- Ethereum’s surge to $3.6K is more speculative in nature, as whales capitalize on high volatility.

- With open interest (OI) reaching an all-time high, the $4K target for ETH seems more distant.

As a seasoned crypto investor with battle-tested nerves and a knapsack full of hard-earned lessons, I can’t help but feel a mix of excitement and caution regarding Ethereum’s latest surge past $3,600. The recent spike in open interest and the massive liquidations suggest that this rally is more speculative than fundamental – a rollercoaster ride fueled by whales capitalizing on high volatility.

This week, Ethereum (ETH) has experienced a significant increase of around 15%, marking its first return to $3,600 in the last seven months. Despite brief periods of profit-taking and consolidation following extended periods of growth, there’s been no substantial drop in price so far.

As a crypto investor, I can’t help but feel the pressure of FOMO (Fear of Missing Out) when it comes to buying during market retracements. It seems like those with weaker hands are quickly exiting their positions, which could potentially set up ETH for a rebound. However, it’s important to note that this rally may be fueled more by high-leverage futures trading, as both long and short open interest have reached a staggering $24.08 billion, an all-time high. This indicates a significant level of betting on the market, which could potentially lead to increased volatility.

Although a modest rebound in Bitcoin brings some hope, it appears that Ethereum reaching $4,000 is not imminent because of an accumulation of substantial liquidity. This situation could potentially lead to a price adjustment unless crucial factors line up favorably.

High leverage could present a strong resistance barrier

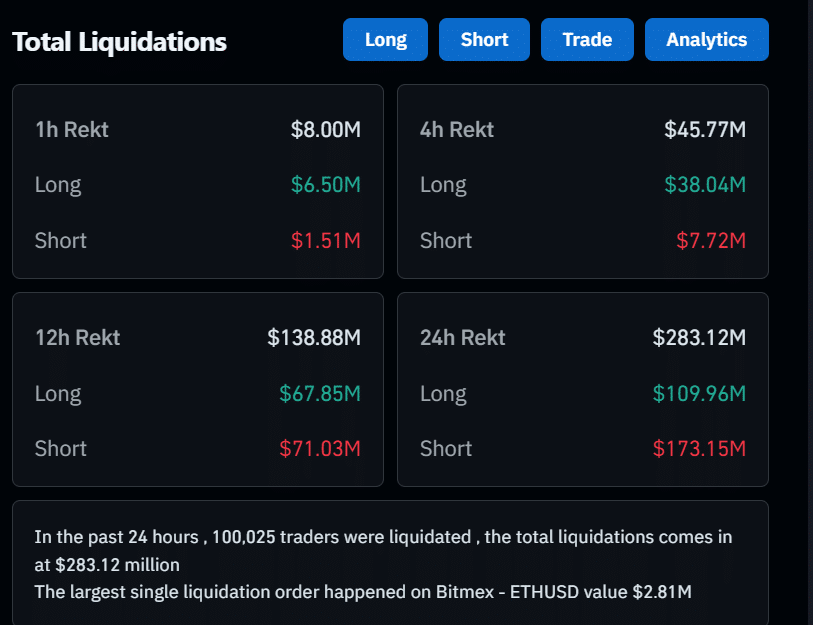

Over the last day, the overall value of liquidations reached approximately $283.12 million, with short positions suffering significant losses estimated at around $173 million. This development arises as the market experiences a recovery, with the majority of leading cryptocurrencies registering substantial gains. Ethereum (ETH) saw a nearly 9% increase and returned to the $3.6K price range.

Significantly, Ethereum (ETH) recorded the biggest liquidation order on Bitmax, amounting to approximately $2.81 million. It’s suspected that ‘whales’, holding roughly 50 million ETH tokens, may have instigated a significant short-squeeze event, causing the price to reach a critical resistance level.

In simple terms, Ethereum faced a ‘tug-of-war’ over the past week, with bulls and bears battling for control. The bulls ultimately won, as whales intervened, forcing short-sellers to buy back their positions, triggering a notable price surge.

Source : Coinglass

From here on out, we’re moving into the crucial phase. If the ‘whales’ maintain their current approach over the next few days, it could lead to a near-term goal of $4,000. This level at $3,800 might become psychologically significant, stirring up fresh market attention and potentially setting the stage for a surge towards $4,000.

As I delve into this analysis, it’s essential to take a holistic approach, factoring in both internal and external elements. The optimistic trends observed across multiple datasets play a pivotal role in our pursuit of the near-term objective.

If it weren’t present, Ethereum’s growth might encounter obstacles. With such high activity in the futures market, even a slight deviation could provide room for bears to apply pressure.

As a consequence, short sellers might gain influence, potentially causing a brief reversal towards the $3.5K level.

Ethereum’s surge likely at the mercy of whale support

It appears that a larger number of investors are opting for higher levels of financial risk in derivatives trading, as evidenced by the record-breaking leverage ratio. This trend seems to indicate that the current growth spike might be primarily fueled by speculative rather than fundamentally grounded actions.

It’s not unexpected because, being the second largest cryptocurrency by market capitalization, Ethereum’s price fluctuations often follow Bitcoin’s trends. Many investors watch Bitcoin’s behavior carefully to decide whether to buy (go long) or sell short (bet that its price will decrease) on Ethereum.

Currently, Bitcoin has surged over 4% and returned to the $95K range, causing Ethereum enthusiasts to react favorably. Big investors view this development as an important trigger for a temporary increase in price.

