- Leading platforms such as Binance, Upbit, and Wintermute have recently added to their ONDO positions.

- Meanwhile, derivative traders engaging in sell-offs may find their activity short-lived as market sentiment shifts.

As a seasoned researcher who has navigated through the tumultuous waters of the cryptocurrency market for years, I find the recent developments surrounding ONDO quite intriguing. The strategic accumulation by whales such as Binance, Upbit, and Wintermute, coupled with the tightening supply due to spot traders, paints a bullish picture that is hard to ignore.

As a crypto investor, I’ve noticed that despite a slight dip of 0.46% last week, Ondo [ONDO] has made a comeback, climbing by 3.64% today. This surge has boosted its total monthly gain to an impressive 49.42%, a testament to the robust bullish sentiment surrounding this cryptocurrency.

As more whales stockpile ONDO and the number of traders selling at current spots decreases, there’s an increasing likelihood that the cost of ONDO will go up.

Consequently, our analysis at AMBCrypto indicates that those who have profited from downtrends by selling derivatives might experience increasing losses if the optimistic market trend continues.

Whales continue accumulating ONDO

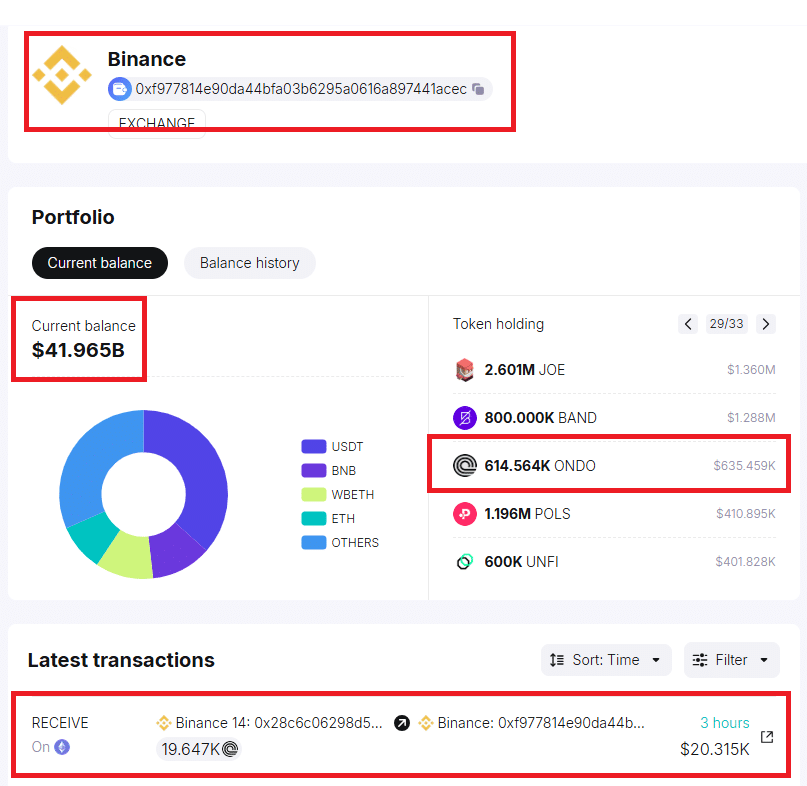

Based on the analysis by Twitter user Jacky, it appears that leading cryptocurrency platforms are strategically accumulating ONDO tokens.

Among the notable entities, Upbit – a leading cryptocurrency exchange in South Korea – has been growing consistently over the past five months. Now, it holds approximately 1.86% of the entire Ondo supply.

In Jacky’s words:

Upbit’s holdings of $ONDO have increased dramatically, going from 50 million to 185 million, which represents approximately 1.86% of the entire $ONDO supply.

Likewise, following the news that ANB Crypto mentioned Binance had acquired ONDO, it’s been revealed that Binance has further expanded its holdings, increasing its ONDO balance from around 594,000 to 631,000 in a short period.

In simple terms, just like other significant players in the field, the well-known crypto market maker, Wintermute, is also participating in the buying trend.

Typically, an increase in whale ownership of a token is often a sign that major investors are purchasing more before a possible price surge. Consequently, the value of the ONDO asset tends to rise, potentially bringing increased profits to its holders.

