- Polkadot sees strong stablecoin growth with USDC and USDT surpassing $120 million in value.

- Development activity remains low, limiting Polkadot’s ability to fully capitalize on stablecoin adoption.

As a seasoned crypto investor with a knack for spotting trends, I’ve been closely monitoring Polkadot [DOT] and its impressive stablecoin growth. The surge in USDC and USDT adoption is undeniably promising, signaling confidence in DOT’s infrastructure. However, while the short-term gains are exciting, I remain cautiously optimistic about DOT’s long-term potential.

The usage of stablecoins like USDC and USDT on the Polkadot platform [DOT] has experienced significant expansion, accumulating over $120 million in total worth. This spike underscores growing trust in Polkadot’s infrastructure, offering assurances of scalability and security.

Currently, Polkadot’s price stands at $8.51, marking a 3.76% increase over the past day. Yet, while this growth is encouraging, it raises the question: Can Polkadot continue to expand its stablecoin ecosystem and draw in more liquidity?

What’s driving stablecoin adoption on DOT?

The increasing popularity of Polkadot as a platform for stablecoins aligns with broader movements within the blockchain industry. The prominent stablecoins USDC and USDT are experiencing significant growth, largely due to Polkadot’s capacity to provide affordable transaction costs and high scalability.

Consequently, Polkadot stands out as a captivating choice for stablecoin users seeking quicker and more affordable transactions when contrasted with Ethereum.

While the increasing use of Polkadot’s stablecoins might provide a short-term boost, sustained development of its wider ecosystem is crucial for long-term growth, as it stands now.

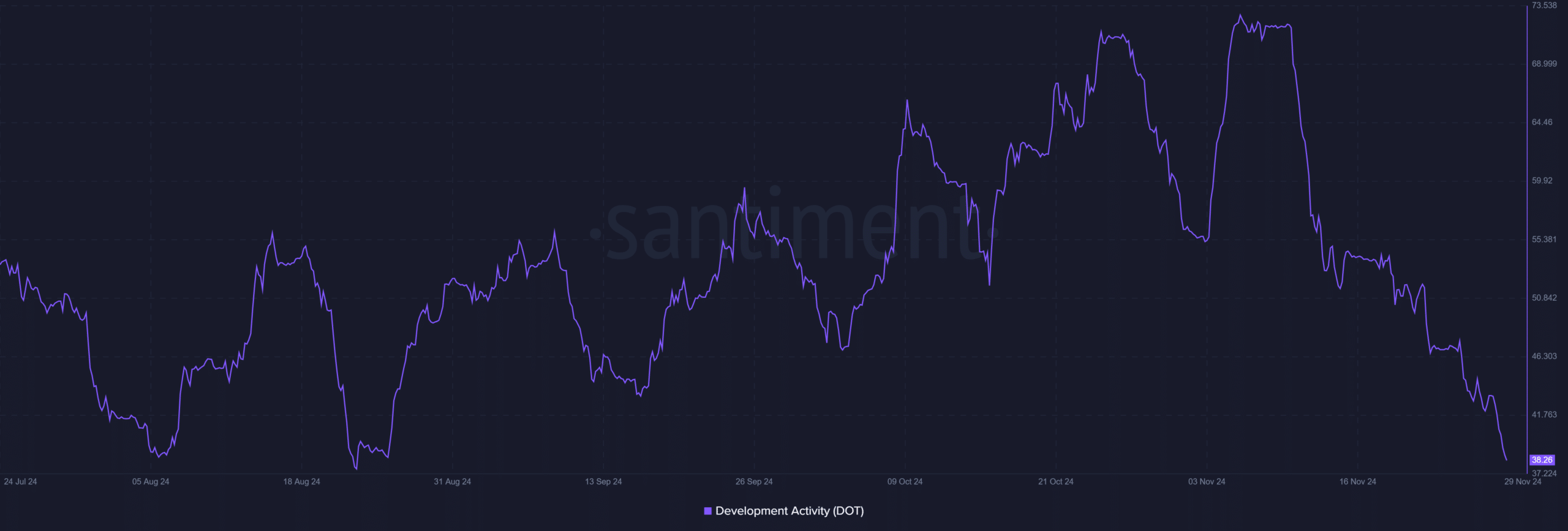

Development activity: Does it match the growth?

