- SUKU crypto pumped over 30% to a high of $0.119.

- But it erased the gains amid the Bitcoin price decline; what are the recovery odds?

As a seasoned researcher with a knack for deciphering market trends, I must admit that the SUKU crypto rollercoaster ride has been quite intriguing. The initial surge was reminiscent of a bull charging up the hills, only to be brought back down by a bear swipe in the market’s broader decline.

😱 Trump's Tariff Bombshell Could Crush EUR/USD!

Markets on edge — read the urgent new forecasts before it’s too late!

View Urgent ForecastOn this week, the global Web3 remittance platform SUKU crypto experienced a significant price increase, primarily fueled by a substantial 250% rise in trading activity.

During its highest point, when the price reached around $0.12, there was a significant surge in trading volume, rising from approximately $1.7 million to $12 million. This increase coincided with a 30% jump in price.

However, it had wiped out previous progress and was currently 29% lower due to a wider market trend change, with Bitcoin falling beneath $95K during the time of this writing.

What’s next for SUKU crypto?

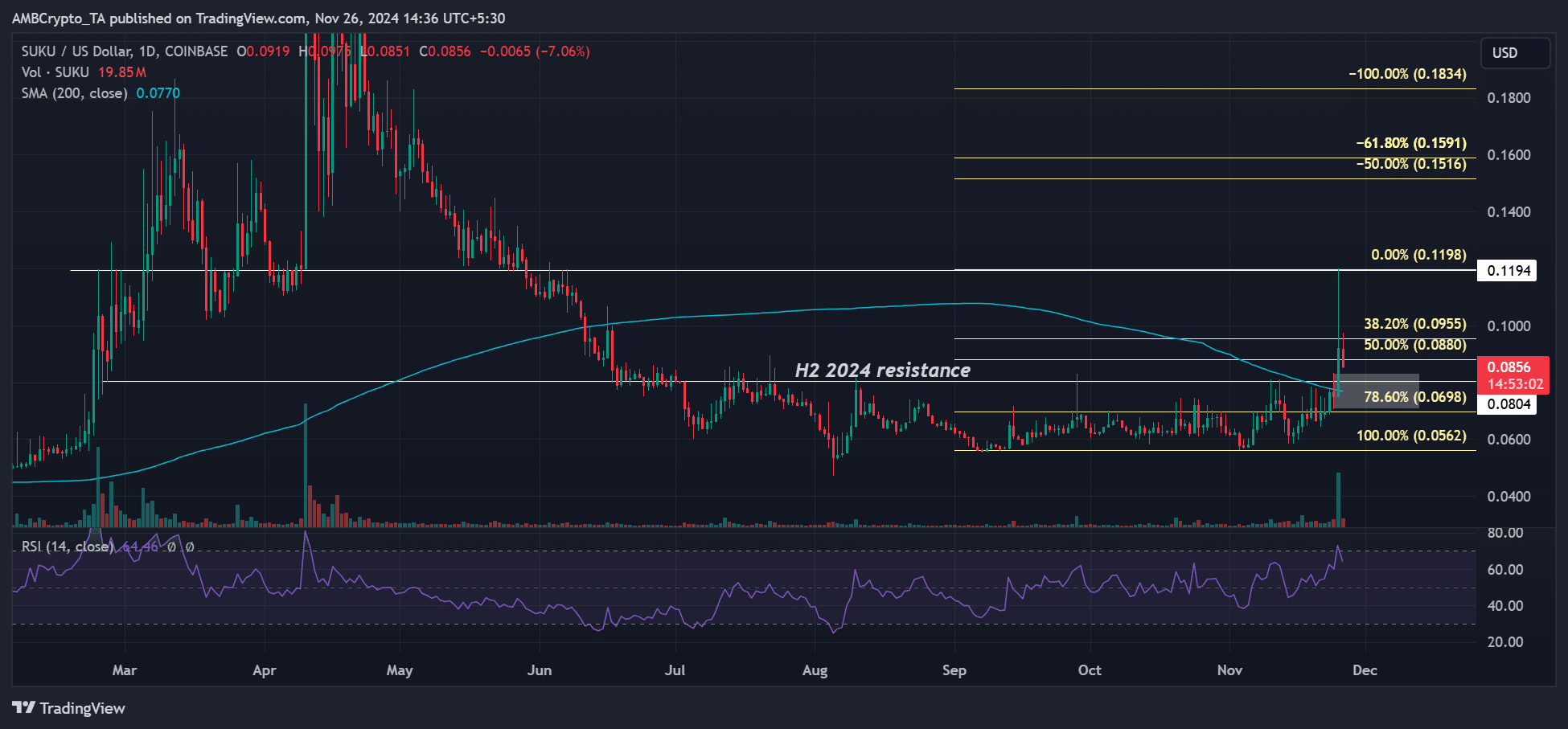

For the initial time since June, SUKU has consistently stayed above its 200-day Moving Average (MA), signaling a robust long-term uptrend or bullish breakout.

