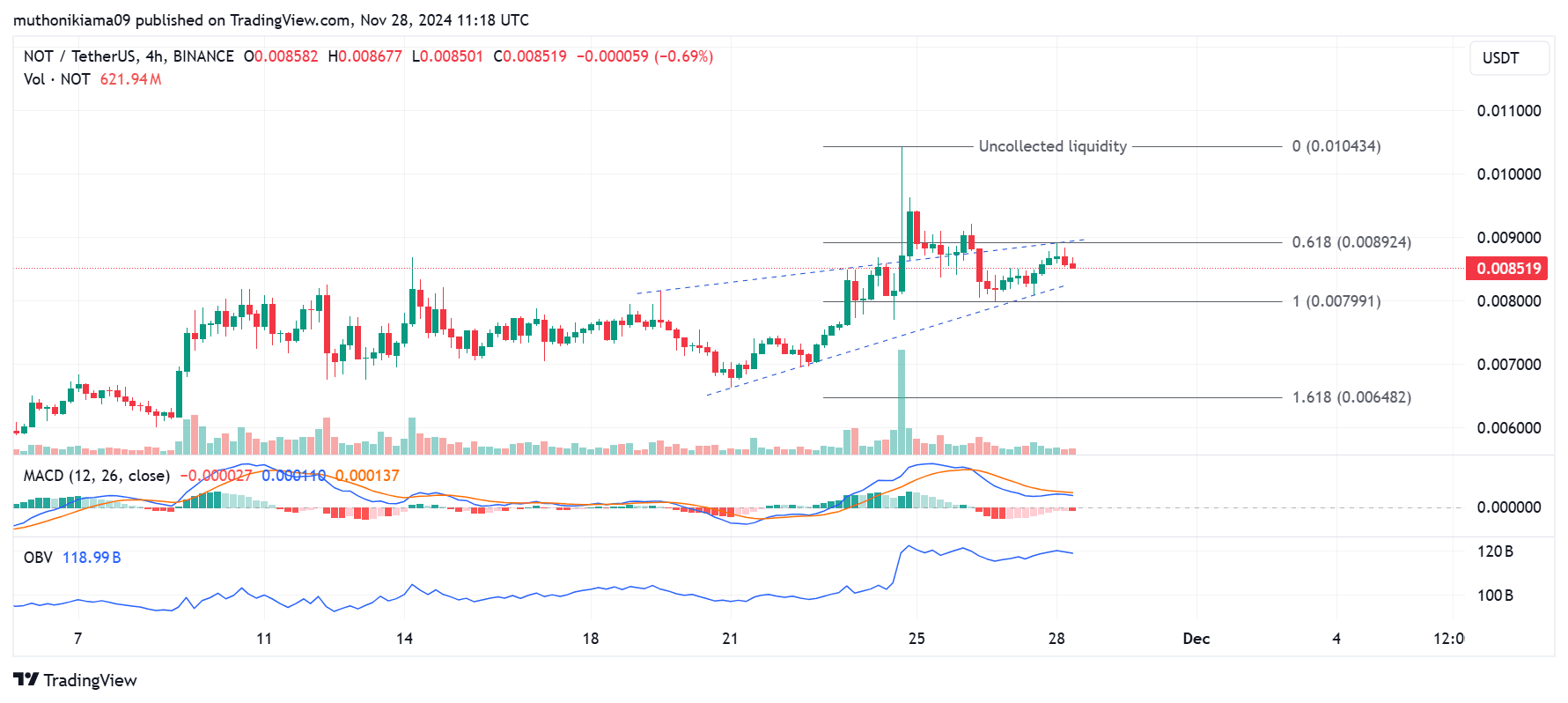

- Notcoin has formed a rising wedge pattern on its four-hour chart, suggesting bearish trends.

- Active addresses doubled in 24 hours, showing growing interest.

As an analyst with years of experience in the ever-evolving world of cryptocurrencies, I find myself intrigued by the current state of Notcoin [NOT]. While its price action suggests bearish trends, the surge in active addresses and growing interest is a compelling contrast.

Currently, Notcoin (NOT) is exchanging hands for approximately $0.0085, marking a 3.4% increase over the past 24 hours. This upward movement in Notcoin’s price mirrors a broader recovery within the cryptocurrency market, where most alternative coins (altcoins) have seen an uptrend.

Regardless of recent advances, the asset appeared to be facing downward pressure post-timestamp. Its trading pattern on the four-hour chart resembled a rising wedge, suggesting a decline in positive momentum.

This bearish trend will be confirmed if NOT falls below the lower trendline of this pattern.

The MACD histograms, which indicate a downward trend, suggested that the market was being dominated by the bears.

Furthermore, as the Moving Average Convergence Divergence (MACD) line persisted beneath the signaling line, it indicated that sellers remained dominant in the market.

Keep an eye on situations where the Moving Average Convergence Divergence (MACD) line drops beneath the zero line. This occurrence might suggest robust bearish feelings in the market, potentially leading to a price decrease.

Even though the current market trends seem negative, the On-Balance Volume (OBV) indicator is still quite high, implying that buyers have been maintaining their positions. This might indicate that the asset “NOT” could potentially be moving into a period of stability or consolidation.

As an analyst, I’m observing that if the price does not buck the current bearish trends, it might climb up to accumulate liquidity at approximately $0.0104. On the flip side, dipping below $0.0079 could potentially trigger a more pronounced descent towards $0.0064.