Despite increasing usage of stablecoins, the pace of development within Polkadot’s ecosystem appears sluggish, scoring only 38.26 in terms of activity. This score suggests that while Polkadot’s underlying structure is steady, the rate of creative advancement on the network seems to be decreasing.

In my analysis, insufficient vigorous developer engagement might cause a slowdown or standstill, potentially restricting the network’s capacity to accommodate and assimilate more decentralized applications (dApps) down the line.

Consequently, it’s crucial for Polkadot to boost its development pace to maintain competitiveness and cater to the increasing demand for stablecoins.

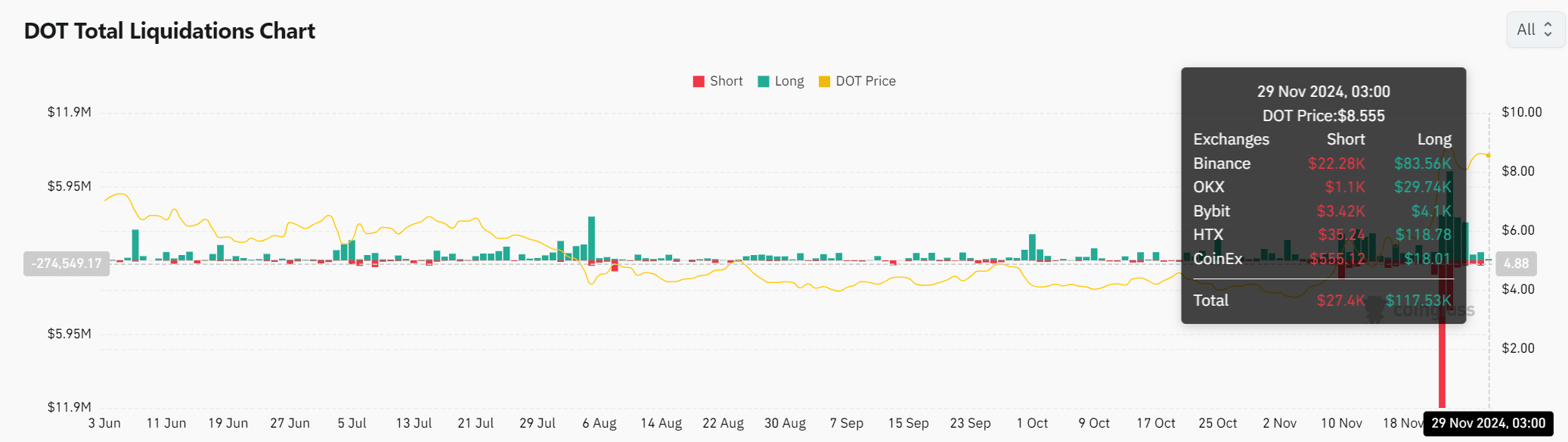

Liquidations reveal mixed market sentiment

Examining the market mood as indicated by DOT, it’s clear that there is a significant discrepancy in the amount of positions being closed out. The short liquidations stand at approximately $27,400, whereas the long liquidations sum up to a much larger figure of around $117,530.

It implies that although most traders are generally optimistic about the market, numerous investors have experienced substantial losses from their long-term investments.

Consequently, DOT might experience fluctuations in the near future since investors reposition themselves. Yet, should the positive trend persist, DOT could potentially rise even more, particularly given that increasing adoption of stablecoins is likely to enhance its liquidity.

