- The Altcoin Season Index saw a major spike for the first time since April.

- Bitcoin remained dominant despite the spike.

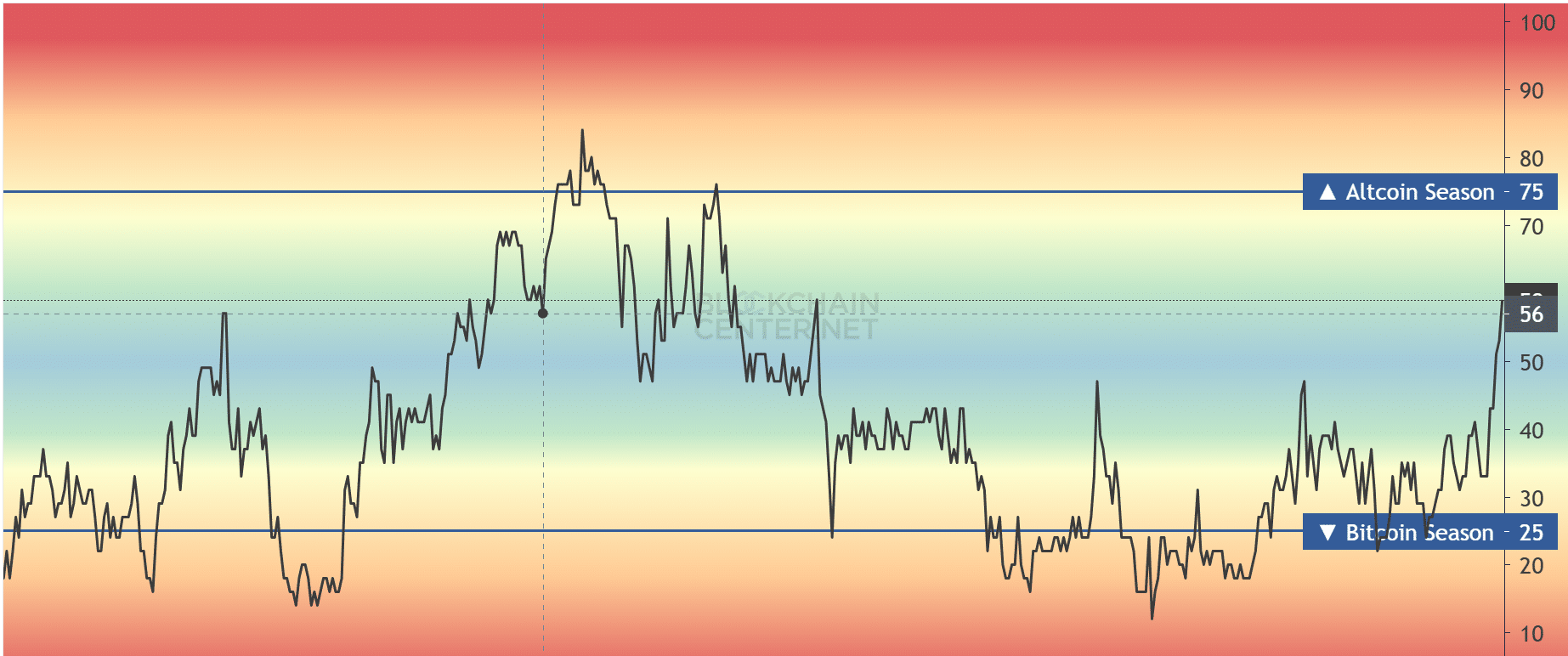

As a seasoned analyst with over two decades of market analysis under my belt, I’ve seen bull markets come and go, but the current shift in the cryptocurrency landscape is particularly intriguing. The recent spike in the Altcoin Season Index to 59 suggests that we might be on the brink of an altcoin-dominated cycle, a phenomenon not witnessed since April.

The market for digital currencies, or cryptocurrencies, is undergoing significant changes since the Altcoin Season Index has risen to 59, possibly indicating a shift toward a period where alternative coins (altcoins) could take center stage.

