- The DOGE futures market has seen more activities in the last few weeks.

- Its funding rate has remained positive despite increased liquidations.

As a seasoned analyst with over two decades of market experience under my belt, I’ve seen my fair share of bull and bear markets, but the recent surge in Dogecoin futures activity is something truly intriguing. The parallels between this meme coin’s journey and the rollercoaster ride of a certain inflatable tube man are uncanny!

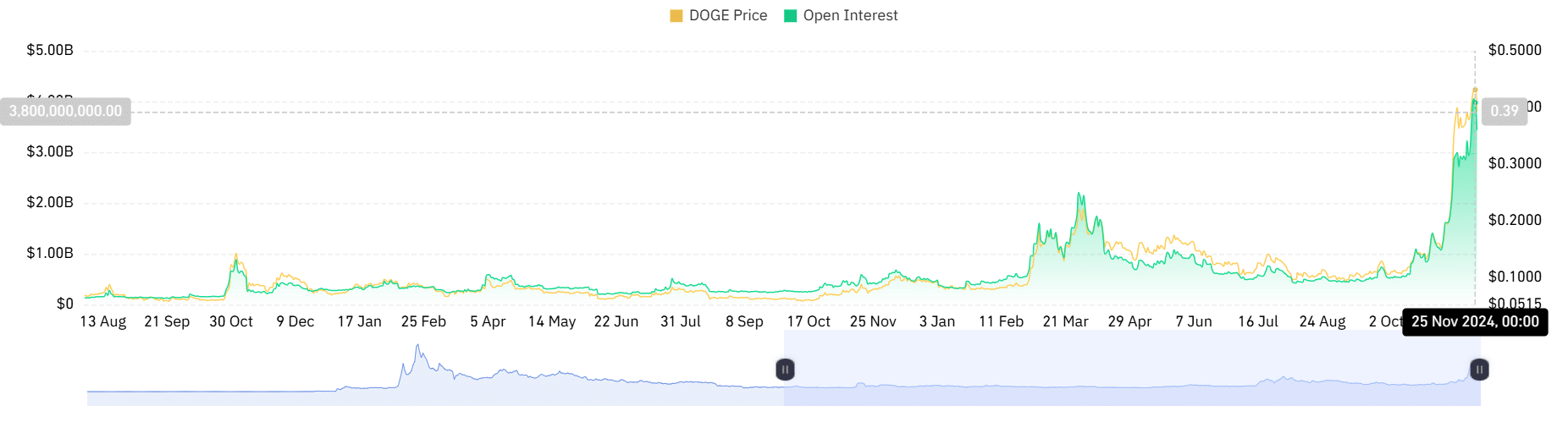

The total amount of outstanding future contracts for Dogecoin [DOGE] has hit a record high, suggesting increased trading activity and fueling discussions about where the well-known digital currency might be headed next.

As Dogecoin’s price has significantly increased over the past few weeks, it has led to an increase in derivative positions, causing some to wonder if this could signal a significant turning point for the asset.

Dogecoin futures open interest and market sentiment

According to Coinglass data, there’s been a remarkable surge in Dogecoin futures engagement, primarily due to heightened involvement from both individual and institutional investors.

The analysis showed that the DOGE open interest hit $4 billion recently for the first time. Although it has declined to around $3.4 billion as of this writing, it is one of its highest points in history.

The intense action we’ve been witnessing seems to mirror Dogecoin’s price rise, now hovering around $0.407. A surge in open interest usually signals growing speculation, yet it can also heighten market vulnerability, especially when combined with highly leveraged trades.