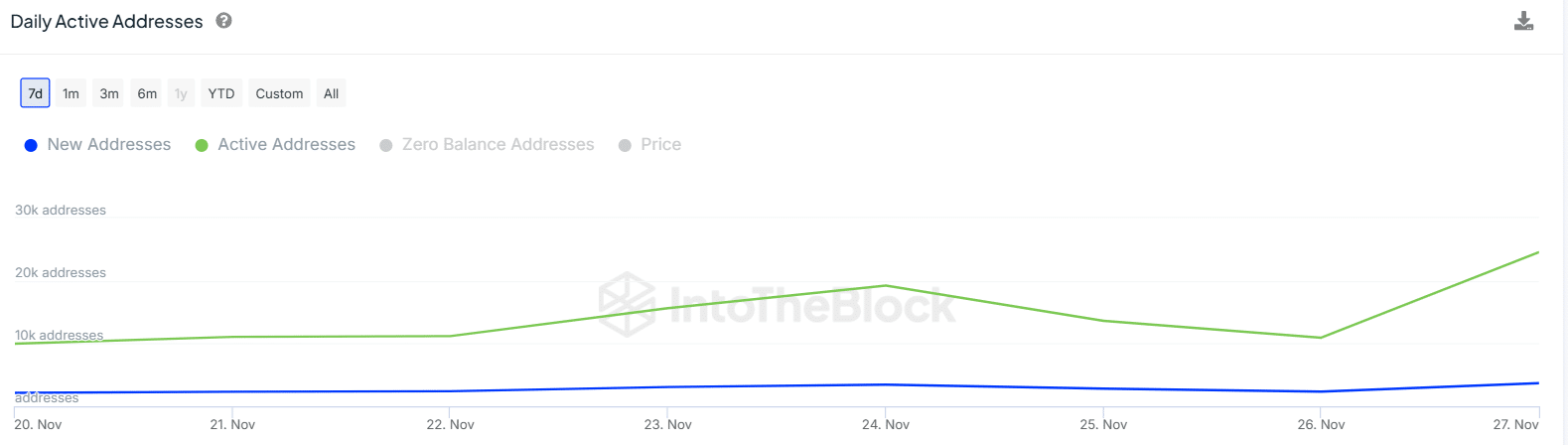

Active addresses spike 124%

One of the factors that could drive gains for NOT is a surge in the number of active addresses.

24-hour data from IntoTheBlock indicates a significant surge of 124%, with active addresses rising from 10,930 to 24,530 on the network.

Additionally, it was observed that Notcoin experienced an increase in the creation of new user accounts, climbing from 2,340 to 3,670. This suggests a rising curiosity and engagement among users.

As a crypto investor, I witnessed an uptick in transactions coinciding with the rise in unique addresses. The volume of transactions soared from 1.57 billion NOT to 1.96 billion NOT.

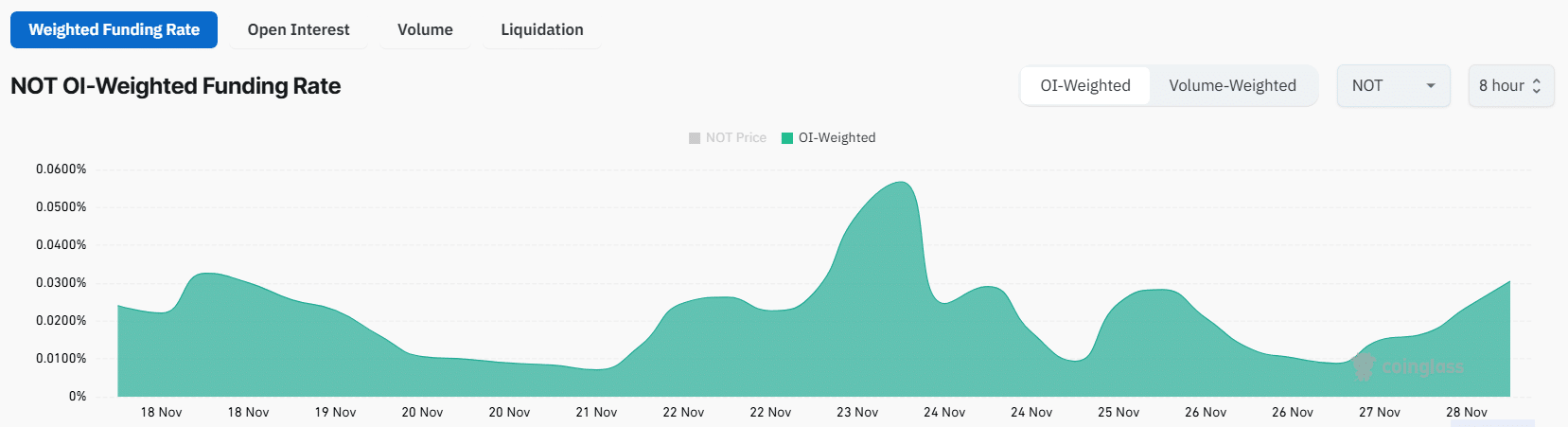

Notcoin Funding Rates flip positive

According to Coinglass data, it seems like traders on the derivatives market are anticipating higher returns for Notcoin because of an increase in Funding Rates.

At the current moment, NOT’s Funding Rates are at 0.0305%. This implies that long-term traders are prepared to pay an additional fee to keep their positions open, indicating their confidence in the market.

Read Notcoin’s [NOT] Price Prediction 2024–2025

Positive Funding Rates also suggested that more traders were betting on a further price rally.

A growing trend in investment (Funding Rates) and optimistic market feelings towards a particular token can stimulate purchasing actions, potentially leading to an increase in its value.

Read More

2024-11-28 21:43