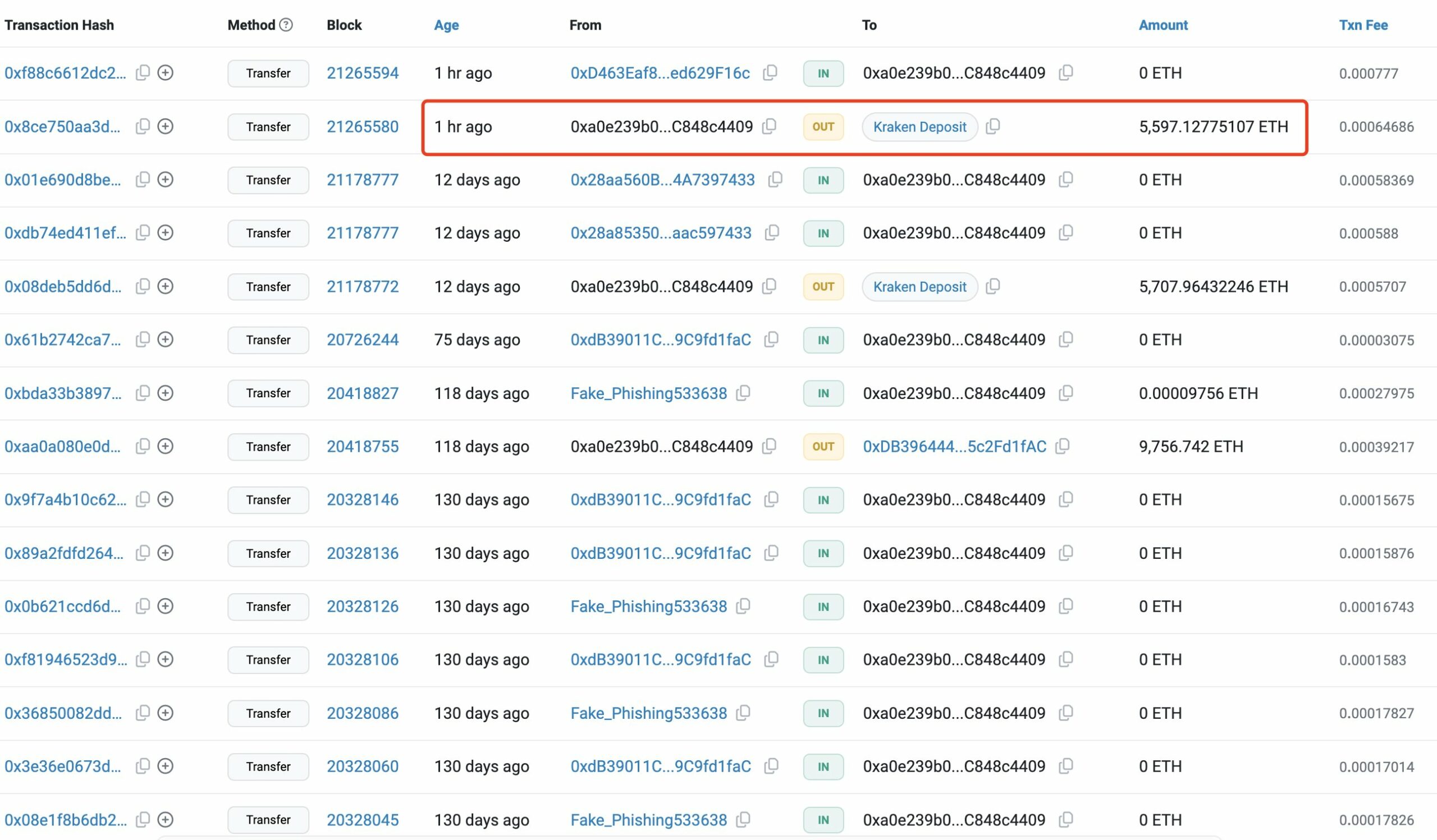

- In a key development, one whale moved $19.54 million worth of ETH to Kraken.

- Market sentiment remained divided, with conflicting signals from key indicators.

As an experienced crypto investor who has weathered numerous market cycles, I find myself cautiously optimistic about Ethereum’s current trajectory. The recent transfer of $19.45 million worth of ETH by a whale to Kraken certainly raises eyebrows, but it’s important not to jump to conclusions.

On November 25th, there was momentary volatility with Ethereum [ETH], but it showcased strength and ended up with a 1.38% increase in value for the day.

This ongoing recovery shows a significant week-on-week growth of 9.85%, which highlights the strong upward trend currently observed in the market.

Although these advancements were made, a sense of caution lingered. Hidden signs suggested a bearish trend, which could push ETH downward if the overall market worsens.

Whale transfers ETH, potentially triggering a price drop

Based on information from Lookonchain, a wallet identified as linked to ETH Devcon has transferred approximately 5,597 ETH, equivalent to around $19.45 million, to the digital currency platform Kraken.

The transaction occurred not long after Ethereum temporarily surpassed the $3,500 mark. These types of spikes are usually interpreted as negative signs, because significant deposits into exchanges frequently indicate plans to sell, either for realizing profits or because of decreasing market faith.