Supply squeeze incoming

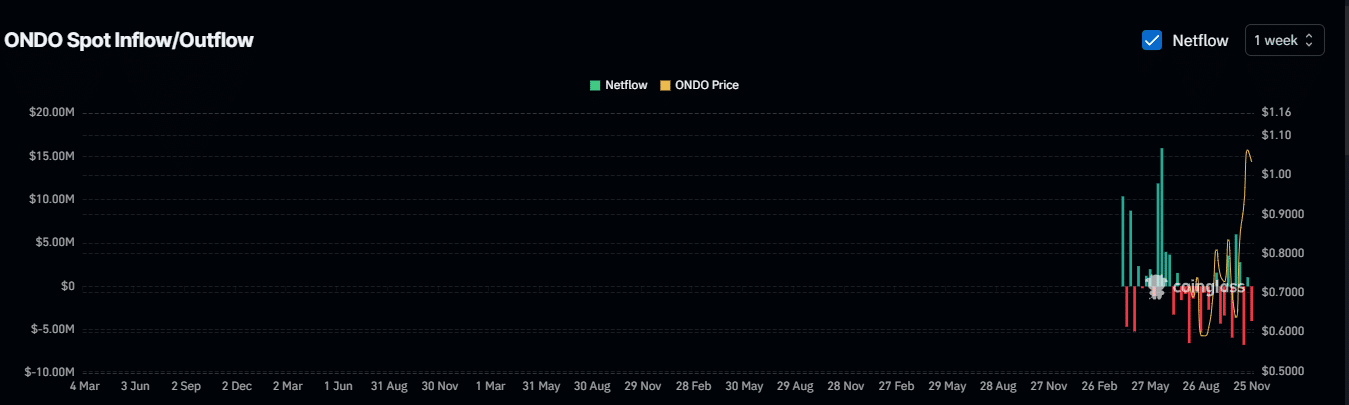

Traders who specialize in immediate transactions (spot traders) are withdrawing more ONDO from exchanges than they’re depositing, leading to a decrease in the ONDO supply on these platforms. This shift is indicated by the Negative Exchange Netflow for the token, as reported by Coinglass.

Based on my years of experience in financial markets, I have noticed that when more of a particular asset, such as ONDO, is being withdrawn from trading platforms than deposited, it can lead to a decrease in the asset’s availability. This situation often results in a supply squeeze, making it harder for investors to obtain the asset and potentially driving up its price. I have seen this phenomenon occur many times before, and it can be a good opportunity for those who are able to secure the asset at a lower price during the initial stages of the supply squeeze. However, it’s important to remember that such situations can also be risky, as the market dynamics may change rapidly and the price could fall just as quickly as it rose.

As we speak, over the past seven days, around $4.10 million of ONDO tokens have been transferred to personal wallets, indicating a robust long-term investment strategy by holders.

As an analyst, I’m observing a potential trend where ONDO’s price surge might accelerate. The reason being, the diminishing supply on exchanges is aligning harmoniously with a growing market demand.

Short derivative traders may face losses soon

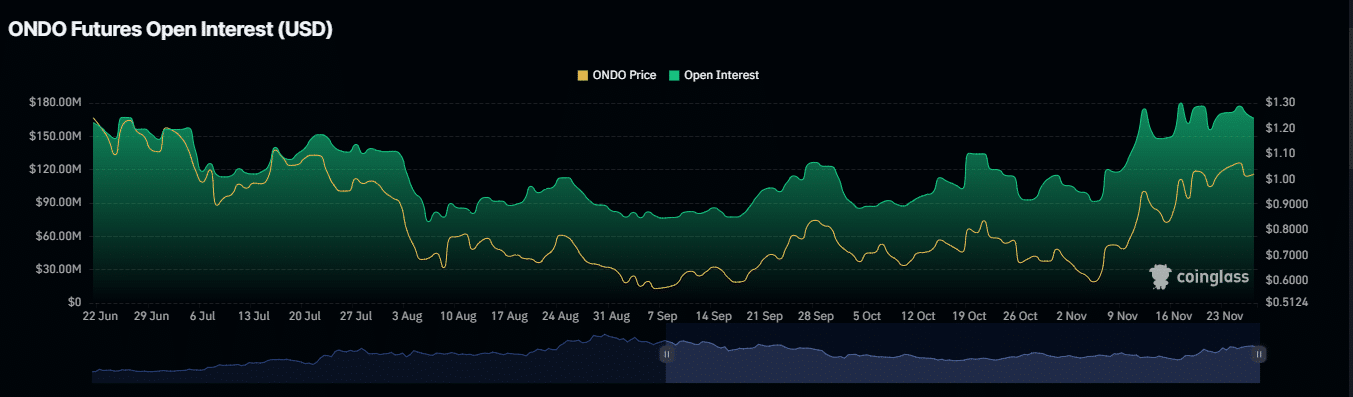

Over the past day, around $297,180 worth of ONDO’s long positions were closed down due to a temporary change in the market trend towards bearishness.

Read Ondo’s [ONDO] Price Prediction 2024–2025

The situation matches a decrease in Open Interest, a measurement that gauges market opinion through the count of unresolved derivative contracts. It’s worth noting that there’s been a rise in the number of open short positions or unsettled short contracts.

Considering the prevailing optimism among whales and day traders, and ONDO’s consistent daily increase of 3.46%, it’s possible that traders who have taken short positions in derivatives could experience substantial losses if the bullish trend persists further.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Rick and Morty Season 8: Release Date SHOCK!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-11-28 09:12