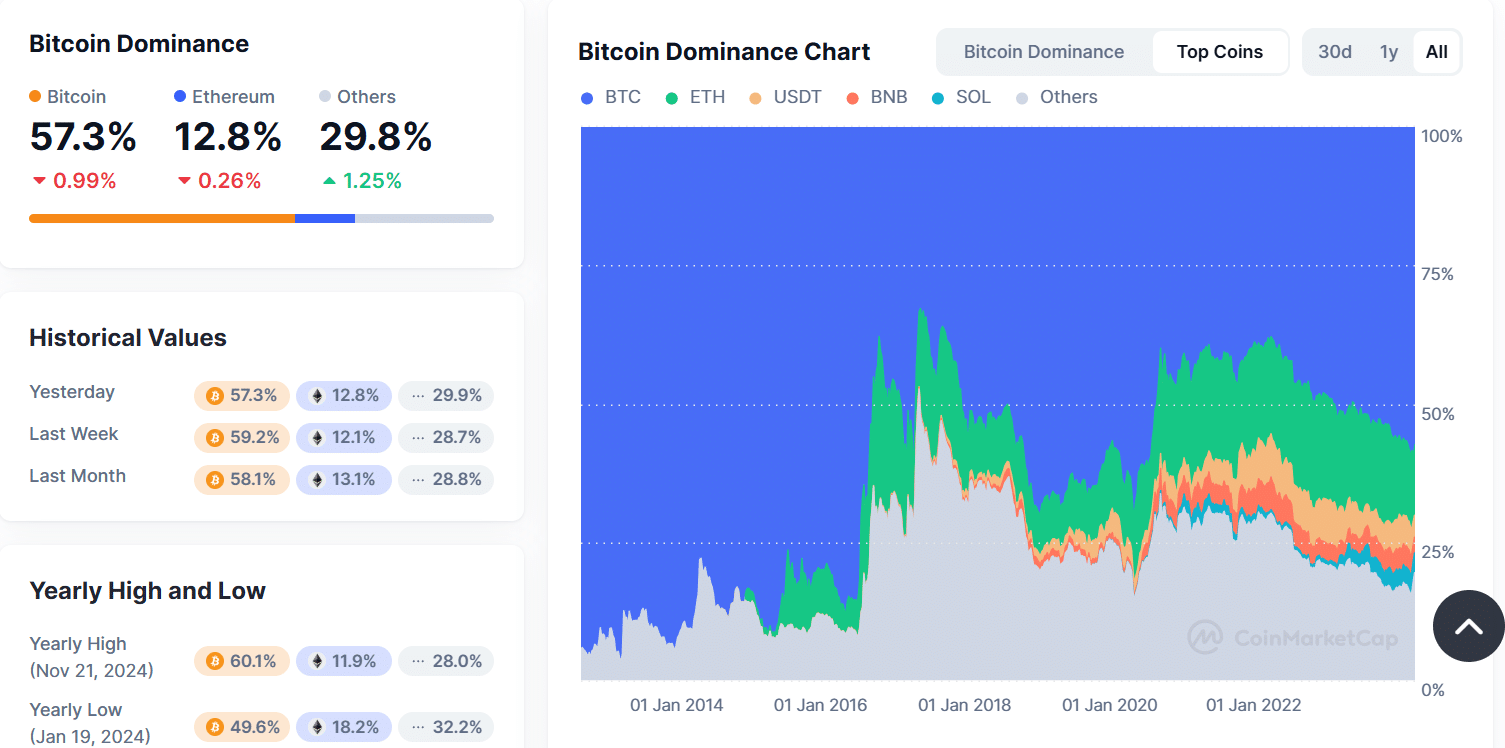

The strength of Bitcoin’s [BTC] dominance, currently at 57.3%, has shown a slight decrease, suggesting that investors might be exploring other investment options more frequently.

Rising altcoin season index

Currently, the Altcoin Season Index – a tool that compares altcoins’ performance with Bitcoin – has climbed up to 59.

Examination of the graph indicated a significant increase in the index, moving closer to the benchmark of 75 which signifies the start of an altcoin boom period.

The rise suggests a rising tide for altcoins, with strong evidence from substantial price changes in cryptocurrencies such as Ethereum, Solana, and Binance Coin.

Historically, these types of shifts in the market have often occurred during times when Bitcoin’s influence decreased, creating opportunities for other cryptocurrencies to gain prominence.

As a crypto investor, I’ve noticed a significant change in the market landscape this year. The dominance of Bitcoin seems to be giving way to a more diverse portfolio, which is an exciting shift. Yet, it’s important to remember that we haven’t seen a definitive breakthrough into altcoins just yet. This cautious optimism suggests that while diversification is on the rise, we should still tread carefully and keep a close eye on market trends.

Bitcoin dominance: Holding ground amid shifting sentiment

As I compose this at the moment, Bitcoin’s dominance is currently pegged at 57.3%. It has slightly dipped from its peak of 60.1% that was reported merely a week ago.

This downtrend coincides with altcoins capturing a larger share of the market. Ethereum’s dominance has slightly increased to 12.8%, signaling a renewed interest in the second-largest cryptocurrency.

In tough market conditions, Bitcoin’s robustness becomes evident, providing a safe investment option for many.

However, the recent decrease in its leading position might signal an impending surge in popularity for other investment options, especially since investor trust is increasing.

