- Pepe has a long-term bullish outlook but a short-term bearish one.

- This retracement might not last long, but traders should be prepared for volatility.

As a seasoned crypto investor who’s weathered more market storms than I can count, I find myself in a bit of a mixed bag with Pepe [PEPE]. On one hand, I maintain a long-term bullish outlook for this meme coin, given its impressive performance this November. But, my short-term sentiment is bearish, as the current retracement might not be over just yet.

Over the last week, PEPE has experienced a decrease of 9.4%. Interestingly, just two weeks ago, on November 13th, it surged by an impressive 47% in a single day. However, this surge’s momentum seems to have faltered, as evidenced by decreased trading activity. This could potentially indicate that PEPE might experience a more significant adjustment in the near future.

As Bitcoin [BTC] continues to dip towards $90k and may continue falling, those trading Pepe coin should exercise caution. With possible price drops in the coming days or weeks, potential buyers could benefit from significant discounts on Pepe.

Pepe price prediction- short-term dip to continue

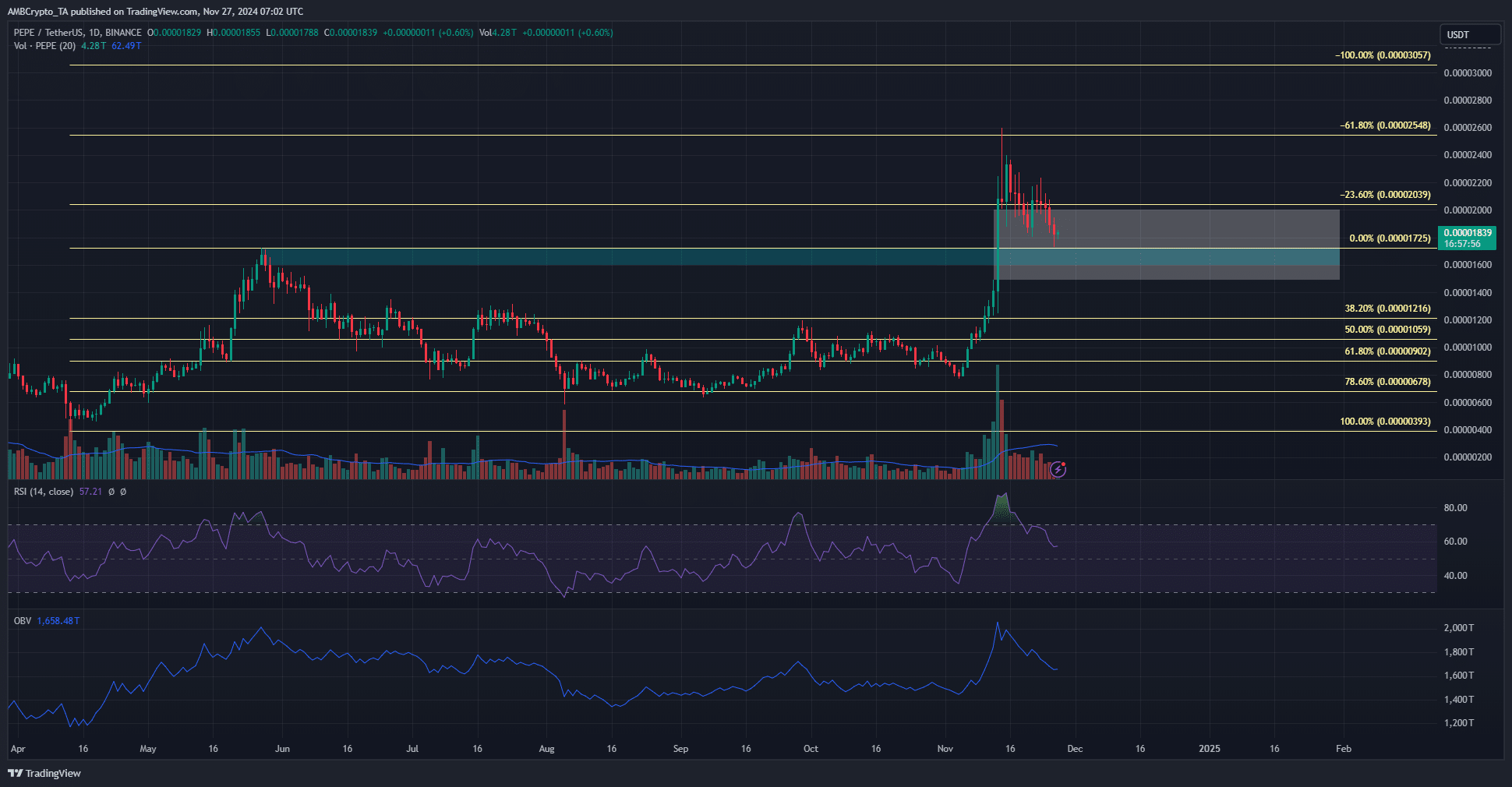

On a daily basis, the cryptocurrency PEPE appears to have a robust bullish trend. Over the past eleven days, it has been pulling back from its gains, but its performance in November has been noteworthy. On the 13th of November, it created a substantial gap in fair value during its surge, which is clearly marked in white.

