- Virtuals Protocol (VIRTUAL) gained by 42% in 24 hours after listing on the Bithumb exchange.

- Open interest also increased by 90% despite a rise in short liquidations.

As a seasoned researcher with years of experience in the cryptocurrency market, I have witnessed countless price surges and dips, but the recent performance of Virtuals Protocol (VIRTUAL) has left me genuinely intrigued. The 42% gain within 24 hours following its listing on Bithumb exchange is a testament to its potential, and the subsequent increase in open interest by 90% despite a rise in short liquidations is a bullish sign that I find particularly interesting.

On November 29th, VIRTUAL Protocol reached a new record high of $1.42. At the moment of writing this, the cryptocurrency focused on artificial intelligence had experienced a slight dip, trading at $1.29, and showing a 42% increase over the past 24 hours. Its market cap has also grown to an impressive $1.28 billion.

In the last 24 hours, the trading volume of VIRTUAL has significantly surged beyond 100%, reaching approximately $166 million. This substantial increase is most likely due to the altcoin’s listing on the Bithumb exchange, which now allows trading with Korean Won pairs for VIRTUAL.

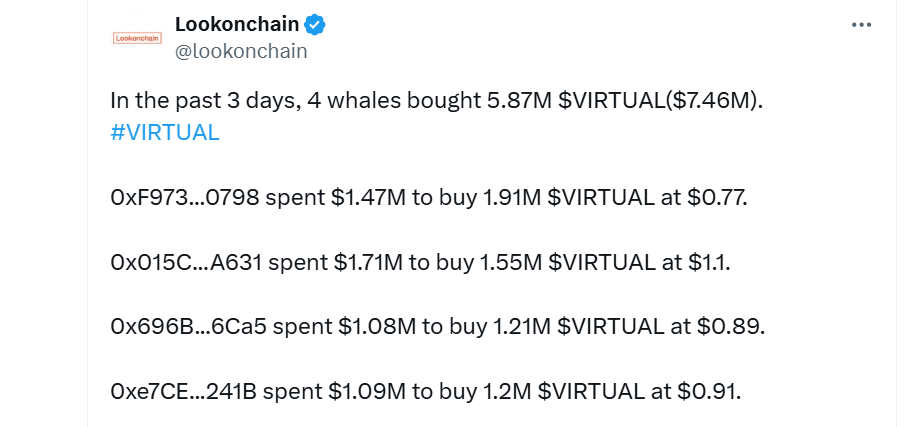

In the last few days, there’s been a growing fascination among whales towards VIRTUAL. According to Lookonchain, over the past three days, no less than four large investors (whales) have bought approximately 5.87 million tokens.

In my exploration as a researcher, I’ve noticed that Virtual is surpassing the wider cryptocurrency market with increasing whale activity and trading volumes. The question now is: Will this altcoin maintain its bullish trajectory, or will we witness a reversal in the trend?

Technical indicators show strong bullish signs

On the four-hour chart for Virtual Crypto, it appears that bullish tendencies are growing more prominent as the Positive Directional Indicator (DI) consistently exceeds the Negative DI, suggesting a bullish outlook.

The significant difference between the high Positive Directional Index (DI+) and low Negative Directional Index (DI-) in conjunction with the increasing Average Directional Index (ADX) indicates a robust upward trend.

In simpler terms, the Money Flow Index (MFI) being at 85 suggests strong buying activity, but this could mean VIRTUAL might be overbought. Keep an eye on the MFI dropping, as it could signal that sellers are starting to step in and potentially profit-take, which may lead to a price decrease.

Should the purchasing trend persist, it’s possible that VIRTUAL might surpass its previous All-Time High (ATH) and reach new peak levels. On the flip side, if the uptrend starts to falter, a significant support level can be found at $1.04. A decline below this point could intensify the downward trend.

VIRTUAL crypto’s open interest soars by 90%

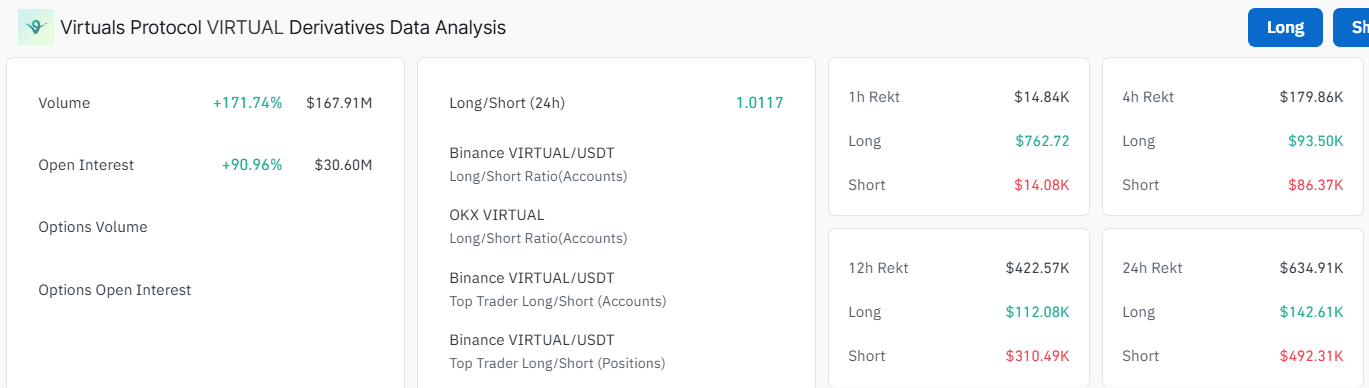

The derivatives market is significantly contributing to the growth of VIRTUAL. Right now, their Open Interest (OI) has spiked by an impressive 90%, reaching a level of $30 million. Moreover, derivative trading volumes have increased by 171% to a substantial $167 million.

As the Optimism Index (OI) increases along with the price hikes for VIRTUAL, this indicates that derivative investors are initiating fresh trades, signaling optimistic market sentiment. Yet, it’s important to note that this bullish trend could lead to heightened volatility as well.

Over the past 24 hours, the amount of liquidations near VIRTUAL has risen significantly to approximately $634,000 at present. These liquidations, particularly the $492,000 worth of leveraged short positions, might have triggered compulsory purchases. This could potentially lead to more growth in the value of VIRTUAL’s crypto.

AI cryptos lead market gains

At the moment, the AI-focused cryptocurrency segment has outshone other market sectors, as the combined value of all AI-related crypto assets increased by a substantial 18% over the past day, reaching an aggregate market capitalization of approximately $7 billion according to CoinMarketCap.

Currently, VIRTUAL stands as the second most significant AI Agent following the Artificial SuperIntelligence Alliance (FET). This growing influence in the field may pave the way for increased returns on its associated tokens.

Read More

- OM/USD

- ETH/USD

- Solo Leveling Season 3: What You NEED to Know!

- Lisa Rinna’s RHOBH Return: What She Really Said About Coming Back

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- Inside the Turmoil: Miley Cyrus and Family’s Heartfelt Plea to Billy Ray Cyrus

- Aimee Lou Wood: Embracing Her Unique Teeth & Self-Confidence

- Joan Vassos Reveals Shocking Truth Behind Her NYC Apartment Hunt with Chock Chapple!

- Netflix’s Dungeons & Dragons Series: A Journey into the Forgotten Realms!

2024-11-29 17:11