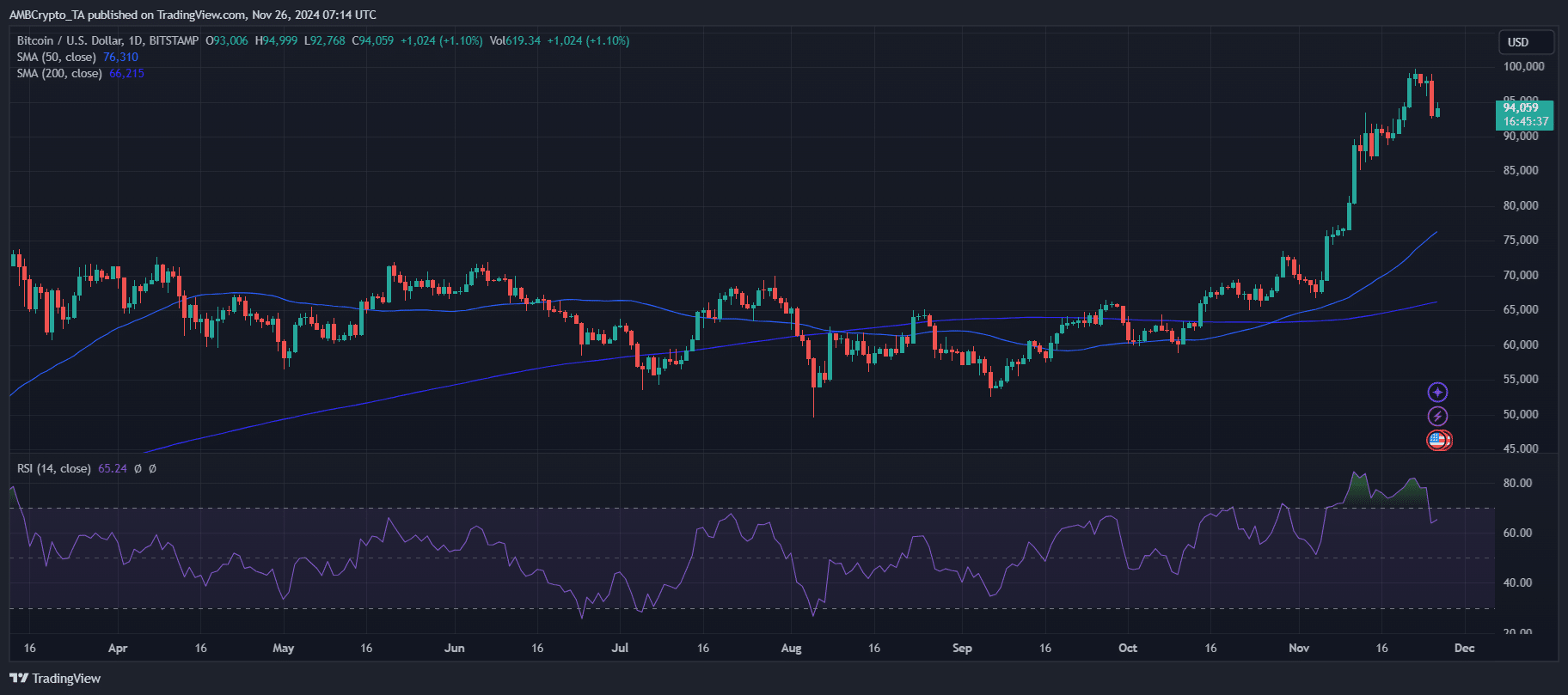

Strong bullish momentum for BTC

The cost of Bitcoin continues to stay significantly higher than its 50-day Simple Moving Average ($76,311) and 200-day Simple Moving Average ($66,215), indicating a robust long-term bullish trend. This substantial difference between the two averages highlights a strong push upward, and the 50-day SMA serves as a crucial support line.

Trading volume shows consistent activity, but a decline from recent peaks suggests a cooling phase in buying pressure. RSI at 65.29 maintains a bullish posture, aligning with current price action.

The signs suggest that the market may continue to rise, yet it’s important to exercise caution because lower trading activity might prevent instant gains or intensify fluctuations during pullbacks.

Short-term predictions

In its current unpredictable stage, short-term forecasts for Bitcoin primarily depend on crucial levels of support and resistance. If the digital currency manages to hold above $93,000, it appears probable that we’ll witness a recovery heading towards $98,000, which might initiate a chain reaction of liquidations, further driving the price upward.

If the price drops below $93,000, it could trigger more selling actions. The levels around $88,000 or even lower might then serve as significant areas of potential support.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Keep an eye out for continuous purchasing activity or changes in trading volume, as these might indicate the upcoming trend’s direction.

As a crypto investor, I’m keeping my eyes on the long-term bullish trend, but I find myself treading cautiously in the near term. The market fluctuations can be quite unforeseeable, so it’s essential to exercise caution when considering new investment positions.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-11-26 15:04