- Derivative traders drove significant sell-offs in the last 24 hours, leading to a sharp drop in CRO’s value

- Whales appeared to be stepping back too, while spot traders’ interest showed signs of waning

As a seasoned crypto investor with battle-tested nerves and a portfolio that has weathered its fair share of market storms, I must admit that the recent drop in CRO’s value has me somewhat concerned. The derivative traders seem to be driving the selling pressure, and their collective actions have sent ripples across the market.

Recently, CRO experienced a significant increase in value earlier this month, jumping by 124.41%. This rise was fueled by increased market attention. Yet, the upward trend has now taken a sharp downturn. In fact, within just the past day, the crypto has seen a drop of 12.07% in its worth.

As a crypto investor, I’m curious about the insights AMBCrypto offers regarding the recent drop in CRO. Given that derivative traders have been exerting selling pressure and whales seem to be mostly inactive, what does their analysis suggest could be the reasons behind this downturn?

Derivative traders drive CRO’s sharp decline

It appeared that derivative traders were leading the decline in CRO’s current price, as market signals suggested a possibility of further price drops.

On November 12th, the Open Interest of CRO reached an annual high of $23.73 million. Yet, this positive trend took a turn as Open Interest dropped by a significant 13.74% within just 24 hours, leaving it at $16.21 million currently.

This steep decline reflected a bearish shift, as traders increasingly favored short positions.

The long-to-short ratio, with a reading of 0.9209, reflected this sentiment better.

As a crypto investor, I’d like to highlight an important point: when the sell-to-buy ratio is less than 1, it suggests that there are more sellers in the market compared to buyers, which puts additional pressure on the price to drop. If this trend continues, CRO might experience a deeper decline from its current levels.

It’s evident that market conditions have shown a dominant position for bearish forces, as the downward trend has been further intensified by derivative traders boosting the selling pressure. As the overall sentiment turned more pessimistic, this negative attitude spread throughout the market.

Liquidation gap intensifies sell pressure on CRO

It appeared that a substantial discrepancy between buyers and sellers was intensifying the downward trend for CRO, reflecting a strongly negative outlook among market participants.

Indeed, as per the most recent liquidation figures reported by Coinglass, a total of approximately $108,410 in long CRO contracts was forcibly terminated, whereas merely $7.26 in short contracts underwent liquidation.

This stark disparity highlighted a market that has turned decisively against the bulls. It may point to the potential for sustained downward momentum, with short derivative traders set to profit.

Examining the discrepancy between liquidation amounts through the perspective of the long-to-short ratio reveals some intriguing numbers – For roughly every dollar’s worth of short positions closed, approximately $14,930 worth of long positions were terminated. This substantial disparity strongly suggested increased market volatility, particularly given that the market was heavily biased towards bearish opinions.

Whale inactivity and spot sales force CRO’s decline

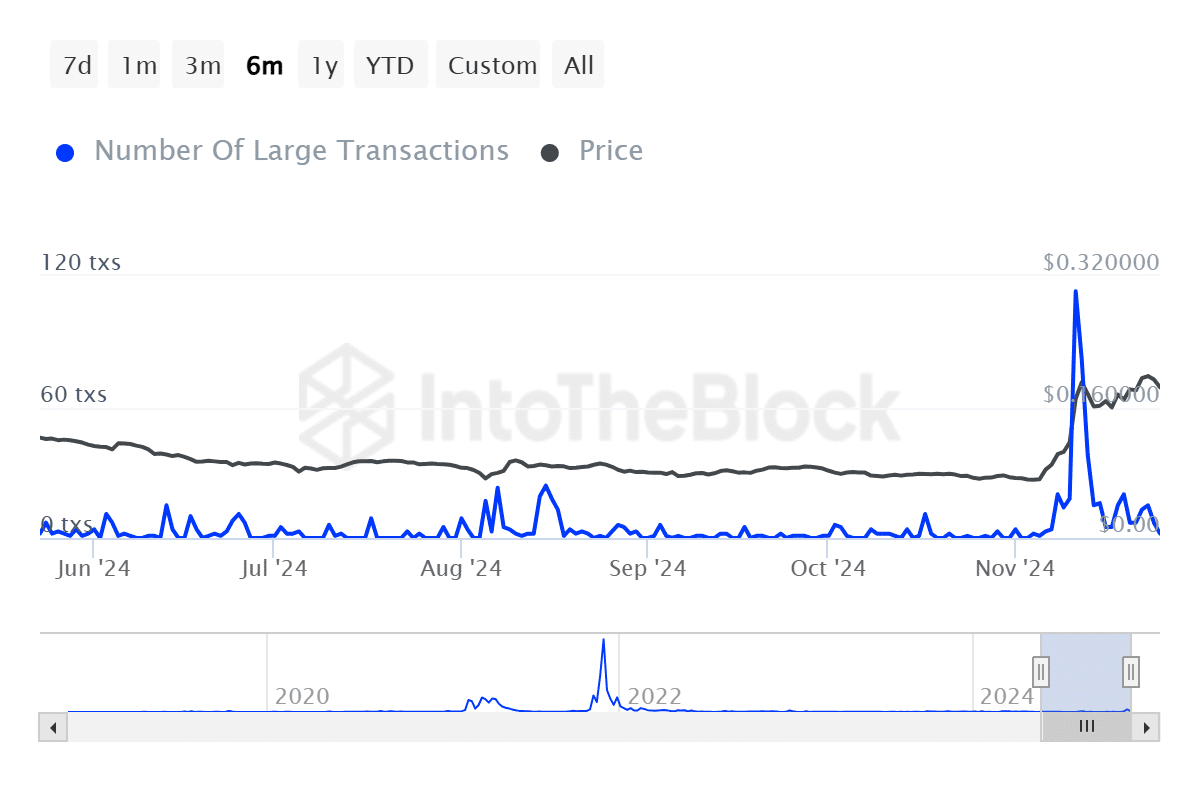

Over the past day, there’s been a significant drop in whale-related activities in CRO, with merely two substantial transactions taking place. This has led to the lowest trading volume witnessed within the last seven days, amounting to approximately 4.8 million CRO being exchanged.

Large investors, or “whales,” significantly influence the price fluctuations of CRO due to their substantial holdings. When whale transactions decrease and there’s a simultaneous drop in the asset’s price, it often indicates that these investors may have sold off their positions because market demand has weakened.

Additionally, it appears that active traders were also participating in the downward trend. This is indicated by a decrease of 19.38% in the number of active wallets or addresses during the last week.

If these trends persist and prices keep dropping, CRO could experience additional losses and possibly reach new record lows.

Read More

- OM/USD

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- Solo Leveling Season 3: What You NEED to Know!

- ETH/USD

- Lisa Rinna’s RHOBH Return: What She Really Said About Coming Back

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Solo Leveling Season 3: What Fans Are Really Speculating!

- Inside the Turmoil: Miley Cyrus and Family’s Heartfelt Plea to Billy Ray Cyrus

- Aimee Lou Wood: Embracing Her Unique Teeth & Self-Confidence

- Leslie Bibb Reveals Shocking Truth About Sam Rockwell’s White Lotus Role!

2024-11-27 11:35