However, the flash crash seen at press time could push it back below the key level.

Moreover, the 200-day Simple Moving Average (SMA) coincided with the anticipated resistance level in H2 2024, potentially strengthening bulls’ position if it holds as a support. Consequently, SUKU might aim for its previous highs around $0.119 once more.

Market demand dropped

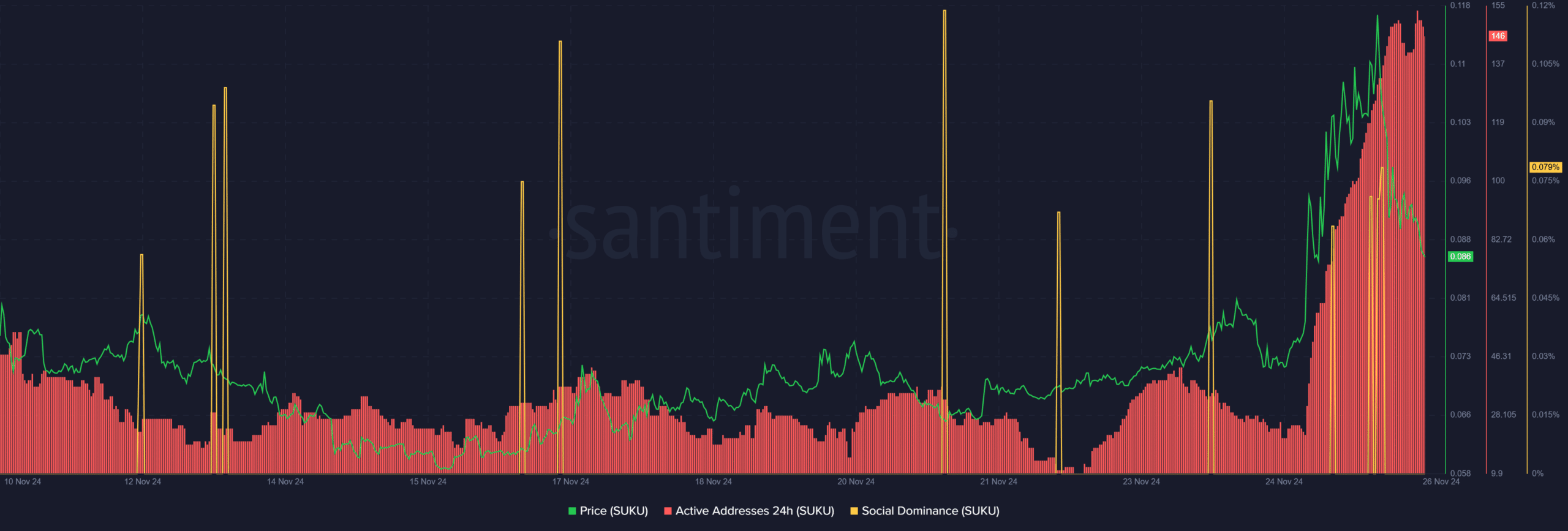

More individuals became users and owners due to the price surge, demonstrated by the increase in active wallets. The rise in influence on social media platforms, as indicated by an increase in token mentions, seems to have fueled some of the market’s growing curiosity.