In simpler terms, this area corresponds to the “bullish breaker block” from May at approximately $0.000016. The combination of these factors makes it likely that the range between $0.00001615 and $0.00001715 will serve as a strong area of demand, which traders might try to protect or defend.

A continued downtrend might lead PEPE to touch $0.00001216. However, technical indicators suggest optimism, with the daily RSI staying above 50, indicating that the buying pressure is stronger than the selling pressure. The On-Balance Volume (OBV) showed a decrease due to eleven consecutive days of selling activity.

If the OBV (On Balance Volume) trend persists downward for the next 3-4 days without showing any signs of reversal, it might indicate persistent selling pressure. This prolonged selling could potentially cause the price of PEPE to decrease towards $0.000012. For now, PEPE bulls are expected to hold their ground against this short-term negative sentiment, hoping for a market rebound.

Liquidation levels show Pepe could see a bounce soon

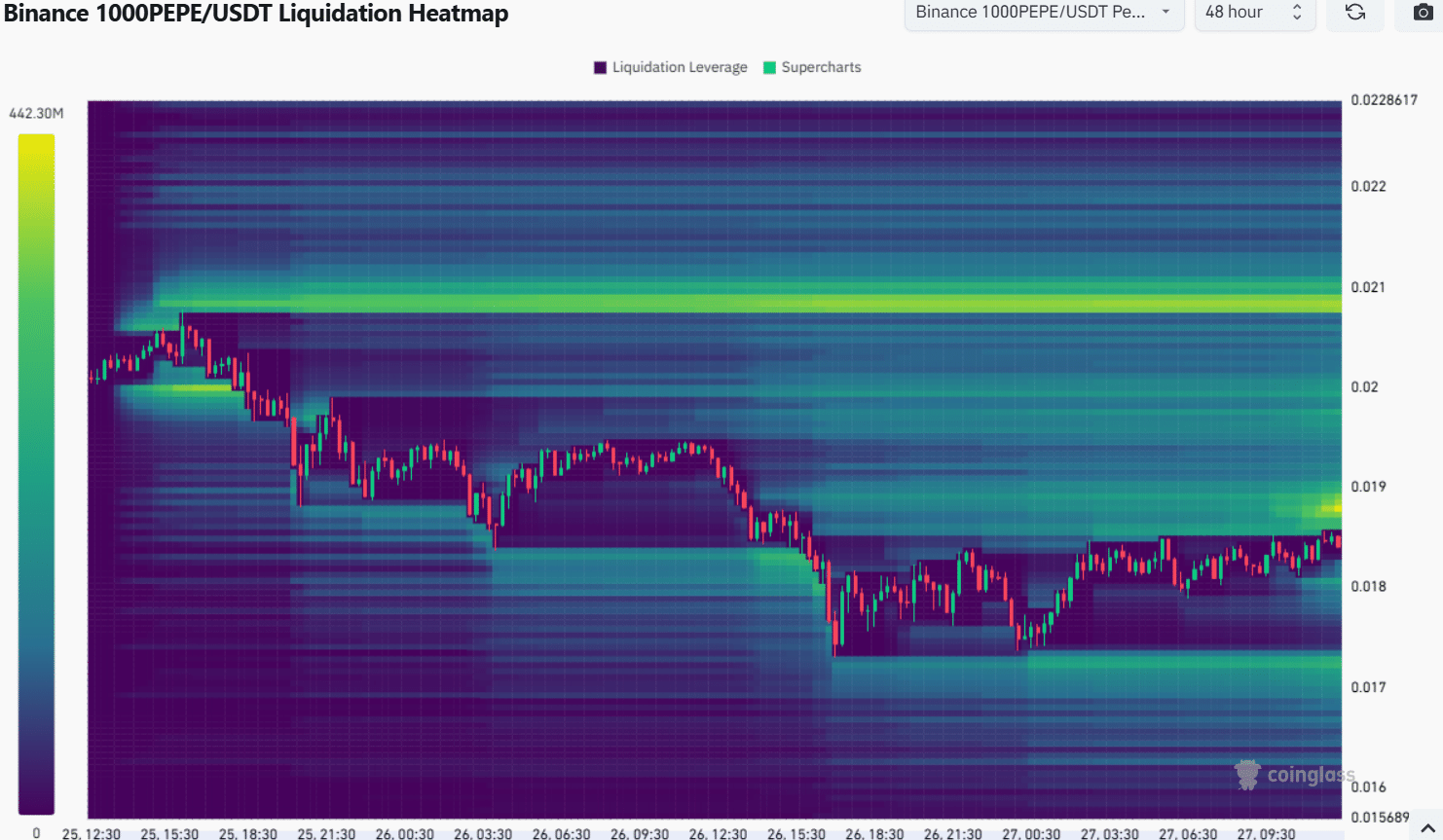

Over the last two days, the heatmap indicates that the price might rise towards the areas around $0.0000188 and $0.0000208, as there appears to be potential for growth in these regions. Additionally, a concentration of liquidity has been observed at approximately $0.0000172.