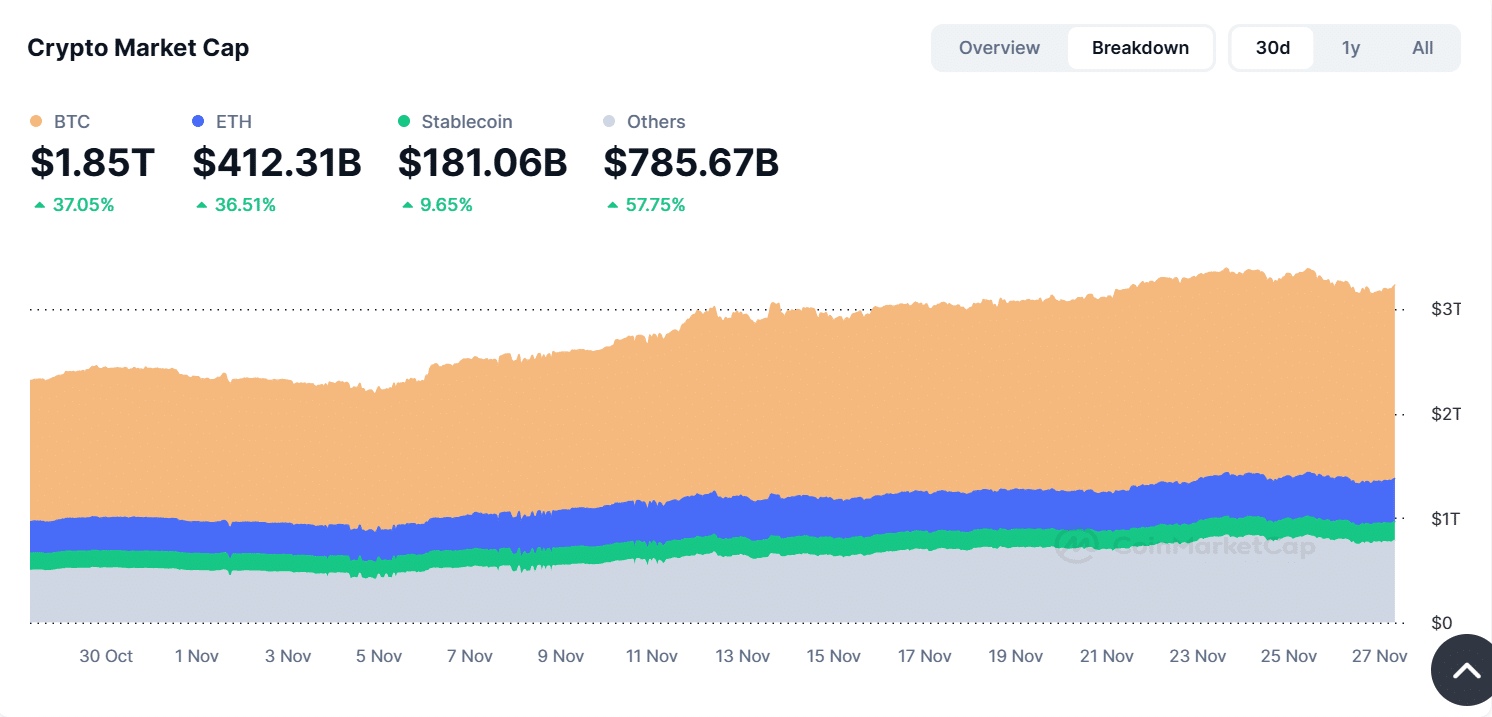

Market capitalization: Altcoins closing the gap

According to information from CoinMarketCap, the total value of the cryptocurrency market has climbed significantly to approximately $3.23 trillion dollars. Of this amount, Bitcoin accounts for around $1.85 trillion, while altcoins, not including stablecoins, represent a substantial $785.67 billion.

It’s worth noting that the total value of stablecoins, such as Tether or USD Coin, has grown significantly to reach approximately $181.06 billion. This growth indicates a persistent interest in accessing liquidity and managing risk.

Over the last month, I’ve noticed a robust expansion in the altcoin market, particularly among key players such as Ethereum and Solana. These heavyweights have shown remarkable growth, with double-digit percentage increases.

The increase in the total value of altcoins matches up with the Altcoin Season Index, which suggests that an altcoin surge might be imminent. This strengthens the argument for a potential rise in altcoins.

Are we in an altcoin season?

Although the Altcoin Season Index and decreasing Bitcoin’s dominance suggest a change, the market finds itself at a critical juncture.

For all altcoin supporters, the upcoming weeks carry significant importance. The market is eagerly waiting for clarification about whether this altcoin momentum represents a prolonged period of growth or simply a short-term spike.

Keep a close eye on important indicators like the Altcoin Season Index and Bitcoin’s dominance, as the present market trends suggest an intriguing period. Nevertheless, it’s essential to note that we haven’t quite reached the altcoin season yet, since the index has not surpassed the 70 mark.

Read More

2024-11-28 01:12