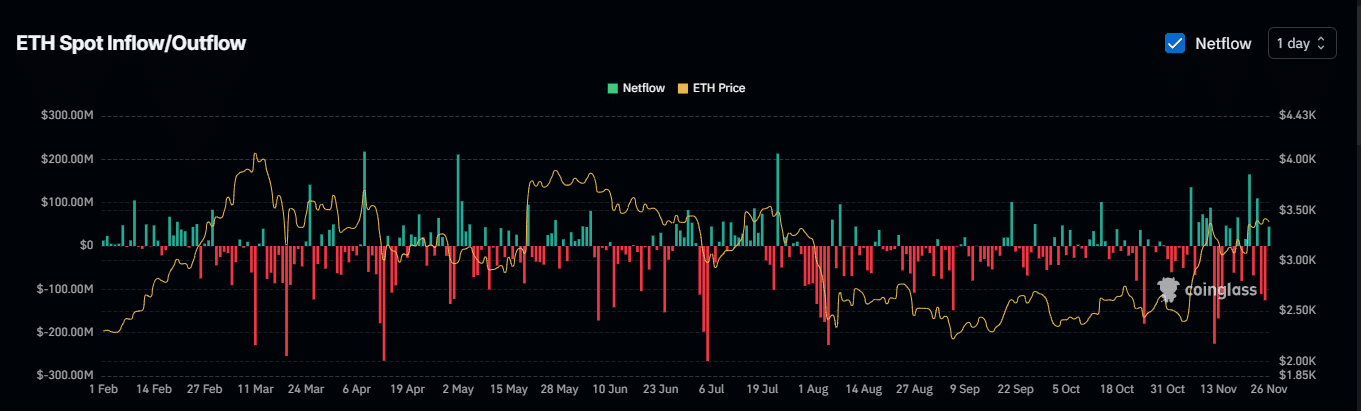

According to AMBCrypto, examining the overall Exchange Netflow offers an alternate viewpoint regarding Ethereum’s possible price movement.

Market participants align with whales

Measuring the inflow and outflow of assets within trading platforms, known as Netflow, serves as a crucial tool for gauging overall market sentiment.

In simpler terms, a positive netflow often suggests bearish sentiment because it means assets are moving out of exchanges for possible selling, whereas a negative netflow usually indicates bullish sentiment, as it shows that assets are being withdrawn to hold onto them.

25th of November saw a negative Netflow, indicating a withdrawal of approximately $125.17 million from exchanges. This bullish sign overshadowed the impact of whale activity.

However, the Netflow has since turned positive, with $53.96 million moved back to exchanges.

Should this pattern persist, it may lead to a rise in the urge to sell Ethereum, implying that investors are more inclined to offload their holdings compared to keeping them.

ETH’s next move is unclear

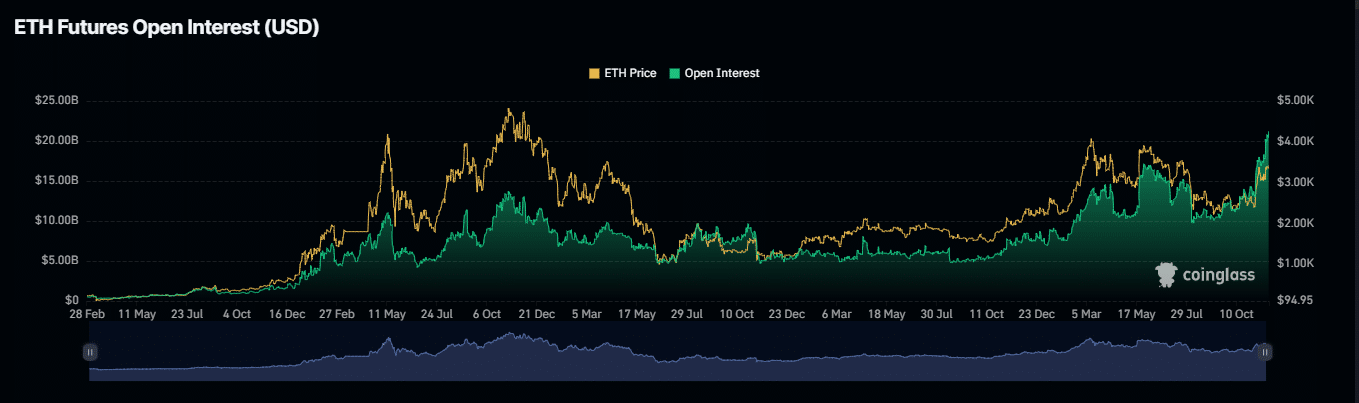

Currently, opinions about the market are still split. On one hand, there’s evidence of strong selling pressure, indicated by approximately $52 million worth of long positions being closed, suggesting substantial losses for traders betting on a rise in prices as the market has moved against them. This is a clear indication that many investors are choosing to sell rather than hold onto their investments.

Read Ethereum’s [ETH] Price Prediction 2024–2025

At the moment, the Open Interest soared to its highest level in nearly two years, amounting to $21.44 billion. This spike indicates an increasing number of long derivative contracts being entered into, which often signals anticipation for a possible price hike.

Until these opposing signals converge, ETH’s price direction will remain uncertain.

Read More

- Gold Rate Forecast

- Discover Liam Neeson’s Top 3 Action Films That Will Blow Your Mind!

- OM PREDICTION. OM cryptocurrency

- Kanye West Praises Wife Bianca’s Daring Naked Dress Amid Grammys Backlash

- Nintendo Switch 2 Price & Release Date Leaked: Is $449 Too Steep?

- Netflix’s New Harlan Coben Series Features Star-Studded Cast You Won’t Believe!

- Meet the Stars of The Wheel of Time!

- Why Gabriel Macht Says Life Abroad Saved His Relationship With Family

- Where Teen Mom’s Catelynn Stands With Daughter’s Adoptive Parents Revealed

- EUR PKR PREDICTION

2024-11-27 01:11