As an analyst, I’m considering re-examining this lower level following a scan of the adjacent liquidity pool at approximately $0.0000188. The short-term price action appears to be bearing a negative trend.

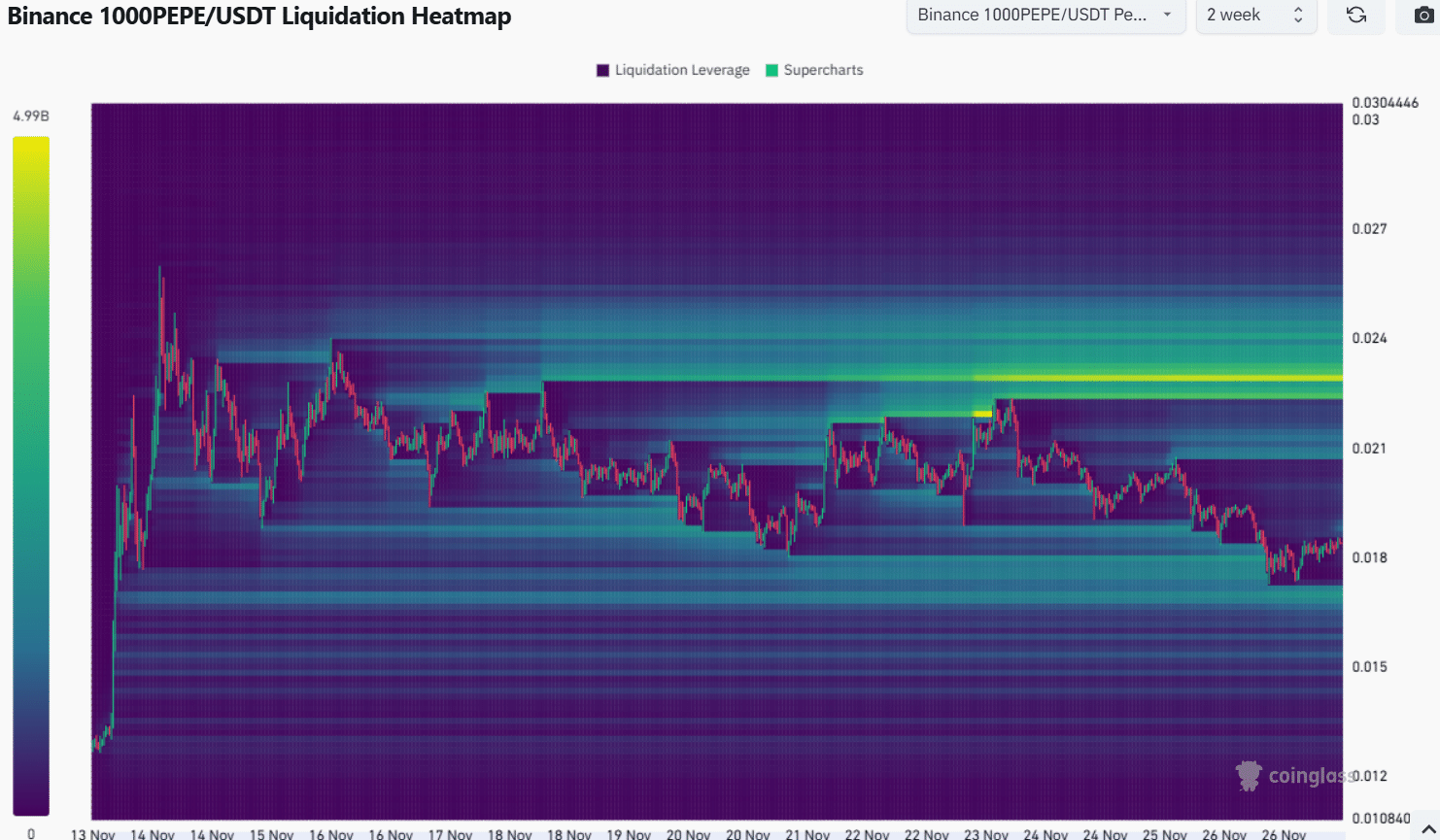

Over the last fortnight, PEPE experienced a retreat following its strong surge. The recent market cooling indicated that a rebound to approximately 0.000021 could be expected soon. Beyond this point, the price might aim for around 0.000023 within the next week or so.

Read Pepe’s [PEPE] Price Prediction 2024-25

In simpler terms, for Bitcoin to avoid a short-term price drop, it needs to halt its current bearish trend. At present, traders should brace themselves for a potential fall to approximately $0.000017, as this level also has liquidity available. This aligns with the technical analysis we’re considering.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

2024-11-27 16:07