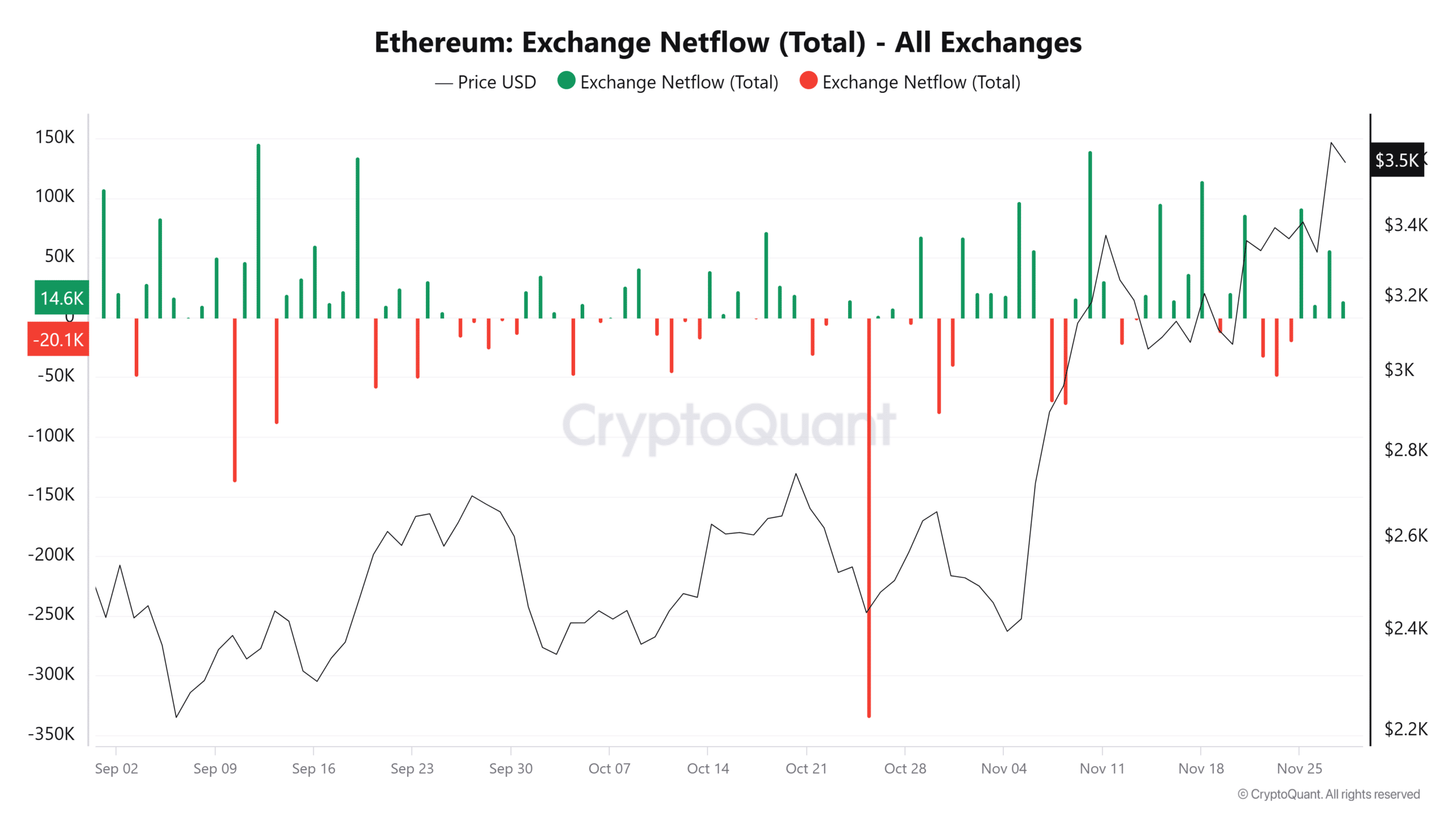

In the last four days, there’s been a shift where more investors with weaker positions have left the market, leading to an increase in inflow (or positive net flow).

Source : CryptoQuant

In contrast to past periods, when each green bar suggested a possible peak followed by a correction, this time around, the large investors (whales) took the pressure, leading to a nearly 10% increase in price instead.

It’s important to acknowledge that the growing demand for Ethereum’s current pricing level is significant, as its upward trend seems to depend more and more on the backing of large investors, or “whales.

If that support fails, though, what could transpire? Presently, the volatility index is at 66, implying a higher level than usual in the market. This might imply that investors are expecting large price fluctuations within a brief timeframe.

Due to the volatile market conditions, it’s probable that whales have redirected their focus from Bitcoin’s unpredictable fluctuations. Given the ambiguity about Bitcoin’s short-term trends, they seem to be more interested in high-value cryptocurrencies now.

Read Ethereum [ETH] Price Prediction 2024-2025

A rise in Ethereum’s price towards $3,600 becomes less grounded and more influenced by speculation, as the $4K target remains out of reach unless large investors (whales) continue to stockpile, even during optimistic phases, thereby fueling the increase on a more ‘solid’ foundation.

For now, it appears that consolidation is the most probable scenario. However, if large investors decide to cash out their profits, this could trigger a possible price correction, giving room for short sellers to gain control over the market.

Read More

2024-11-28 16:08