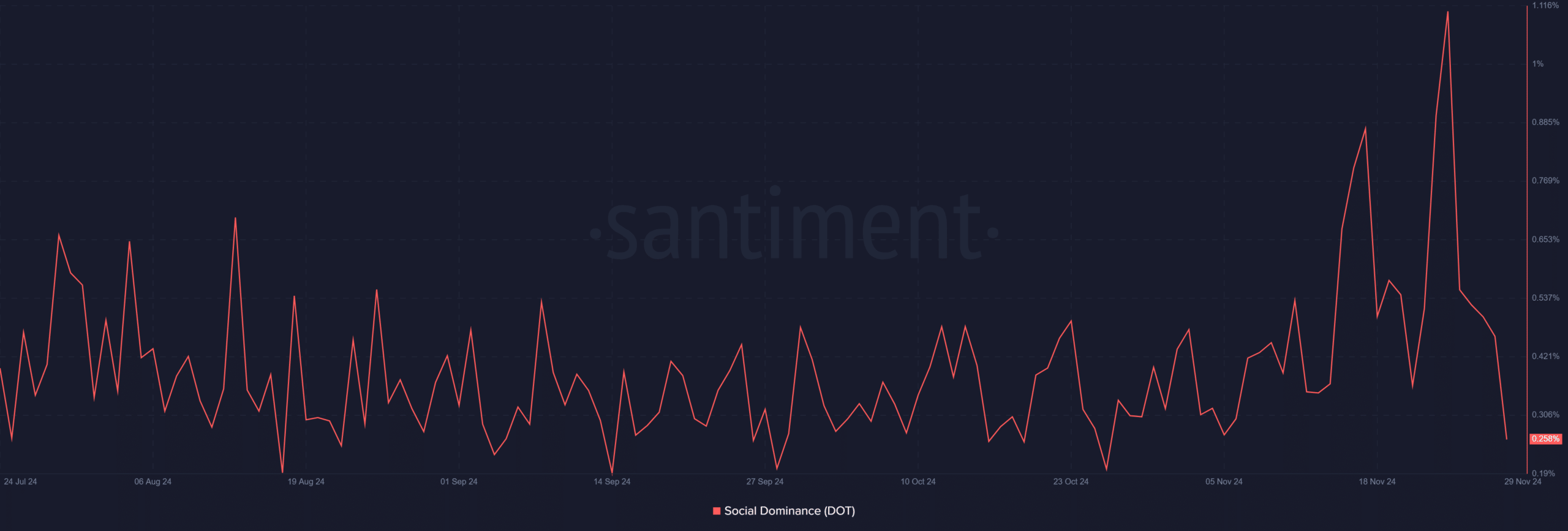

DOT’s social dominance: A barrier to growth?

Even though Polkadot’s influence on the social media scene is minimal at a rate of 0.258%, there’s increasing curiosity about incorporating stablecoins. However, Polkadot faces difficulties in generating substantial engagement on social networking sites. This limited online presence might make it challenging to draw in new users and developers, who are crucial for ensuring its long-term prosperity.

Consequently, it’s crucial for Polkadot to enhance its brand recognition and foster stronger community interactions to establish a more vibrant ecosystem.

Read Polkadot [DOT] Price Prediction 2024-2025

Can Polkadot continue to expand its stablecoin ecosystem?

The use of Polkadot’s stablecoin is increasing significantly, demonstrating that the network can handle larger scales. Yet, it encounters certain hurdles. Given the minimal development work happening and a relatively insignificant social influence, addressing these problems will be crucial for DOT to maintain its progress.

Furthermore, as the use of stablecoins increases liquidity, Polkadot should seize this opportunity to nurture a more extensive network of projects. By focusing on development and community interaction, Polkadot could maintain its path of growth.

Read More

- PI PREDICTION. PI cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- WCT PREDICTION. WCT cryptocurrency

- PS5 Finally Gets Cozy with Little Kitty, Big City – Meow-some Open World Adventure!

- Quick Guide: Finding Garlic in Oblivion Remastered

2024-11-30 05:11