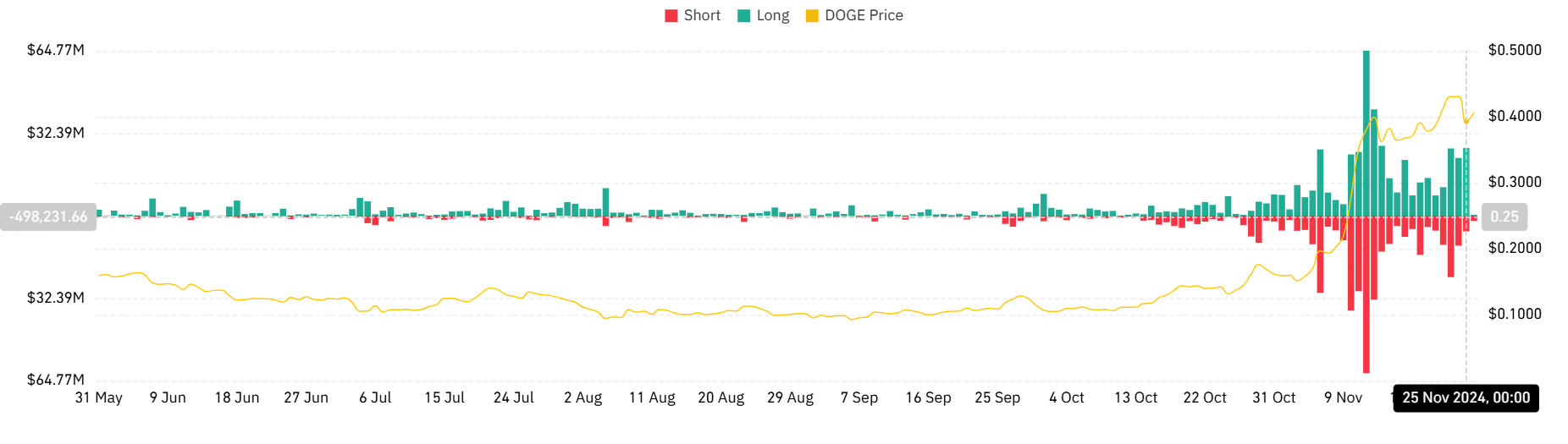

Long liquidations dominate Dogecoin market

Recently, there’s been a significant increase in the open interest of Dogecoin, yet during the past few days, more long positions have been closed out than short ones. On November 23rd alone, long liquidations totaled approximately $26.38 million, which is higher than the $24.16 million in shorts that were liquidated.

On November 24th, a significant difference emerged, with $22.65 million in long positions being liquidated compared to $11.79 million from short positions. The next day, the disparity expanded further: Long liquidations amounted to $26.59 million, while shorts only accounted for $6.16 million.

This pattern indicates that some traders who wagered on continued market growth might have taken on too much debt, potentially making the market prone to adjustments or corrections.

The imbalance additionally underscores some level of doubt, because optimistic investors are progressively feeling more stress due to the unpredictable fluctuations in prices.

How the whales are moving

Despite the challenges posed by long liquidations, Dogecoin’s price has remained resilient, trading near $0.407 at the time of writing.

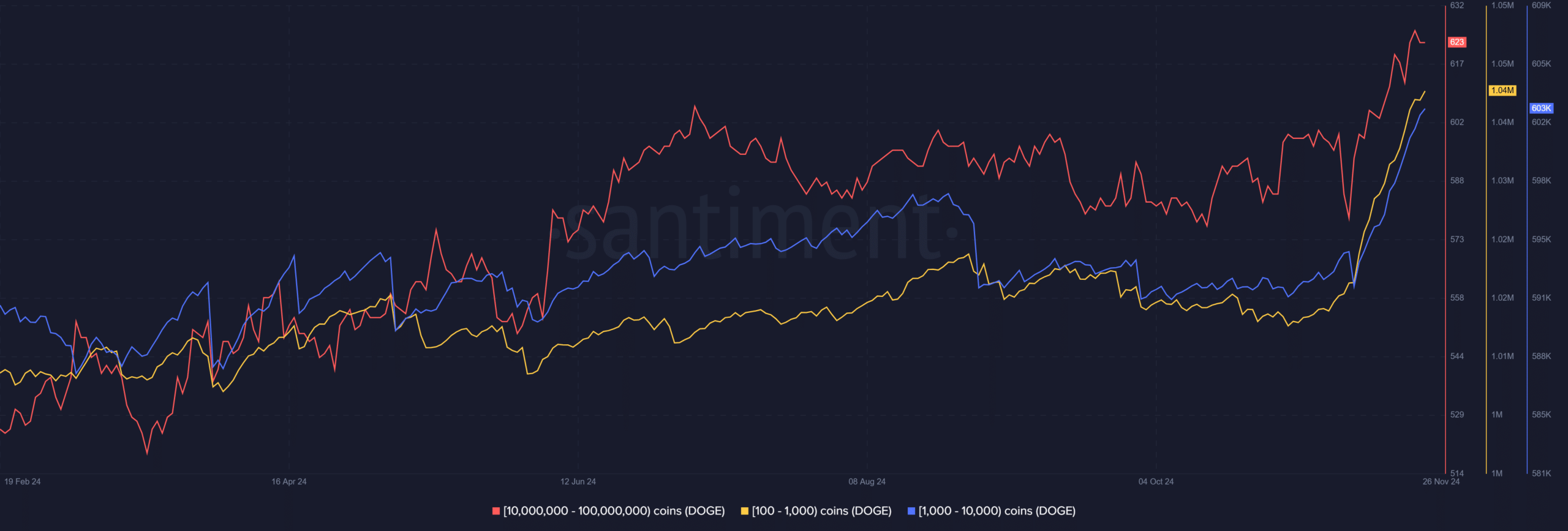

As a keen crypto investor, I’ve been closely monitoring the movement of whales – those big players with holdings between 10 million and 100 million DOGE. According to Santiment data, these whales have shown a consistent pattern of accumulating more DOGE, which could indicate a positive outlook for the meme coin.

This implies that major investors continue to trust in Dogecoin’s future prospects, offering a degree of stability during market upheaval.