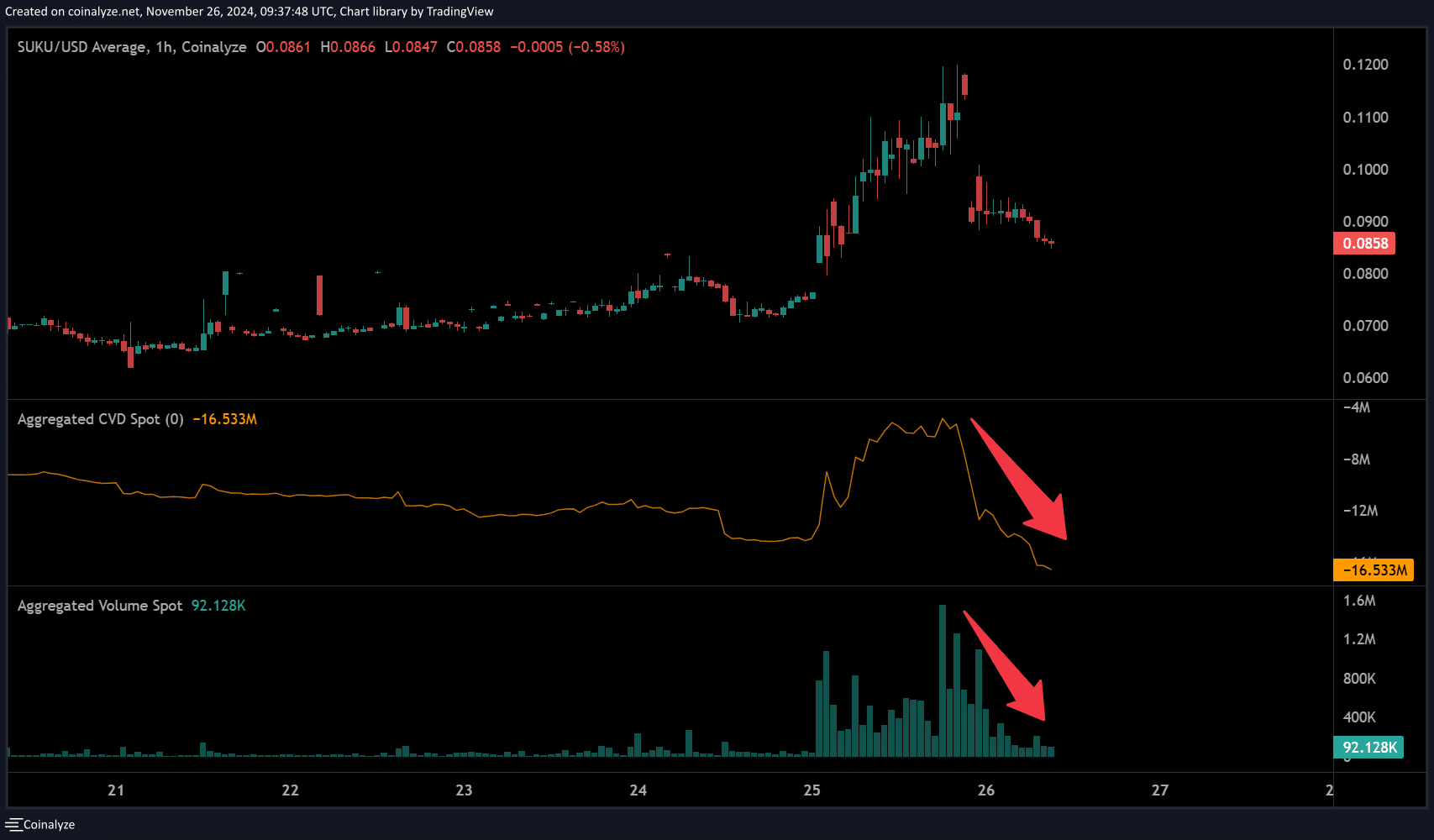

However, the urge to buy due to fear of missing out didn’t persist, instead it was followed by a significant change in market sentiment that led to a decrease in demand and a wave of selling. This shift is evident in the drop observed in Spot Cumulative Volume Delta (CVD), suggesting that sellers took control.

Read Bitcoin [BTC] Price Prediction 2024-2025

The drop in trading volume might weaken SUKU’s price recovery efforts. Recovery possibilities would increase significantly if there was a widespread change in market sentiment accompanied by another large volume spike.

Read More

- OM PREDICTION. OM cryptocurrency

- Solo Leveling Season 3: What You NEED to Know!

- Oblivion Remastered – Ring of Namira Quest Guide

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Gumball’s Epic Return: Season 7 Closer Than Ever!

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Oshi no Ko Season 3: Release Date, Cast, and What to Expect!

- Lisa Rinna’s Jaw-Dropping Blonde Bombshell Takeover at Paris Fashion Week!

- Poppy Playtime Chapter 4: Release date, launch time and what to expect

2024-11-26 20:07