In simpler terms, the balance between large investors (whales) buying whales and increased activity in future markets is leading to a lively trading atmosphere. Whales help keep prices steady, but aggressive traders contribute to market fluctuations, magnifying both profits and risks.

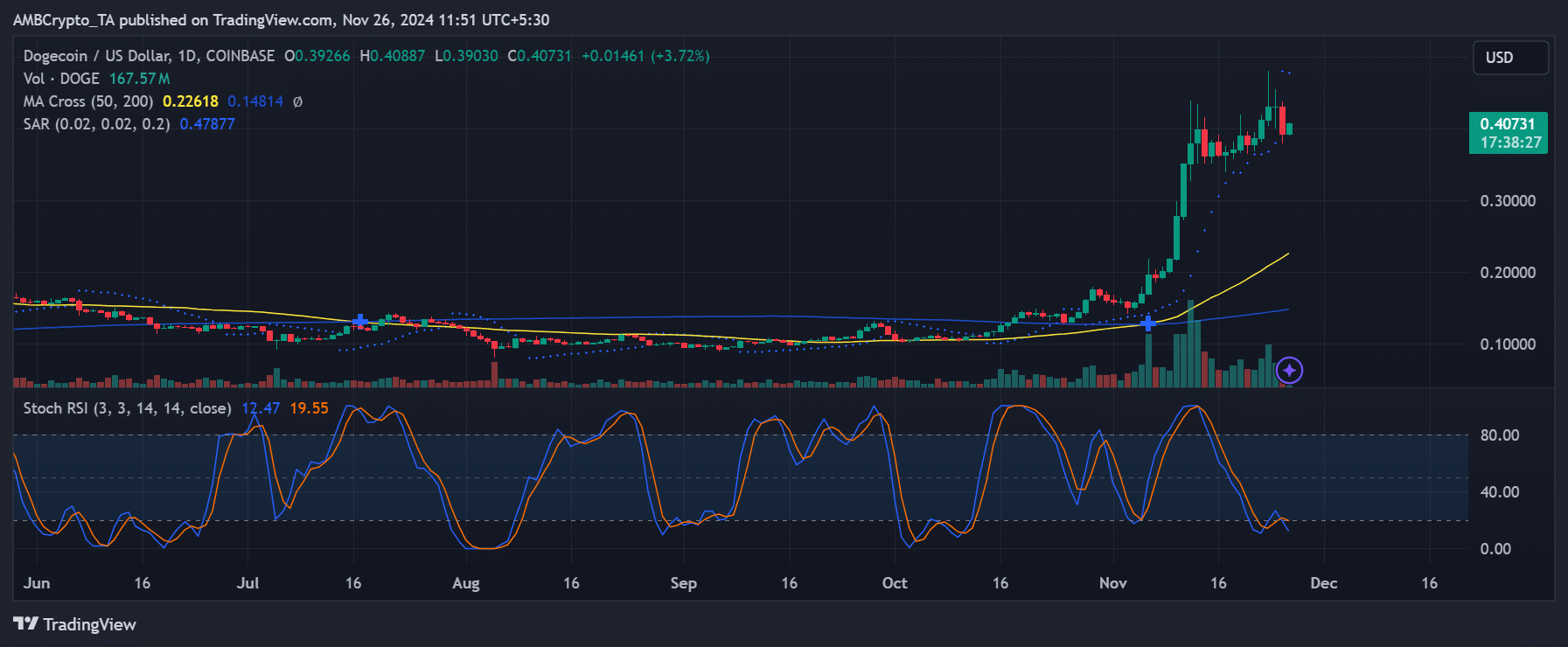

DOGE technical indicators signal mixed outlook

The power behind Dogecoin persists, as evidenced by the Parabolic Stop and Reverse (PSAR), which points to an ongoing upward trend. Nevertheless, the Stochastic Relative Strength Index (RSI) hints that Dogecoin is nearing overbought levels, potentially leading to a temporary downturn in the near future.

The combined analysis of liquidation data and technical indicators presents a somewhat ambiguous scenario. On one hand, the prevalence of long liquidations implies that optimism among traders is still high. However, this same trend might suggest that the current upward momentum could be nearing its end.

Investors need to exercise caution because prolonged selling (long liquidations) might lead to a wider market instability if crucial support barriers get broken.

The DOGE outlook

The exceptionally high future contracts involvement with Dogecoin points towards significant investor speculation, yet the escalation of forced closure of long positions stirs doubts about the market’s resilience.

Displaying confidence, whales can serve as a balancing force. However, technical signals and market exit patterns hint towards the need for prudence and careful consideration.

At this crucial crossroads, the path Doge’s price takes hinges on whether optimistic investors can continue driving the trend forward or if excessive sell-offs resulting from margin calls might trigger a wider market adjustment instead.

The coming days will provide crucial insights into the sustainability of Dogecoin’s recent rally.

Read More

2024-11-26 17:12